Global Digital Asset Trading Platform Market Size, Share, and COVID-19 Impact Analysis, By Asset Type (Cryptocurrencies, Security Tokens, Utility Tokens, Stablecoins, and Others), By End-User (Retail Investors, Institutional Investors, and Others), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Banking & FinancialGlobal Digital Asset Trading Platform Market Insights Forecasts to 2033

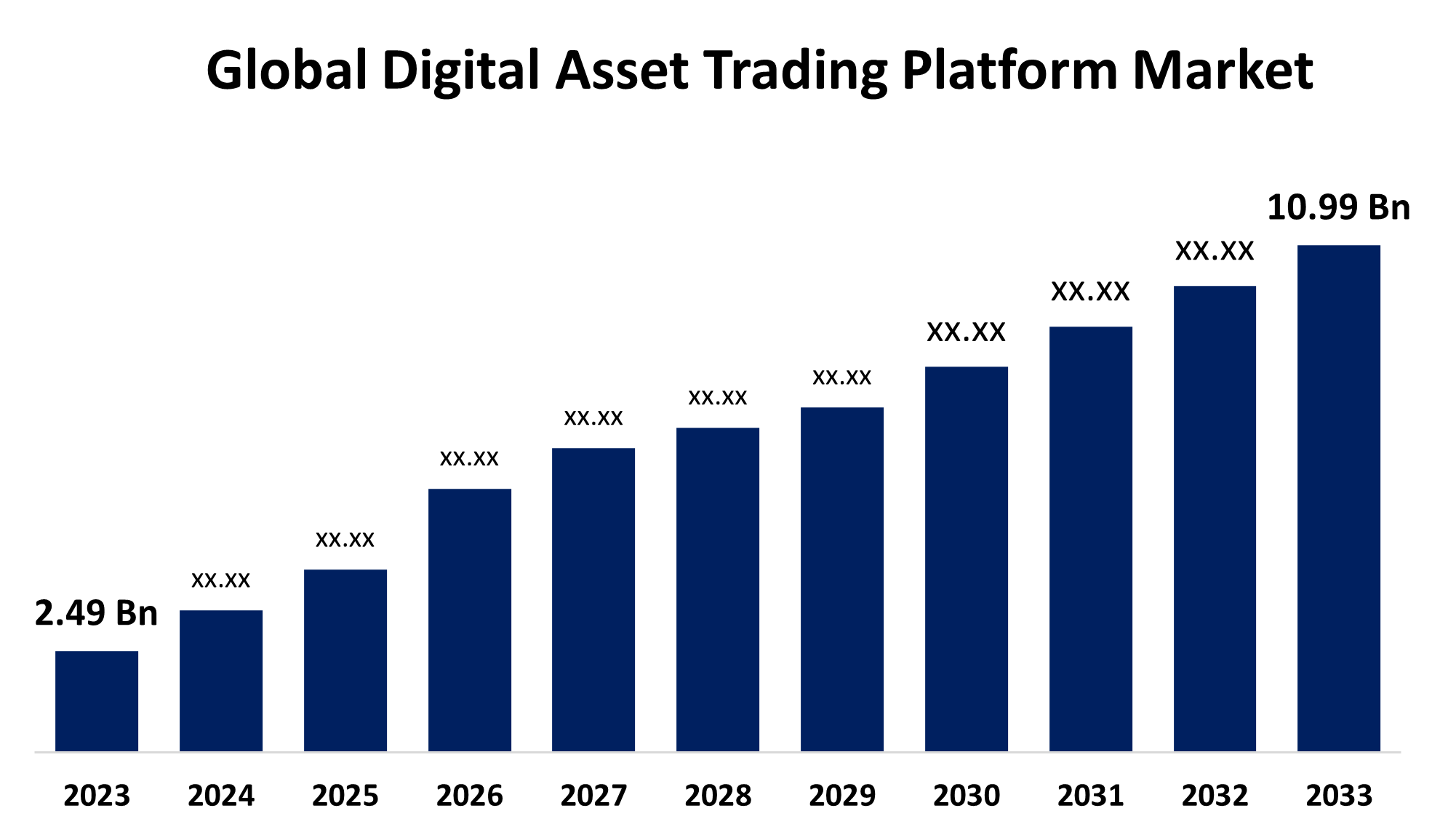

- The Global Digital Asset Trading Platform Market Size was Valued at USD 2.49 Billion in 2023

- The Market Size is Growing at a CAGR of 16.01% from 2023 to 2033

- The Worldwide Digital Asset Trading Platform Market Size is Expected to Reach USD 10.99 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Digital Asset Trading Platform Market Size is anticipated to exceed USD 10.99 Billion by 2033, Growing at a CAGR of 16.01% from 2023 to 2033.

Market Overview

A digital asset trading platform is a digital platform that facilitates the buying, selling, and exchanging of digital assets which consist of tokenized assets, non-fungible tokens (NFTs), and cryptocurrencies including Ethereum and Bitcoin. The blockchain technology that underpins these systems distributes transaction data across several places, guaranteeing transaction security and integrity. A digital wallet is usually required for users of these services in order to safely manage and keep their assets. Additionally, the growing usage of blockchain technology in financial services and the growing appeal of digital assets as investment opportunities have propelled the demand for digital asset trading platforms. The emergence of decentralized finance (DeFi), which provides a non-centralized trading environment, and the growing acceptance of digital assets as acceptable holdings by both institutions and private investors are key drivers driving this industry.

Report Coverage

This research report categorizes the global digital asset trading platform market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global digital asset trading platform market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global digital asset trading platform market.

Global Digital Asset Trading Platform Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.49 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | CAGR of 16.01% |

| 023 – 2033 Value Projection: | USD 10.99 Billion |

| Historical Data for: | 2021-2022 |

| No. of Pages: | 246 |

| Tables, Charts & Figures: | 104 |

| Segments covered: | By Asset Type, By End-User, By Regional Analysis |

| Companies covered:: | Coinbase, Binance, Kraken, Bitfinex, Huobi Global, OKEx, Bittrex, Gemini, Bitstamp, KuCoin, eToroX, CEX.IO, Gate.io, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The significant growth driver for digital asset trading platform is increasing legal acceptance and rising recognition of cryptocurrency as a valid asset class. For instance, in December2024, Hong Kong's financial authority authorized four cryptocurrency exchanges on Wednesday, marking the city's latest bid to remain competitive in the battle to become a worldwide hub for digital asset trading. As more people, investor, and institutions realize that there is an significant chance of high return, there is an increase of preference for reliable and secure trading platforms. Additionally, the number of bitcoin users is expected to reach 992.50 million by 2028, up from 833.70 million in 2024. The number of people using cryptocurrencies is growing quickly, and over the coming years, substantial growth is predicted. The market for platforms for trading digital assets is being further driven by the growing number of investors and cryptocurrency users.

Restraints & Challenges

The constantly changing and frequently strict regulatory environment is one of the main obstacles facing the industry for digital asset trading platforms. To stop fraud, money laundering, and other illegal acts, governments and financial regulators around the world are closely examining transactions involving digital assets.

Market Segmentation

The global digital asset trading platform market share is classified into asset type and end-user.

- The cryptocurrencies segment is expected to hold the largest share of the global digital asset trading platform market during the forecast period.

Based on asset type, the global digital asset trading platform market is categorized as cryptocurrencies, security tokens, utility tokens, stablecoins, and others. Among these, the cryptocurrencies segment is expected to hold the largest share of the global digital asset trading platform market during the forecast period. The most popular asset class is cryptocurrency, with Bitcoin and Ethereum dominating both market value and trade volume. Cryptocurrencies' decentralization, high return potential, and resilience to conventional financial market swings are what make them a popular investment asset.

- The retail investors segment is expected to grow at the fastest CAGR during the forecast period.

Based on the end-user, the global digital asset trading platform market is categorized as retail investors, institutional investors, and others. Among these, the retail investors segment is expected to grow at the fastest CAGR during the forecast period. The decentralized nature of finance and the easy availability of trading sites have made retail investors an essential component of the digital asset market. Retail investors can now easily trade cryptocurrencies, tokens, and other digital assets due to the growth of online trading platforms and smartphone applications.

Regional Segment Analysis of the Global Digital Asset Trading Platform Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is projected to hold the largest share of the global digital asset trading platform market over the forecast period.

Get more details on this report -

North America is projected to hold the largest share of the global digital asset trading platform market over the forecast period. North America's unique position at the forefront of the digital asset revolution can be linked to a number of important elements. First of all, the area boasts a highly advanced technology infrastructure, which is critical to the development and uptake of online marketplaces. Digital asset trading platforms may operate and innovate in an optimal environment because to the availability of sophisticated IT infrastructure and extensive internet access. Furthermore, the existence of significant technology centers like Silicon Valley supports continuous technical development and the quick uptake of new technologies.

Asia Pacific is expected to grow at the fastest CAGR growth of the global digital asset trading platform market during the forecast period. The market for digital asset trading platforms, which is fueled by growing consumer interest in cryptocurrencies and quick digitization. With strong trade volumes and an increasing number of blockchain-based firms, nations like China, Japan, and South Korea are leading the way in the adoption of digital assets. The development of digital asset trading platforms is facilitated by the region's technology innovations and encouraging government policies. The industry is anticipated to increase significantly as more Asian nations adopt blockchain technology and digital money.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global digital asset trading platform market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Coinbase

- Binance

- Kraken

- Bitfinex

- Huobi Global

- OKEx

- Bittrex

- Gemini

- Bitstamp

- KuCoin

- eToroX

- CEX.IO

- Gate.io

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2024, for over $200 million, Robinhood Markets announced that it would buy Bitstamp, a cryptocurrency exchange based in Europe. With the help of Bitstamp's vast global licenses and clientele in Europe, Asia, and the United States, Robinhood hopes to improve its cryptocurrency offerings and broaden its global footprint.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global digital asset trading platform market based on the below-mentioned segments:

Global Digital Asset Trading Platform Market, By Type

- Cryptocurrencies

- Security Tokens

- Utility Tokens

- Stablecoins

- Others

Global Digital Asset Trading Platform Market, By Application

- Retail Investors

- Institutional Investors

- Others

Global Digital Asset Trading Platform Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?