Global De-identified Health Data Market Size, Share, and COVID-19 Impact Analysis, By Type (Clinical Data, Genomic Data, Patient Demographics, Prescription Data, Hospital and Provider Data, and Pharmacogenomic Data), By Application (Clinical Research and Trials, Public Health, Precision Medicine, Health Economics and Outcomes Research (HEOR), Population Health Management, and Drug Discovery and Development), By End-user (Pharmaceutical Companies, Biotechnology Firms, Medical Device Manufacturers, Healthcare Providers, Insurance Companies/ Healthcare Payers, Government Agencies, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Consumer GoodsGlobal De-identified Health Data Market Insights Forecasts to 2033

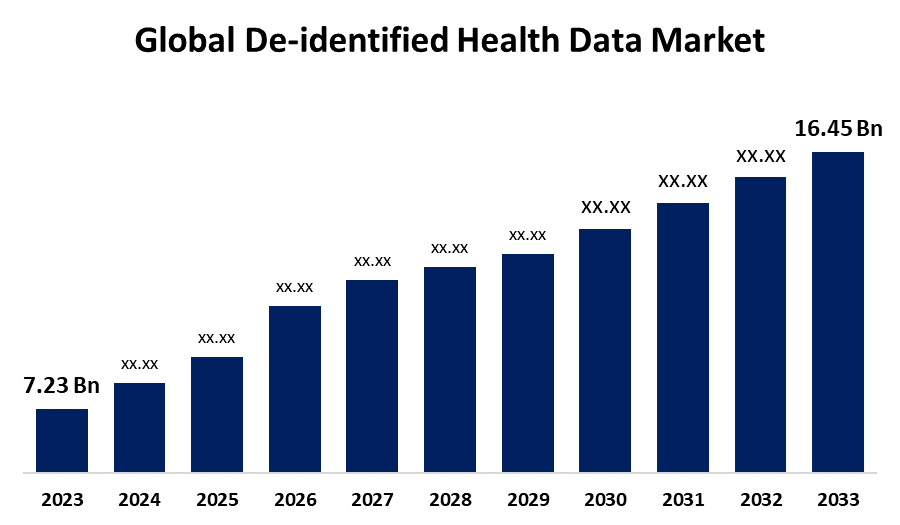

- The Global De-identified Health Data Market Size was Valued at USD 7.23 Billion in 2023

- The Market Size is Growing at a CAGR of 8.57% from 2023 to 2033

- The Worldwide De-identified Health Data Market Size is Expected to Reach USD 16.45 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The De-identified Health Data Market Size is Anticipated to Exceed USD 16.45 Billion by 2033, Growing at a CAGR of 8.57% from 2023 to 2033.

Market Overview

De-identification is a technique that permits organizations to eliminate personal information from the data they gather, utilize, archive, and exchange with other organizations. The cloud healthcare API recognizes confidential data in DICOM cases and FHIR resources, like protected health information (PHI), and then applies a de-identification transformation to mask, erase, or otherwise disguise the data. De-identification is not a single strategy, but rather a set of approaches, algorithms, and tools that can be used to various types of data with varying degrees of success. In general, using more severe de-identification techniques increases privacy protection, but the resulting dataset has less utility. The market is being promoted by the growing adoption of data analytics in healthcare, which permits significant research and forecasting while maintaining patient privacy. Researchers can improve the excellence of their findings and promote improvements in medical knowledge and practice by utilizing de-identified data. For example, in April 2023, the Institute for Medical Engineering and Science (IMES) at MIT and Philips worked together to create an improved critical care dataset to progress clinical research and AI applications in the healthcare industry. This dataset combines extensive clinical information with de-identified data from ICU patients to help educators and academics recognize critical care and patient outcomes.

Report Coverage

This research report categorizes the market for the de-identified health data market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the de-identified health data market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the de-identified health data market.

Global De-identified Health Data Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 7.23 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.57% |

| 2033 Value Projection: | USD 16.45 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Type, By Application, By End-user, By Region and COVID-19 Impact Analysis |

| Companies covered:: | IQVIA, Oracle (Cerner Corporation), Merative (Truven Health Analytics), Optum, Inc. (UnitedHealth Group), ICON plc, Veradigm LLC, IBM, Flatiron Health (F. Hoffmann-La Roche Ltd), Premier, Inc., Shaip, Komodo Health, Inc., Evidation Health, Inc., Medidata, Clarify Health Solutions and others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

One of the main driving factors of the de-identified health data market is that research and development can benefit from the usage of de-identified data. Innovation is possible without compromising individual privacy. Academics can use de-identified medical records to examine illness trends and develop novel therapeutic approaches. It protects the privacy of individuals by erasing or hiding personal identifiers. This ensures that personal information remains confidential. Hence, it is fueling the growth of the market.

Restraining Factors

The main obstacle facing the de-identified health data market AI is capable of re-identifying individuals from de-identified data. It challenges prevailing privacy safeguards. This requires an evaluation of privacy safeguards in the age of machine learning.

Market Segmentation

The de-identified health data market share is classified into type, application, and end-user.

- The clinical data segment is expected to grow the highest market share through the forecast period.

Based on the type, the de-identified health data market is categorized into clinical data, genomic data, patient demographics, prescription data, hospital and provider data, and pharmacogenomic data. Among these, the clinical data segment is expected to grow the highest market share through the forecast period. This dominance is due to its significant contribution to patient care optimization, research, and therapeutic development. Personalized healthcare cannot progress without the identification of treatment results and patient demographics made accessible by the wide availability of clinical data.

- The clinical research and trials segment holds the largest market share through the forecast period.

Based on the application, the de-identified health data market is categorized into clinical research and trials, public health, precision medicine, health economics and outcomes research (HEOR), population health management, and drug discovery and development. Among these, the clinical research and trials segment holds the largest market share through the forecast period. This is because its essential function in improving treatment techniques and ensuring patient safety is responsible for the segment's greatest share. Researchers can evaluate a range of patient demographics, estimate medication responses, and spot any safety issues early in the development process due to de-identified data. The market is growing because of these factors shared, which raise demand for clinical trials that heavily depend on de-identified data.

- The healthcare providers segment is predicted to grow at the fastest CAGR during the forecast period.

Based on the end-user, the de-identified health data market is categorized into pharmaceutical companies, biotechnology firms, medical device manufacturers, healthcare providers, insurance companies/ healthcare payers, government agencies, and others. Among these, the healthcare providers segment is predicted to grow at the fastest CAGR during the forecast period. Healthcare providers dominated the industry because of their critical role in clinical decision-making, treatment optimization, and patient outcomes. Healthcare providers use de-identified data for research, public health leadership, and quality improvement programs, allowing them to analyze trends without risking patient privacy.

Regional Segment Analysis of the De-identified Health Data Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the de-identified health data market over the predicted timeframe.

Get more details on this report -

North America is projected to hold the largest share of the de-identified health data market over the forecast period. The region has a cutting-edge healthcare infrastructure and has made considerable technology investments, particularly in data analytics and artificial intelligence. Furthermore, tight legal frameworks, like as HIPAA, increase the priority on data privacy, encouraging the use of de-identified data for research while guaranteeing compliance. Moreover, the presence of major pharmaceutical and biotechnology businesses drives up demand for high-quality data to assist clinical trials and drug development.

Asia Pacific is expected to grow at the fastest CAGR growth in the de-identified health data market during the forecast period. The expansion is due to tremendous developments in healthcare infrastructure and technologies. This rise is driven by increased investments in health IT and data analytics, in addition to a growing desire for personalized care. Furthermore, increased awareness of data privacy legislation encourages organizations to use de-identified data solutions to ensure compliance. The region's booming pharmaceutical and biotech businesses add to the need for extensive health data for investigation and clinical trials.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the de-identified health data market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- IQVIA

- Oracle (Cerner Corporation)

- Merative (Truven Health Analytics)

- Optum, Inc. (UnitedHealth Group)

- ICON plc

- Veradigm LLC

- IBM

- Flatiron Health (F. Hoffmann-La Roche Ltd)

- Premier, Inc.

- Shaip

- Komodo Health, Inc.

- Evidation Health, Inc.

- Medidata

- Clarify Health Solutions

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2024, ICON plc collaborated with IBM to announce developments in clinical trial processes using de-identified health data, which improves patient registration and study design. The effort aims to increase trial efficiency and speed up medication discovery by harnessing massive datasets while protecting patient privacy.

- In December 2023, nference, a software firm dedicated to converting healthcare data for research, teamed with Emory Healthcare, Georgia's biggest academic health institution, to improve access to varied, aggregated, de-identified data.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the de-identified health data market based on the below-mentioned segments:

Global De-identified Health Data Market, By Type

- Clinical Data

- Genomic Data

- Patient Demographics

- Prescription Data

- Hospital and Provider Data

- Pharmacogenomic Data

Global De-identified Health Data Market, By Application

- Clinical Research and Trials

- Public Health

- Precision Medicine

- Health Economics and Outcomes Research (HEOR)

- Population Health Management

- Drug Discovery and Development

Global De-identified Health Data Market, By End-user

- Pharmaceutical Companies

- Biotechnology Firms

- Medical Device Manufacturers

- Healthcare Providers

- Insurance Companies/ Healthcare Payers

- Government Agencies

- Others

Global De-identified Health Data Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global de-identified health data market over the forecast period?The global de-identified health data market is to expand at 8.57% during the forecast period.

-

2. Which region is expected to hold the largest share of the global de-identified health data market?The North America region is expected to hold the largest share of the global de-identified health data market.

-

3. Who are the top key players in the global de-identified health data market?The key players in the global de-identified health data market are IQVIA, Oracle (Cerner Corporation), Merative (Truven Health Analytics), Optum, Inc. (UnitedHealth Group), ICON plc, Veradigm LLC, IBM, Flatiron Health (F. Hoffmann-La Roche Ltd), Premier, Inc., Shaip, Komodo Health, Inc., Evidation Health, Inc., Medidata, Clarify Health Solutions, and others.

Need help to buy this report?