Global Digital Banking Platforms (DBP) Market Size, Share, and COVID-19 Impact Analysis By Component (Platforms, Services), By Banking Type (Retail Banking, Corporate Banking, Investment Banking), By Deployment Mode (On-Premises and Cloud), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Banking & FinancialGlobal Digital Banking Platforms (DBP) Market Insights Forecasts to 2033

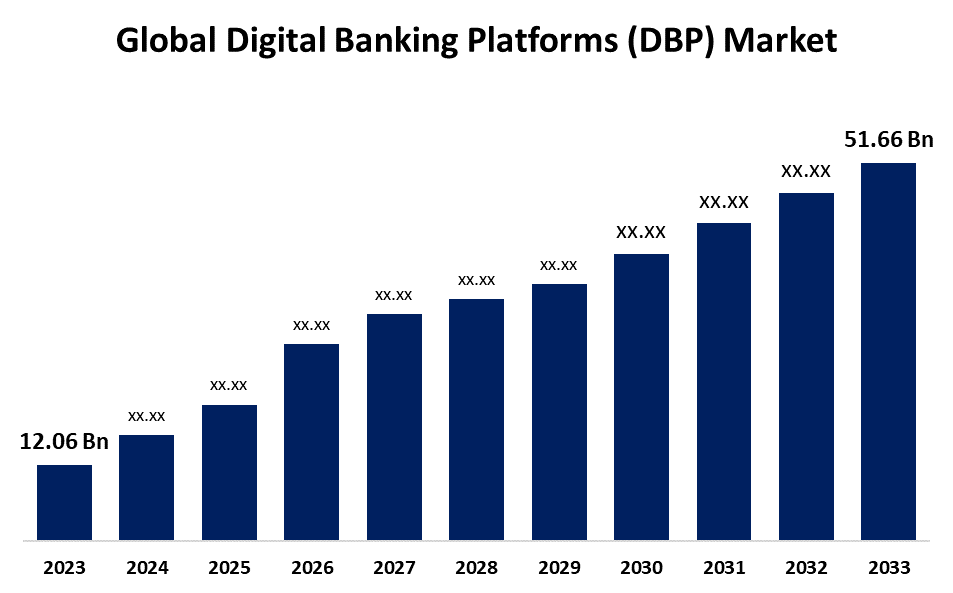

- The Global Digital Banking Platforms (DBP) Market Size was Estimated at USD 12.06 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 15.66% from 2023 to 2033

- The Worldwide Digital Banking Platforms (DBP) Market Size is Expected to Reach USD 51.66 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Digital Banking Platforms (DBP) Market Size was worth around USD 12.06 Billion in 2023 and is predicted to Grow to around USD 51.66 Billion by 2033 with a compound annual growth rate (CAGR) of 15.66% between 2023 and 2033. The market is driven by the rising penetration of cutting-edge technologies in communication and internet access, changing client preferences towards digitalization, and the swift uptake of cloud-based technology.

Market Overview

The digital banking platforms (DBP) market refers to the automated provision of traditional and innovative banking products and services directly to the end customers via interactive communication channels. It is typically a virtual portal where users may access and manage their accounts, make payments, pay bills, and apply for loans. The growth in the DBP market is primarily fueled by the fast-paced adoption of digital transformation strategies by the banking industry. Moreover, banks globally are spending significantly on digital infrastructure to automate operations and improve customer interactions. Penetration of smartphones and internet connectivity has also fuelled this trend, with customers seeking more efficient and convenient banking options. Furthermore, the growing use of digital transformation strategies throughout the banking industry. The most important opportunity is the creation of sophisticated technologies like AI, ML, and blockchain. These technologies can transform digital banking platforms with features like predictive analytics, real-time fraud alerts, and better security. Additionally, the emerging trend of open banking and API integration offers banks opportunities to partner with FinTechs and third-party service providers to deliver innovative banking solutions.

Report Coverage

This research report categorizes the digital banking platforms (DBP) market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the digital banking platforms (DBP) market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the digital banking platforms (DBP) market.

Digital Banking Platforms (DBP) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 12.06 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 15.66% |

| 2033 Value Projection: | USD 51.66 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 214 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Component, By Banking Type, By Deployment Mode |

| Companies covered:: | Finastra, Oracle Corporation, SAP SE, Tata Consultancy Services (TCS), Infosys Limited, FIS Global, Fiserv, Inc., Appway, Backbase, EdgeVerve Systems Limited, Intellect Design Arena, Kony, Inc., Q2 Software, Inc., and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The digital banking platforms (DBP) market is driven by some major trends. Customer-centric offerings allow banks to enhance customer loyalty through better services and quicker resolution of customer inquiries. Banks are keen on implementing customer retention strategies and bringing in new customers by communicating with them effectively. Moreover, an omnichannel capability of a digital banking platform assists banks in enabling personalized conversations through various channels like voice, web, and mobile. It helps banks to reach out to customers across all touchpoints. Furthermore, tracking end-to-end customer paths and monitoring all their activities assists in building a general perception of each customer. Also, customers anticipate speedy and instantaneous transactions, and this is making digital banking websites increasingly efficient and safe to use.

Restraining Factors

The digital banking platforms (DBP) market encounters certain difficulties that would restrain its development. The most critical threats are the growing vulnerability of cyberattacks and data breaches. Since digital banking channels hold and process personally identifiable customer data, they are at the top of cyberattacks' target lists. Banks keep the security and privacy of customers' information as a priority, and any invasion could lead to tremendous monetary losses, loss of reputation, and fines.

Market Segmentation

The digital banking platforms (DBP) market share is classified into components, banking type, and deployment mode.

- The platforms segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on component, the global digital banking platforms (DBP) market is divided into platforms and services. Among these, the platforms segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The growth is driven by the growing need for integrated digital banking solutions that will combine different banking functions under one platform. Moreover, their scalability and flexibility enable banks to create and tailor their digital services by changing regulatory requirements and customer demands.

- The retail banking segment held the largest share of the market in 2023 and is projected to grow at a substantial CAGR during the forecast period.

Based on banking type, the digital banking platforms (DBP) market is segmented into retail banking, corporate banking, and investment banking. Among these, the retail banking segment held the largest share of the market in 2023 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to the growing need for smooth and personalized banking experiences from individual consumers. Additionally, these platforms are created to increase customer involvement and loyalty through convenient and accessible banking solutions tailored to the specific requirements of retail customers.

- The cloud segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on deployment mode, the global digital banking platforms (DBP) market is categorized into on-premises and cloud. Among these, the cloud segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment's growth is attributed to its various benefits, including cost-effectiveness, scalability, and flexibility. Furthermore, they also offer the opportunity to scale services up or down according to demand, which is especially beneficial in managing peak transaction times without major hardware investments.

Regional Segment Analysis of the Digital Banking Platforms (DBP) Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the digital banking platforms (DBP) market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the digital banking platforms (DBP) market over the predicted period. The dominance is due to accelerating digitalization and the growing use of sophisticated technologies such as cloud technology by major industry players. Moreover, payment has become the most prevalent method for many to access their banks. Unlike the majority of American banks, Canadian banks saw this early. Canadian banks quickly took up industry e-payment technologies, but the United States still leans on competing private-sector technology.

Asia-Pacific is expected to grow rapidly in digital banking platform (DBP) markets during the forecast period. The market in the region is driven by the deepening penetration of smartphones and internet connectivity, especially in emerging markets such as China and India. Furthermore, the growing middle class and the increasing demand for efficient and convenient banking platforms are also driving digital banking platforms' growth in the region.

Competitive Analysis:

The report offers an appropriate analysis of the key organization markets/companies involved within the digital banking platforms (DBP) market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, business strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Finastra

- Oracle Corporation

- SAP SE

- Tata Consultancy Services (TCS)

- Infosys Limited

- FIS Global

- Fiserv, Inc.

- Appway

- Backbase

- EdgeVerve Systems Limited

- Intellect Design Arena

- Kony, Inc.

- Q2 Software, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2024, 10x Banking, the cloud-native core banking platform, launched a new category of core technology – a 'meta core' to enable banks and financial services to accelerate towards complete transformation.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the digital banking platforms (DBP) market based on the below-mentioned:

Global Digital Banking Platforms (DBP) Market, By Component

- Platforms

- Services

Global Digital Banking Platforms (DBP) Market, By Banking Type

- Retail Banking

- Corporate Banking

- Investment Banking

Global Digital Banking Platforms (DBP) Market, By Deployment Mode

- On-Premises

- Cloud

Global Digital Banking Platforms (DBP) Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the digital banking platforms (DBP) market over the forecast period?The global digital banking platforms (DBP) market is projected to expand at a CAGR of 15.66% during the forecast period.

-

2. What is the market size of the digital banking platforms (DBP) market?The global digital banking platforms (DBP) market size is expected to grow from USD 12.06 billion in 2023 to USD 51.66 billion by 2033, at a CAGR of 15.66% during the forecast period 2023-2033.

Need help to buy this report?