Global Digital Diagnostics Market Size, Share, and COVID-19 Impact Analysis, By Product (Hardware and Software), By Application (Cardiology, Oncology, Neurology, Pathology, and Others), By End-User (Hospitals and Clinical Laboratories), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Digital Diagnostics Market Insights Forecasts to 2033

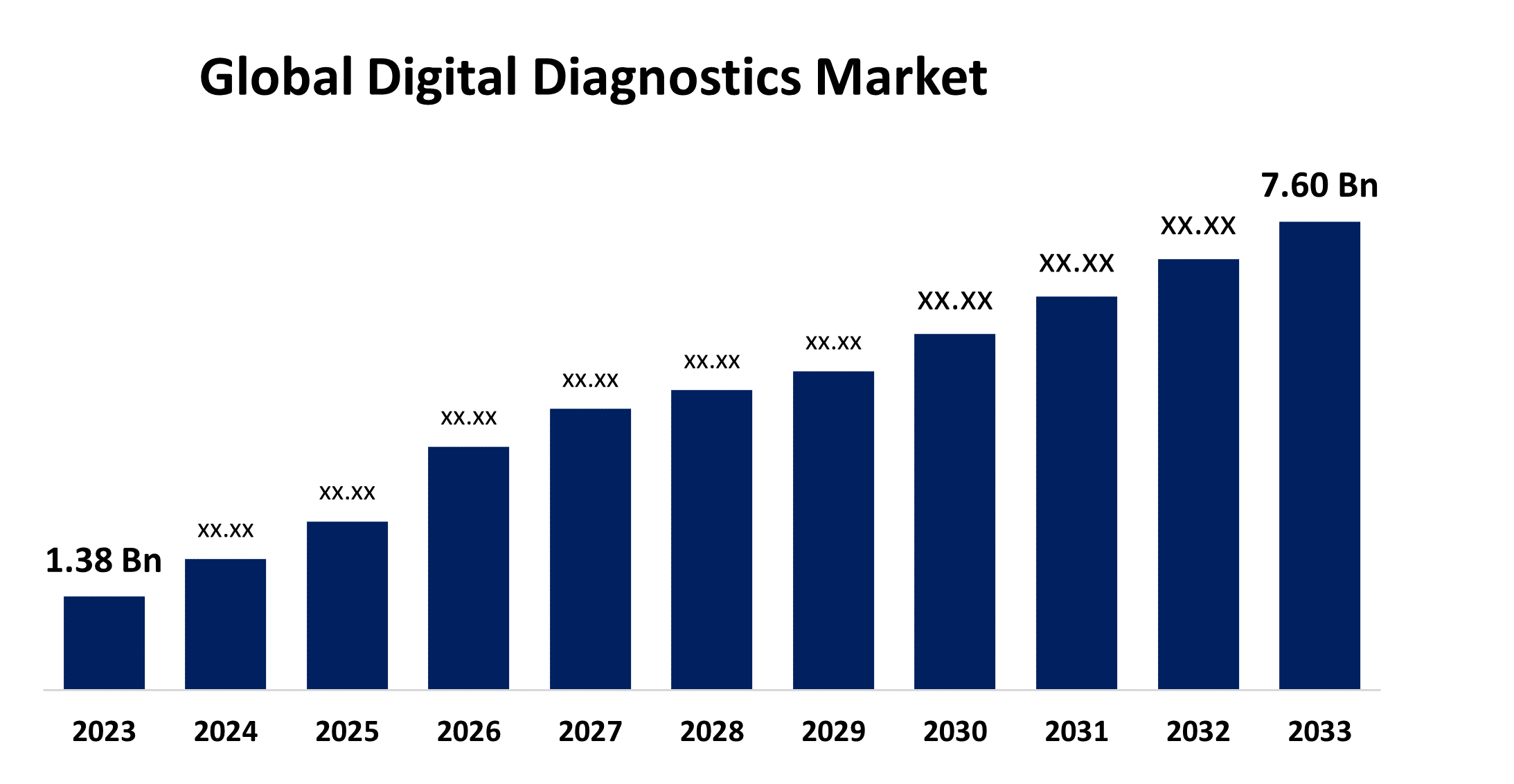

- The Global Digital Diagnostics Market Size was Valued at USD 1.38 Billion in 2023

- The Market Size is Growing at a CAGR of 18.60% from 2023 to 2033

- The Worldwide Digital Diagnostics Market Size is Expected to Reach USD 7.60 Billion by 2033

- Asia-Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Digital Diagnostics Market Size is Anticipated to Exceed USD 7.60 Billion by 2033, Growing at a CAGR of 18.60% from 2023 to 2033.

Market Overview

Digital diagnostics is defined as diagnostic services facilitated by digital technologies, which partially or wholly replace healthcare professionals. It is technically robust, lawful, and ethical. It has changed the way of disease diagnosis, offering a more accurate and practical approach by lowering errors, improving accuracy, and enabling early treatments by utilizing data analytics, AI algorithms, and remote patient monitoring. Digital diagnostics is the combination of data and analytics with traditional IVD testing to generate new clinical insights and more efficient workflows. Advanced technologies such as artificial intelligence and machine learning are enhancing the precision and speed of medical diagnostics, enabling the analysis of biological and clinical data using advanced algorithms, fundamentally altering the landscape of patient care. The integration of data analytics not only provides valuable information about population health but also drives evidence-based decision-making by healthcare organizations and policymakers. The increasing demand for precise diagnostic tools and automation in healthcare settings for alleviating the burden on healthcare providers and the accessibility of healthcare services are promoting market opportunities for digital diagnostics.

Report Coverage

This research report categorizes the market for the global digital diagnostics market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global digital diagnostics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global digital diagnostics market.

Global Digital Diagnostics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.38 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 18.60% |

| 2033 Value Projection: | USD 7.60 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 214 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application, By End-User, By Region |

| Companies covered:: | Hoffmann-La, Roche Ltd., GE Healthcare, ThermoFisher Scientific Inc., Laboratory Corporation of America Holdings, Siemens Healthcare GmbH, Digital Diagnostics Inc., Midmark Corporation, Riverain Technologies, Cerora, AliveCor, Inc., Behold.ai, Brainomix, Healthy.io, Canon Inc., and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising incidence of chronic diseases such as cardiac diseases, neurological diseases, and cancer, along with awareness about early diagnostic intervention is accelerating the market demand for digital diagnostics. Further, the increasing investments, product launches, and services are driving the market growth. The adoption of key strategies by major market players such as collaborations, partnerships, and acquisitions by the key market players are driving the market. The rising demand for innovative technologies diagnosing cardiovascular diseases and the launch of new products and services are bolstering the market growth.

Restraining Factors

The challenges regarding biased data leading to miscalculations in data-driven diagnostic software are restraining the market. Further, the lack of awareness about digital diagnostics and the concerns regarding data security and privacy are restraining the adoption of digital diagnostics which is hampering the market.

Market Segmentation

The global digital diagnostics market share is classified into product, application, and end-user.

- The software segment dominates the market with the largest revenue share during the forecast period.

Based on the product, the global digital diagnostics market is categorized into hardware and software. Among these, the software segment dominates the market with the largest revenue share during the forecast period. Digital solutions are required to accelerate operations, and efficacy and enhance patient care. The integration of advanced software in healthcare settings is driving the market growth in the software segment.

- The oncology segment dominated the market with the largest revenue share in 2023.

Based on the application, the global digital diagnostics market is categorized into cardiology, oncology, neurology, pathology, and others. Among these, the oncology segment dominated the market with the largest revenue share in 2023. Diagnosis of cancer involves the discovery of biomarkers, proteins, and other indicators that lead to the detection of a cancerous tumor. The increasing prevalence of cancer and the adoption of digital diagnostics for cancer screening, technical innovation, and new product releases are driving the market growth in the oncology segment.

- The hospitals segment dominated the market with the largest share of the global digital diagnostics market in 2023.

Based on the end-user, the global digital diagnostics market is categorized into hospitals and clinical laboratories. Among these, the hospitals segment dominated the market with the largest share of the global digital diagnostics market in 2023. Hospitals have access to CT scanners and computer-aided diagnosis systems. The integration of AI platforms and the widespread use of digital pathology and radiography in hospitals are augmenting the market growth in the hospital segment.

Regional Segment Analysis of the Global Digital Diagnostics Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global digital diagnostics market over the predicted timeframe.

Get more details on this report -

North America is projected to hold the largest share of the global digital diagnostics market over the forecast period. The presence of advanced healthcare infrastructure and high adoption rates of digital technologies for chronic disease management are driving the market in the region. The increasing investments in healthcare IT for the development of advanced solutions are leveraging market growth. Further, the adoption of strategies like rising partnerships, expansion, and increasing investments by major players in the region for promoting innovation are boosting the market.

Asia-Pacific is expected to grow at the fastest CAGR growth of the global digital diagnostics market during the forecast period. The increasing adoption of digital health technologies and the rising demand for remote monitoring solutions are propelling the market growth. The rising healthcare expenditure and growing awareness about the benefits of digital diagnostics in the region are further bolstering the market. In addition, rising product launches, and key initiatives taken by the key market players are contributing to driving the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global digital diagnostics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hoffmann-La

- Roche Ltd., GE Healthcare

- ThermoFisher Scientific Inc.

- Laboratory Corporation of America Holdings

- Siemens Healthcare GmbH

- Digital Diagnostics Inc.

- Midmark Corporation

- Riverain Technologies

- Cerora

- AliveCor, Inc.

- Behold.ai

- Brainomix

- Healthy.io

- Canon Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2024, Roche entered into a collaboration agreement with PathAI to expand digital pathology capabilities for companion diagnostics. PathAI would exclusively work with Roche Tissue Diagnostics (RTD) to develop artificial intelligence (AI) digital pathology algorithms for RTD’s companion diagnostics business.

- In May 2022, British medtech company TestCard raised in excess of $10 million in its latest round of fundraising, which would be used primarily to further commercialize its existing product suite whilst also launching new products such as diabetes, pregnancy, CKD, and flu testing.

- In February 2022, Labcorp launched a new digital diagnostics platform. Labcorp OnDemand allows patients to choose tests online. Depending on the test, they can either collect samples at home or make an appointment at a Labcorp location.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global digital diagnostics market based on the below-mentioned segments:

Global Digital Diagnostics Market, By Product

- Hardware

- Software

Global Digital Diagnostics Market, By Application

- Cardiology

- Oncology

- Neurology

- Pathology

- Others

Global Digital Diagnostics Market, By End-User

- Hospitals

- Clinical Laboratories

Global Digital Diagnostics Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the global digital diagnostics market over the forecast period?The global digital diagnostics market is projected to expand at a CAGR of 18.60% during the forecast period.

-

2.What is the projected market size & growth rate of the global digital diagnostics market?The global digital diagnostics market was valued at USD 1.38 Billion in 2023 and is projected to reach USD 7.60 Billion by 2033, growing at a CAGR of 18.60% from 2023 to 2033.

-

3.Which region is expected to hold the highest share in the global digital diagnostics market?The North America region is expected to hold the highest share of the global digital diagnostics market.

Need help to buy this report?