Global Data Center GPU Market Size, Share, and COVID-19 Impact Analysis, By Deployment (On-premises and Cloud), By Function (Training and Inference), By End-use (Cloud Service Providers, Enterprises, and Government), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Information & TechnologyGlobal Data Center GPU Market Insights Forecasts to 2033

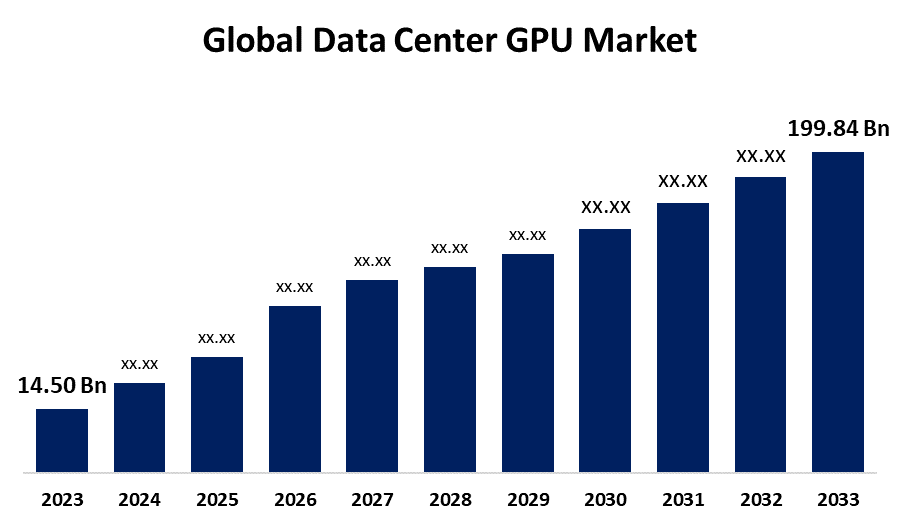

- The Global Data Center GPU Market Size Was Estimated at USD 14.50 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 30.00% from 2023 to 2033

- The Worldwide Data Center GPU Market Size is Expected to Reach USD 199.84 Billion by 2033

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Data Center GPU Market Size is anticipated to exceed USD 199.84 Billion by 2033, growing at a CAGR of 30.00% from 2023 to 2033. The market growth is due to the increased demand in various industries, driven by cloud and edge computing. While supply chain issues impact availability, localization efforts offer long-term solutions for continued market expansion.

Market Overview

The data center GPU market refers to the market for graphics processing units (GPUs), which speed up various computer operations in data centers. These responsibilities include managing workloads related to artificial intelligence (AI), machine learning (ML), cloud computing, high-performance computing (HPC), and large-scale data processing. In many of these applications, GPUs are chosen over conventional CPUs due to their superior parallel processing capabilities, which make them appropriate for positions requiring significant computational capacity and involving enormous datasets.

The Indian government has established the AI Kosha platform as part of a larger push to boost artificial intelligence (AI) development in the country. The portal gives access to datasets designed exclusively for the building and validation of AI models, as well as language translation tools geared primarily toward Indian languages. AI Kosha's datasets also contain non-personal data from a variety of sources, including health data, census data, satellite images, and meteorological information.

India is making great progress in launching its own indigenous AI model, focusing on safety, security, and affordability. Union Minister Shri Ashwini Vaishnaw launched this effort, which is part of the wider India AI Mission. The purpose is to develop AI models that are specific to the Indian setting, employing Indian languages and focused on citizen-centric applications.

The Indian industries are associated with accelerated rising data center growth and India gets bites twice for its initial target of GPUs that can export excess data center capacity. The increase in the promises and potential of GPUs as a service. With the rising use of GPUs government initiatives and increased demand for advanced power across various sectors, market expansion is boosting growth.

Report Coverage

This research report categorizes the data center GPU market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the data center GPU market. Recent market developments and competitive strategies such as expansion, Type of Software launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the data center GPU market.

Global Data Center GPU Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 14.50 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 30.00% |

| 2033 Value Projection: | USD 199.84 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Deployment, By Function, By End-use, and By Region |

| Companies covered:: | IBM, Advanced Micro Devices, Inc., Intel Corporation, NVIDIA Corporation, Google Cloud, Huawei Cloud Computing Technologies Co., Ltd., Qualcomm Technologies, Inc., Micron Technology, Inc., Imagination Technologies, Samsung SDS, and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The data center GPU market is experiencing rapid growth driven by the growing need across businesses for high-performance computing. GPU use is growing in industries including gaming, healthcare, and finance due to the rise of cloud computing, hybrid cloud environments, and edge computing. There are plenty of growth prospects in the gaming and entertainment sector, especially in the areas of virtual reality and cloud gaming. GPU availability is impacted by supply chain issues including semiconductor shortages, Additionally, localization initiatives provide long-term fixes. The need for GPUs keeps increasing as the world's digital transformation picks up speed, which encourages market growth.

Restraining Factors

Market expansion is hampered by the GPUs are more expensive than CPUs because of their high acquisition and operating expenses, which include electricity, cooling, and maintenance, even if they provide better performance for data analytics. The overall investment is increased by the requirement for specialist software and infrastructure changes. GPUs are essential for high-performance jobs, which makes them worth the greater price in some applications.

Market Segmentation

The data center GPU market is classified into deployment, function, and end-use.

- The on-premises segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the forecast period.

Based on the deployment, the data center GPU market is categorized into on-premises and cloud. Among these, the on-premises segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the forecast period. The segmental growth can be attributed to the growing need for high-performance computing (HPC) in sectors including healthcare, finance, and defense. To reduce security concerns and preserve direct control over their data, many firms in these sectors favor on-premise deployment, particularly when handling sensitive or proprietary data.

- The inference segment held the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the function, the data center GPU market is segmented into training and inference. Among these, the inference segment held the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to the business's need for the ability to make decisions in real-time for live applications, the inference market is expanding. With their capacity for parallel processing, GPUs are perfect for these kinds of jobs, especially in edge computing and Internet of Things settings. Manufacturers of GPUs now have the chance to produce small, powerful devices for processing data in real-time.

- The cloud service providers segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end use, the data center GPU market is divided into cloud service providers, enterprises, and government. Among these, the cloud service providers segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be propagated to the rising demand for workloads involving AI and machine learning. To satisfy computational demands, major CSPs such as AWS, Microsoft Azure, and Google Cloud are implementing GPU-accelerated services. The need for GPU-powered data centers is only growing as more businesses switch to cloud-based solutions.

Regional Segment Analysis of the Data Center GPU Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the data center GPU market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the data center GPU market over the predicted timeframe. The region's growth can be attributed to the driving key trend in these regions and the rapid adoption of AI and learning technology like finance, healthcare, and autonomous vehicles. Leading cloud service providers and tech firms like NVIDIA, Amazon, and Google, which are at the forefront of GPU research, are based in the region. Large expenditures in GPU infrastructure are being driven by the need for high-performance computing (HPC) in both the public and private sectors.

Asia Pacific is expected to grow at the fastest CAGR of the data center GPU market during the forecast period. In these regions, the increase in smart cities and 5G technologies such as China, Japan, and South Korea is expanding the demand for the data center GPU market. Some countries in these regions rapidly choosing AI technologies in sectors such as manufacturing, retail, and public infrastructure. The demand for widespread GPU deployment is being driven by China's increasing leadership in AI development and the growth of regional cloud providers. As governments and businesses invest in cutting-edge computational infrastructure, the region's emphasis on digital transformation and the incorporation of AI in governance presents numerous opportunities for the industry to grow significantly.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the data center GPU market along with a comparative evaluation primarily based on their Type of Software offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes Type of Software development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- IBM

- Advanced Micro Devices, Inc.

- Intel Corporation

- NVIDIA Corporation

- Google Cloud

- Huawei Cloud Computing Technologies Co., Ltd.

- Qualcomm Technologies, Inc.

- Micron Technology, Inc.

- Imagination Technologies

- Samsung SDS

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2025, NVIDIA unveiled the RTX PRO Blackwell series, a groundbreaking lineup of GPUs designed for workstations and data centers, offering accelerated computing, AI inference, ray tracing, and neural rendering technologies. This new series, which includes desktop, server, and laptop GPUs, is aimed at professionals in AI, design, simulation, and scientific computing. The RTX PRO Blackwell GPUs provide exceptional performance, scalability, and efficiency, enhancing workflows across industries such as healthcare, automotive, and entertainment.

- In March 2024, At Nvidia's GTC event, the company showcased its expanding role in industrial automation, highlighting collaborations with major tech suppliers such as Aveva, Rockwell Automation, Schneider Electric, Universal Robots, and MiR. Nvidia has evolved from a GPU supplier to a comprehensive technology provider, offering solutions in artificial intelligence, digital twins, and robotics, all crucial for manufacturing's Industry 4.0 transformation.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the data center GPU market based on the below-mentioned segments:

Global Data Center GPU Market, By Deployment

- On-premises

- Cloud

Global Data Center GPU Market, By Function

- Training

- Inference

Global Data Center GPU Market, By End-use

- Cloud Service Providers

- Enterprises

- Government

Global Data Center GPU Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the data center GPU market over the forecast period?The data center GPU market is projected to expand at a CAGR of 30.00% during the forecast period.

-

2. What is the market size of the data center GPU market?The Global Data Center GPU Market Size is Expected to Grow from USD 14.50 Billion in 2023 to USD 199.84 Billion by 2033, at a CAGR of 30.00% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the data center GPU market?North America is anticipated to hold the largest share of the data center GPU market over the predicted timeframe.

Need help to buy this report?