Global Data Center Physical Security Market Size, Share, and COVID-19 Impact Analysis, By Solutions Types (Video Surveillance, Access Control Solutions, and Monitoring Solutions), By Service Type (Security Consulting Services, Professional Services, and System Integration Services), By Vertical (IT and Telecom, Healthcare, BFSI, Government, Energy, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Information & TechnologyGlobal Data Center Physical Security Market Insights Forecasts to 2033

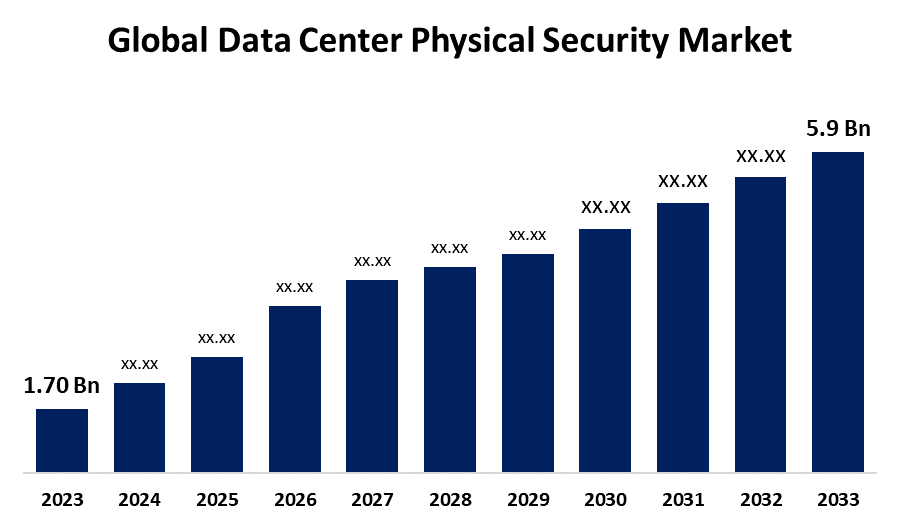

- The Global Data Center Physical Security Market Size was Valued at USD 1.70 Billion in 2023

- The Market Size is Growing at a CAGR of 13.25% from 2023 to 2033

- The Worldwide Data Center Physical Security Market Size is Expected to Reach USD 5.9 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Data Center Physical Security Market Size is Anticipated to Exceed USD 5.9 Billion by 2033, Growing at a CAGR of 13.25% from 2023 to 2033.

Market Overview

Information technology (IT) equipment and network infrastructure, commonly referred to as computing and networking equipment, are housed in centralized places called data centers. Network infrastructure includes servers, firewalls, storage systems, gateways, routers, switches, and application delivery controllers for organizing, storing, and managing data and applications. In order to handle, analyze, and distribute vast volumes of data, data centers link businesses with service providers. Instead of buying their own off-site data center, many businesses rent space and networking equipment from one. Data centers that serve numerous businesses are run by third parties and are referred to as multi-tenant or colocation data centers.

According to the Ministry of Electronics and Information Technology, there are some guidelines for data center physical security, Data centers should install cameras in all areas of the data center and premises, with motion sensors to start recording when movement is detected. The data should be recorded in digital format and stored on hard disks or tapes for future investigation. There should also be a central monitoring room to monitor the data center and premises. Limit access to essential personnel and implement multi-factor authentication (MFA) to verify users. making certain that everyone accessing the building has undergone numerous authentications via 2FA, access cards, or biometrics. Every six months, have a third-party expert examine the data center's security to look for any vulnerabilities. Use landscape to deter foreign things from entering the site, such as trees, flagpoles, stones, and curved roads. Additionally, erect crash-proof barriers to erect a 100-foot safety zone surrounding the location. If there are windows in the data center, keep them restricted to the administrative or break rooms and utilize laminated glass for security.

Report Coverage

This research report categorizes the market for data center physical security based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the data center physical security market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the data center physical security market.

Global Data Center Physical Security Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.70 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 13.25% |

| 2033 Value Projection: | USD 5.9 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 203 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Solutions Types, By Service Type, By Vertical, By Region |

| Companies covered:: | ADT Inc., Assa Abloy AB, Axis Communications AB, Bosch Security Systems, Check Point Software Technologies Ltd., Cisco Systems, Inc., Eagle Eye Network, Genetec Inc., Hikvision Digital Technology Co., Ltd., Honeywell International Inc., Johnson Controls International plc., Schneider Electric SE, Siemens AG, Avigilon, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Numerous important factors are driving the market for physical security in data centers. First off, there is a greater need than ever for strong physical security measures to guard against theft, unauthorized access, and natural catastrophes due to the rising reliance on cloud computing and the value of data as a crucial asset. Second, there is a bigger addressable market for physical security solutions due to the growth of data centers, especially in emerging economies. The use of cutting-edge technology has also increased the efficacy and efficiency of physical security measures, which has fueled their acceptance. Examples of these technologies include biometrics, video analytics, and integrated security systems. Furthermore, data center operators are being forced to invest in comprehensive security solutions due to the expanding regulatory requirements and industry standards, such as GDPR, PCI DSS, and HIPAA, which have demanded stringent physical security controls. Finally, data center operators are being driven to prioritize physical security as an essential part of their overall risk management strategy due to a growing awareness of the possible consequences of physical security breaches, which include data loss, reputational damage, and financial implications.

Restraining Factors

Numerous restraint factors impact the data center physical security industry. First off, smaller data center operators might be discouraged by the substantial capital outlay necessary to install strong physical security measures like biometrics, access control systems, and surveillance gear. The intricacy of incorporating these security solutions with the current infrastructure as well as the requirement for constant upkeep and updates may raise the overall cost of operations. Furthermore, the emphasis on digital security measures and the constantly changing environment of cybersecurity threats may cause certain cases to shift away from physical security. Finally, data center operators may encounter difficulties in striking a balance between physical security and operational efficiency and ease of access, which may require making trade-offs in the use of certain physical security measures.

Market Segmentation

The data center physical security market share is classified intoequipment, services, and vertical.

- The video surveillance segment is estimated to hold the highest market revenue share through the projected period.

Based on the equipment, the data center physical security market is classified into video surveillance, access control solutions, and monitoring solutions. Among these, the video surveillance segment is estimated to hold the highest market revenue share through the projected period. Video surveillance systems have become an essential component of data center security because they offer real-time monitoring, event detection, and forensic analysis capabilities. The demand for advanced video surveillance solutions, like high-definition cameras, analytics-driven monitoring, and cloud-based platforms, has increased as data centers continue to scale in size and complexity. Adoption of these technologies has also been fueled by the need to comply with industry standards and regulatory requirements, which frequently require the implementation of comprehensive video surveillance systems. Data center operators may now more easily and affordably utilize these systems due to the decreasing prices of video surveillance equipment and the growing availability of cloud-based video management solutions. Video surveillance's significance in the context of data center physical security has also been further solidified by the increased focus on proactive security measures as well as its capacity to improve situational awareness and incident response.

The security consulting services segment is anticipated to hold the largest market share through the forecast period.

Based on the services, the data center physical security market is divided into security consulting services, professional services, and system integration services. Among these, the security consulting services segment is anticipated to hold the largest market share through the forecast period. There are various factors for this. First off, operators of data centers are realizing more and more the importance of professional security knowledge and counsel as their facilities grow more intricate and confront ever-changing security risks. Comprehensive assessments, risk analyses, and specially designed security plans that are adapted to the particular needs of any data center can be obtained through security consulting services. Second, the demand for security consulting services has increased due to the expanding regulatory landscape and the need to guarantee industry standards are being met. These experts can assist data center operators in navigating the intricate regulatory framework and putting the required physical security measures in place. Furthermore, the necessity for specialized knowledge to assess, integrate, and optimize physical security technologies like biometrics, access control systems, and video analytics in data center operations has grown due to the swift progress of technology in these areas. Furthermore, data center operators depend on the knowledge of security consulting service providers to improve their total physical security posture because of the growing emphasis on proactive security measures and the necessity to keep ahead of emerging threats.

The IT and telecom segment dominates the market with the largest market share through the forecast period.

Based on the vertical, the data center physical security market is divided into IT and telecom, healthcare, BFSI, government, energy, and others. Among these, the IT and Telecom segment is anticipated to hold the largest market share through the forecast period, This is because the telecom and IT sectors heavily rely on safe and dependable data centers to provide their vital infrastructure and services. One of the main drivers of the data center industry is the IT and telecom sectors, as demand for data processing, transmission, and storage keeps rising. As a result, it is now imperative to have strong physical security measures in place to safeguard these vital data centers. Data centers associated to IT and telecom have become increasingly important to secure due to factors including the growing demand for edge computing, the emergence of 5G technology, and the increasing popularity of cloud computing. In addition, these companies have to make significant investments in complete physical security solutions to guarantee compliance and reduce the risks of data breaches, equipment theft, and unauthorized access due to the stringent industry standards and regulatory requirements that apply to the IT and telecom sectors.

Regional Segment Analysis of the Data Center Physical Security Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the data center physical security market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the data center physical security market over the predicted timeframe, There are multiple important reasons for this. First off, there are a lot of well-established data centers in the area, especially in the US, that have implemented cutting-edge physical security measures to safeguard its vital infrastructure and priceless data assets. Second, in order to protect their mission-critical facilities, major data center operators, cloud service providers, and technology businesses have made strong physical security solutions more and more necessary in North America. Additionally, data center operators have been forced to heavily invest in comprehensive physical security measures in order to mitigate the risks of natural disasters, vandalism, and unauthorized access due to the region's well-developed regulatory environment and strict compliance requirements related to data privacy and security. Furthermore, North American data center operators' early embrace of cutting-edge technologies like biometrics, access control systems, and video analytics has helped the area dominate the data center physical security market. Lastly, North America's standing as a top market for data center physical security solutions has been further cemented by the region's excellent R&D capabilities and the availability of a competent labor force.

Europe is expected to grow the fastest during the forecast period. First, a proliferation of new data centers has resulted from the growing demand for strong physical security solutions due to the increasing usage of cloud computing, the expansion of the Internet of Things (IoT), and the increase in data generation across numerous businesses in the region. Second, the need for thorough security measures, including physical security, to secure sensitive data and stop breaches has increased as a result of the implementation of strict data protection legislation like the General Data Protection Regulation (GDPR). Furthermore, European data center operators are prioritizing investments in cutting-edge physical security technologies like biometrics, access control systems, and video surveillance due to their growing awareness of the possible negative effects of physical security incidents, such as harm to their reputation and monetary losses. The availability of financing programs and government efforts targeted at encouraging the creation and uptake of innovative physical security solutions in the area has also contributed to the expansion of the European data center physical security market. The need for creative and effective physical security measures is anticipated to increase quickly as the region solidifies its standing as a global hub for data center infrastructure.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the data center physical security market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ADT Inc.

- Assa Abloy AB

- Axis Communications AB

- Bosch Security Systems

- Check Point Software Technologies Ltd.

- Cisco Systems, Inc.

- Eagle Eye Network

- Genetec Inc.

- Hikvision Digital Technology Co., Ltd.

- Honeywell International Inc.

- Johnson Controls International plc.

- Schneider Electric SE

- Siemens AG

- Avigilon

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2024, with the opening of its Data Center in Mumbai, Ishan Technologies has increased the size of its footprint. This calculated action demonstrates the company's dedication to offering cutting-edge telecom and IT solutions that are customized to satisfy a range of business objectives.

- In March 2024, in an effort to support tech in the area, AWS invest $5.3 to construct data centers in Saudi Arabia.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the data center physical security market based on the below-mentioned segments:

Global Data Center Physical Security Market, By Solutions Types

- Video Surveillance

- Access Control Solutions

- Monitoring Solutions

Global Data Center Physical Security Market, By Service Type

- Security Consulting services

- Professional Services

- System Integration Services

Global Data Center Physical Security Market, By Vertical

- IT and Telecom

- Healthcare

- BFSI

- Government

- Energy

- Others

Global Data Center Physical Security Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the data center physical security market over the forecast period?The data center physical security market is projected to expand at a CAGR of 13.25% during the forecast period.

-

2. What is the market size of the data center physical security market?The Global Data Center Physical Security Market Size is Expected to Grow from USD 1.70 Billion in 2023 to USD 5.9 Billion by 2033, at a CAGR of 13.25% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the data center physical security market?North America is anticipated to hold the largest share of the data center physical security market over the predicted timeframe.

Need help to buy this report?