Global Digital Substation Market Size, Share, and COVID-19 Impact Analysis, By Module (Hardware, Fiber-Optic Communication Networks, and SCADA Systems), By Type (Transmission Substation and Distribution Substation), By Installations Type (New Installations, Retrofit Installations), By Voltage (Up to 220kV, 220-500kV, Above 500kV), By Industry (Utility, Heavy Industries, Transportation, Others) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Energy & PowerGlobal Digital Substation Market Insights Forecasts to 2033

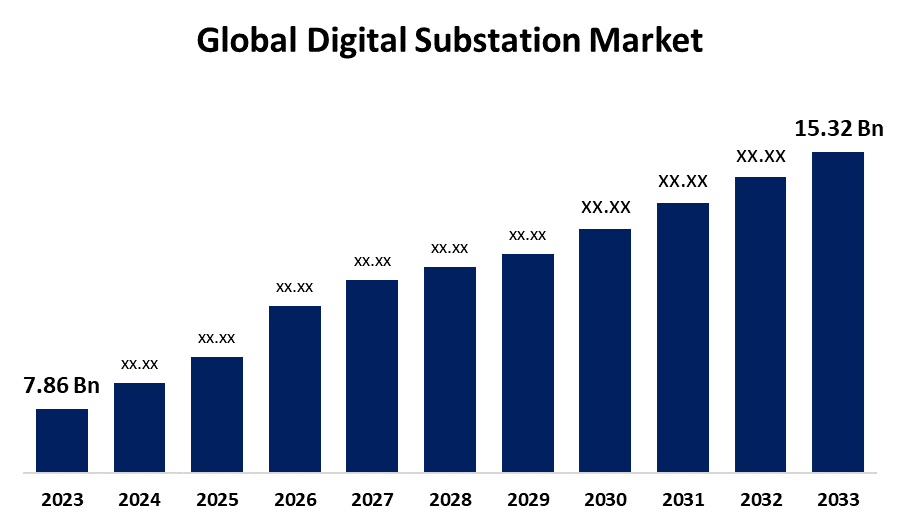

- The Global Digital Substation Market Size was Valued at USD 7.86 Billion in 2023

- The Market Size is Growing at a CAGR of 6.90% from 2023 to 2033

- The Worldwide Digital Substation Market Size is Expected to Reach USD 15.32 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Digital Substation Market Size is Anticipated to Exceed USD 15.32 Billion by 2033, Growing at a CAGR of 6.90% from 2023 to 2033.

Market Overview

A digital substation is a digitized version of a substation’s secondary system that eliminate the majority of analog secondary circuits between the instrument transformers and protective relays. This is a crucial component of electrical generation, transmission, and distribution systems, allowing electric utilities and other sectors to remotely monitor, manage, and coordinate the transmission and distribution components located in the substation.

A digital substation necessitates the use of digital communication networks and enhanced capabilities for advanced grid management as well as helps in collecting operational and asset data, which can be analyzed to detect and predict breakdown. Digital substations are utilized in various industries to provide a more reliable and cost-effective power generation and distribution source to satisfy their diverse requirements. The digital substation market has been classified by industry into utility, heavy industries, transportation, and others (IT parks, residential, and commercial end users).

For Instance, In January 2024, Hitachi Energy enhanced its pioneering digital substation technology with the all-new SAM600 3.0, a process interface unit (PIU) that helps transmission utilities expedite the implementation of digital substations.

Report Coverage

This research report categorizes the market for digital substation based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the digital substation market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the digital substation market.

Global Digital Substation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 7.86 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.90% |

| 2033 Value Projection: | USD 15.32 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Module, By Type, By Installations Type, By Voltage, By Region and COVID-19 Impact Analysis |

| Companies covered:: | ABB Ltd., General Electric Company, Siemens AG, Eaton Corporation Inc., Hitachi Ltd., Schneider Electric SE, NR Electric, Emerson Electric Co., Larsen & Toubro Limited, Honeywell International Inc., Cisco System Inc. and Others key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The digital substation market is expanding rapidly as digital technologies such as IoT, big data, and enhanced sensors improve substation efficiency and reliability. This expansion is accelerated by the desire for smart grids, which necessitate digital substations for greater integration of renewable energy sources and improved grid management. Regulatory support and regulations targeted at updating energy infrastructure and resolving cybersecurity issues are also crucial. Furthermore, the initial investment in digital substations might be significant, their ability to reduce long-term operational costs makes them an appealing option. The expansion of metropolitan areas, as well as the growing demand for reliable electricity, are driving market growth.

Restraining Factors

Several factors have constrained the growth of digital substations including high initial expenses for technology, equipment, and training, which particularly affect utilities in developing countries. Furthermore, cybersecurity issues and an abundance of experienced workers impede adoption and maintenance. Regulatory compliance and concerns about technological obsolescence exacerbate stakeholders' uncertainty. Lack of awareness and understanding about the benefits of digital substations constrain the market growth worldwide.

Market Segmentation

The digital substation market share is classified into module, type, and industry.

- The hardware segment is estimated to hold the highest market revenue share through the projected period.

Based on the module, the digital substation market is classified into hardware, fiber-optic communication networks, and SCADA systems. Among these, the hardware segment is estimated to hold the highest market revenue share through the projected period. The hardware segment dominated due to the essential role that physical components, such as transformers, circuit breakers, and switchgear, play in the overall functioning of substations. The significant investment required for these components, coupled with ongoing technological advancements and the need for regular maintenance and upgrades, contributes to the hardware segment’s leadership in the market.

- The transmission substation segment is anticipated to hold the largest market share through the forecast period.

Based on the type, the digital substation market is divided into transmission substation and distribution substation. Among these, the transmission substation segment is anticipated to hold the largest market share through the forecast period. The transmission substation segment is attributed to transmission substations play a crucial role in managing and directing high-voltage electricity over long distances, which requires advanced digital technologies to enhance efficiency and reliability. Additionally, investments in upgrading transmission infrastructure to support growing energy demands and integrating renewable energy sources drive significant expenditure in transmission substation segment.

- The utility segment dominates the market with the largest market share through the forecast period.

Based on the industry, the digital substation market is categorized into utility, heavy industries, transportation, and others. Among these, the utility segment dominates the market with the largest market share through the forecast period. The segment dominance is driven by the crucial role that utilities play in managing and distributing electricity across extensive networks. Utilities require advanced digital substations to enhance grid reliability, integrate renewable energy sources, and improve overall operational efficiency. The substantial investment in upgrading and modernizing utility infrastructure, coupled with the increasing demand for smart grid technologies, further reinforces the utility sector's leading position in the market.

Regional Segment Analysis of the Digital Substation Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the digital substation market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the digital substation market over the predicted timeframe. The region's strong focus on technological innovation, substantial infrastructure upgrades, and government initiatives supporting smart grid technologies drive the region's growth. Additionally, significant investments in modernizing energy infrastructure and a high demand for improved grid reliability and efficiency further bolster the adoption of digital substations.

Asia Pacific is expected to grow at the fastest CAGR growth of the digital substation market during the forecast period. This rapid expansion is fueled by significant investments in energy infrastructure, driven by rapid urbanization and industrialization in countries like China and India. Government initiatives and policies aimed at modernizing power grids and integrating smart technologies further accelerate the adoption of digital substations. Additionally, increased investments in smart grid technologies and renewable energy sources contribute to the region's market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the digital substation market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ABB Ltd.

- General Electric Company

- Siemens AG

- Eaton Corporation Inc.

- Hitachi Ltd.

- Schneider Electric SE

- NR Electric

- Emerson Electric Co.

- Larsen & Toubro Limited

- Honeywell International Inc.

- Cisco System Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2024, Godrej Electricals & Electronics, a Godrej & Boyce business company, reported the acquisition of orders worth more than Rs.1,000 crore in FY24 for its Power Infrastructure & Renewable Energy (PIRE) division.

- In March 2024, GE Vernova's Grid Solutions division announced the release of GridBeats, a comprehensive range of software-defined automation solutions aimed at enabling grid digitalization and improving grid resilience.

- In September 2023, East Japan Railway Company and Hitachi, Ltd. (Hitachi) jointly developed a full-digital substation system in fiscal 2025. The system enabled the dual configuration of transmission lines as well as the protection and control functions in the substation premises, enabling stable railway transportation through the steady supply of power.

- In July 2022, The Dubai Electricity and Water Authority (DEWA) commissioned a new 400/132 kV substation in Al Qusais Industrial Area 5 and 10 132/11 kV substations in various locations in Dubai.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the digital substation market based on the below-mentioned segments:

Global Digital Substation Market, By Module

- Hardware

- Fiber-Optic Communication Networks

- SCADA Systems

Global Digital Substation Market, By Type

- Transmission Substation

- Distribution Substation

Global Digital Substation Market, By Installations Type

- New Installations

- Retrofit Installations

Global Digital Substation Market, By Voltage

- Up to 220kV

- 220-500kV

- Above 500Kv

Global Digital Substation Market, By Industry

- Utility

- Heavy Industries

- Transportation

- Others

Global Digital Substation Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the digital substation market over the forecast period?The digital substation market is projected to expand at a CAGR of 6.90% during the forecast period.

-

2. What is the market size of the digital substation market?The Global Digital Substation Market Size is Expected to Grow from USD 7.86 Billion in 2023 to USD 15.32 Billion by 2033, at a CAGR of 6.90% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the digital substation market?North America is anticipated to hold the largest share of the digital substation market over the predicted timeframe.

Need help to buy this report?