Global Defense Robotics Market Size, Share, and COVID-19 Impact Analysis, By Type (Autonomous and Human Operated), By Application (Firefighting, Search & Rescue, Transportation, Mine Clearance, Intelligence, Surveillance, & Reconnaissance (ISR), Combat Support, EOD, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Defense Robotics Market Insights Forecasts to 2033

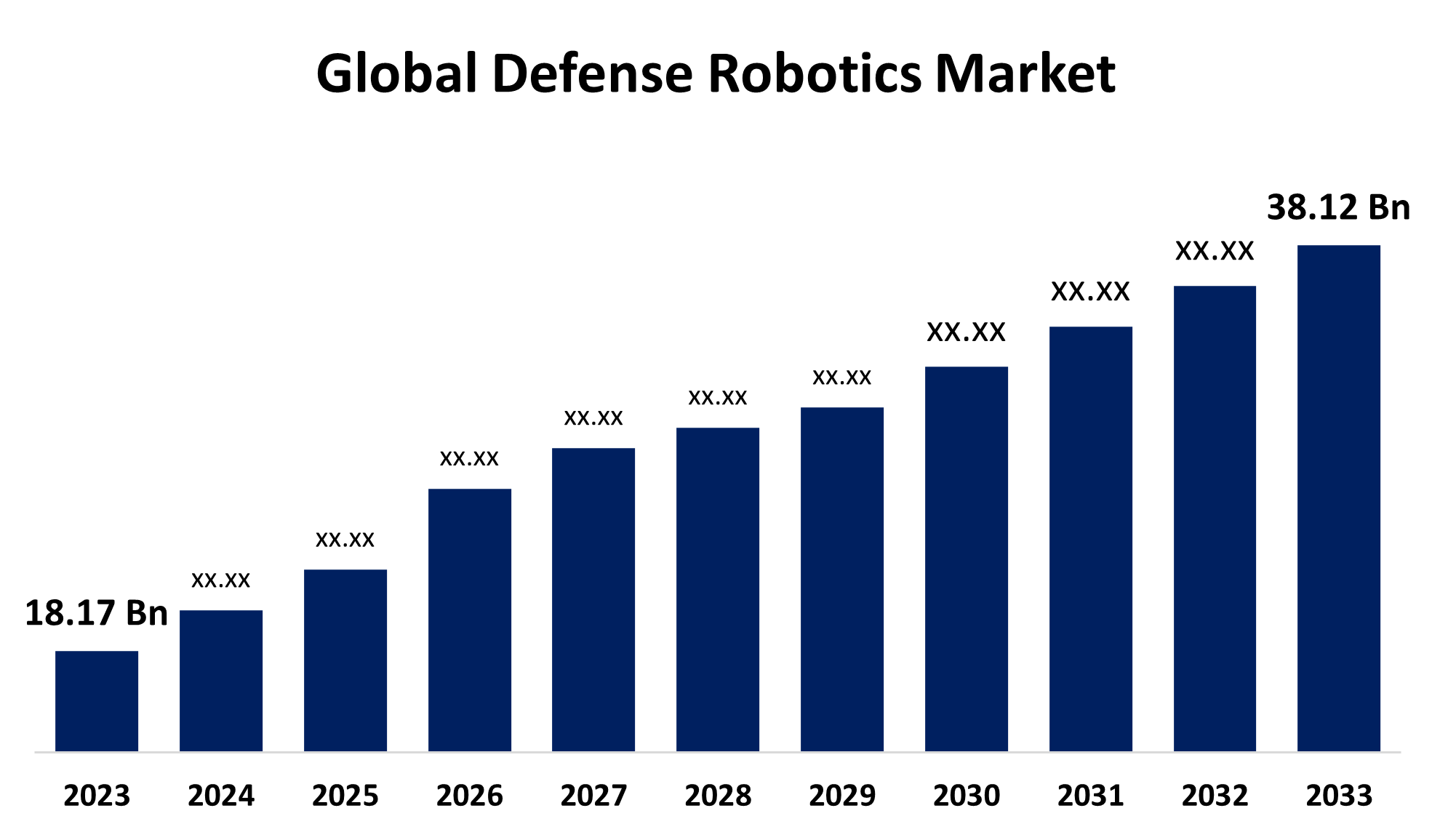

- The Global Defense Robotics Market Size was estimated at USD 18.17 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 7.69% from 2023 to 2033

- The Worldwide Defense Robotics Market Size is Expected to Reach USD 38.12 Billion by 2033

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Defense Robotics Market Size is expected to cross USD 38.12 Billion by 2033, Growing at a CAGR of 7.69% from 2023 to 2033. The defense robotics market is seeing great opportunities as a result of the ongoing rise in global defense spending and the push by governments worldwide for military modernization programs.

Market Overview

The defense robotics market refers to the global industry engaged in the design, development, manufacture, and fielding of robot systems and technology for specific defense or military applications. Gunshot, airborne, and underwater surveillance have become possible through the development of defense robots, mainly to be used in defense and for national security reasons. This market includes a vast spectrum of robotic platforms including UGVs, UAVs, underwater drones, and autonomous weapon systems that have been used for a variety of defense-related operations. The support that defense robotics provides to the military includes conducting picture capturing, explosive ordnance disposal, shooting, carrying wounded soldiers, and mine detection operations. For instance, in July 2024, Advanced security technologies, such as Prahasta, an AI-driven quadruped robot for real-time 3D mapping, were launched by Zen Technologies and its subsidiary AI Turing Technologies. Barbarik-URCWS, the lightest remote weapon station in the world, Hawkeye, an anti-drone camera, and Sthir Stab 640, an armoured vehicle stabilized sight, are other advancements. Several factors, such as rising military spending worldwide, technology transfers between industries, and strategic modernization efforts by national defense forces, are driving the growth of the defense robotics market. The increasing automation in the military sector is a major factor that drives the growth of the defense robotics market.

Report Coverage

This research report categorizes the defense robotics market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the defense robotics market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the defense robotics market.

Global Defense Robotics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 18.17 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 7.69% |

| 023 – 2033 Value Projection: | USD 38.12 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 257 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Type, By Application, By Regional Analysis and COVID-19 Impact Analysis. |

| Companies covered:: | Zen Technologies, India Accelerator, DARPA, Boeing Company, Elbit System Ltd., Thales Group, Boston Dynamics, BAE Systems Plc., AeroVironment, Lockheed Martin Corporation, Northrop Grumman Corporation, Clearpath Robotics Inc., Saab AB, Kongsberg Gruppen, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The necessity for unmanned systems for military operations, rising defense budgets, and technology developments are the primary factors driving the growth of the defense robotics market. Technological developments, the growth of defense budgets, the need for unmanned systems, national security concerns, and operational cost-efficiency considerations are the main factors driving the growth of the defense robotics market. Increased military expenditure, the need for unmanned systems (UAVs, UGVs), and the advancement of automation, artificial intelligence, and sensor technology are anticipated to be the significant factors driving the growth of the defense robotics market. All geopolitical tensions, concerns over cost-effectiveness in operation, reduced human death toll, and national security matters push more market growth.

Restraining Factors

The growth of the defense robotics market is expected to be restricted by the inability of human workers to handle UGVs and robots when detecting and aiming at specific locations due to a lack of depth, a small field of view, and insufficient context.

Market Segmentation

The defense robotics market share is classified into type and application.

- The autonomous segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the type, the defense robotics market is divided into autonomous and human-operated. Among these, the autonomous segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Autonomous defense robots, which include unmanned aerial vehicles (UAVs), unmanned ground vehicles (UGVs), and autonomous underwater vehicles (AUVs), are of common use in surveillance, reconnaissance, logistics, and even combat.

- The intelligence, surveillance, & reconnaissance (ISR) segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the defense robotics market is divided into firefighting, search and rescue, transportation, mine clearance, intelligence, surveillance, & reconnaissance (ISR), combat support, EOD, and others. Among these, the intelligence, surveillance, & reconnaissance (ISR) segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Applications of ISR are essential to military and defense operations due to their enabling decision-making in both combat and non-combat situations, monitoring enemy activity, and helping offer situational awareness.

Regional Segment Analysis of the Defense Robotics Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the defense robotics market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the defense robotics market over the predicted timeframe. The North American region is becoming increasingly recognized as having the most advanced military systems in terms of technology. Moreover, this field has a great deal of experience integrating a variety of technologies. Mobility and project scheduling, mapping and danger prevention, and human-machine interfaces through voice and haptics are all covered in the concept. Furthermore, by the conclusion of the anticipated time frame, the United States anticipates having roughly 10,000 robots in its defensive system.

Asia Pacific is expected to grow at the fastest CAGR growth of the defense robotics market during the forecast period. It is projected that Asia Pacific would grow exponentially in the years to come, trailing only Europe. The region has made investments in air, sea, and land security programs, which is mostly to blame. Investment in advanced technologies, such as artificial intelligence and nanotechnology, which significantly transform defense systems' capabilities, is highly valued by the countries in the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the defense robotics market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Zen Technologies

- India Accelerator

- DARPA

- Boeing Company

- Elbit System Ltd.

- Thales Group

- Boston Dynamics

- BAE Systems Plc.

- AeroVironment

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Clearpath Robotics Inc.

- Saab AB

- Kongsberg Gruppen

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2024, In collaboration with DARPA, SpaceLogistics is utilizing the robotic loaded weapons for the MRV. Three clients have already signed up for the company's MRV services: two Intelsat satellites and one Optus satellite. The propulsion jet packs known as Mission Extension Pods (MEPs), which can extend the operational life of aged satellites by roughly six years, would be provided to these clients.

- In May 2024, A new vertical dubbed RUMS (Robotics, Unmanned & Space) was launched by India Accelerator (IA) to assist entrepreneurs in the domains of space technology, ground robots, unmanned aerial systems (UAS), and counter-drone systems. The goal of this program is to promote growth and innovation in various sectors.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the defense robotics market based on the below-mentioned segments:

Global Defense Robotics Market, By Type

- Autonomous

- Human Operated

Global Defense Robotics Market, By Application

- Firefighting

- Search and Rescue

- Transportation

- Mine Clearance

- Intelligence, Surveillance, & Reconnaissance (ISR)

- Combat Support, EOD

- Others

Global Defense Robotics Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the defense robotics market over the forecast period?The defense robotics market is projected to expand at a CAGR of 7.69% during the forecast period.

-

2. What is the market size of the defense robotics market?The Global Defense Robotics Market Size is Expected to Grow from USD 18.17 Billion in 2023 to USD 38.12 Billion by 2033, at a CAGR of 7.69% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the defense robotics market?North America is anticipated to hold the largest share of the defense robotics market over the predicted timeframe.

Need help to buy this report?