Global Decorative Laminates Market Size, Share, and COVID-19 Impact Analysis, By Product (High Pressure Laminates and Low Pressure Laminates), By Application (Furniture, Flooring, Wall, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Advanced MaterialsGlobal Decorative Laminates Market Insights Forecasts to 2033

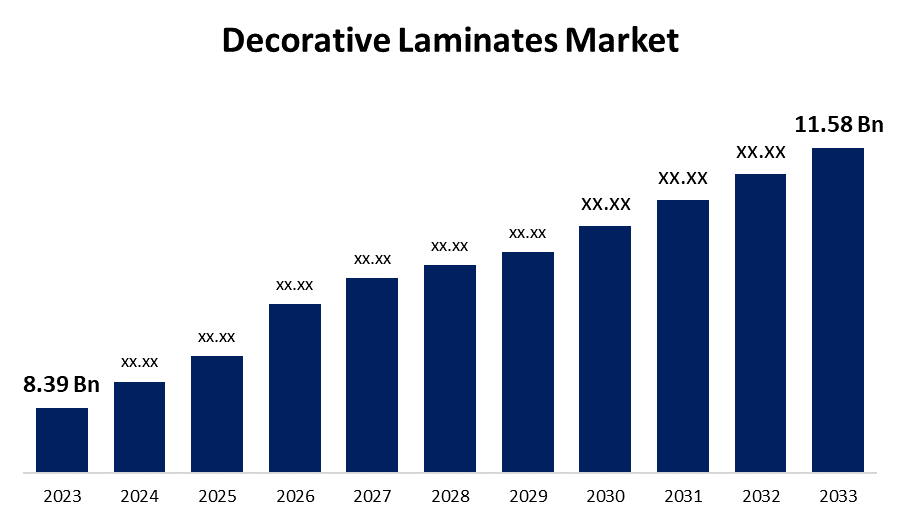

- The Global Decorative Laminates Market Size was Valued at USD 8.39 Billion in 2023

- The Market Size is Growing at a CAGR of 3.27% from 2023 to 2033

- The Worldwide Decorative Laminates Market Size is Expected to Reach USD 11.58 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Decorative Laminates Market Size is Anticipated to Exceed USD 11.58 Billion by 2033, Growing at a CAGR of 3.27% from 2023 to 2033.

Market Overview

Decorative laminates are laminated products used for wall paneling or furniture surfaces. Laminates are appropriate for both household and business applications. Due to their versatility and durability, these laminate sheets can be utilized to improve the appearance of any surface, including furniture, walls, and cabinets. Decorative laminates are hard, brittle sheets used to improve surface attractiveness. It is comprised of resins and high-quality paper, which are pressed with the appropriate amount of heat and pressure using cutting-edge technology in a wide range of colors, design patterns, and textures. Decorative laminates are commonly used as furniture tops, kitchen tops, countertops, cabinets, and tabletops, among other applications. It is also applied to walls, doors, and other internal structures. Furniture demand has risen over the last decade as the number of houses has scaled. Furthermore, the development of work-from-home culture is driving up demand. Furthermore, as urbanization accelerates, the number of residential and non-residential buildings in cities grows. Furthermore, decorative laminates are used as an overlay on both exterior and interior walls. Furthermore, high-pressure laminates are appropriate for flooring applications. Recyclable and biodegradable decorative laminates have the potential to generate significant revenue in the worldwide decorative laminates market. Recyclable decorative materials can improve the durability and scalability of laminate sheets, creating growth for market expansion.

Report Coverage

This research report categorizes the market for the decorative laminates market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the decorative laminates market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the decorative laminates market.

Decorative Laminates Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 8.39 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.27% |

| 2033 Value Projection: | USD 11.58 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Application, By Region |

| Companies covered:: | Sekisui Chemical, Kronospan Holdings, SierraPine, Omnova Solutions, FunderMax, Airolam decorative laminates, Archidply, Aica Kogyo Co., Ltd., OMNOVA Solutions Inc., Stylam Industries Ltd., Wilsonart LLC, Abet Laminati SpA, Panolam Industries International, Inc., Witex Flooring Products GmbH, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The growing customer interest in purchasing products and raw materials to improve the appearance of their homes is one of the primary reasons encouraging the expansion of decorative laminates, owing to their ability to convert the appearance of homes and offices into a beautiful environment. The ability to change individual mindsets and bring quiet through the introduction of personalized decorative laminates and at-ease residences is boosting demand from companies wanting relief from work stress. Moreover, the rise in global population and the growing trend toward nuclear families have greatly raised the demand for residential infrastructure. This has increased the growth in the use of decorative laminates, which are widely used on floors, walls, doors, and windows.

Restraining Factors

The supply chain disruptions of raw materials used in the production process of decorative laminates, such as adhesives, plastic resin, and paper, are resulting in lower production of decorative laminates, raising the cost of decorative laminates to end users. Furthermore, the lack of raw materials, worker shortages in construction, and a lack of transportation services all had an impact on the worldwide decorative laminates industry.

Market Segmentation

The decorative laminates market share is classified into product and application.

- The high pressure laminates segment accounted for the largest revenue share over the forecast period.

Based on the product, the decorative laminates market is categorized into high pressure laminates and low pressure laminates. Among these, the high pressure laminates segment accounted for the largest revenue share over the forecast period. High-pressure laminates are in high demand because of their enhanced functional qualities, which include scratch resistance, chemical resistance, and anti-microbial capabilities. High pressures laminates surfaces durability and ease of cleaning make them ideal for achieving stringent hygiene standards and infection control needs in hospital and laboratory environments.

- The furniture segment holds the highest market share through the forecast period.

Based on the application, the decorative laminates market is categorized into furniture, flooring, wall, and others. Among these, the furniture segment holds the highest market share through the forecast period. Due to the ongoing increase in home remodeling operations and the growing demand for interior design among households, retailers, and others. Decorative laminates are frequently utilized to improve the visual impact of wooden furniture.

Regional Segment Analysis of the Decorative Laminates Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the decorative laminates market over the predicted timeframe.

Get more details on this report -

North America is projected to hold the largest share of the decorative laminates market over the forecast period. This is mostly due to market players' increased company expansion operations to increase brand awareness and manufacturing capacity in response to rising customer demand. For example, in March 2023, North American Specialty Laminations announced the acquisition of California-based Diversified Manufacturing to increase its presence in the decorative laminate industry.

Asia Pacific is expected to grow at the fastest CAGR growth in the decorative laminates market during the forecast period. Due to the developing residential industry and rising disposable income in the region. The market demand for decorative laminates in the Asia Pacific area is predicted to be driven by increased spending on new construction activities for residential and non-residential buildings in developing countries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the decorative laminates market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sekisui Chemical

- Kronospan Holdings

- SierraPine

- Omnova Solutions

- FunderMax

- Airolam decorative laminates

- Archidply

- Aica Kogyo Co., Ltd.

- OMNOVA Solutions Inc.

- Stylam Industries Ltd.

- Wilsonart LLC

- Abet Laminati SpA

- Panolam Industries International, Inc.

- Witex Flooring Products GmbH

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2024, the program "Io sono un drago" included Alessandro Mendini's Abet Laminati decorative panels. The True Story of Alessandro Mendini" at the Triennale di Milano.

- In November 2023, EGGER UK has announced its desire to produce a highly anticipated international collection including exquisite matt textures, tactile material decors, and contemporary uni colors to meet the needs of its clients.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the decorative laminates market based on the below-mentioned segments:

Global Decorative Laminates Market, By Product

- High Pressure Laminates

- Low Pressure Laminates

Global Decorative Laminates Market, By Application

- Furniture

- Flooring

- Wall

- Others

Global Decorative Laminates Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?