Global Digital Audio Workstation Market Size, Share, and COVID-19 Impact Analysis, By Type (Recording, Editing, and Mixing), By OS Compatibility (MAC, Windows, Android, and Linux), By End-user (Professional/Audio Engineers & Mixers, Electronic Musicians, and Music Studios), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

Industry: Electronics, ICT & MediaGlobal Digital Audio Workstation Market Insights Forecasts to 2033.

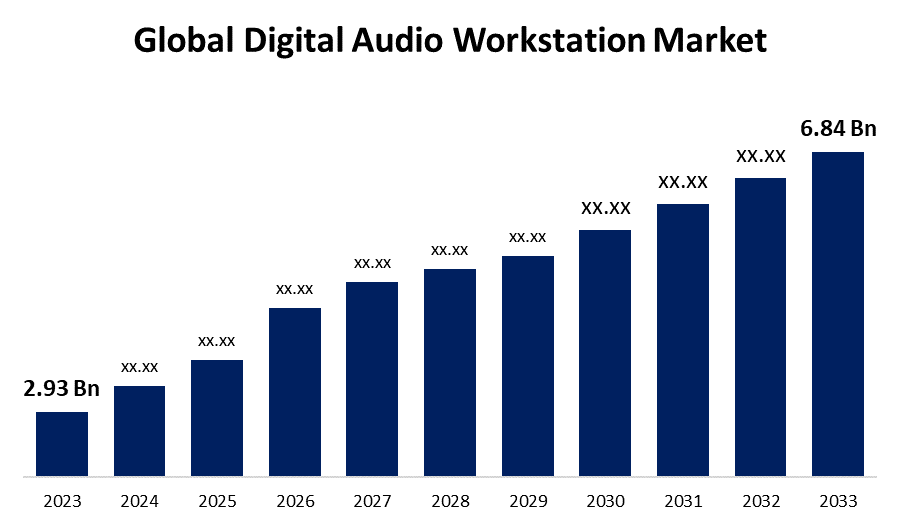

- The Global Digital Audio Workstation Market Size was Valued at USD 2.93 Billion in 2023.

- The Market Size is Growing at a CAGR of 8.85% from 2023 to 2033.

- The Worldwide Digital Audio Workstation Market Size is Expected to Reach USD 6.84 Billion By 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Digital Audio Workstation Market Size is Anticipated to Exceed USD 6.84 Billion by 2033, Growing at a CAGR of 8.85% from 2023 to 2033.

Market Overview

An electronic equipment or application software used for recording, editing, and generating audio files is called a digital audio workstation (DAW). DAWs are available in a broad range of configurations, ranging from a laptop with a single software application to integrated stand-alone equipment to a very complicated setup with many components managed by a single computer. Modern DAWs, regardless of setup, provide a single interface that lets the user edit and combine several recordings and tracks into a finished product. Integrated editing, recording, and playback tools are available with computer-based DAWs (some additionally offer functionality relating to video). For instance, they can offer polyphony, virtually infinite tracks for recording, and virtual synthesizers or sample-based instruments for use in music production. DAWs also offer a vast array of effects, like reverb, to alter or improve the audio waves directly. Since DAWs are now used in training and instructional initiatives, their user base has increased dramatically. Academic institutions and music production schools recognize the value of teaching students to utilize industry-standard DAWs as a means of preparing them for careers in sound engineering, music production, and related fields. The focus on education creates a consistent market for DAW software.

Report Coverage

This research report categorizes the market for the global digital audio workstation market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global digital audio workstation market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global digital audio workstation market.

Global Digital Audio Workstation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.93 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.85% |

| 2033 Value Projection: | USD 6.84 |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By OS Compatibility, By End-User, By Region |

| Companies covered:: | Bitwig, Reaper, Renoise, Audiotool FL Studio, Harrison Consoles, Apple Inc., BandLab Technologies, Adobe, AVID, Presonus, Steinberg, Ableton, Native Instruments, Image-Line, Motu, Acoustica, Magix, Cakewalk, Mark of the Unicorn, MuLab, Reason, and other key ccompanies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

The global digital audio workstations market is steadily expanding owing to several factors. Since the transition of music production to digital forms and the expansion of independent and home studios, there is a greater need for feature-rich DAWs. Although these platforms enable collaborative procedures and integrate state-of-the-art audio processing technology, they are indispensable to the creation of high-quality music. The expanding podcasting industry, the need for virtual instruments, cross-platform interoperability, educational initiatives, and continuous software improvements are all factors contributing to the growing popularity of DAWs. These factors together have led to the continued growth of the global digital audio workstations market, which provides producers, artists, and content creators with adaptable tools for artistic expression in the dynamic realm of digital audio creation.

Restraining Factors

The availability of free software is one of the many reasons impeding the growth of the global digital audio workstation (DAW) market. Digital audio workstation purchases can be pricey, especially if the consumer wants professional-grade hardware and software. Adoption may be restricted as a result, especially for independent artists, small studios, and budget-conscious hobbyists. Although technological developments have enhanced the capabilities of computers and audio interfaces, some users could still experience hardware constraints that impact the efficiency of DAW programs that need a lot of resources. The resistance of many industry traditionalists towards the shift from analog to digital processes might potentially impede the general expansion of the global digital audio workstations market.

Market Segmentation

The Global digital audio workstation Market share is classified into type, OS compatibility, end-user

- The editing segment is expected to hold the largest share of the global digital audio workstation market during the forecast period.

Based on the type, the global digital audio workstation market is divided into recording, editing, and mixing. Among these, the editing segment is expected to hold the largest share of the global digital audio workstation market during the forecast period. This is because digital audio workstations are becoming more and more popular for editing reasons and because many businesses utilize digital audio workstation software. Digital audio workstations offer musicians a crucial way to rapidly and precisely edit tracks in addition to enabling users to eliminate noise from recordings, generate noise-free music, and restore sounds. Due to the growing popularity of digital audio editing, the editing segment is anticipated to support the expansion of the global digital audio workstation market.

- The Windows segment is expected to hold the greatest share of the global digital audio workstation market during the forecast period.

Based on the OS compatibility, the global digital audio workstation market is divided into MAC, Windows, Android, and Linux. Among these, the Windows segment is expected to hold the greatest share of the global digital audio workstation market during the forecast period. This is because Windows operating systems are widely used by both individual users and professionals. The widespread use of Windows-based DAW software in music creation, recording, and editing has helped Windows maintain its market dominance. The dominant position of the Windows segment in the global digital audio workstation market is further supported by the availability of a large selection of compatible hardware and software solutions for Windows platforms.

- The professional/audio engineers & mixers segment is expected to grow at the greatest pace in the global digital audio workstation market during the forecast period.

Based on the end-user, the global digital audio workstation market is divided into professional/audio engineers & mixers, electronic musicians, and music studios. Among these, the professional/audio engineers & mixers segment is expected to grow at the greatest pace in the global digital audio workstation market during the forecast period. To produce polished, professional-sounding audio that satisfies the demands of contemporary audiences, competent audio engineers and mixers are indispensable. The fast expansion of the professional/audio engineers & mixers segment in the global digital audio workstation market has been driven by the confluence of technology breakthroughs, modifications in the media landscape, and the democratization of audio production equipment.

Regional Segment Analysis of the Global Digital Audio Workstation Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global digital audio workstation market over the predicted timeframe.

North America is anticipated to hold the largest share of the global digital audio workstation market over the predicted timeframe. This is because digital technologies are being adopted by North American companies at a rapid pace. DAWs are essential to the digital workflows that the area's studios, recording studios, and production firms have adopted. The need for sophisticated audio production equipment has increased due to the societal movement toward digital solutions. The infrastructure for education and training in audio engineering and music production is well-established in North America. Programs and courses on the usage of DAWs and associated technologies are offered by several universities. This promotes the development of a trained labor force and helps the global digital audio workstations market gain traction.

Asia Pacific is expected to grow at the fastest pace in the global digital audio workstation market during the forecast period. The Asia-Pacific area has demonstrated a tendency to absorb new technology rapidly. DAWs and other advanced audio production tools are becoming more widely known and used as the area embraces digital transformation in a variety of sectors. Asia Pacific educational institutions have been creating courses and programs in sound design, music production, and audio engineering. The availability of competent experts who have completed DAW training influences the growth of the global digital audio workstation market in the area.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global digital audio workstation along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bitwig

- Reaper

- Renoise

- Audiotool FL Studio

- Harrison Consoles

- Apple Inc.

- BandLab Technologies

- Adobe

- AVID

- Presonus

- Steinberg

- Ableton

- Native Instruments

- Image-Line

- Motu

- Acoustica

- Magix

- Cakewalk

- Mark of the Unicorn

- MuLab

- Reason

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2023, FL Studio 21.2 was released by Image-Line. The much-awaited Stem Separation and FL Cloud, a suite of services designed specifically for FL Studio with an emphasis on innovation in response to user input, are now available with this significant release. New tools and features for FL Studio have also been added. These include the new analog-modeling synth Kepler and Audio Clips for FL Studio Fruity Edition.

- In April 2023, to improve audio capabilities and get the best sound possible for post-production customers, AVID released the Tools MTRX II and MTRX Thunderbolt 3 module. More IO capacity, routing, and immersive monitoring flexibility are provided by MTRX II to its users. Compared to MTRX, it offers greater flexibility and expandability by enabling software-based processes and capture tools.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Digital Audio Workstation Market based on the below-mentioned segments:

Global Digital Audio Workstation Market, By Type

- Recording

- Editing

- Mixing

Global Digital Audio Workstation Market, By OS Compatibility

- MAC

- Windows

- Android

- Linux

Global Digital Audio Workstation Market, By End-user

- Professional/Audio Engineers & Mixers

- Electronic Musicians

- Music Studios

Global Digital Audio Workstation Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?Bitwig, Reaper, Renoise, Audiotool FL Studio, Harrison Consoles, Apple Inc., BandLab Technologies, Adobe, AVID, Presonus, Steinberg, Ableton, Native Instruments, Image-Line, Motu, Acoustica, Magix, Cakewalk, Mark of the Unicorn, MuLab, Reason, and others.

-

2. What is the size of the global Digital Audio Workstation market?The Global Digital Audio Workstation Market is expected to grow from USD 2.93 Billion in 2023 to USD 6.84 Billion by 2033, at a CAGR of 8.85% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global digital audio workstation market over the predicted timeframe.

Need help to buy this report?