Global Digital Banking Platform Market Size, Share, and COVID-19 Impact Analysis, By Deployment (On-Premise and Cloud), By Mode (Online Banking and Digital Banking), By Component (Platforms and Services), By Service (Platform segment and Managed Service), By Type (Retail Banking, Corporate Banking and Investment Banking) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 - 2030

Industry: Banking & FinancialDigital Banking Platform Market Insights Forecasts to 2030

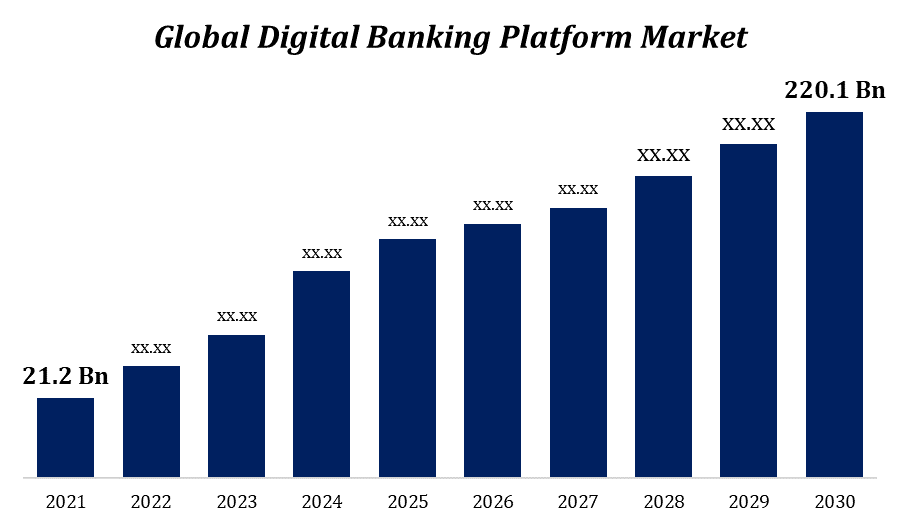

- The digital banking platform market was valued at USD 21.2 Billion in 2021.

- The market is growing at a CAGR of 29.7% from 2021 to 2030

- The digital banking platform market is expected to reach USD 220.1 billion by 2030

- North America is expected to grow the fastest during the forecast period

Get more details on this report -

The digital banking platform market is expected to reach USD 220.1 billion by 2030, at a CAGR of 29.7% during the forecast period 2021 to 2030. The digital banking platform market has been growing owing to the widespread digitalization in the financial sector and is expected to drive the demand for Digital Banking as it enables users with tech-enabled analytics offered by Digital Banking for investment consultations.

Market Overview:

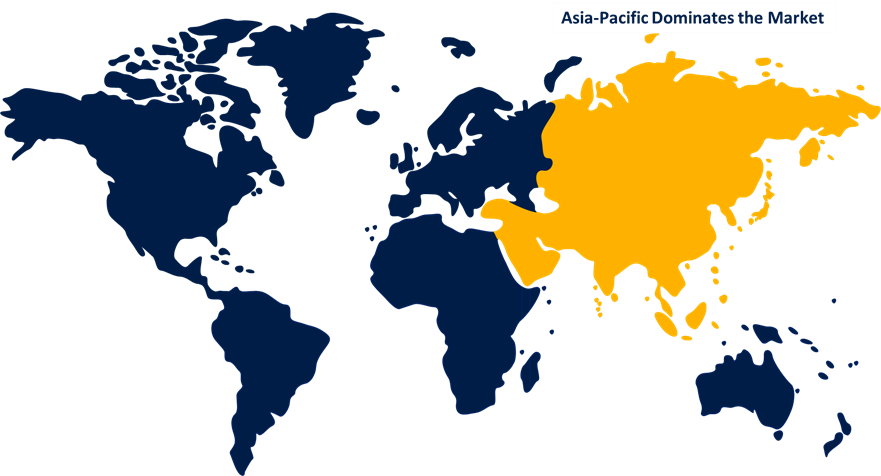

The COVID-19 epidemic increased e-expansion commerce which in turn broadened the application of digital banking. Due to the rise in online purchasing and digital transaction volumes, there will certainly be an increase in demand for digital banking platforms. One of the key drivers propelling the market's expansion is the banking sector's rapidly developing digital transformation, together with customer demand for smart mobile devices and digital banking services. Due to the numerous advantages provided, including lower IT costs, quick time to market, open banking, out-of-the-box yet flexible capabilities, omnichannel customer experience, and microservice architecture, to name a few, the majority of banks favor digital banking systems. For instance, Brattleboro Savings & Loan (BS&L) selected NCR in April 2020 to offer clients and companies a superior digital banking experience. The bank expects to combine three providers who previously handled digital banking into one with the NCR DI platform, streamlining operations and boosting back office efficiency. The region with the biggest market share the Asia Pacific in 2021 is also expected to experience the quickest growth. This is explained by the area's higher population density and growing digitalization. By reimagining the banking industry for both consumers and businesses, new companies like Tonik Digital Bank, Inc., Anywhere 2 go Co., Ltd., and Cashfree Payments India Private Limited are fundamentally changing the sector. For example, in June 2022, Cashfree Payments India Private Limited unveiled "Token Vault," a tokenization solution that can exchange and use data in card tokenization. North America, the second-largest market in the world by sales, is anticipated to develop at a rate of 19.9% CAGR from 2022 to 2030.

Report Coverage

This research report on digital banking platforms categorizes the market for medical tubes based on various segments and regions and forecasts revenue growth. It analyzes trends in each of the submarkets. The report analyses the key growth drivers, opportunities, and challenges influencing the digital banking platform market. Recent market developments and competitive strategies such as expansion, product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each digital banking platform market sub-segments.

Global Digital Banking Platform Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 21.2 Billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 29.7% |

| 2030 Value Projection: | USD 220.1 billion |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 207 |

| Tables, Charts & Figures: | 180 |

| Segments covered: | By Deployment, By Mode, By Component, By Service, By Type, By Region, COVID-19 Impact Analysis |

| Companies covered:: | Appway AG, Alkami Technology Inc., Finastra, Fiserv, Inc., Crealogix AG, Temenos, Urban FT Group, Inc., Q2 Software, Inc., Sopra Banking Software, Tata Consultancy Service |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Segmentation Analysis

- In 2021, the On-premise segment in Digital Banking dominated the market with the largest market share of 70% and market revenue of 14.84 billion.

Based on the deployment, The digital banking platform market is divided into On-Premise and Cloud. In 2021, the On-premise segment in Digital Banking dominated the market with the largest market share of 70% and market revenue of 14.84 billion. Many customers choose the on-premise solution because it is safer than cloud software. Additionally, security and IT employees have direct access to the software because it is installed and only utilized on the user's network. The staff has full control over its management, security, and configuration. Adopting SaaS and the cloud will be essential to inclusive banking's success in the future. The difficulties of the inclusive banking environment are mitigated by the advantages of cloud computing and software as a service for underserved communities. The COVID-19 crisis's impact on financial stability made cloud and SaaS technology appealing to the developed world.

- In 2021, the Online banking segment accounted for the largest market share, with a share of more than 80.1% and market revenue of 16.9 billion.

Based on the mode, The digital banking platform market is divided into Online Banking and Mobile Banking. In 2021, the Online banking segment accounted for the largest market share, with a share of more than 80.1% and market revenue of 16.9 billion. Online banking is the most recent technique for providing retail financial services. Inter-account transfers, balanced reporting, and other typical retail banking duties are just a few features that are included in online banking. Customers utilize these services so they may do tasks like making information requests and paying bills over a telecommunications network without having to leave their homes or places of business.

- In 2021, The Platform segment dominated the market, with 60.0% and market revenue of 12.72 billion.

Based on the Component, the Digital Banking Platform market is divided into Platforms and Service. In 2021, The Platform segment dominated the market, with 60.0% and market revenue of 12.72 billion. With the introduction of fintech, when tech corporate giants began enforcing reforms and developing new platforms for conducting business, banks have been pursuing digital transformation. To meet client needs and proactively launch new products, banks are embracing digital technology and fully capitalizing on these advances. The advancement of financial services to the cloud provides the opportunity to develop and reinforce a customer-centric strategy lowering obstacles to entry into the sector and expanding access to banking solutions. Additionally, it's opening possibilities for brand-new service packages that may take advantage of scale, data, and technology. Hence, there can be faster and easier access to data for ensuring regulatory reports, mitigation of risks, and identifying abnormalities in risk management.

- In 2021, The managed service segment dominated the market, with 61.0% and market revenue of 12.9 billion.

Based on the Service, the digital banking platform market is divided into professional Services and Managed Services. In 2021, The managed service segment dominated the market, with 61.0% and market revenue of 12.9 billion. Managed data center services can improve business management and increase business automation to help organizations run more efficiently in a hybrid IT environment. The utilization of managed security services in end-use industries is anticipated to rise as the frequency of cyberattacks rises.

Regional Segment Analysis of the Digital Banking Platform Market

Get more details on this report -

- Asia Pacific(U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Among all regions, Asia Pacific emerged as the largest market for the global Digital Banking Platform market, with a market share of around 35.23% and 21.2 billion of the market revenue in 2021.

- In 2021, Asia Pacific emerged as the largest market for the global Digital Banking Platform market, with a market share of around 35.23% and 21.2 billion of the market revenue. The regional market expansion can be linked to consumers' increasing understanding of the advantages of using automated financial help for investments and savings. It is anticipated that the initiatives taken by several Asia Pacific businesses to encourage the usage of the Digital Banking Platform would also aid in regional development. For instance, TradeSmart, one of India's top new-age online discount brokerage companies, said in July 2022 that it had partnered with Modern Algos to provide AI-powered advisory services. This platform has AI to give users a productive order management solution. It uses deep analytics to ensure consumers receive the most personalized counsel depending on their age, investment, and future ambitions.

- The North America market is expected to grow at the fastest CAGR between 2021 and 2030. Every business area, including the banking and financial industry, is increasingly implementing cloud-based solutions. Due to their inexpensive start-up costs and rapid upgrades, cloud-based digital banking platform solutions are currently being used by banks, and this trend is predicted to continue.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the digital banking platform market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Market Players:

- Appway AG

- Alkami Technology Inc.

- Finastra

- Fiserv, Inc.

- Crealogix AG

- Temenos

- Urban FT Group, Inc.

- Q2 Software, Inc.

- Sopra Banking Software

- Tata Consultancy Service

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Third-party knowledge Modes

- Value-Added Resellers (VARs)

Recent Development

- In September 2022, Recently, Oracle Retail Xstore Point-of-Service was implemented by Rogers & Hollands (POS). By adopting mobile retail POS systems throughout its stores, the jeweler has improved service efficiency and given its "rock" star associates access to each customer's transaction history, wish lists, and preferences to enable personalized guest interactions.

- In September 2022, NVIDIA GPUs on Oracle Cloud Infrastructure will enable customers to receive faster AI training and inferencing (OCI). OCI has subsequently increased the infrastructure it uses to train large-scale AI models.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2030. Spherical Insights has segmented the digital banking platform market based on the below-mentioned segments:

Global Digital Banking Platform Market, By Deployment

- On-Premise

- Cloud

Global Digital Banking Platform Market, By Mode

- Online Banking

- Mobile Banking

Global Digital Banking Platform Market, By Component

- Platforms

- Services

Global Digital Banking Platform Market, By Service

- Professional Service

- Managed Service

Global Digital Banking Platform Market, By Type

- Retail Banking

- Corporate Banking

- Investment Banking

Global Digital Banking Platform Market, Regional Analysis

- North America

- THE US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- The Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?