Global Defense Integrated Antenna Market Size, Share, and COVID-19 Impact Analysis, By Component Type (Transmitters, Receivers, Transceivers, Radio Frequency (RF) Switches), By Antenna Type (Fixed Antennas, Conformal Antennas, Phased Array Antennas, Adaptive Antennas), By Platform (Airborne, Ground-based, Naval, Space-based), By Application (Communication Systems, Radar Systems, Electronic Warfare Systems, Navigation Systems), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Defense Integrated Antenna Market Insights Forecasts to 2033

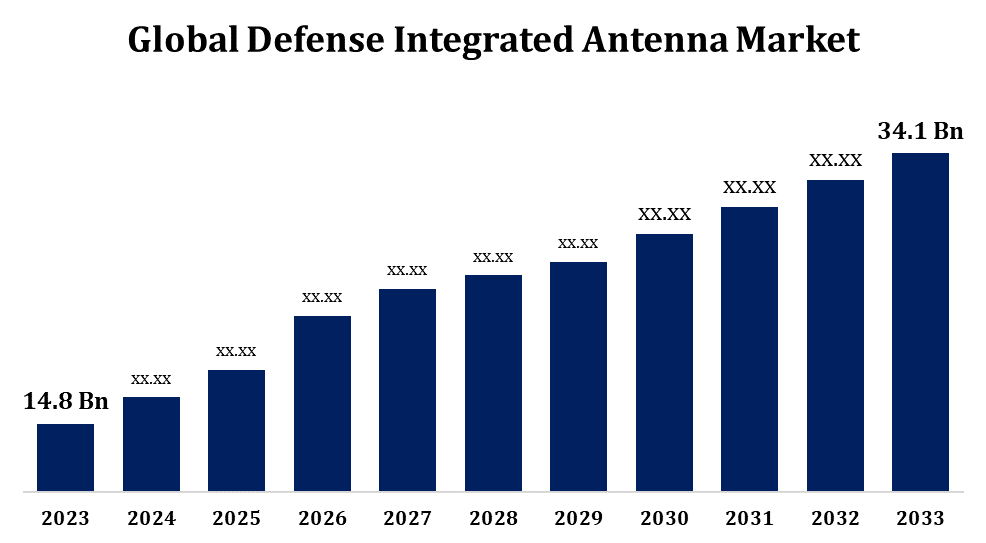

- The Defense Integrated Antenna Market was valued at USD 14.8 Billion in 2023.

- The Market Size is Growing at a CAGR of 8.70% from 2023 to 2033.

- The Worldwide Defense Integrated Antenna Market Size is Expected to reach USD 34.1 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Defense Integrated Antenna Market Size is Expected to reach USD 34.1 Billion by 2033, at a CAGR of 8.70% during the forecast period 2023 to 2033.

The Defense Integrated Antenna Market Size is experiencing significant growth due to increasing defense modernization programs, rising geopolitical tensions, and advancements in communication technologies. These antennas are crucial for secure, real-time data transmission in military applications such as radar, electronic warfare, and satellite communications. The market is driven by the demand for lightweight, high-performance antennas with enhanced stealth capabilities, particularly in unmanned systems and next-generation fighter aircraft. North America leads the market, supported by strong defense budgets and technological advancements, while the Asia-Pacific region is witnessing rapid expansion due to rising military expenditures. Key players are focusing on innovation, miniaturization, and multi-functionality to improve operational efficiency. The integration of artificial intelligence and software-defined radios is expected to further enhance market growth in the coming years.

Defense Integrated Antenna Market Value Chain Analysis

The Defense Integrated Antenna Market value chain comprises several key stages, from raw material sourcing to end-user deployment. It begins with raw material suppliers providing essential components such as metals, composites, semiconductors, and advanced dielectric materials. Manufacturers then design and develop antennas using cutting-edge technologies, integrating them with defense communication systems. System integrators play a crucial role in ensuring compatibility with military platforms, including aircraft, naval vessels, and ground-based systems. Testing and quality assurance are critical to meeting stringent military standards. Defense contractors and government agencies procure these antennas for various applications, including surveillance, electronic warfare, and secure communications. Post-deployment, maintenance and upgrades ensure operational efficiency. Collaboration between defense agencies, research institutions, and technology providers continues to drive innovation and market growth.

Defense Integrated Antenna Market Opportunity Analysis

The Defense Integrated Antenna Market presents significant opportunities driven by rising defense budgets, technological advancements, and evolving warfare strategies. The increasing adoption of unmanned systems, next-generation fighter jets, and advanced naval platforms is fueling demand for high-performance antennas with enhanced stealth, miniaturization, and multi-functionality. The integration of artificial intelligence, 5G, and software-defined radios offers new growth prospects, enabling real-time data exchange and improved battlefield communication. Emerging markets in the Asia-Pacific and Middle East regions present lucrative opportunities due to rising military modernization efforts. Additionally, growing investments in space-based defense infrastructure, such as satellite communication and missile defense systems, further expand market potential. Companies focusing on R&D, cybersecurity, and cost-effective manufacturing will gain a competitive edge in this evolving market landscape.

Defense Integrated Antenna Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 14.8 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.70% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 246 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Component Type, By Antenna Type, By Platform, By Application |

| Companies covered:: | NEC Corporation, Thales Group, SAAB AB, General Dynamics, L3Harris Technologies, Airbus Group, Raytheon Technologies, Northrop Grumman, BAE Systems, Toshiba Corporation, Mitsubishi Electric, Leonardo SpA, Harris Corporation, Lockheed Martin, Rockwell Collins, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Market Dynamics

Defense Integrated Antenna Market Dynamics

Increasing demand for cutting-edge defense technologies

The Defense Integrated Antenna Market is witnessing growth due to the increasing demand for cutting-edge defense technologies. Modern military operations rely on advanced communication, radar, and electronic warfare systems, driving the need for high-performance antennas. The rise of unmanned aerial vehicles (UAVs), next-generation fighter aircraft, and naval defense systems has further accelerated the adoption of lightweight, multi-functional, and stealth-compatible antennas. Technological advancements such as 5G, artificial intelligence, and software-defined radios are enhancing battlefield connectivity and situational awareness. Additionally, increasing investments in satellite-based defense infrastructure and cybersecurity are creating new opportunities. Emerging markets in Asia-Pacific and the Middle East are also contributing to market expansion through military modernization programs. Companies focusing on innovation and cost-effective solutions are well-positioned for growth in this evolving sector.

Restraints & Challenges

One key hurdle is the high cost of advanced antenna technologies, which limits adoption, especially in budget-constrained defense programs. Strict military regulations and compliance requirements add complexity to manufacturing and integration processes. The increasing need for miniaturization and multi-functionality presents design challenges, requiring continuous innovation. Cybersecurity threats and electronic warfare risks also pose concerns, as military communication systems must be highly secure and resistant to interference. Supply chain disruptions, including shortages of critical raw materials and semiconductors, can impact production timelines. Additionally, the rapid evolution of technology demands frequent upgrades, increasing maintenance costs.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Defense Integrated Antenna Market from 2023 to 2033. The United States, as the largest defense spender, heavily invests in next-generation communication, radar, and electronic warfare systems, driving demand for high-performance antennas. The presence of major defense contractors, such as Lockheed Martin, Raytheon, and Northrop Grumman, fosters innovation in stealth, miniaturization, and multi-functional antenna technologies. The increasing adoption of unmanned aerial vehicles (UAVs), satellite-based defense infrastructure, and 5G-enabled battlefield communications further fuels market growth. Additionally, government initiatives to enhance cybersecurity and space-based defense capabilities contribute to expansion. With continuous R&D investments and collaborations between defense agencies and technology firms, North America remains a key region for advancements in defense integrated antenna systems.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China, India, Japan, and South Korea are heavily investing in advanced communication, radar, and electronic warfare systems to enhance their defense capabilities. The demand for integrated antennas is driven by the adoption of unmanned aerial vehicles (UAVs), next-generation fighter jets, and naval defense systems. Additionally, the expansion of satellite-based military communication and surveillance infrastructure is boosting market opportunities. Local defense manufacturers and international players are focusing on innovation, indigenous production, and strategic partnerships to strengthen regional capabilities. As governments emphasize self-reliance and technological advancements, the Asia-Pacific defense integrated antenna market is poised for significant expansion in the coming years.

Segmentation Analysis

Insights by Component

The Transmitters segment accounted for the largest market share over the forecast period 2023 to 2033. As modern defense operations require real-time data transmission, secure and high-frequency transmitters are becoming essential components in integrated antenna systems. The increasing adoption of unmanned aerial vehicles (UAVs), next-generation fighter jets, and naval defense platforms is driving demand for high-power, lightweight, and efficient transmitters. Advancements in software-defined radios, 5G, and satellite-based communication are further fueling innovation in this segment. Additionally, governments worldwide are investing in next-generation transmitters to enhance secure battlefield connectivity and surveillance capabilities. With continuous research and development, miniaturization, and improved power efficiency, the transmitters segment is expected to play a crucial role in the evolution of defense communication systems.

Insights by Antenna Type

The Phased Array Antennas segment accounted for the largest market share over the forecast period 2023 to 2033. These antennas offer high-speed beam steering, enhanced target tracking, and improved resistance to jamming, making them essential for modern defense applications. The rising adoption of next-generation fighter jets, unmanned aerial vehicles (UAVs), and naval defense systems is driving demand for phased array antennas. Additionally, advancements in active electronically scanned arrays (AESA) are improving performance, reducing weight, and increasing operational efficiency. Governments and defense agencies worldwide are investing in phased array technologies to enhance surveillance, missile defense, and battlefield connectivity. As innovation in miniaturization, multi-functionality, and 5G-enabled systems continues, the phased array antennas segment is expected to grow rapidly in the coming years.

Insights by Platform

The Airborne segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is due to the increasing deployment of advanced aircraft, unmanned aerial vehicles (UAVs), and military helicopters for surveillance, reconnaissance, and combat missions. Modern defense operations require high-performance antennas for secure communication, radar, and electronic warfare, driving demand for lightweight, compact, and multi-functional airborne antennas. The integration of software-defined radios, satellite-based communication, and 5G technology is further enhancing airborne connectivity and operational efficiency. Rising defense budgets and military modernization programs, particularly in North America and the Asia-Pacific region, are fueling investment in next-generation airborne systems. Additionally, advancements in stealth technology and phased array antennas are improving performance in contested environments. With continuous R&D efforts, the airborne segment is poised for substantial expansion in the coming years.

Insights by Application

The Communication Systems segment accounted for the largest market share over the forecast period 2023 to 2033. Modern defense operations require real-time data transmission for battlefield awareness, command and control, and intelligence sharing, driving the adoption of advanced integrated antennas. The rise of unmanned aerial vehicles (UAVs), next-generation fighter jets, and naval platforms has further accelerated the need for robust communication solutions. Key advancements such as software-defined radios, satellite-based communication, and 5G-enabled networks are enhancing connectivity, encryption, and anti-jamming capabilities. Growing defense budgets, particularly in North America and Asia-Pacific, are fueling investments in next-generation military communication infrastructure. As cyber threats and electronic warfare risks increase, the demand for highly secure and adaptive communication systems is expected to drive significant market expansion.

Recent Market Developments

- In January 2022, L3Harris Technologies secured an IDIQ contract valued at USD 750 million from the US Marine Corps for multi-channel handheld and vehicular radio systems.

Competitive Landscape

Major players in the market

- NEC Corporation

- Thales Group

- SAAB AB

- General Dynamics

- L3Harris Technologies

- Airbus Group

- Raytheon Technologies

- Northrop Grumman

- BAE Systems

- Toshiba Corporation

- Mitsubishi Electric

- Leonardo SpA

- Harris Corporation

- Lockheed Martin

- Rockwell Collins

- Others

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Defense Integrated Antenna Market, Component Analysis

- Transmitters

- Receivers

- Transceivers

- Radio Frequency (RF) Switches

Defense Integrated Antenna Market, Antenna Type Analysis

- Fixed Antennas

- Conformal Antennas

- Phased Array Antennas

- Adaptive Antennas

Defense Integrated Antenna Market, Platform Analysis

- Airborne

- Ground-based

- Naval

- Space-based

Defense Integrated Antenna Market, Application Analysis

- Communication Systems

- Radar Systems

- Electronic Warfare Systems

- Navigation Systems

Defense Integrated Antenna Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Defense Integrated Antenna Market?The global Defense Integrated Antenna Market is expected to grow from USD 14.8 billion in 2023 to USD 34.1 billion by 2033, at a CAGR of 8.70% during the forecast period 2023-2033.

-

2. Who are the key market players of the Defense Integrated Antenna Market?Some of the key market players of the market are the NEC Corporation, Thales Group, SAAB AB, General Dynamics, L3Harris Technologies, Airbus Group, Raytheon Technologies, Northrop Grumman, BAE Systems, Toshiba Corporation, Mitsubishi Electric, Leonardo SpA, Harris Corporation, Lockheed Martin, Rockwell Collins.

-

3. Which segment holds the largest market share?The airborne segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?