Global Deception Technology Market Size, Share, and COVID-19 Impact Analysis, By Component (Solution and Services), By Deployment (On-Premise and Cloud-based), By Deception (Application Security, Data Security, Endpoint Security, and Network Security), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032.

Industry: Information & TechnologyGlobal Deception Technology Market Insights Forecasts to 2032

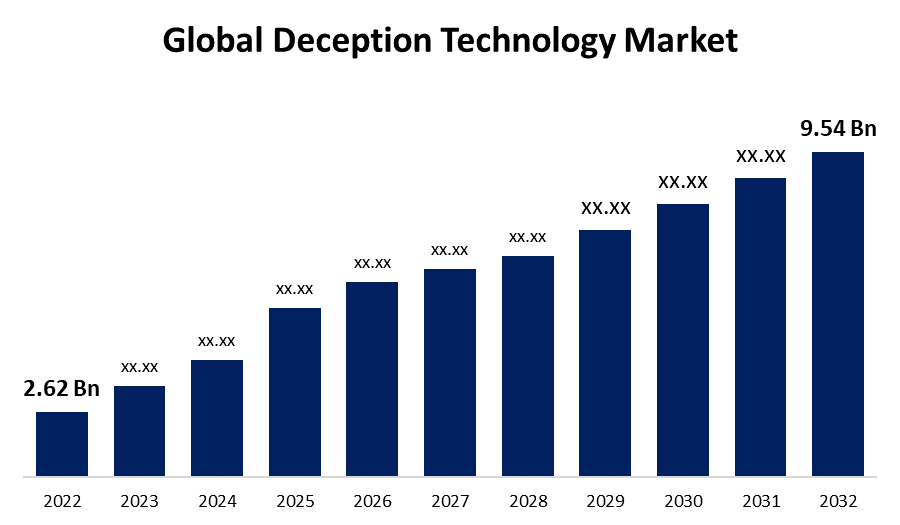

- The Global Deception Technology Market Size was valued at USD 2.62 Billion in 2022.

- The Market is Growing at a CAGR of 13.8% from 2022 to 2032

- The Worldwide Deception Technology Market Size is expected to reach USD 9.54 Billion by 2032

- Asia-Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Deception Technology Market Size is expected to reach USD 9.54 Billion by 2032, at a CAGR of 13.8% during the forecast period 2022 to 2032.

Market Overview

Deception technology is a proactive cybersecurity approach that aims to detect and mitigate threats by deceiving attackers. It involves deploying decoy systems, networks, and data that appear authentic to lure hackers away from critical assets. These decoys mimic real IT environments and contain traps, false information, and alert mechanisms. By engaging attackers and diverting their attention, deception technology provides early warning signals and valuable insights into their tactics, techniques, and motives. It enhances threat detection, shortens incident response times, and reduces the risk of successful attacks. Deception technology complements traditional security measures like firewalls and antivirus software, offering an additional layer of defense against sophisticated cyber threats. Its adoption has become increasingly crucial in safeguarding organizations from emerging and evolving cyber risks.

Report Coverage

This research report categorizes the market for deception technology market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the deception technology market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the deception technology market.

Global Deception Technology Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 2.62 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 13.8% |

| 2032 Value Projection: | USD 9.54 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Component, By Deployment, By Deception, By Region. |

| Companies covered:: | Allure Security Technology, Inc., Topspin Security, Varmour, Smokescreen Technologies, Acalvio Technologies, NTT security limited, Ridgeback Network Defense Inc., SEC Technologies, WatchGuard Technologies Inc., Attivo Networks Inc., Commvault Systems Inc., Illusive Networks. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The deception technology market is driven by several factors that contribute to its growth and adoption. The increasing frequency and sophistication of cyber-attacks have compelled organizations to adopt advanced security measures beyond traditional defenses. Deception technology provides a proactive approach by actively engaging and deceiving attackers, enhancing threat detection capabilities. The rising demand for real-time threat intelligence and incident response solutions has fueled the market growth. Deception technology offers early warning signals, alerts, and valuable insights into attacker tactics, enabling organizations to respond swiftly and effectively. Additionally, the growing adoption of cloud-based services and the Internet of Things (IoT) has expanded the attack surface, making deception technology crucial in detecting and mitigating threats across diverse environments. Moreover, regulatory compliance requirements and the need to protect critical assets further drive the adoption of deception technology in various industries.

Restraining Factors

While the deception technology market presents numerous opportunities, it also faces certain restraints. One significant restraint is the complexity of implementing and managing deception technology solutions. Organizations may require specialized skills and resources to deploy and maintain the decoy systems effectively, which can pose challenges, particularly for smaller businesses. Additionally, false positives generated by deception technology can potentially impact operational efficiency and hinder incident response efforts. Another restraint is the cost associated with implementing and maintaining deception technology solutions, which may deter organizations with limited budgets from adopting this approach. Furthermore, the evolving nature of cyber threats requires continuous updates and improvements to deception technology solutions, adding to the ongoing investment and operational costs.

Market Segmentation

- In 2022, the network security segment accounted for around 30.4% market share

Based on deception, the global deception technology market is segmented into application security, data security, endpoint security, and network security. The network security segment has emerged as the dominant sector in the overall cybersecurity market, holding the largest market share. This can be attributed to several factors. Networks serve as a critical infrastructure for organizations, connecting various devices, systems, and users. As a result, securing network environments against cyber threats has become paramount. The increasing sophistication of cyber-attacks, such as ransomware, DDoS attacks, and data breaches, has heightened the demand for robust network security solutions. Organizations are investing in advanced firewalls, intrusion detection and prevention systems, secure web gateways, and network access control solutions to safeguard their networks. Furthermore, the rising adoption of cloud-based services and the proliferation of connected devices in the Internet of Things (IoT) have expanded the attack surface, necessitating strong network security measures. Overall, the network security segment's prominence reflects the critical role networks play in protecting sensitive data and ensuring business continuity.

- In 2022, the cloud-based segment dominated with more than 64.7% market share

Based on deployment, the global deception technology market is segmented into on-premise and cloud-based. The cloud-based segment has emerged as the dominant sector in the cybersecurity market, holding the largest market share. Several factors contribute to its significant growth and adoption. The organizations are increasingly embracing cloud computing to enhance their agility, scalability, and cost-efficiency. As more critical data and applications move to the cloud, securing these cloud environments becomes a top priority. Cloud-based security solutions offer centralized control, real-time monitoring, and seamless scalability, making them well-suited for protecting cloud-based assets. The rise of remote work and the need for secure access from anywhere have accelerated the demand for cloud-based security solutions. These solutions provide secure remote access, data encryption, and threat detection capabilities. Additionally, the continuous evolution of cyber threats requires robust and dynamic security measures that can be seamlessly updated and deployed across cloud infrastructures. The cloud-based segment's dominance reflects the growing reliance on cloud services and the critical importance of securing cloud environments in today's digital landscape.

Regional Segment Analysis of the Deception Technology Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominated the market with more than 52.6% revenue share in 2022.

Get more details on this report -

Based on region, North America has emerged as the leading region in the deception technology market, holding the largest market share. Several factors contribute to its dominant position. North America is home to numerous major players and innovators in the cybersecurity industry, with a strong presence of technology giants and cybersecurity solution providers. This concentration of expertise and resources fosters the development and adoption of advanced security technologies like deception technology. The region has witnessed a significant rise in cyber threats and attacks, driving the demand for robust cybersecurity solutions. Additionally, stringent regulatory frameworks and compliance requirements in industries such as finance, healthcare, and government sectors have fueled the adoption of deception technology to protect sensitive data and critical assets. Furthermore, the high awareness levels about cybersecurity risks and the willingness of organizations to invest in cutting-edge security measures have further propelled the market growth in North America.

Recent Developments

- In January 2022, Honeywell has expanded its OT Cybersecurity Portfolio by introducing the Active Defense and Deception Technology Solution. In collaboration with Acalvio Technologies, they have unveiled a new solution specifically designed to identify both known and unknown attacks targeting operational technology (OT) systems in commercial buildings. The Honeywell Threat Protection Platform (HTDP) powered by Acalvio leverages autonomous deception techniques to out maneuver attackers, providing advanced and active defense capabilities, along with precise and accurate threat detection

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the global deception technology market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Allure Security Technology, Inc.

- Topspin Security

- Varmour

- Smokescreen Technologies

- Acalvio Technologies

- NTT security limited

- Ridgeback Network Defense Inc.

- SEC Technologies

- WatchGuard Technologies Inc.

- Attivo Networks Inc.

- Commvault Systems Inc.

- Illusive Networks

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global deception technology market based on the below-mentioned segments:

Deception Technology Market, By Component

- Solution

- Services

Deception Technology Market, By Deployment

- On-Premise

- Cloud-based

Deception Technology Market, By Deception

- Application Security

- Data Security

- Endpoint Security

- Network Security

Deception Technology Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?