Global Distributed Antenna System Market Size, Share, and COVID-19 Impact Analysis, By Coverage (Indoor and Outdoor), By Ownership (Carrier Ownership, Neutral-host Ownership, and Enterprise Ownership), By Type (Active DAS, Passive DAS, and Hybrid DAS), By Signal Source (Off-air Antennas, On-site Base Transceiver Station, and Small Cells), By Application (Airports & Transportation, Public Venues & Safety, Education Sector & Corporate Offices, Hospitality, Industrial, Healthcare, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032.

Industry: Electronics, ICT & MediaGlobal Distributed Antenna System Market Insights Forecasts to 2032

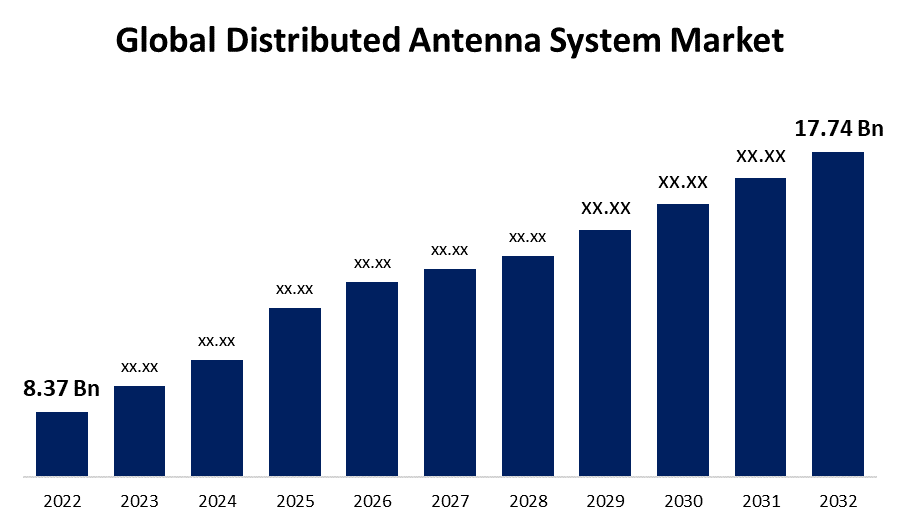

- The Global Distributed Antenna System Market Size was valued at USD 8.37 Billion in 2022.

- The Market is Growing at a CAGR of 7.8% from 2022 to 2032

- The Worldwide Distributed Antenna System Market Size is expected to reach USD 17.74 Billion by 2032

- Asia-Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Distributed Antenna System Market Size is expected to reach USD 17.74 Billion by 2032, at a CAGR of 7.8% during the forecast period 2022 to 2032.

Market Overview

A distributed antenna system is a network of interconnected antennas that are strategically placed to enhance wireless communication within a designated area. It is designed to address challenges related to signal coverage, capacity, and quality in large or densely populated spaces such as stadiums, airports, shopping malls, and office buildings. DAS works by distributing the signal from a central source to multiple remote antennas, which are connected through a network of fiber or coaxial cables. These antennas are strategically positioned throughout the area to ensure uniform coverage and efficient signal transmission. By extending the reach of wireless signals, DAS enhances network performance, reduces congestion, and improves signal quality for end-users. It provides reliable connectivity, enhances data transfer speeds, and ensures seamless voice and data communication for a large number of users simultaneously. DAS technology plays a vital role in meeting the increasing demand for reliable wireless connectivity in areas with high user density, providing a scalable and efficient solution to enhance wireless network performance.

Report Coverage

This research report categorizes the market for distributed antenna system market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the distributed antenna system market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the distributed antenna system market.

Global Distributed Antenna System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 8.37 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.8% |

| 2032 Value Projection: | USD 17.74 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Coverage, By Ownership, By Type, By Signal Source, By Application, By Region. |

| Companies covered:: | Advanced RF Technologies, Inc., ATC IP LLC, Betacom, Boingo Wireless, Inc., BTI Wireless, CenRF Communications Limited, Comba Telecom Systems Holdings Ltd., CommScope, Inc., Corning Incorporated, Decypher, Fixtel Services, HUBER+SUHNER, JMA Wireless, Symphony Technology Solutions, Inc., Zinwave. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The distributed antenna system market is driven by several factors. The increasing demand for high-speed data connectivity and seamless wireless communication in crowded public spaces such as stadiums, airports, and shopping malls is a major driver. The growing adoption of smartphones and other wireless devices has fueled the need for enhanced network coverage and capacity. Additionally, the rise in Internet of Things (IoT) devices and applications, along with the deployment of 5G networks, has further boosted the demand for DAS solutions. Moreover, regulatory requirements and guidelines for reliable wireless communication in critical infrastructure sectors like healthcare and public safety are driving the market. Overall, the need for efficient and cost-effective solutions to address signal interference and weak coverage in indoor environments also contributes to the growth of the DAS market.

Restraining Factors

The distributed antenna system market faces several restraints. The high initial deployment and installation costs associated with DAS infrastructure pose a challenge, particularly for small and medium-sized enterprises. The complexity of integrating DAS with existing wireless networks and infrastructure can be a deterrent. Additionally, the need for extensive planning and site surveys to optimize DAS performance and coverage adds complexity and time to the implementation process. Moreover, the rapid evolution of wireless technologies and standards can make DAS solutions susceptible to obsolescence. Lastly, regulatory and legal restrictions, as well as the availability of suitable locations for antenna placement, can limit the adoption of DAS in certain regions or environments.

Market Segmentation

- In 2022, the neutral-host ownership segment accounted for more than 34.7% market share

On the basis of ownership type, the global distributed antenna system market is segmented into carrier ownership, neutral-host ownership, and enterprise ownership. the neutral-host ownership segment has held the largest market share in the global distributed antenna system market. Neutral-host ownership refers to DAS installations owned and operated by independent third-party providers, known as neutral hosts. These neutral hosts invest in DAS infrastructure and lease out the network capacity to multiple wireless carriers and service providers. This ownership model enables multiple operators to share the same DAS infrastructure, reducing costs and improving efficiency. Neutral-host DAS installations are particularly prevalent in public venues and large commercial buildings where multiple carriers need to provide coverage. The neutral-host approach allows for a more neutral and inclusive approach to network access, driving its dominance in the market and providing a cost-effective solution for enhancing wireless connectivity across various industries.

- The public venues & safety is expected to grow at a higher CAGR during the forecast period

Based on the type of application, the global distributed antenna system market is segmented into airports & transportation, public venues & safety, education sector & corporate offices, hospitality, industrial, healthcare, and others. The public venues & safety segment is anticipated to witness rapid growth during the forecast period. Several factors contribute to this growth. The public venues such as stadiums, airports, shopping malls, and convention centers are experiencing increasing footfall and higher user density, resulting in a heightened need for reliable wireless communication and coverage. distributed antenna systems offer an effective solution to address this demand by enhancing network capacity and ensuring seamless connectivity for a large number of users in such venues. Additionally, the growing emphasis on public safety and emergency communication further drives the adoption of DAS in these environments. DAS installations in public venues facilitate reliable communication during emergencies, ensuring the safety and well-being of occupants.

Regional Segment Analysis of the Distributed Antenna System Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominated the market with more than 39.4% revenue share in 2022.

Get more details on this report -

Based on region, North America has emerged as the dominant region in the distributed antenna system market, holding the largest market share. This can be attributed to several factors. North America has a high level of technological advancement and widespread adoption of wireless communication technologies. The region has a significant number of large-scale commercial buildings, stadiums, and public venues that require robust wireless coverage, driving the demand for DAS solutions. North America has been at the forefront of 5G deployment, with telecom operators investing heavily in infrastructure upgrades. The need to support the increased data capacity and improved network performance of 5G networks has further propelled the adoption of DAS in the region. Additionally, stringent regulations regarding wireless connectivity in critical sectors, such as healthcare and public safety, have also contributed to the growth of the DAS market in North America.

Recent Developments

In June 2022, Comba telecom systems holdings limited unveiled an environmentally-friendly integrated base station antenna (8TR) for 4G/5G networks, broadening their range of tower top products and supporting their carbon neutrality objectives. This latest addition to their portfolio not only fulfills the demands for coverage and capacity but also establishes itself as a prominent tower-top antenna option for the deployment of 5G networks.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global distributed antenna system market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Advanced RF Technologies, Inc.

- ATC IP LLC

- Betacom

- Boingo Wireless, Inc.

- BTI Wireless

- CenRF Communications Limited

- Comba Telecom Systems Holdings Ltd.

- CommScope, Inc.

- Corning Incorporated

- Decypher

- Fixtel Services

- HUBER+SUHNER

- JMA Wireless

- Symphony Technology Solutions, Inc.

- Zinwave

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global distributed antenna system market based on the below-mentioned segments:

Distributed Antenna System Market, By Coverage

- Indoor

- Outdoor

Distributed Antenna System Market, By Ownership

- Carrier Ownership

- Neutral-host Ownership

- Enterprise Ownership

Distributed Antenna System Market, By Type

- Active DAS

- Passive DAS

- Hybrid DAS

Distributed Antenna System Market, By Signal Source

- Off-air Antennas

- On-site Base Transceiver Station

- Small Cells

Distributed Antenna System Market, By Application

- Airports & Transportation

- Public Venues & Safety

- Education Sector & Corporate Offices

- Hospitality

- Industrial

- Healthcare

- Others

Distributed Antenna System Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?