Global Digestive Health Supplements Market Size, Share, and COVID-19 Impact Analysis, By Product (Prebiotics, Probiotics, Enzymes, Fulvic Acid, and Others), By Form (Capsules, Tablets, Powders, Liquids, and Others), By Distribution Channel (OTC, and Prescribed), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: HealthcareGlobal Digestive Health Supplements Market Insights Forecasts to 2033

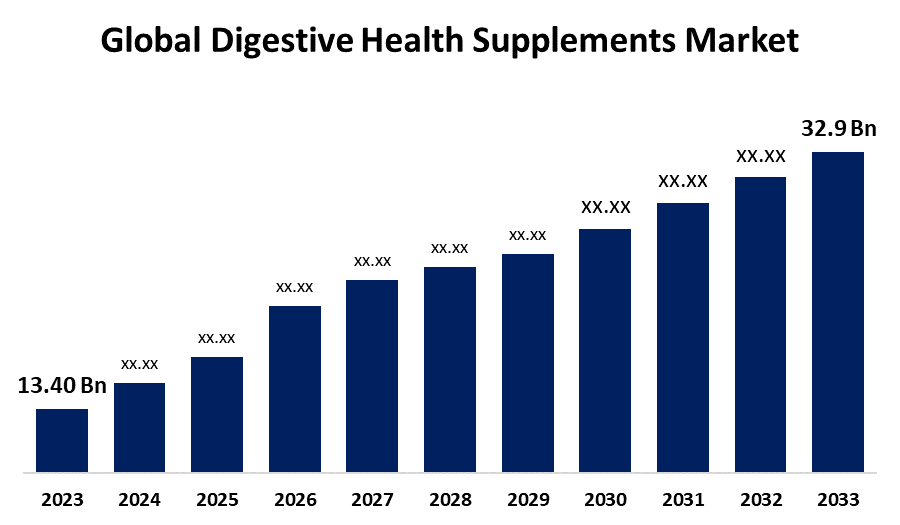

- The Global Digestive Health Supplements Market Size Was Valued at USD 13.40 Billion in 2023

- The Market Size is Growing at a CAGR of 9.40% from 2023 to 2033

- The Worldwide Digestive Health Supplements Market Size is Expected to Reach USD 32.9 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Digestive Health Supplements Market Size is Anticipated to Exceed USD 32.9 Billion by 2033, Growing at a CAGR of 9.40% from 2023 to 2033.

Market Overview

Digestive health supplements are designed to help resolve GI issues and improve gut function in general. These can be a range of components such as probiotics which are live bacteria and yeast that help with digestion, and other things like fiber supplements to soften your stool and aid in moving them out. However because there is no regulation by the Food and Drug Administration (FDA), many of these products come onto the market with no backing or evidence from that overseeing agency. They must be FDA-approved and need to have a clinical study to get onto drug therapy. Furthermore, she comes with her digestive enzymes (lipase/amylase/protease/lactate/cellulose) which are necessary for digesting food and gut health. These vitamins help reduce inflammation, gas, and bloating as well as piles, diarrhea, or acid reflux. It is also said to reduce inflammation, relieve achy muscles and joints, and ease chemotherapy side effects. Minerals and plants are also found in supplements that maintain a healthy GI tract. There are also no FDA-approved prescription or OTC drugs that help keep your gut in order.

Report Coverage

This research report categorizes the market for digestive health supplements based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the digestive health supplements market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the digestive health supplements market.

Global Digestive Health Supplements Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 13.40 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 9.40% |

| 023 – 2033 Value Projection: | USD 32.9 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Form, By Distribution Channel, By Region |

| Companies covered:: | Amway Corp., Bayer AG, Custom Probiotics Inc., Herbalife Nutrition Ltd., BASF SE, Nature’s Bounty, Garden of Life, Lonza Group Ltd., NOW Foods, Procter & Gamble, Pfizer Inc., Schiff Nutrition International, Pharmavite, Bayer AG, NU SKIN, Yakult Honsha Co., Ltd., Sanofi, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving factor

The high growth of the worldwide market for digestive health supplements is powered by several variables. One of the top digestive disorders aside from acid reflux, constipation, and irritable bowel syndrome (IBS) is due to more consumption of processed high-fat low-fiber food. Meanwhile, because people increasingly care about the gut microbiota and how performance contributes to their overall health and well-being, there is a growing consumer demand for supplements that promote digestive function to clear things up. There is an increasing prevalence of gastrointestinal disorders such as Crohn's disease, gastroesophageal reflux disease (GERD), and irritable bowel syndrome (IBS) that has led to the demand for herbal remedies in particular cases where conventional pharmaceuticals are unsatisfactory. As a result, individuals are gradually inclining towards plant-based natural supplements instead of synthetic or prescribed ones. This includes probiotics, enzymes, and fiber from natural sources. Together, these wide and varied inclinations have underpinned the extraordinary rise of the digestive health supplements market in terms of both volume and variety as stakeholders continue to be more aligned with new consumer demands.

Restraining Factors

Some of the factors that may restrict demand for digestive health supplements and retard market growth include: The main issue is the absence of industry standards and regulations which could potentially open up some quality/safety issues for consumers. Not having a definitive pool of clinical research and clear-cut recommendations on using particular supplements for digestive health gives rise to uncertainty, fear, or mistrust that might interfere with its wider utility. Besides, the high cost of certain specialized supplements may also discourage a larger share of the market from buying them, especially in underdeveloped countries. These include things like special probiotic strains or high-quality enzyme mixes in particular supplements. In the end, while both nonprescription and recommended medications may take away shares from supplements for treating some digestive problems consumers would rather have been tested to allow the use of proper knowledgeable pharmaceutical remedies. These barriers to entry in an already crowded market may explain why digestive health has not seen the same growth as other conditions, but they will also need to be solved if it is going to continue growing.

Market Segmentation

The digestive health supplements market share is classified into product, form, and distribution channel.

- The probiotics segment is estimated to hold the highest market revenue share through the projected period.

Based on the product, the digestive health supplements market is classified into prebiotics, probiotics, enzymes, fulvic acid, and others. Among these, the probiotics segment is estimated to hold the highest market revenue share through the projected period. This is reflected in the increasing scientific evidence that probiotic bacteria may help to maintain a healthy digestive system and support such diverse intestinal conditions as irritable bowel syndrome (IBS), inflammatory bowel disease (e.g., Crohn's or ulcerative colitis), antibiotic-associated diarrhea and other disturbances of human gut health. As people grow to understand the significance of gut health, there has been a surge in demand for probiotic-based supplements that can help aid digestion. strengthen immunity and improve physical well-being all around. Additionally, a wide choice of probiotic strains and formulations for administration modes have significantly strengthened the dominance in the segment, bolstered by rising consumer confidence in their efficacy as supplements. The consistent need for improved gut health and a growing understanding of the multi-factorial relationship between human well-being and the bacteria found inside the body is expected to help sustain probiotic supplements.

- The capsules segment is anticipated to hold the largest market share through the forecast period.

Based on the form, the digestive health supplements market is divided into capsules, tablets, powders, liquids, and others. Among these, the Capsules segment is expected to record the largest market share through the forecast period. That is due to the great demand and consumerism when it comes to capsule-based supplements. They have some benefits such as ease of administration, precise dosing, and better stability and shelf life for the actives compared to liquids or powders. Another reason capsules are more widely used is they can be seen as a convenient and inconspicuous option for people who want to include digestive health supplements in their regular diet. Additionally, capsule dosing allows for an increased diversity of probiotic strains and enzymes, in combination with other gut-supporting ingredients. The capsule form of digestive health supplements, thanks to its intrinsic benefits such as convenient dosage compliance for all age groups and accessibility in retail pharmacies will be the most sought-after among consumers going forward.

- The OTC segment is expected to dominate the global digestive health supplements market during the forecast period.

Based on the distribution channel, the digestive health supplements market is divided into OTC, and prescribed. Among these, the OTC segment is expected to dominate the global commercial food and biomedical refrigerators and freezers market during the forecast period. Consumers are increasingly seeking self-care options for minor digestive issues, driving demand for easily accessible OTC supplements. These products offer convenience, and affordability, and don't require a prescription, making them attractive to a wide range of consumers. Additionally, growing health awareness, rising disposable incomes, and the prevalence of digestive disorders are contributing to the segment's growth. OTC digestive health supplements, including probiotics, enzymes, and fiber products, are widely available in pharmacies, supermarkets, and online retailers, further boosting their market dominance, As consumers continue to prioritize preventive healthcare and wellness.

Regional Segment Analysis of the Digestive Health Supplements Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

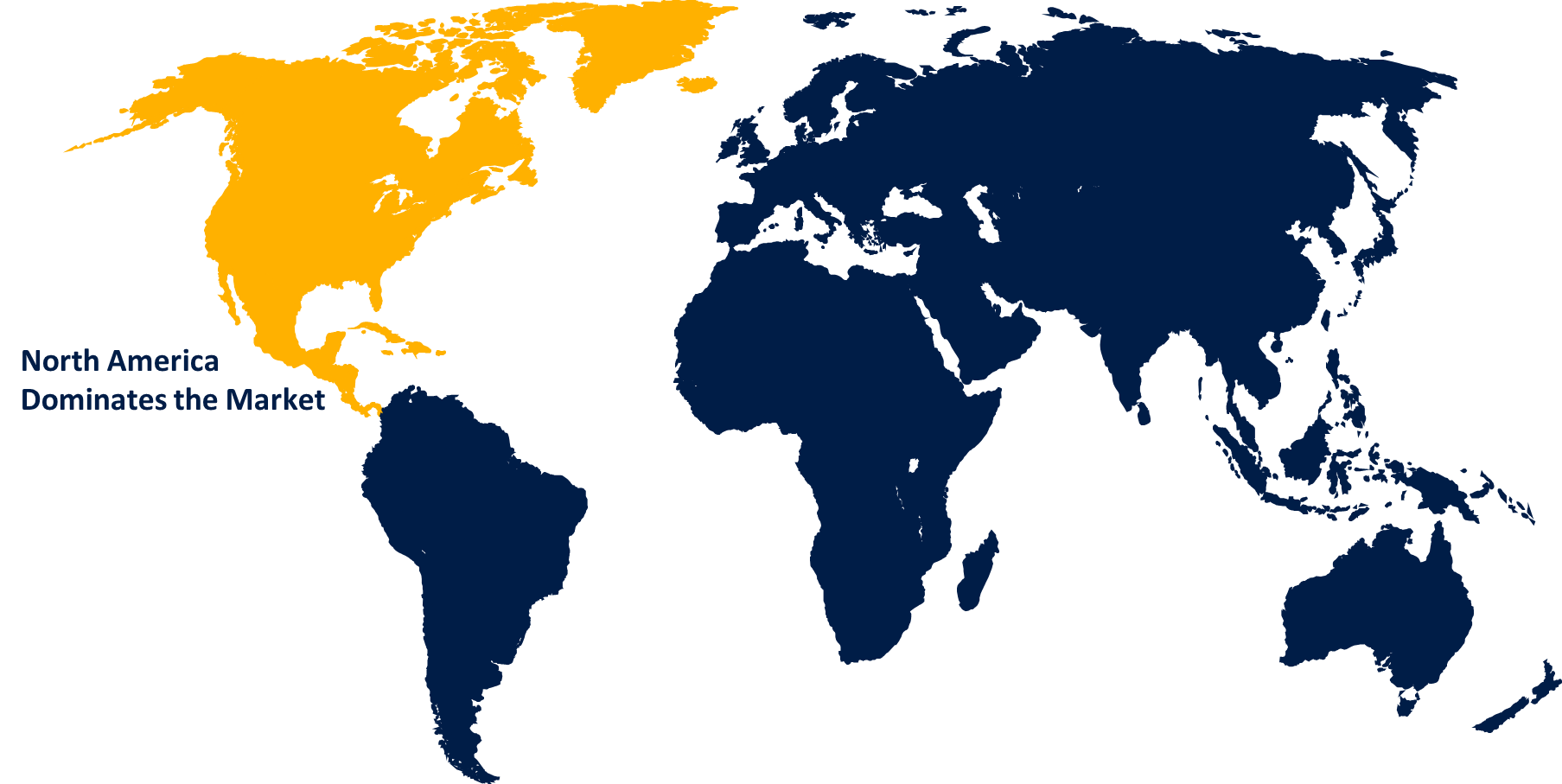

North America is anticipated to hold the largest share of the digestive health supplements market over the predicted timeframe. Explain in one paragraph

Get more details on this report -

North America is anticipated to hold the largest share of the digestive health supplements market over the predicted timeframe. The region boasts a high level of health awareness among consumers, coupled with a strong awareness of digestive health issues. Additionally, North America has a well-established healthcare infrastructure and a large population of health-conscious individuals willing to invest in preventive care. The prevalence of digestive disorders, coupled with the increasing adoption of natural and organic supplements, further drives market growth. The region also benefits from a robust retail network for dietary supplements, including both brick-and-mortar stores and e-commerce platforms. Furthermore, North America is home to many leading digestive health supplement manufacturers, fostering innovation and product development. The combination of these factors, along with high disposable incomes and a culture that embraces self-care and wellness, positions North America as the dominant market for digestive health supplements in the foreseeable future.

Asia Pacific is expected to grow at the fastest CAGR growth of the digestive health supplements market during the forecast period. Due to several factors, Rapid urbanization, changing lifestyles, and increasing disposable incomes are driving awareness and demand for health supplements. The region's large and growing population, particularly in countries like China and India, provides a huge consumer base. Rising health awareness and the increasing prevalence of digestive disorders due to dietary changes and stress drive the market growth. Additionally, the traditional use of natural remedies in many Asian cultures aligns well with digestive health supplements. The growing middle class, improving healthcare infrastructure, and increasing penetration of e-commerce platforms are making these products more accessible. Furthermore, government initiatives promoting preventive healthcare and the entry of international supplement brands into the market are contributing to the rapid growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the digestive health supplements market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amway Corp.

- Bayer AG

- Custom Probiotics Inc.

- Herbalife Nutrition Ltd.

- BASF SE

- Nature’s Bounty

- Garden of Life

- Lonza Group Ltd.

- NOW Foods

- Procter & Gamble

- Pfizer Inc.

- Schiff Nutrition International

- Pharmavite

- Bayer AG

- NU SKIN

- Yakult Honsha Co., Ltd.

- Sanofi

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2024, the Bengaluru-based gut health startup MicrobioTx launched India's first hyper-personalized probiotic on World Microbiome Day. The product is based on over 15 years of research by Dr. Palok Aich, a professor and Dean of R&D at NISER Bhubaneswar.

- In May 2024, the New Culturelle® Probiotics "Made for Human Nature" Platform Raises Critical Awareness of the Need to Protect the Gut Microbiome.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the digestive health supplements market based on the below-mentioned segments:

Global Digestive Health Supplements Market, By Product

- Prebiotics

- Probiotics

- Enzymes

- Fulvic Acid

- Others

Global Digestive Health Supplements Market, By Form

- Capsules

- Tablets

- Powders

- Liquids

- Others

Global Digestive Health Supplements Market, By Distribution Channel

- OTC

- Prescribed

Global Digestive Health Supplements Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the digestive health supplements market over the forecast period?The digestive health supplements market is projected to expand at a CAGR of 9.40% during the forecast period.

-

2.What is the market size of the digestive health supplements market?The Global Digestive Health Supplements Market Size is Expected to Grow from USD 13.40 Billion in 2023 to USD 32.9 Billion by 2033, at a CAGR of 9.40% during the forecast period 2023-2033.

-

3.Which region holds the largest share of the digestive health supplements market?North America is anticipated to hold the largest share of the digestive health supplements market over the predicted timeframe.

Need help to buy this report?