Global Dispersing Agents Market Size, Share, and COVID-19 Impact Analysis, By Type (Water-borne and Others), By Structure (Anionic, Non-ionic, Hydrophilic, Amphoteric, and Others), By End-Use (Paints, Coatings, & Inks, Adhesives & Sealants, Personal Care & Cosmetics, Agriculture, Building & Construction, Household & Industrial/Institutional Cleaning, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsInsights Forecasts to 2033

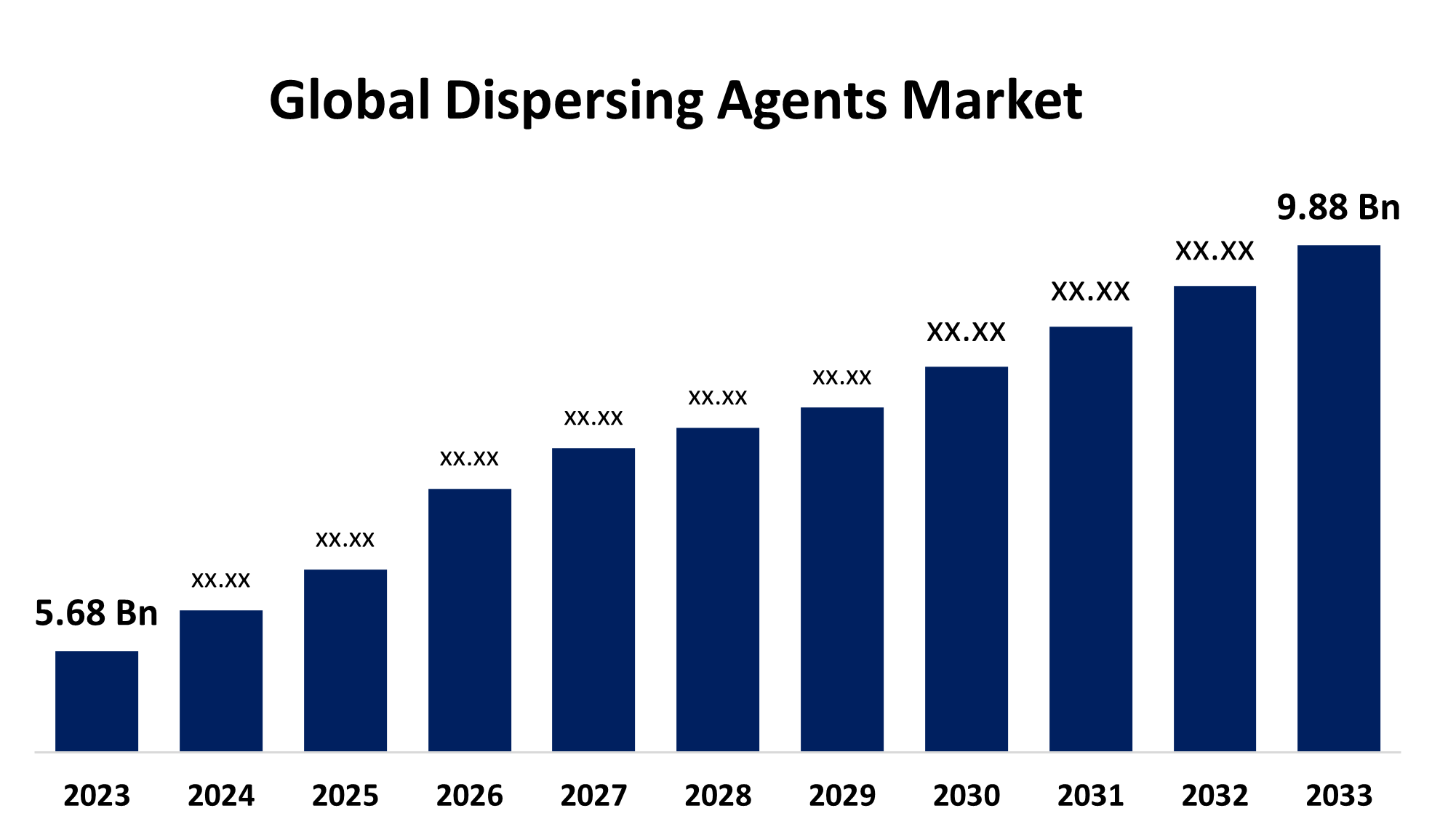

- The Global Dispersing Agents Market Size was Estimated at USD 5.68 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 5.69% from 2023 to 2033

- The Worldwide Dispersing Agents Market Size is Expected to Reach USD 9.88 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Dispersing Agents Market Size is anticipated to exceed USD 9.88 Billion by 2033, Growing at a CAGR of 5.69% from 2023 to 2033. The rising demand from end-use industries, increased infrastructure spending, and low base effects are driving the market for dispersing agents.

Market Overview

The dispersing agents market refers to the industry for chemical additives that break up clumps and stabilize suspended particles. Dispersing agents, also known as dispersants, are chemical substances that improve the separation of solid or liquid particles in a liquid, preventing their settling or clumping. The solid pigments in the binder solution have been stabilized, wet, and dispersed using dispersing agents, which also stop flocculation. These agents are widely used in paints and coatings in a range of industries including industrial, textile, automotive, and construction. Furthermore, dispersing agents are frequently used in a variety of formulations. Low-foam dispersants are being used more often in the paint and coating sector to produce stable formulations and pigment concentrates. Dispersants are used in oil spills to help protect marine habitats by breaking up large oil molecules into smaller ones. Special boats and aircraft are used to spray these dispersants. The increasing need for dispersing agents in current and emerging end-use industries such as paints & coatings, construction, water treatment, and oil & gas is offering a lucrative market growth opportunity for dispersing agents.

Report Coverage

This research report categorizes the dispersing agents market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the dispersing agents market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the dispersing agents market.

Global Dispersing Agents Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.68 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 5.69% |

| 023 – 2033 Value Projection: | USD 9.88 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Structure, By End-Use and By Regional Analysis |

| Companies covered:: | BASF SE, Arkema SA, Kemira, Solvay S.A., Altana AG, Clariant AG, Dow Inc., Lanxess AG, RUDOLF GmbH, Lubrizol, Evonik Industries AG, Uniqchem, Croda International, and Other Key vendors. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising oil drilling and exploration activities especially during offshore operations are promoting the market growth for dispersing agents. Further, the growing need for dispersing agents in industries such as construction, paints and coatings, and pharmaceuticals is driving the market demand. The growing industrialization drives the requirement for high-performance products that meet stringent quality standards and consumer expectations, thereby propelling the dispersing agents market.

Restraining Factors

The presence of alternative technologies or additives that provide similar functionalities is negatively influencing the market growth for dispersing agents.

Market Segmentation

The dispersing agents market share is classified into type, structure, and end-use.

- The water-borne segment held the largest market share in 2023 and is expected to grow at a significant CAGR growth during the forecast period.

Based on the type, the dispersing agents market is classified into water-borne and others. Among these, the water-borne segment held the largest market share in 2023 and is expected to grow at a significant CAGR growth during the forecast period. The increasing need for sustainable and environmentally friendly products in industries such as paints, coatings, and inks is driving the market in the water-borne segment.

- The anionic segment dominated the market with 37.8% market revenue share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the structure, the dispersing agents market is classified into anionic, non-ionic, hydrophilic, amphoteric, and others. Among these, the anionic segment dominated the market with 37.8% market revenue share in 2023 and is expected to grow at a significant CAGR during the forecast period. Anionic dispersion agents essentially act as a stabilizing agents possessing a negative charge on their active molecule. The growing need for colorants, pigments, and tinting systems is driving the market growth in the anionic segment.

- The building & construction segment dominated the market with the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-use, the dispersing agents market is classified into paints, coatings, & inks, adhesives & sealants, personal care & cosmetics, agriculture, building & construction, household & industrial/institutional cleaning, and others. Among these, the building & construction segment dominated the market with the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Dispersing agents are used to enhance the workability and quality of concrete and other cementitious materials by evenly dispersing cement particles.

Regional Segment Analysis of the Dispersing Agents Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the dispersing agents market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the dispersing agents market over the predicted timeframe. The growing construction and automotive industry which leads to the need for the paints and coatings industry is driving the market for dispersing agents market. The rapidly growing textile market in the countries such as India and China is contributing to propelling the market demand. In addition, the rapidly growing industrialization in the region is contributing to propel the dispersing agents market.

North America is expected to grow at the fastest CAGR growth of the dispersing agents market during the forecast period. The expanding industries such as paints and coatings, automotive, construction, pharmaceuticals, and agriculture along with the increasing urbanization, infrastructure development, and technological advancements, drive the market demand for dispersing agents. Further, the increasing number of house renovation activities in countries such as Canada, Mexico, and the United States propel the regional market growth for dispersing agents.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the dispersing agents market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- Arkema SA

- Kemira

- Solvay S.A.

- Altana AG

- Clariant AG

- Dow Inc.

- Lanxess AG

- RUDOLF GmbH

- Lubrizol

- Evonik Industries AG

- Uniqchem

- Croda International

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2023, BASF is set to double its production capacity for water-soluble dispersants based on acrylic acid at its Dilovasi, Turkey location with the introduction of a new production plant. This investment aims to support BASF’s customers in the detergent, cleaning and chemical processing industry across Europe, the Middle East and Africa.

- In July 2022, Evonik launched its new sustainable dispersing additive, TEGO Dispers 658. The latest TEGO dispersing agent in the portfolio is readily biodegradable so improves the sustainability of pigment and colored coatings production, while at the same time offering formulators a similar high-performance profile to other comparable Evonik products.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the dispersing agents market based on the below-mentioned segments:

Global Dispersing Agents Market, By Type

- Water-borne

- Others

Global Dispersing Agents Market, By Structure

- Anionic

- Non-ionic

- Hydrophilic

- Amphoteric

- Others

Global Dispersing Agents Market, By End-Use

- Paints, Coatings, & Inks

- Adhesives & Sealants

- Personal Care & Cosmetics

- Agriculture

- Building & Construction

- Household & Industrial/Institutional Cleaning

- Others

Global Dispersing Agents Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the dispersing agents market over the forecast period?The dispersing agents market is projected to expand at a CAGR of 5.69% during the forecast period.

-

2. What is the market size of the dispersing agents market?The Dispersing Agents Market Size is Expected to Grow from USD 5.68 Billion in 2023 to USD 9.88 Billion by 2033, at a CAGR of 5.69% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the dispersing agents market?Asia Pacific is anticipated to hold the largest share of the dispersing agents market over the predicted timeframe.

Need help to buy this report?