Global Digital Dental Technology Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Digital Radiology Equipment, Dental CAD/CAM Systems, Dental Lasers, and Others), By Application (Prosthodontics, Orthodontics, Implantology, Endodontics, and Others), By End User (Dental Clinics, Dental Laboratories, Hospitals, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Digital Dental Technology Market Insights Forecasts to 2033

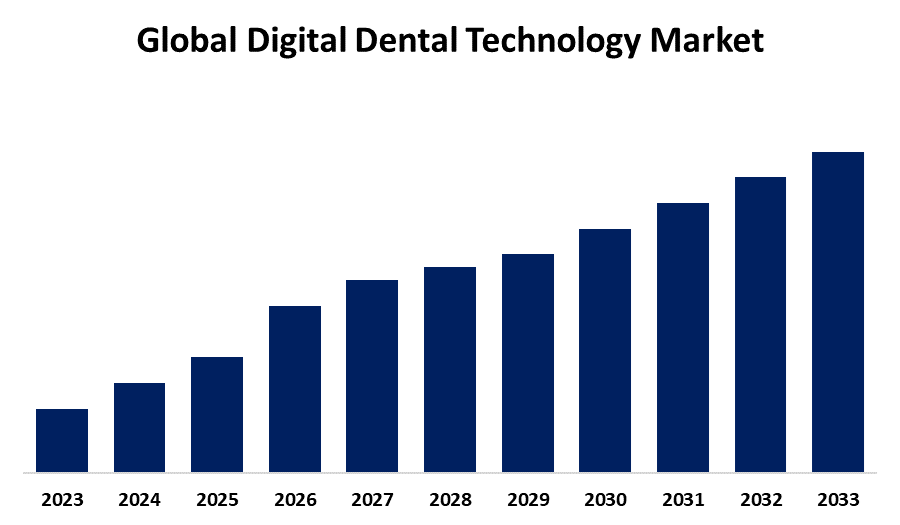

- The Global Digital Dental Technology Market Size was estimated to exceed a significant share in 2023

- The Market Size will Grow at a Substantial CAGR from 2023 to 2033.

- The Worldwide Digital Dental Technology Market Size is Expected to Reach a Significant Share by 2033.

- Asia-Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Digital Dental Technology Market Size is anticipated to reach a significant share by 2033, at a substantial CAGR during the forecast period 2023-2033.

Market Overview

The global digital dental technology market comprises the use of digital technology and techniques in dentistry. These technologies are used to improve the diagnosis, treatment planning, and execution of numerous dental operations, resulting in improved accuracy, efficiency, and patient experience. The primary objective of digital dental technologies is to streamline dental processes, decrease manual errors, and provide individualized treatments that meet the specific needs of patients. These technologies not only help to create precise dental restorations such as crowns and bridges, but they also increase diagnostic capabilities through improved imaging techniques.

In addition, the use of 3D printing for personalized dental products, rising consumer demand for cosmetic dentistry procedures, and the use of AI for improved diagnoses and treatment planning are all important factors. Furthermore, the rise of tele-dentistry and remote patient monitoring provides new opportunities for improving patient access, particularly in underprivileged areas. Emerging regions, notably in Asia-Pacific and Latin America, provide unexplored opportunities due to rising disposable incomes and healthcare investments. Furthermore, collaborations between digital technology suppliers and dental clinics improve workflow efficiency, save costs, and promote market penetration. These trends, together with ongoing technical improvements, set the digital dental technology industry up for continued growth and innovation in the coming years.

Report Coverage

This research report categorizes the digital dental technology market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the digital dental technology market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the digital dental technology market.

Global Digital Dental Technology Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 - 2033 |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 252 |

| Tables, Charts & Figures: | 118 |

| Segments covered: | By Product Type, By Application, By End User, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Dentsply Sirona, Align Technology, Inc., Envista Holdings Corporation, Institut Straumann AG, 3Shape A/S, Ivoclar Vivadent AG, Planmeca Oy, Carestream Dental LLC, 3D Systems Corporation, Henry Schein, Inc., Zimmer Biomet Holdings, Inc., Medit Corp., Vatech Co., Ltd., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing demand for less invasive and efficient dental operations has resulted in increased use of digital equipment, which provide faster, more precise treatments while reducing patient discomfort. Furthermore, increased awareness of oral health and the value of preventive treatment is pushing both patients and dentists to invest in innovative digital solutions. Dental operations have become more accessible due to technology breakthroughs in CAD/CAM systems, 3D printing, and intraoral scanning. The aging global population also adds to market growth, as older persons are more likely to require dental implants, restorations, and continuous dental care, which benefits from technological advancements. Furthermore, government measures that promote healthcare digitization and innovation, as well as increased investments in dental healthcare infrastructure, are creating a conducive climate for the development of digital dental technologies. These factors contribute to the market's growth and adoption.

Restraining Factors

The global digital dental technology market has challenges such as high initial expenses for advanced digital technology, which may hinder adoption among smaller dental practices. Furthermore, a dearth of experienced individuals to run advanced digital instruments can impede wider adoption. Furthermore, regulatory constraints and disparities in healthcare standards between regions can limit market expansion.

Market Segmentation

The digital dental technology market share is classified into product type, application, and end user.

- The dental CAD/CAM systems segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product type, the digital dental technology market is divided into digital radiology equipment, dental CAD/CAM systems, dental lasers, and others. Among these, the dental CAD/CAM systems segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Dental CAD/CAM systems provide unprecedented precision and efficiency when creating dental restorations such as crowns, bridges, veneers, and dentures. Additionally, reduced production time is another driving factor. CAD/CAM technologies allow dental restorations to be manufactured rapidly and in-house, reducing the need for outsourcing, resulting in faster turnaround times and improved workflow efficiency for dental clinics. This makes CAD/CAM systems especially tempting to practices looking to cut operational expenses while still producing high-quality products.

- The implantology segment accounted for the majority of the share in 2023 and is estimated to grow at the substantial CAGR during the projected timeframe.

Based on the application, the digital dental technology market is divided into prosthodontics, orthodontics, implantology, endodontics, and others. Among these, the implantology segment accounted for the majority of the share in 2023 and is estimated to grow at the substantial CAGR during the projected timeframe. The growth is being driven by ongoing developments in digital tools that improve the efficiency and results of implant procedures. The growing demand for minimally invasive and individualized dental treatments fuels the segment's expansion. As digital technologies advance, the potential to provide extremely precise and personalized implant solutions will become increasingly appealing to both dental professionals and patients, resulting in robust growth in the category throughout the projection period.

- The dental clinics segment held the largest share in 2023 and is estimated to grow at the remarkable CAGR during the predicted timeframe.

Based on the end user, the digital dental technology market is divided into dental clinics, dental laboratories, hospitals, and others. Among these, the dental clinics segment held the largest share in 2023 and is estimated to grow at the remarkable CAGR during the predicted timeframe. The growth is driven by reasons such as increased demand for cosmetic dentistry, minimally invasive treatments, and individualized care. Furthermore, as patient expectations for faster and more efficient dental operations develop, dental clinics are anticipated to increase their investment in advanced digital technologies to suit these needs. The shift toward in-house restoration manufacturing, as well as an increased emphasis on patient comfort and satisfaction, are driving this segment's growth.

Regional Segment Analysis of the Digital Dental Technology Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the digital dental technology market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the digital dental technology market over the predicted timeframe. This region is likely to maintain its leading position due to a number of variables, including a high acceptance rate of advanced dental technologies, a robust healthcare infrastructure, and a significant concentration of dental professionals and clinics equipped with cutting-edge digital technology. The United States, in particular, has a well-established market for digital dental solutions, with rising interest in cosmetic dentistry, less invasive procedures, and precision-driven treatments like dental implants and restorations. Rising healthcare spending, technical developments, and increased patient knowledge of the benefits of digital dentistry technologies all help to drive regional growth. The existence of top market firms, considerable R&D activity, and favorable government policies all contribute to North America's market dominance.

Asia-Pacific is expected to grow at the fastest CAGR growth of the digital dental technology market during the forecast period. Several factors contribute to this rapid rise, including increased healthcare investments, rising disposable incomes, and expanding oral health awareness in nations such as China, India, and Japan. Furthermore, there is an increasing demand for advanced dental operations, driven by an expanding middle class and a greater emphasis on cosmetic dentistry and dental implants. As the region's healthcare infrastructure improves and more dental professionals utilize digital technologies, the market is expected to grow significantly. The increased frequency of dental illnesses, combined with government attempts to improve healthcare access, drives the use of digital dental solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the digital dental technology market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dentsply Sirona

- Align Technology, Inc.

- Envista Holdings Corporation

- Institut Straumann AG

- 3Shape A/S

- Ivoclar Vivadent AG

- Planmeca Oy

- Carestream Dental LLC

- 3D Systems Corporation

- Henry Schein, Inc.

- Zimmer Biomet Holdings, Inc.

- Medit Corp.

- Vatech Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2023, the Invisalign System of clear aligners, iTero intraoral scanners, and exocad CAD/CAM software for digital orthodontics and restorative dentistry are all designed, manufactured, and sold by Align Technology, Inc., a leading global medical device company. The company recently announced new iTero intraoral scanner product innovations that offer general practitioner ("GP") dentists a flexible all-in-one solution.

- In November 2022, the 3Dme Crown, an AI-powered web dental CAD module, was unveiled by Imagoworks Inc. This cutting-edge solution, which is a component of the 3Dme suite, is made to automatically create crown prosthesis designs that are customized for each patient's particular oral environment.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the digital dental technology market based on the below-mentioned segments:

Global Digital Dental Technology Market, By Product Type

- Digital Radiology Equipment

- Dental CAD/CAM Systems

- Dental Lasers

- Others

Global Digital Dental Technology Market, By Application

- Prosthodontics

- Orthodontics

- Implantology

- Endodontics

- Others

Global Digital Dental Technology Market, By End User

- Dental Clinics

- Dental Laboratories

- Hospitals

- Others

Global Digital Dental Technology Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the digital dental technology market over the forecast period?The Digital Dental Technology Market Size will Grow at a Substantial CAGR from 2023 to 2033.

-

2. What is the market size of the digital dental technology market?The Global Digital Dental Technology Market Size is expected to reach a significant share by 2033, at a substantial CAGR during the forecast period 2023-2033.

-

3. Which region holds the largest share of the digital dental technology market?North America is anticipated to hold the largest share of the digital dental technology market over the predicted timeframe.

Need help to buy this report?