Global Diabetes Devices Market Size, Share, and COVID-19 Impact Analysis By Type (Blood Glucose Monitoring Devices and Insulin Delivery Devices), By Distribution Channel (Hospital Pharmacies, Diabetes Clinics, Retail Pharmacies, Online Pharmacies, and Others), By Applications (Hospitals, Diagnostic Centers and Homecare), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 - 2030.

Industry: HealthcareGlobal Diabetes Devices Market Insights Forecasts to 2030

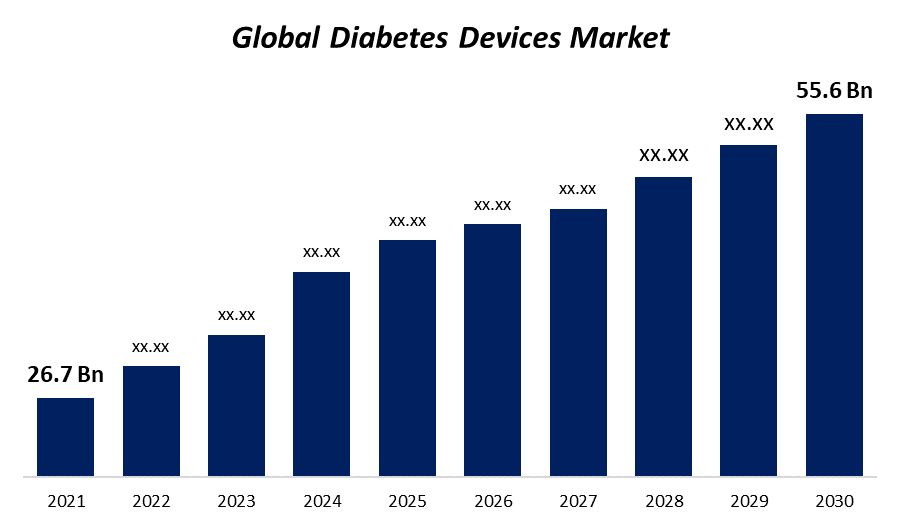

- The global diabetes devices market was valued at USD 26.7 billion in 2021.

- The market is growing at a CAGR of 8.5% from 2021 to 2030

- The global diabetes devices market is expected to reach USD 55.6 billion by 2030

- The Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The global diabetes devices market is expected to reach USD 55.6 billion by 2030, at a CAGR of 8.5% during the forecast period 2021 to 2030. It is expected that the number of programs that governments and organizations are running to raise awareness of diabetes will lead to more people using diabetic devices.

Market Overview:

Diabetes mellitus, sometimes called "diabetes," is a group of metabolic diseases in which the blood sugar level stays high. Typical signs are going to the bathroom more often, thirsting, and wanting to eat more. Heart disease, stroke, chronic kidney disease, foot ulcers, nerve damage, eye damage, and mental decline are all serious long-term risks. The rise in diabetes, which can be caused by things like getting older, being overweight, and living an unhealthy lifestyle, is one of the things that is making the market grow. People who are overweight or obese are much more likely to get diabetes. Diabetes is becoming more common because risk factors like being overweight and obese are also becoming more common. Diabetes is becoming more common in places like the Middle East and Asia-Pacific (APAC), which is driving up the demand for diabetes treatment and, in turn, the price of diabetes therapy. For example, in 2017, 72,946,400 people in India were diagnosed with diabetes for the first time, according to the International Diabetes Federation. It is expected that the demand for diabetic devices will be driven by untapped development potential in fast-growing countries in the Middle East, Africa, and Asia, as well as a greater awareness of diabetes in these areas. A large number of older people is one reason why companies that make devices for diabetics want to grow their businesses. Other reasons are the availability of low-cost medical facilities, cheap labor, and loose regulations. To get the biggest market share possible, manufacturers are putting most of their efforts into taking advantage of the opportunities that come with growing economies. Recent changes in diabetic device technology, such as the creation of more advanced insulin pumps and pens, are making more people want to buy these things. To get a large share of the market, the most successful companies are focusing on developing new technologies and products.

Report Coverage

This research report categorizes the market for the global diabetes devices market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global diabetes devices market. Recent market developments and competitive strategies such as expansion, product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each global diabetes devices market sub-segments.

Global Diabetes Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 26.7 billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 8.5% |

| 2030 Value Projection: | USD 55.6 billion |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 197 |

| Tables, Charts & Figures: | 133 |

| Segments covered: | By Type, By Distribution Channel, By Applications, By Region, COVID-19 Impact Analysis |

| Companies covered:: | Medtronic plc, Abbott Laboratories, F.Hoffmann-La-Ltd., Bayer AG, Lifescan, Inc., B Braun Melsungen AG, Lifescan, Inc., Dexcom Inc., Insulet Corporation, Ypsomed Holdings, Companion Medical, Sanofi, Valeritas Holding Inc., Novo Nordisk, Arkray, Inc. |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Segmentation Analysis

- In 2021, the insulin delivery devices segment dominated the market with the largest market share of 55% and market revenue of 14.68 billion.

Based on type, the diabetes devices market is categorized into Blood Glucose Monitoring Devices and Insulin Delivery Devices. In 2021, the insulin delivery devices segment dominated the market with the largest market share of 55% and market revenue of 14.68 billion. In the market for people with diabetes, insulin delivery devices are expected to grow at the fastest rate. Some of the main things that drive the demand for insulin delivery devices are the increasing number of rules and approvals for technological advances in insulin delivery devices like insulin pens, insulin pumps, jet injectors, and other devices. More and more people are using insulin patches and smart insulin pumps to self-manage their diabetes. When it came to devices for people with diabetes in 2021, pens made up a larger part of the market. On the other hand, the pump sector is expected to get a big share of the market because it is expected to grow at the fastest CAGR over the forecast period.

- In 2021, the hospital pharmacies segment accounted for the largest share of the market, with 35% and market revenue of 9.34 billion.

Based on distribution channel, the diabetes devices market is categorized into Hospital Pharmacies, Diabetes Clinics, Retail Pharmacies, Online Pharmacies, and Others. In 2021, hospital pharmacies dominated the market with the largest market share of 35% and market revenue of 9.34 billion. Because hospital pharmacies see a lot of people and have a lot of products, they have a lot of market share. This helps them keep their dominant position in the market. On the campus of a hospital, there are two different kinds of pharmacies: the inpatient pharmacy and the outpatient pharmacy. The hospital has an inpatient pharmacy that only certain staff members can use. It serves operating rooms, intensive care units, inpatient wards, and other special service areas. On the other hand, outpatient pharmacies are usually near hospital entrances or lobbies so that patients can get to them easily. Outpatient pharmacies usually have glucose monitoring devices that patients can carry in their pockets and systems for giving insulin.

- In 2021, the hospital's segment accounted for the largest share of the market, with 40% and a market revenue of 10.68 billion.

Based on application, the diabetes devices market is categorized into Hospitals, Diagnostic Centers and Homecare. In 2021, hospitals dominated the market with the largest market share of 40% and market revenue of 10.68 billion. Demand in this market is going up because more and more diabetic people are being admitted to hospitals, driving up the number of people needing these products. Compared to people who don't have diabetes, people with diabetes are three times more likely to be admitted to the hospital. Because of these technological changes, more insulin pumps are being used in places like hospitals.

Regional Segment Analysis of the Diabetes Devices Market

Get more details on this report -

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

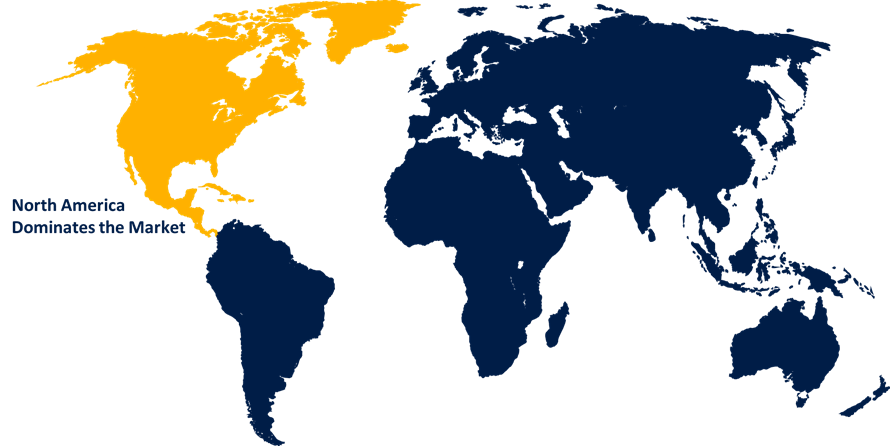

Among all regions, North America emerged as the largest market for the global diabetes devices market, with a market share of around 38.94% and 26.7 billion of the market revenue in 2021.

- In 2021, North America emerged as the largest market for the global diabetes devices market, with a market share of around 38.94% and 26.7 billion of the market revenue. The United States has been the leader in the North American market for a long time because of its large number of diabetic people and its generous reimbursement rules. The market for this product is largely driven by rising healthcare costs and high per capita income. The average cost of diabetes-specific treatments for a single person in 2019 was expected to be USD 9,505.60, according to the American Diabetes Association. A diabetic in the United States may spend about USD 16,750 on medical care yearly, which is a lot of money.

- The Asia Pacific market is expected to grow at the fastest CAGR between 2022 and 2030. In Asian countries like China and India, there has been a big rise in the number of people who use insulin-delivery devices. Several reasons these devices are becoming more popular in the Asia-Pacific region. For example, people are learning more about how to treat diabetes, and the healthcare system is changing. Also, more money is being spent on healthcare, leading countries like China and India to buy more technologically advanced goods. This is expected to lead to more growth in the market as a whole.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global diabetes devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Market Players:

- Medtronic plc

- Abbott Laboratories

- F.Hoffmann-La-Ltd.

- Bayer AG

- Lifescan, Inc.

- B Braun Melsungen AG

- Lifescan, Inc.

- Dexcom Inc.

- Insulet Corporation

- Ypsomed Holdings

- Companion Medical

- Sanofi

- Valeritas Holding Inc.

- Novo Nordisk

- Arkray, Inc.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Third-party knowledge providers

- Value-Added Resellers (VARs)

Recent Development

- In March 2022, Medtronic India released the MiniMed 780G. The MiniMed 780G system is a closed-loop insulin pump system made for people with type-1 diabetes who are between the ages of 70 and 80.

- In February 2022, BlueSemi, a company based in Hyderabad, India, made Eyva, a glucose monitor that doesn't need any kind of invasive procedure. India is where Eyva was designed and made.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2030. Spherical Insights has segmented the global diabetes devices market based on the below-mentioned segments:

Global Diabetes Devices Market, By Type

- Blood Glucose Monitoring Devices

- Insulin Delivery Devices

Global Diabetes Devices Market, By Distribution Channel

- Hospital Pharmacies

- Diabetes Clinics

- Retail Pharmacies

- Online Pharmacies

- Others

Global Diabetes Devices Market, By Applications

- Hospitals

- Diagnostic Centers

- Homecare

Global Diabetes Devices Market, Regional Analysis

- North America

- The US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- The Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?