Global Defense Electronics Obsolescence Market Size, Share, and COVID-19 Impact Analysis, By Type (Logistics Obsolescence, Functional Obsolescence, Technology Obsolescence), By Systems (Sensors, Electronic Warfare Systems, Targeting Systems), By Platform (Airborne, Naval, Land), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Defense Electronics Obsolescence Market Insights Forecasts to 2033

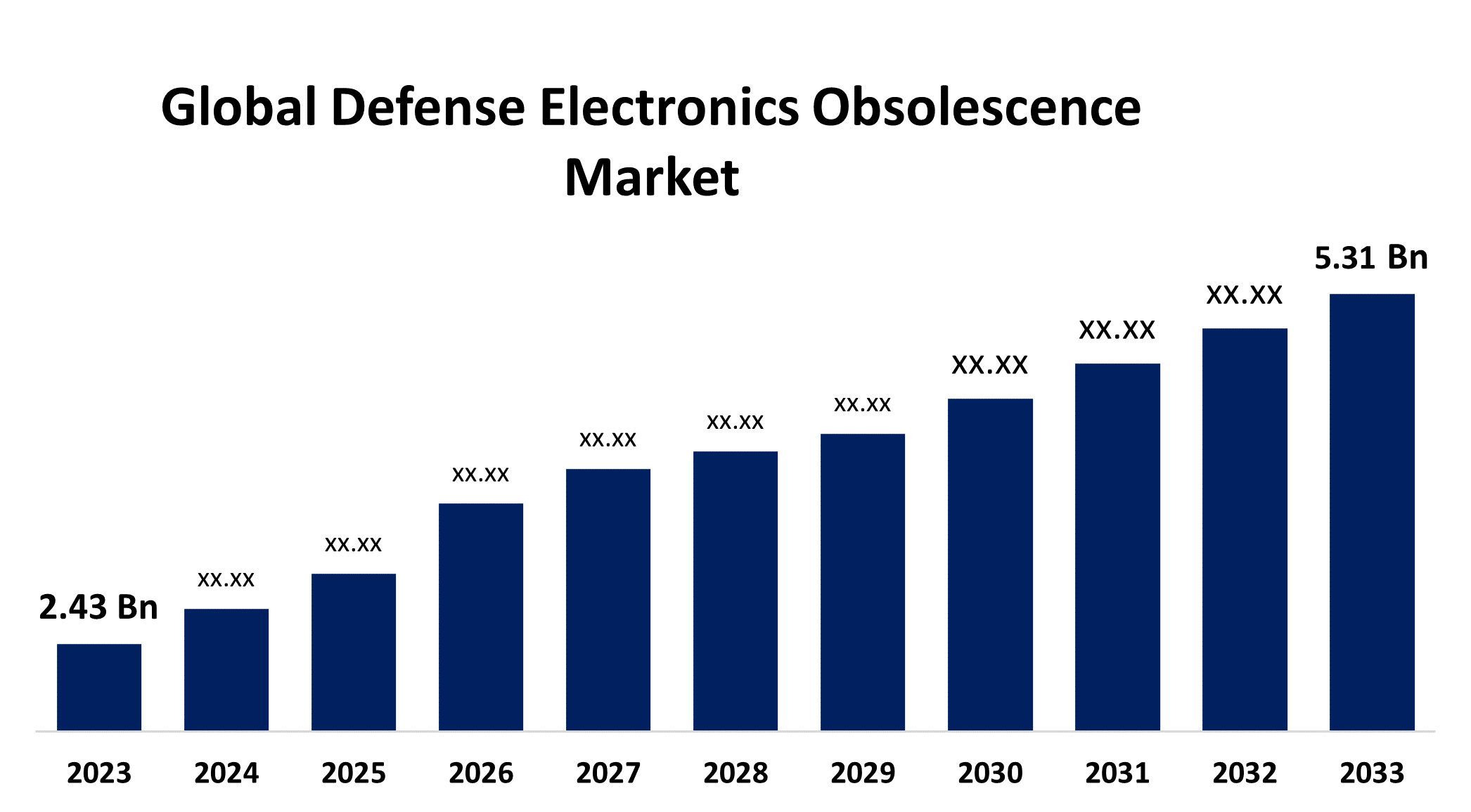

- The Global Defense Electronics Obsolescence Market Size was Valued at USD 2.43 Billion in 2023

- The Market Size is Growing at a CAGR of 8.13% from 2023 to 2033

- The Worldwide Defense Electronics Obsolescence Market Size is Expected to Reach USD 5.31 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Defense Electronics Obsolescence Market Size is Anticipated to Exceed USD 5.31 Billion by 2033, Growing at a CAGR of 8.13% from 2023 to 2033.

Market Overview

The defense electronics obsolescence covers a wide range of activities, including reverse engineering and upgrading outdated systems with contemporary components. In order to solve the particular difficulties, the defense industry faces, cooperation between research institutes, electronics producers, and defense contractors is also necessary. The obsolescence refers to the situation in which electronic systems, components, or technologies are no longer maintained, available, or sustainable because of improvements in technology, stops in manufacturing, or a lack of replacement parts. In January 2024, the Commonwealth of Australia awarded BAE Systems a contract to install a Common Control System (CCS) to upgrade the Mk 45 Mod 2 naval gun systems currently installed aboard Anzac class frigates. Strict regulations and standards are essential in determining how systems and components are designed to last in the defense electronics obsolescence industry. Defense electronics must adhere to the strictest operational, environmental, and interoperability criteria in order to meet the strictest requirements for performance and dependability. The emergence of modular and open architecture designs is making upgrades and component replacements simpler, decreasing vendor dependence, and lowering the long-term risk of obsolescence. The market for obsolete defense electronics is expected to expand further as military agencies priorities modernization initiatives and look for creative ways to maintain operational readiness.

Report Coverage

This research report categorizes the market for the defense electronics obsolescence market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the defense electronics obsolescence market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the defense electronics obsolescence market.

Global Defense Electronics Obsolescence Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 2.43 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.13% |

| 2033 Value Projection: | USD 5.31 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 193 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Type, By Systems, By Platform, By Region |

| Companies covered:: | Actia Group, Altium, Assel Poland, BAE Systems, Elbit Systems Ltd., L3Harris Technologies, Inc., Like Technologies, Raytheon Technologies Corporation, Thales, Whistler Technology, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Due to factors like shifting geopolitical landscapes, developing security threats, and the need to replace ageing equipment, many nations across the world are boosting their defense spending to modernize their armed forces and improve their capabilities. The desire for cutting-edge military technologies, particularly defense electronics, is fueled by this increase in defense spending. Because defense systems depend more and more on complex electronics, there are large potential to invest in obsolescence management solutions as this increases the danger of obsolescence. These kinds of solutions are essential for guaranteeing that defense systems continue to function and be efficient for the duration of their lives, assisting nations in avoiding expensive downtime and the necessity of disruptive system updates or replacements.

Restraining Factors

Defense electronics obsolescence market development is severely hampered by the high cost of replacing antiquated components in defense systems. This difficulty involves several expenses, including those related to developing new technologies, testing, certifying them, integrating them into current systems, and overseeing international supply chains. These endeavours necessitate significant financial outlays, frequently reaching into the millions or billions of dollars for comprehensive system redesigns

Market Segmentation

The defense electronics obsolescence market share is classified into type, system, and platform.

- The technology obsolescence segment is expected to hold the largest share of the defense electronics obsolescence market during the forecast period.

Based on the type, the defense electronics obsolescence market is categorized into logistics obsolescence, functional obsolescence, and technology obsolescence. Among these, the technology obsolescence segment is expected to hold the largest share of the defense electronics obsolescence market during the forecast period. Since the objective of optimizing the potential of older software and hardware solutions usually influences component choices, component selection during development frequently results in premature product redesigns and requalification due to this technology obsolescence segment boosting the market growth.

- The sensors segment is expected to grow at the fastest CAGR during the forecast period.

Based on the system, the defense electronics obsolescence market is categorized into sensors, electronic warfare systems, and targeting systems. Among these, the sensors segment is expected to grow at the fastest CAGR during the forecast period. Defense systems depend heavily on sensors, which supply essential information for functions like target tracking, surveillance, reconnaissance, and navigation. The risk of sensor obsolescence increases as defense systems rely more and more on sensors to perform these tasks. In addition, as sensor technology develops at a rapid pace, older models become obsolete quickly, forcing defense organizations to replace their outdated sensor systems with newer, more sophisticated models to remain competitive and effectively counter developing threats.

- The airborne segment is expected to hold a significant share of the defense electronics obsolescence market during the forecast period.

Based on the platform, the global defense electronics obsolescence market is categorized into airborne, naval, and land. Among these, the airborne segment is expected to hold a significant share of the defense electronics obsolescence market during the forecast period. Due to the high risk of obsolescence associated with the sophisticated electronics used by military aircraft, such as radars, aerial delivery systems, helmet-mounted displays (HMDs), communication systems, and palletized loading systems (PLS), it is expected that the airborne category will dominate the market.

Regional Segment Analysis of the Global Defense Electronics Obsolescence Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

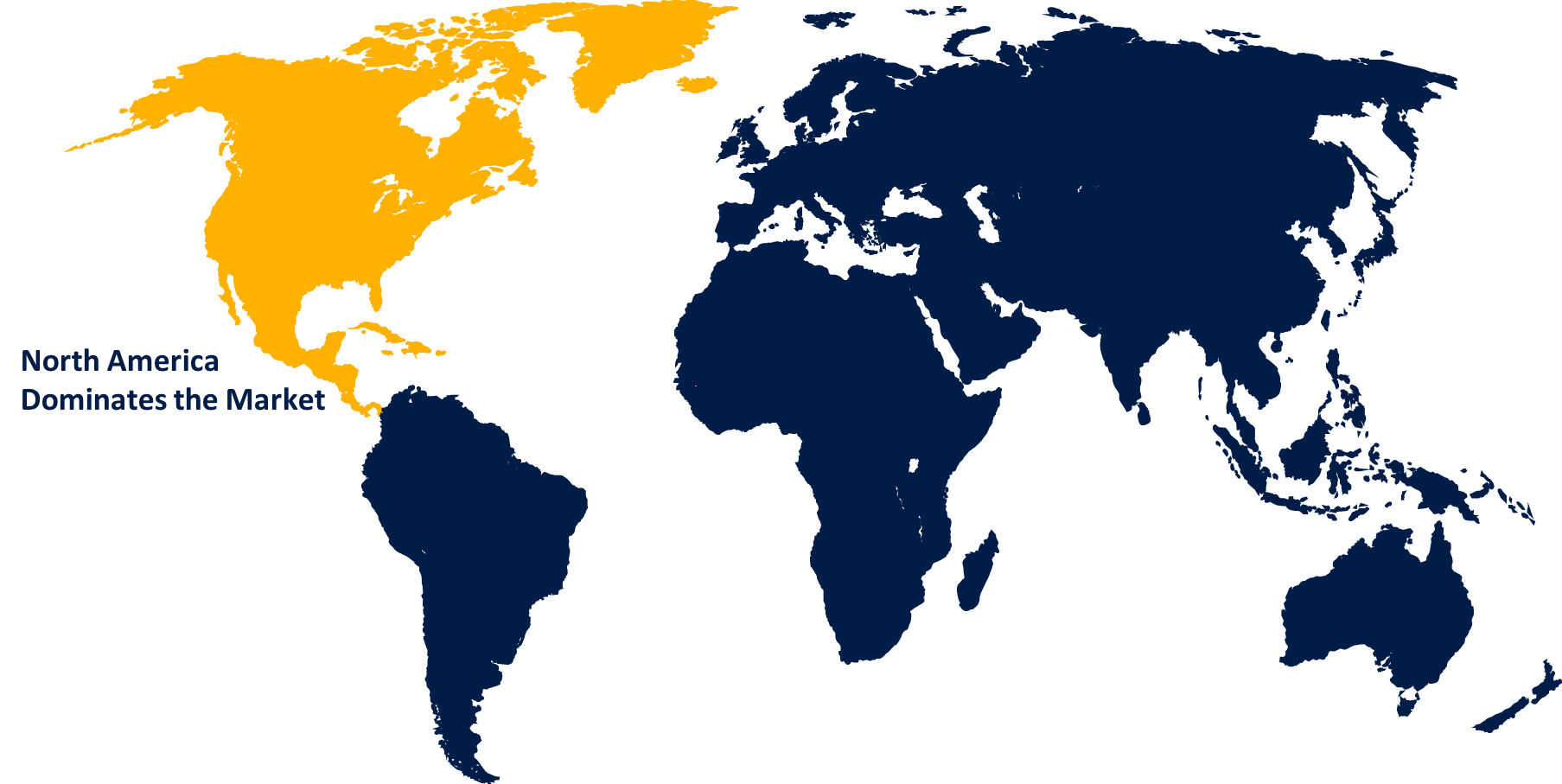

North America is projected to hold the largest share of the defense electronics obsolescence market over the forecast period.

Get more details on this report -

North America is projected to hold the largest share of the defense electronics obsolescence market over the forecast period. Prominent North American enterprises are building sophisticated obsolescence management approaches customized to suit the distinct needs of diverse platforms, emphasizing terrestrial, aquatic, and aerial systems. By leading the way in obsolescence management, North American businesses enable the military to sustain its technological superiority and operational preparedness. They do this by carefully allocating funds for collaboration, research and development, and R&D. North America is the leader in the defense electronics obsolescence business, which makes it essential for maintaining stability in an increasingly complex geopolitical setting and for safeguarding national security interests.

Asia Pacific is expected to grow at the fastest CAGR growth of the defense electronics obsolescence market during the forecast period. Innovative obsolescence management solutions catered to the unique requirements of defense electronics can be developed more easily because of the region's booming technological sector, which is characterized by rapid breakthroughs in fields like electronics, software, and engineering. Furthermore, as their defense industries grow, nations like China, South Korea, and India present chances for regional businesses to offer obsolescence management services and solutions, further boosting the sector's overall expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the defense electronics obsolescence market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Actia Group

- Altium

- Assel Poland

- BAE Systems

- Elbit Systems Ltd.

- L3Harris Technologies, Inc.

- Like Technologies

- Raytheon Technologies Corporation

- Thales

- Whistler Technology

- Others

Key Market Developments

- In October 2023, A licence agreement has been reached by Collins Aerospace, a division of Raytheon Technologies Corporation, and Hanwha Systems, a firm based in South Korea, to produce airborne tactical radios there as part of an upgrade programmer for the Second-generation Anti-jam Tactical UHF Radio for NATO waveform (SATURN).

- In September 2023, Collins Aerospace was selected by BAE Systems to supply the large-area display for the cockpit development of the Eurofighter Typhoon. Collins Aerospace and BAE Systems will work together to build a Large Area Display system that integrates the newest display technology with tried-and-true design components to minimize development schedule risks and obsolescence.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global defense electronics obsolescence market based on the below-mentioned segments:

Global Defense Electronics Obsolescence Market, By Type

- Logistics Obsolescence

- Functional Obsolescence

- Technology Obsolescence

Global Defense Electronics Obsolescence Market, By System

- Sensors

- Electronic Warfare Systems

- Targeting Systems

Global Defense Electronics Obsolescence Market, By Platform

- Airborne

- Naval

- Land

Global Defense Electronics Obsolescence Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the global defense electronics obsolescence market over the forecast period?The Global Defense Electronics Obsolescence Market Size is Expected to Grow from USD 2.43 Billion in 2023 to USD 5.31 Billion by 2033, at a CAGR of 8.13% during the forecast period 2023-2033.

-

2.Which region is expected to hold the highest share in the defense electronics obsolescence market?North America is projected to hold the largest share of the defense electronics obsolescence market over the forecast period.

-

3.Who are the top key players in the defense electronics obsolescence market?Actia Group, Altium, Assel Poland, BAE Systems, Elbit Systems Ltd., L3Harris Technologies, Inc., Like Technologies, Raytheon Technologies Corporation, Thales, Whistler Technology, and Others.

Need help to buy this report?