Global Digital Business Support System (BSS) Market Size, Share, and COVID-19 Impact Analysis, By Component (Solution, Services), By Solution (Revenue and billing Management, Customer Management, Order Management, and Product Management, Others), By Enterprise Size (Large Enterprise, SMEs), By End User (Healthcare, Retail & E-Commerce, Media & Entertainment, Manufacturing, Energy & Utilities, BFSI, IT & Telecom, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Information & TechnologyGlobal Digital Business Support System (BSS) Market Insights Forecasts to 2032

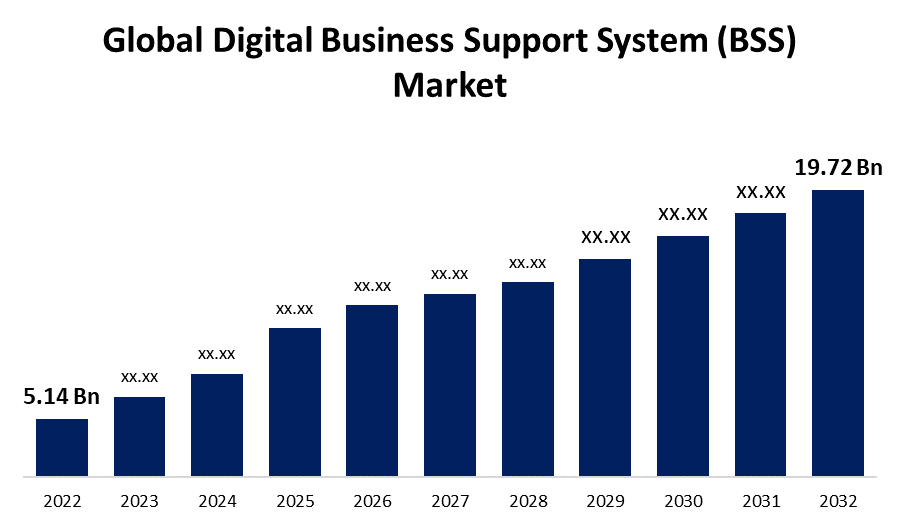

- The Global Digital Business Support System (BSS) Market Size was valued at USD 5.14 Billion in 2022.

- The Market is Growing at a CAGR of 14.39% from 2022 to 2032

- The Worldwide Digital Business Support System (BSS) Market Size is expected to reach USD 19.72 Billion by 2032

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Digital Business Support System (BSS) Market Size is expected to reach USD 19.72 Billion by 2032, at a CAGR of 14.39% during the forecast period 2022 to 2032.

The digital business support system (BSS) incorporates the components of a telecommunications organisation that are used to conduct business with customers. Business support systems (BSS) in telecommunications refer to both the software and all of the processes required for back-office functionality. The growing demand for enhanced customer experiences, such as personalised and seamless interactions, real-time service fulfilment, and proactive issue resolution with digital BSS, is driving the market. In addition, cloud computing, AI, ML, IoT, and big data are among the technologies used in digital BSS. Organisations benefit from these technologies in a variety of ways, including improved customer experience, lower operational costs, and increased revenue. As these technologies advance, the demand for digital business support system (BSS) solutions will rise. Furthermore, digital business support system (BSS) solutions are needed to aggregate services, accommodate dynamic relationships with partner businesses, and effectively support the new business model. As a result, digital business support system (BSS) vendors are increasingly embracing advanced technologies such as analytics and business intelligence in order to develop better real-time solutions. The cloud-native architecture of the digital business support system (BSS) allows for unprecedented levels of flexibility and scale. With cloud-native architecture, operators can take advantage of the cloud's multitenancy to improve process consistency while reducing overall development time and cost. CSPs are thus heavily deploying digital business support systems (BSS), driving the global market growth in the forecast period.

Global Digital Business Support System (BSS) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 5.14 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 14.39% |

| 2032 Value Projection: | USD 19.72 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Component, By Solution, By Enterprise Size, By End User, By Region. |

| Companies covered:: | Nokia Corporation, International Business Machines Corporation, Amdocs Limited, Optiva Inc., Sigma Systems Canada LP., Cerillion Technologies Limited, Huawei Technologies Co. Ltd, LM Ericsson Telephone Company, CSG Systems International, Inc, ZTE Corporation, Sterlite Technologies Limited and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rise of advanced technologies and innovative business models is propelling the digital business support system (BSS) market into the future. Innovative BSS solutions use technologies like artificial intelligence, cloud computing, and machine learning to optimise processes, improve customer engagement, and generate new revenue streams. AI-powered BSS systems, for example, enable personalised customer offerings, effective self-service support, real-time fraud detection, and flexible pricing models. Furthermore, new business models such as service subscriptions and usage-based billing are gaining popularity, necessitating agile and scalable BSS systems. Because of their inherent flexibility and adaptability, digital business support system (BSS) solutions are well-suited for these models.

Restraining Factors

Implementing BSS solutions improves business profitability in the long run, even though they are costly and take considerable time to implement. Smaller organisations face significant costs for implementing and maintaining BSS solutions and services. Telecom companies typically avoid BSS transformations because overhauling their existing systems can take up to two years. As a result, the digital business support system (BSS) market's growth is hampered by high expenses for installation and excessive resource consumption.

Market Segmentation

By Component Insights

The solution segment dominates the market with the largest revenue share over the forecast period.

On the basis of components, the global digital business support system (BSS) market is segmented into solutions, and services. Among these, the solution segment is dominating the market with the largest revenue share over the forecast period. digital business support system (BSS) encompasses a wide range of solutions, including order management, product management, customer management, and revenue and billing management, and has been instrumental in assisting telecommunications and communication service providers with their digital operations. The segment's expansion can be attributed to the increasing demand for digital transformation in the telecom industry, where providers improve customer experiences, streamline operations, and adapt to a constantly changing technological landscape.

By Solution Insights

The customer management segment is witnessing significant CAGR growth over the forecast period.

On the basis of the solution, the global digital business support system (BSS) market is segmented into revenue and billing management, customer management, order management, product management and others. Among these, the customer management segment is witnessing significant growth over the forecast period. A digital business support system (BSS) solution enables service providers to provide automated service configuration to their customers. Without the need for human intervention, the system can then configure the service, price it according to the operator's cost, provide a quote according to the customer's cost, supply the service, and issue an invoice.

By Enterprise Size Insights

The large enterprise segment is expected to hold the largest share of the global digital business support system (BSS) market during the forecast period.

Based on the enterprise size, the global digital business support system (BSS) market is classified into large enterprises and SMEs. Among these, the large enterprise segment is expected to hold the largest share of the digital business support system (BSS) market during the forecast period. Large enterprise businesses are expected to grow significantly in the coming years as they seek to streamline their operations. The digital business support system market will expand during the forecast period as technological advances improve their performance.

By End User Insights

The BFSI segment accounted for the largest revenue share over the forecast period.

On the basis of end-user, the global digital business support system (BSS) market is segmented into healthcare, retail & e-commerce, media & entertainment, manufacturing, energy & utilities, BFSI, IT& telecom and others. Among these, the BFSI segment dominates the market with the largest revenue share over the forecast period. The reason for this prominence is the increasing use of online financial services and digital banking, which is fuelling the industry's need for sophisticated solutions for customer management, billing, and collection. Artificial intelligence, machine learning, and blockchain are driving the adoption of digital business support system (BSS) solutions in the BFSI sector.

Regional Insights

North America is analysed to be the largest market share over the forecast period.

Get more details on this report -

North America is analysed to be the largest market share over the forecast period. the telecoms and communication service providers' increasing use of digital business support system (BSS) solutions in their digital transformation. The region has advanced technological infrastructure, a large customer base, and the industry's pursuit of more efficient and streamlined digital business operations. The digital business support system (BSS) market in the United States and Canada is expected to grow rapidly. These countries have well-established IT and telecom sectors, and their contributions to digital innovation are likely to boost demand for BSS solutions.

Asia Pacific is expected to grow the fastest during the forecast period. The growth is justified by the increasing rates of internet and smartphone penetration, which encourage the use of online shopping and services and fuel demand for digital business support system (BSS) solutions. The region's consumers are spending more on online goods and services as a result of having more disposable income, which is driving up demand for these solutions. Furthermore, several regional government programs supporting digital transformation are opening up new markets for digital business support system (BSS) solutions.

List of Key Market Players

- Nokia Corporation

- International Business Machines Corporation

- Amdocs Limited

- Optiva Inc.

- Sigma Systems Canada LP.

- Cerillion Technologies Limited

- Huawei Technologies Co. Ltd

- LM Ericsson Telephone Company

- CSG Systems International, Inc

- ZTE Corporation

- Sterlite Technologies Limited

Key Market Developments

- In June 2023, Apptio Inc. was acquired by IBM in an official partnership with Vista Equity Partners. Apptio's acquisition will accelerate IBM's IT automation capabilities and enable enterprise leaders to deliver greater business value from technology investments.

- In January 2023, Schurz Communications Inc., a cloud-managed services provider and broadband media group based in the United States, expanded its partnership with Netcracker for digital BSS.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the global digital business support system (BSS) market based on the below-mentioned segments:

Digital Business Support System (BSS) Market, Component Analysis

- Solution

- Services

Digital Business Support System (BSS) Market, Solution Analysis

- Revenue and billing Management

- Customer Management

- Order Management

- Product Management

- Others

Digital Business Support System (BSS) Market, Enterprise Size Analysis

- Large Enterprise

- SMEs

Digital Business Support System (BSS) Market, End-User Analysis

- Healthcare

- Retail & E-Commerce

- Media & Entertainment

- Manufacturing

- Energy & Utilities

- BFSI

- IT & Telecom

- Others

Digital Business Support System (BSS) Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the global Digital Business Support System (BSS) Market?The Global Digital Business Support System (BSS) Market is expected to grow from USD 5.14 billion in 2022 to USD 19.72 billion by 2032, at a CAGR of 14.39% during the forecast period 2022-2032.

-

2. What are the elements driving the growth of the global Digital Business Support System (BSS) market?Growing digital transformation initiatives across various industries and increasing adoption of IoT & 5G are key elements driving the global Digital Business Support System (BSS) market expansion.

-

3. Which region is dominating the global Digital Business Support System (BSS) market?North America is dominating the global Digital Business Support System (BSS) market.

-

4. Which are the key companies in the market?Nokia Corporation, International Business Machines Corporation, Amdocs Limited, Optiva Inc., Sigma Systems Canada LP., Cerillion Technologies Limited, Huawei Technologies Co. Ltd, LM Ericsson Telephone Company, CSG Systems International, Inc, ZTE Corporation, Sterlite Technologies Limited and others.

Need help to buy this report?