Global Dairy Alternatives Market Size, Share, and COVID-19 Impact Analysis, By Source (Soy, Almond, Coconut, Rice, Oats, and Others), By Product (Milk, Yogurt, Cheese, Ice cream, Creamer, and Others), By Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Online retail, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Food & BeveragesGlobal Dairy Alternatives Market Insights Forecasts to 2033

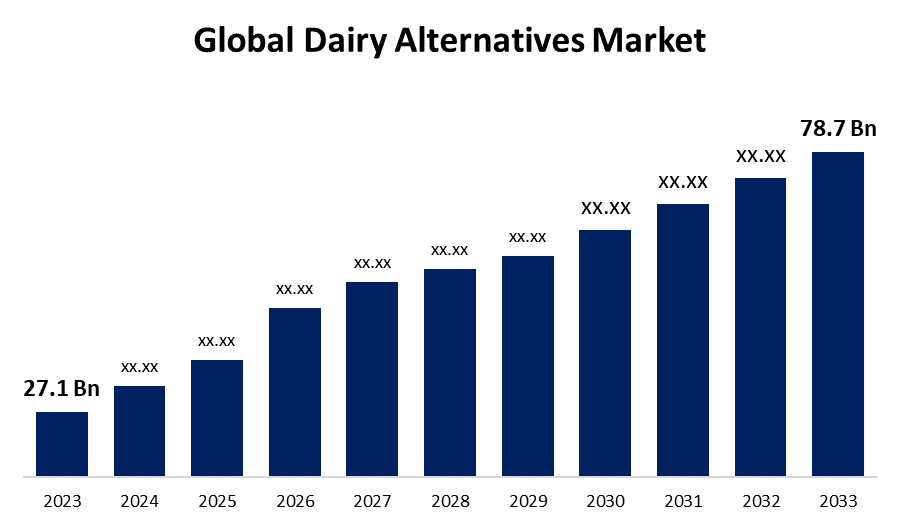

- The Global Dairy Alternatives Market Size was Valued at USD 27.1 Billion in 2023

- The Market Size is Growing at a CAGR of 11.2% from 2023 to 2033

- The Worldwide Dairy Alternatives Market Size is Expected to Reach USD 78.7 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Dairy Alternatives Market Size is Anticipated to Exceed USD 78.7 Billion by 2033, Growing at a CAGR of 11.2% from 2023 to 2033.

Market Overview

Dairy alternatives are plant-based products that replace traditional dairy items such as milk, cheese, yogurt, and butter. These plant-based alternatives, made from almonds, soy, oats, coconut, rice, and cashews, have a similar taste and texture to dairy products. Dairy alternatives are becoming more popular among people who are lactose intolerant, allergic to dairy, vegan or want to reduce their consumption of animal products. Dairy alternatives are high in nutrients and are frequently fortified with vitamins and minerals such as calcium, vitamin D, and B12 to replicate the nutritional profile of dairy products. They are also lower in saturated fat and cholesterol, making them a better option for those concerned about heart health. The growing awareness of animal welfare, environmental sustainability, and personal health has fueled the expansion of the dairy alternatives market. With increasing options available, consumers can easily find dairy-free products that meet their dietary needs and preferences, making dairy alternatives a versatile and necessary component of modern diets.

Report Coverage

This research report categorizes the market for the global dairy alternatives market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global dairy alternatives market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global dairy alternatives market.

Global Dairy Alternatives Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 27.1 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 11.2% |

| 2033 Value Projection: | USD 78.7 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 276 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Source, By Product, By Distribution Channel, By Region |

| Companies covered:: | Ripple Foods, The Whitewave Foods Company, The Hain Celestial Group, Inc., Daiya Foods Inc., Eden Foods, Inc., Nutriops, S.L., Earth’s Own Food Company, SunOpta Inc., Freedom Foods Group Ltd., Oatly Inc., Blue Diamond Growers, CP Kelco, Vitasoy International Holdings Limited, Organic Valley Family of Farms, Living Harvest Foods Inc., Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, and Analysis |

Get more details on this report -

Driving Factors

Customers are increasingly expressing a preference for vegan food options

The global shift toward vegetarian and flexitarian diets is driving growth in the dairy alternatives market. These dietary preferences have grown in popularity due to a variety of factors, including concerns about animal welfare, environmental issues, and personal health. Veganism has emerged as a lifestyle choice that avoids eating animal-derived products, including dairy. The growing global condemnation of animal cruelty has fueled demand for dairy alternatives. Many consumers consider a vegan diet to be a healthy choice, preferring dairy alternatives such as soy milk, almond milk, rice milk, and other plant-based options to traditional dairy milk.

Restraining Factors

The problem of allergies among soy food consumers

The dairy alternatives market faces significant challenges due to allergen cross-contamination, particularly with common allergens like nuts and soy, which can cause severe allergic reactions, endangering consumers and complicating manufacturing processes.

Market Segmentation

The global dairy alternatives market share is classified into source, product, and distribution channels.

- The soy segment is expected to hold the largest share of the global dairy alternatives market during the forecast period.

Based on the source, the global dairy alternatives market is categorized into soy, almond, coconut, rice, oats, and others. Among these, the soy segment is expected to hold the largest share of the global dairy alternatives market during the forecast period. It contains Vitamin B, which increases the body's metabolic rate, allowing fats and calories to be burned more efficiently. This nutritional benefit may help to drive market growth. According to ProVeg's report on the environmental cost of dairy versus plant-based alternatives, alternative milk beverages have significantly higher VAT than conventional milk in six European countries, including Italy, Greece, Austria, Slovakia, Spain, and Germany. In Italy, soymilk has a 450% higher VAT rate than cow milk, which has slowed the growth of non-dairy beverages in recent years. However, non-profit organizations' initiatives, as well as ProVeg International's initiative to end unfair VAT on dairy alternatives, are expected to boost market growth.

- The milk segment is expected to grow at the fastest CAGR during the forecast period.

Based on the product, the global dairy alternatives market is categorized into milk, yogurt, cheese, ice cream, creamer, and others. Among these, the milk segment is expected to grow at the fastest CAGR during the forecast period. Beverage manufacturers are introducing new products to increase market capitalization. Growing consumer demand for diverse beverage options has resulted in a wide range of flavored beverages made with dairy alternatives. These flavored beverages appeal to lactose-intolerant consumers seeking a variety of milk-based dairy alternatives.

The supermarkets & hypermarkets segment is expected to grow at the fastest CAGR during the forecast period.

Based on the distribution channel, the global dairy alternatives market is categorized into supermarkets & hypermarkets, convenience stores, online retail, and others. Among these, the supermarkets & hypermarkets segment is expected to grow at the fastest CAGR during the forecast period. These are large retail outlets that sell a wide range of products. Supermarkets are typically located near residential areas for easy access. Due to land scarcity, many chains are opening new locations outside of cities. Supermarkets and hypermarkets are more common in developed regions, such as Europe and North America, than in developing countries.

Regional Segment Analysis of the Global Dairy Alternatives Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is projected to hold the largest share of the global dairy alternatives market over the forecast period.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the global dairy alternatives market over the forecast period. Health-conscious consumers and growing vegetarianism are among the factors driving demand for dairy alternatives in the region. Dairy alternatives are low in fat, calories, and cholesterol, making them popular among health-conscious, vegan, and lactose-intolerant customers. Lactose intolerance is common throughout Asia, with rates ranging from 58% in Pakistan to 100% in Korea. Lactose-intolerant people should avoid dairy products and instead consume plant-based dairy products. This factor is significantly driving the milk substitutes market in the Asia-Pacific region.

North America is expected to grow at the fastest CAGR growth of the global dairy alternatives market during the forecast period. North America is one of the most important markets for milk alternatives, as dairy alternatives such as ice cream and yogurt are widely consumed. Flavored milk makes up more than two-thirds of dairy products sold in North American schools. The increasing consumer demand for sweetened soy and almond milk is expected to be a major driver of the alternative milk industry. Also, demand for milk substitutes by ice cream manufacturers is expected to significantly increase in North America region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global dairy alternatives market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ripple Foods

- The Whitewave Foods Company

- The Hain Celestial Group, Inc.

- Daiya Foods Inc.

- Eden Foods, Inc.

- Nutriops, S.L.

- Earth’s Own Food Company

- SunOpta Inc.

- Freedom Foods Group Ltd.

- Oatly Inc.

- Blue Diamond Growers

- CP Kelco

- Vitasoy International Holdings Limited

- Organic Valley Family of Farms

- Living Harvest Foods Inc.

- Others

Key Market Developments

- In July 2023, Ripple Foods introduced Ripple Kids Unsweetened Original Milk, a sugar-free version of their Kids Original Milk. The updated formula contains 8 grams of plant-based pea protein, 50 mg of omega-3 fatty acids, prebiotics, choline, and more calcium per serving than conventional milk.

- In June 2023, Oatly Inc. launched plant-based cream cheese in the United States. The plant-based cream cheese comes in two flavors: chive and onion and plain cream cheese. Oatly's innovative offering captures the tangy and savory flavor of traditional cream cheese without using any dairy ingredients.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global dairy alternatives market based on the below-mentioned segments:

Global Dairy Alternatives Market, By Source

- Soy

- Almond

- Coconut

- Rice

- Oats

- Others

Global Dairy Alternatives Market, By Product

- Milk

- Yogurt

- Cheese

- Ice cream

- Creamer

- Others

Global Dairy Alternatives Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online retail

- Others

Global Dairy Alternatives Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?