Global Defense Electronics Market Size, Share, and COVID-19 Impact Analysis, By Vertical (Navigation, Communication & Display, C4ISR, Electronic Warfare, Radar, Optronics) By Platform (Airborne, Marine, Land, Space), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Aerospace & DefenseGlobal Defense Electronics Market Insights Forecasts to 2032

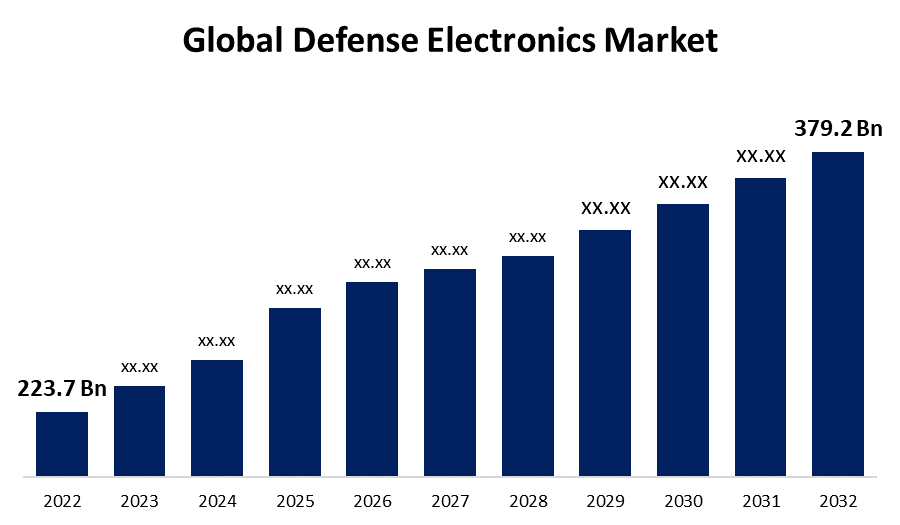

- The Global Defense Electronics Market Size was valued at USD 223.7 Billion in 2022.

- The Market Size is Growing at a CAGR of 5.4% from 2022 to 2032

- The Worldwide Defense Electronics Market Size is expected to reach USD 379.2 Billion by 2032

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Defense Electronics Market size is anticipated to exceed USD 379.2 Billion by 2032, growing at a CAGR of 5.4% from 2022 to 2032. The Defence Electronics Industry is fueled by factors such as joint force strengthening through investment in defence electronic systems and the growing demand for AI and IoT devices in military operations.

Market Overview

Defense electronics are electronic devices and special systems designed for a country's defense technology. To support the work and reduce the risk of injuries, defense electronics provide powerful electrical equipment, high performance, electrical protection, and the ability to extinguish the fire. The growing reliance on information and communication technology security reveals the vulnerability of cyber threats. As a result, cybersecurity measures and sophisticated electronic systems are required to protect critical systems and sensitive data. Various factors, such as the increasing adoption of integrated defense electronic technologies and the development of next-generation air and missile defense systems, are driving the defense electronics market. However, the high initial investment in defense electronics, as well as high installation and upgrade costs for avionic products, are limiting the market's overall growth.

Report Coverage

This research report categorizes the market for the global defense electronics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the defense electronics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the defense electronics market.

Global Defense Electronics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022 : | USD 223.7 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 5.4% |

| 2032 Value Projection: | USD 379.2 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | By Vertical, By Platform, By Region |

| Companies covered:: | Airbus Defence and Space, Bharat Electronics Limited, Boeing Defense, Space & Security, Elbit Systems Ltd., General Dynamics Corporation, Harris Corporation,, Honeywell International Inc., Indra Sistemas,, Lockheed Martin Corporation , Northrop Grumman Corporation , Raytheon Technologies Corporation , Thales Group, BAE Systems plc , Others |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Military aircraft must be outfitted with sophisticated electronic warfare integrated suites, such as anti-jamming devices because electronic jammers can cause aircraft radar or electrical equipment to malfunction. Due to the ineffectiveness and obsolescence of traditional countermeasure techniques, militaries are upgrading their aircraft with technologically advanced countermeasure techniques such as anti-jammers, radar warning receivers (RWRs), laser warning receivers (LWRs), countermeasure dispenser systems (CMDS), and interference mitigation systems. Such advantages associated with the incorporation of integrated defense electronics products in the defense and military sectors help to drive the defense electronics market forward.

Restraining Factors

Electronic warfare systems, avionics, optronics, communication systems, and command and control systems are examples of defense electronic products that collect and transfer large amounts of sensitive data from handheld, electro-optic, and radar sensors. Communicating and distributing such large amounts of data has an impact on real-time processing speeds and may result in decision-making delays, threatening the execution of critical defense missions. To improve the effectiveness of real-time communication, a sophisticated communication technology infrastructure based on big data and efficient data centers is required. Such infrastructure necessitates significant investment, which is a major impediment to the defense electronics market.

Market Segmentation

The Global Defense Electronics Market share is classified into vertical and platform.

- The navigation segment is expected to grow at the fastest pace in the global defense electronics market during the forecast period.

The global defense electronics market is categorized by vertical into navigation, communication & display, C4ISR, electronic warfare, radar, and optronics. Among these, the navigation segment is expected to grow at the fastest pace in the global defense electronics market during the forecast period. These are concerned with systems and technologies for precise location, navigation, and guidance in defence operations. This section contains a variety of equipment and systems designed to provide accurate and dependable navigation in harsh environments. Unmanned systems, such as UAVs (Military Drones) and UGVs, also rely heavily on navigation systems to operate autonomously or remotely. The demand for precise and durable navigation hardware and software solutions for unmanned platforms will increase the navigation segment share.

- The airborne segment accounted for the largest share of the global defense electronics market in 2022.

Based on the platform, the global defense electronics market is divided into airborne, marine, land, and space. Among these, the airborne segment accounted for the largest share of the global defense electronics market in 2022. The airborne segment is concerned with systems and technologies specifically designed for use in aircraft and aircraft platforms. It includes a number of electronics and systems that are required for on-board operations and mission success. Furthermore, avionics systems, which include flight control systems for aircraft control, communications, navigation, and tracking, are critical components of the airborne segment. Flight control, cockpit instructions, communications, navigation systems, and surveillance are all included. The demand for advanced avionics is a major driver of airborne segment growth.

Regional Segment Analysis of the Global Defense Electronics Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global defense electronics market over the predicted timeframe.

Get more details on this report -

North America is projected to hold the largest share of the global defense electronics market over the predicted years. According to the Department of Defence, the United States has the world's largest military budget, spending around USD 715 billion in 2022. To maintain military dominance and protect national security interests, the country invests heavily in improving defence capabilities. Similarly, leading defence electronics companies such as Northrop Gruman, Raytheon, Lockheed Corporation, and others call the country home. In this market, these companies are constantly investing in the development of new technologies. Rising defence spending has created new opportunities for regional market expansion.

Asia Pacific is expected to grow at the fastest pace in the global defense electronics market during the forecast period. Because this region has been investing in the development of modern technologies and the procurement of new platforms, the countries in the Asia Pacific region offer significant opportunities for defence electronics manufacturers. This region's growth is being driven by increased demand for modern technologies and electronic warfare in countries such as Japan, India, and China.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global defense electronics along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Airbus Defence and Space

- Bharat Electronics Limited

- Boeing Defense

- Space & Security

- Elbit Systems Ltd.

- General Dynamics Corporation

- Harris Corporation,

- Honeywell International Inc.

- Indra Sistemas,

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Thales Group

- BAE Systems plc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2023, CAES, a leading supplier of mission-critical advanced RF technology, has been awarded a contract by the US Navy for the initial pre-production stage of the AN/ALQ-99 Low Band Consolidation (LBC) transmitter. The LBC is a modified AN/ALQ-99 Low Band Transmitter.

- In March 2023, The Space Development Agency given Raytheon Technologies a contract to design, develop, and deliver a seven-vehicle missile tracking satellite constellation for missile warning and tracking.

- In March 2022, BAE Systems has released a new Electronic Warfare (EW) package that adds offensive and defensive EW capabilities to a variety of platforms. The Storm Electronic Warfare Module system can be tailored to the needs of the United States and coalition forces, and it can be integrated into fixed-wing aircraft, helicopters, unmanned aerial vehicles, and missiles.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Defense Electronics Market based on the below-mentioned segments:

Global Defense Electronics Market, By Vertical

- Navigation

- Communication & Display

- C4ISR

- Electronic Warfare

- Radar

- Optronics

Global Defense Electronics Market, By Platform

- Airborne

- Marine

- Land

- Space

Global Defense Electronics Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?