Global Digital Insurance Platform Market Size, Share, and COVID-19 Impact Analysis, By Deployment Mode (Cloud-Based, On-Premises), By Insurance Type (Life Insurance, Health Insurance, Property & Casualty Insurance, Travel Insurance, Commercial Insurance, Others), By Component (Tools, Services), By End-User (Insurance Companies, Brokers & Agents, Consumers), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Banking & FinancialGlobal Digital Insurance Platform Market Insights Forecasts to 2033

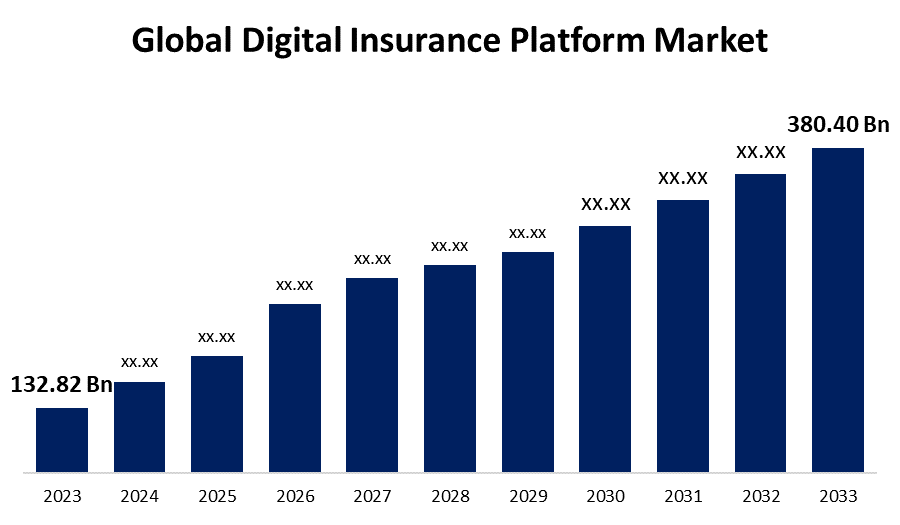

- The Global Digital Insurance Platform Market Size was Valued at USD 132.82 Billion in 2023

- The Market Size is Growing at a CAGR of 11.10% from 2023 to 2033

- The Worldwide Digital Insurance Platform Market Size is Expected to Reach USD 380.40 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Digital Insurance Platform Market Size is Anticipated to Exceed USD 380.40 Billion by 2033, Growing at a CAGR of 11.10% from 2023 to 2033.

Market Overview

A digital insurance platform is a technology-driven system that enables the distribution, management, and servicing of insurance products and services through digital channels. Digital insurance platforms use digital tools to streamline procedures, improve customer experiences, and increase efficiency throughout the insurance lifecycle. It makes policy insurance, claims processing, and customer support easier by including automated underwriting, self-service portals, and AI-driven claims evaluation. The platform also enables data analytics, fraud detection, and regulatory compliance. Integrating with external systems and enabling mobile access improves efficiency, client experience, and innovation in the insurance sector. The digital insurance platform market refers to the industry that develops and utilizes technology-driven solutions to manage various elements of insurance operations. The digital insurance platform market includes a variety of products and services aimed at increasing efficiency, improving client experiences, and driving innovation in the insurance business.

Report Coverage

This research report categorizes the market for digital insurance platform based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the digital insurance platform market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the digital insurance platform market.

Global Digital Insurance Platform Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 132.82 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 11.10% |

| 2033 Value Projection: | USD 380.40 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Deployment Mode, By Insurance Type, By Component, By End-User, By Region |

| Companies covered:: | Accenture, TCS, IBM, DXC Technology, Mindtree, Prima Solutions, Oracle, Microsoft, SAP, Cogitate Technology Solutions, Cognizant, Inzura, Pegasystems, Fineos, Duck Creek, RGI Group, Infosys, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The digital insurance platform market is propelled by several factors driven by technological advancements and shifting consumer preferences. Increasing demand for convenient, accessible digital services is a major force, as consumers seek seamless ways to manage their insurance needs. Innovations in technology, such as AI, machine learning, and big data, enhance platform capabilities, enabling more efficient operations and personalized services. Additionally, the rise of insurtech startups and the need for data-driven decision-making further fuel the market's growth worldwide.

Restraining Factors

The digital insurance platform market faces several factors that can hinder its growth including regulatory compliance is a significant barrier, as navigating complex legal requirements and data protection laws is crucial. Intense market competition and the need for continuous technological innovation further complicate the landscape. Data security and operational challenges including managing processes and maintaining user-friendly experiences, also pose obstacles in the digital insurance platform market.

Market Segmentation

The digital insurance platform market share is classified into deployment mode, insurance type, and end-user.

- The cloud-based segment is estimated to hold the highest market revenue share through the projected period.

Based on the deployment mode, the digital insurance platform market is classified into cloud-based and on-premises. Among these, the cloud-based segment is estimated to hold the highest market revenue share through the projected period. The cloud-based segment dominance is due to the numerous advantages offered by cloud solutions, including scalability, cost efficiency, and flexibility. Cloud-based platforms allow insurance companies to quickly adapt to changing demands, reduce upfront infrastructure costs, and access advanced features and updates without extensive maintenance.

- The property & casualty insurance segment is anticipated to hold the largest market share through the forecast period.

Based on the insurance type, the digital insurance platform market is divided into life insurance, health insurance, property & casualty insurance, travel insurance, commercial insurance, and others. Among these, the property & casualty insurance segment is anticipated to hold the largest market share through the forecast period. The segment dominance is driven by the broad scope of P&C insurance, which includes various products like auto, home, and commercial property insurance, driving substantial demand for digital solutions. The complexity of P&C insurance processes and the high transaction volume associated with insurance products further fuel the adoption of advanced digital platforms.

- The insurance companies segment dominates the market with the largest market share through the forecast period.

Based on the end-user, the digital insurance platform market is categorized into insurance companies, brokers & agents, and consumers. Among these, the insurance companies segment dominates the market with the largest market share through the forecast period. This dominance is due to insurance companies' extensive use of digital platforms for managing complex operations, including policy administration, claims processing, and customer service. Their significant investment in technology to enhance operational efficiency, ensure regulatory compliance, and improve customer experience drives their leading position in the market.

Regional Segment Analysis of the Digital Insurance Platform Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the digital insurance platform market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the digital insurance platform market over the predicted timeframe. The region's expansion is driven by its adoption of advanced technology, large and diverse insurance sector, and significant investment in innovation. The region's robust regulatory environment necessitates sophisticated digital solutions for compliance, while high consumer expectations drive the demand for seamless, user-friendly digital services. Additionally, the competitive nature of the North American insurance market encourages companies to implement cutting-edge digital platforms to enhance efficiency. Top of Form

Bottom of Form

Asia Pacific is expected to grow at the fastest CAGR growth of the digital insurance platform market during the forecast period. The growth of the region is driven by the region's expanding insurance sector, increased technological adoption, and rising middle-class populations. The rapid growth is further reinforced by supportive regulatory environments and heightened competition within the insurance industry, which fuels the need for digital transformation. Additionally, emerging markets within Asia Pacific offer significant opportunities for modernizing insurance processes through advanced digital solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the digital insurance platform market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Accenture

- TCS

- IBM

- DXC Technology

- Mindtree

- Prima Solutions

- Oracle

- Microsoft

- SAP

- Cogitate Technology Solutions

- Cognizant

- Inzura

- Pegasystems

- Fineos

- Duck Creek

- RGI Group

- Infosys

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2024, Synergy Cloud, an independent claims management system (CMS) provider, announced a new collaboration with Claim Technology to create combined solutions for the market.

- In August 2024, APOLLO Insurance, a leading Canadian digital insurance broker, announced the debut of its pet insurance offering. This new option will be made available to "tens of thousands of customers" via a strategic agreement with Petsecure, one of Canada's pioneering pet health insurance companies.

- In August 2024, The State Life Insurance Corporation of Pakistan (SLIC) established cutting-edge digital services and communication frameworks to improve the accessibility, transparency, and efficiency of insurance services for all Pakistanis.

- In June 2024, British Caribbean Insurance Company (BCIC), a leading Caribbean general insurance provider, announced the launch of its omnichannel insurance ecosystem, built on the EIS cloud-native SaaS platform and deployed by EY.

- In June 2024, Sapiens International Corporation, a leading global provider of software solutions for the insurance sector, announced its AI-powered, open, integrated, cloud-native platform. Sapiens Insurance Platform leverages digital engagement, data intelligence, core business processing solutions, and ML and GenAI capabilities to help insurers seamlessly innovate their offerings and processes, enabling them to stay competitive in a dynamic market by making smart, data-driven business decisions and hyper-automating business processes.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the digital insurance platform market based on the below-mentioned segments:

Global Digital Insurance Platform Market, By Deployment Mode

- Cloud-Based

- On-Premises

Global Digital Insurance Platform Market, By Insurance Type

- Life Insurance

- Health Insurance

- Property & Casualty Insurance

- Travel Insurance

- Commercial Insurance

- Others

Global Digital Insurance Platform Market, By Component

- Tools

- Services

Global Digital Insurance Platform Market, By End-User

- Insurance Companies

- Brokers & Agents

- Consumers

Global Digital Insurance Platform Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the digital insurance platform market over the forecast period?The digital insurance platform market is projected to expand at a CAGR of 11.10% during the forecast period.

-

2. What is the market size of the digital insurance platform market?The Global Digital Insurance Platform Market Size is Expected to Grow from USD 132.82 Billion in 2023 to USD 380.40 Billion by 2033, at a CAGR of 11.10% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the digital insurance platform market?North America is anticipated to hold the largest share of the digital insurance platform market over the predicted timeframe.

Need help to buy this report?