Global Distribution Automation Market Size, Share, and COVID-19 Impact Analysis, By Offering (Field Devices, Software, and Services), By Communication Technology (Wired (Fiber Optic, Ethernet, Powerline Carrier, and IP) and Wireless), By Utility (Public Utilities and Private Utilities), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Energy & PowerGlobal Distribution Automation Market Insights Forecasts to 2033

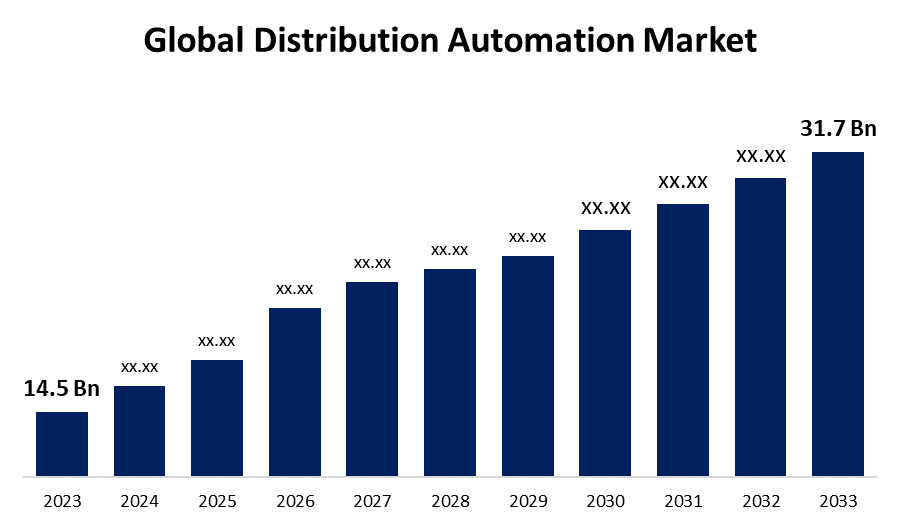

- The Global Distribution Automation Market Size was Valued at USD 14.5 Billion in 2023

- The Market Size is Growing at a CAGR of 8.14% from 2023 to 2033

- The Worldwide Distribution Automation Market Size is Expected to Reach USD 31.7 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Distribution Automation Market Size is Anticipated to Exceed USD 31.7 Billion by 2033, Growing at a CAGR of 8.14% from 2023 to 2033.

Market Overview

A collection of protocols and technologies known as distribution automation (DA) allows electrical distribution networks to be monitored and controlled without the need for human involvement. These protocols and technologies include communications, processors, switches, and sensors. By conserving energy and resources, it can raise the distribution system's efficiency. Additionally, it increases the dependability of the distribution system by lowering the frequency and duration of power outages. It also increases adaptability by permitting the utilization of a wider range of energy sources. Additionally, by utilizing auto restoration technologies to shorten outage durations, DA devices improve dependability and simplicity of operation and maintenance. Industry progress will be fueled by correspondence innovation and the Internet of Things expansion. Throughout the projection period, new developments in IoT and specialized devices are anticipated to increase interest in DAS innovation. Businesses in the worldwide distribution automation sector should find great learning possibilities as sophisticated computerized power supply innovation becomes more widely used. The global need for cutting-edge distribution automation systems has increased due to the sustained growth of renewable energy sources like solar and wind. Furthermore, the need for distribution automation is being driven by the popularity of electric vehicles. To accommodate the increasing load and maximize charging times, effective grid management is needed for EV charging infrastructure.

Report Coverage

This research report categorizes the market for the distribution automation market size based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global distribution automation market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the distribution automation market.

Global Distribution Automation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 14.5 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 8.14% |

| 023 – 2033 Value Projection: | USD 31.7 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Offering, By Communication Technology, By Utility, By Region |

| Companies covered:: | ABB Ltd., General Electric Company, Siemens AG, Schneider Electric SE, Eaton Corporation Plc, S&C Electric Company, Schweitzer Engineering Laboratories, Inc., Advanced Control Systems, Inc., G&W Electric Company, Crompton Greaves Limited, Atlantic City Electric Company, Landis+Gyr Group AG, Honeywell International Inc., Elster Group SE, BPL Global, Ltd., Others, |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

The demand for reliable and efficient power distribution networks is growing due to modernization, industry, and a higher reliance on electricity-consuming devices. Distribution automation technology allows utility firms to reduce downtime, boost service quality, and raise grid reliability—all of which drive market expansion. Distribution automation technologies aid utilities in minimizing losses, optimizing the distribution of electricity, and improving overall grid efficiency. As energy conservation and sustainability become more important, utilities are investing in automation technology to increase operational efficiency and reduce carbon emissions. Operating problems with grid integration of renewable energy sources (e.g., solar and wind power) include power quality, voltage variations, and grid stability. Smooth integration of renewable energy resources is made simpler by the real-time monitoring, control, and optimization capabilities provided by distribution automation systems. Governments and utilities worldwide are initiating grid modernization plans to replace antiquated infrastructure, boost grid resilience, and enable the adoption of cutting-edge technology. Distribution automation is an important component of these modernization activities and a key driver of market demand for automation services and solutions.

Restraining Factors

The infrastructure, software, and hardware required to implement distribution automation systems can come with a substantial initial cost. Utility companies and companies with limited capital spending plans can find this a burden. Integrating distribution automation systems with the existing grid infrastructure, communication networks, and control systems can be challenging and time-consuming. Adopting automation solutions may be impeded by issues with interoperability and compatibility.

Market Segmentation

The global distribution automation market share is classified into offering, communication technology, and utility.

- The field devices segment is anticipated to dominate the global distribution automation market during the forecast period.

Based on the offering, the global distribution automation market is divided into field devices, software, and services. Among these, the field devices segment is anticipated to dominate the global distribution automation market during the forecast period. Its notable market domination can be attributed to the advantages it offers, such as the capacity to remotely monitor distribution power networks in order to reduce the duration of power outages. They automate several aspects of power distribution since they are outfitted with digital controllers, switches, and sensors.

- The wireless segment is anticipated to grow fastest in the market over the forecast period.

Based on the communication technology, the global distribution automation market is divided into wired (fiber optic, ethernet, powerline carrier, and IP) and wireless. Among these, the wireless segment is anticipated to grow fastest in the market over the forecast period. Because of the increased demand for data-driven decision-making and real-time data exchange, wireless is the area of electricity distribution automation that is expanding the quickest in terms of communication technology. Information may be safely and economically transmitted over great distances using wireless communication technology, which eliminates the need for wires or electrical lines.

- The private utilities segment is anticipated to grow at the fastest pace in the market during the forecast period.

Based on the utility, the global distribution automation market is divided into public utilities and private utilities. Among these, the private utilities segment is anticipated to grow at the fastest pace in the market during the forecast period. The increase is credited to private enterprises allocating resources towards sophisticated metering technology, artificial intelligence, and smart grid infrastructure to enhance dependability, expedite complaint response, and capture real-time energy usage. To assist with electricity distribution in light of growing demand and technological advancements, the government is turning to private partners. The industry views private players as beneficial owing to their experience and greater efficiency.

Regional Segment Analysis of the Global Distribution Automation Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific region is anticipated to hold the largest market share with the highest revenue during the forecast period.

Get more details on this report -

Asia Pacific region is anticipated to hold the largest market share with the highest revenue during the forecast period. With more money going toward smart grid initiatives, there should be a rise in demand for distribution automation systems in the area. Significant expansion in the area is being driven by China, Japan, and Australia. To fulfill expanding energy demands, factors including increased industrialization and a growing trend toward sustainable energy are also predicted to support market expansion. Because of the significant investments made in smart grid initiatives, the area is anticipated to have a strong demand for distribution automation systems.

Europe is expected to grow fastest in the market over the projected period. Due to the growing interest in network growth and the increasing complexity of the force distribution system, Europe is also going through important development. France, Germany, and the UK are ardent European market proponents. Moreover, the invention is spreading quickly in nations like Denmark, Spain, and Italy because of larger, brilliant lattice theories with potent in-assembled transmission and appropriation of mechanization resources. Additionally, rising interest in power supply energy efficiency is anticipated to promote district market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global distribution automation market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ABB Ltd.

- General Electric Company

- Siemens AG

- Schneider Electric SE

- Eaton Corporation Plc

- S&C Electric Company

- Schweitzer Engineering Laboratories, Inc.

- Advanced Control Systems, Inc.

- G&W Electric Company

- Crompton Greaves Limited

- Atlantic City Electric Company

- Landis+Gyr Group AG

- Honeywell International Inc.

- Elster Group SE

- BPL Global, Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2021, NTPC welcomed Electricite de France S.A. It will also look at prospects for the development of power projects in Africa, the Middle East, and the Asia Pacific.

- In March 2024, Itron Inc. has acquired Elpis Squared for USD 35 million. This acquisition provides Itron with the ability to integrate real-time, high-resolution "grid edge" data into power grid planning, operations, and engineering processes, a revolutionary advancement for the industry. According to the Alliance to Save Energy, the grid edge is the intersection of smart or connected infrastructure and the electric power grid.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global distribution automation market based on the below-mentioned segments:

Global Distribution Automation Market, By Offering

- Field Devices

- Software

- Services

Global Distribution Automation Market, By Communication Technology

- Wired

- Fiber Optic

- Ethernet

- Powerline Carrier

- IP

- Wireless

Global Distribution Automation Market, By Utility

- Public Utilities

- Private Utilities

Global Distribution Automation Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?ABB Ltd., General Electric Company, Siemens AG, Schneider Electric SE, Eaton Corporation Plc, S&C Electric Company, Schweitzer Engineering Laboratories, Inc., Advanced Control Systems, Inc., G&W Electric Company, Crompton Greaves Limited, Atlantic City Electric Company, Landis+Gyr Group AG, Honeywell International Inc., Elster Group SE, BPL Global, Ltd., and Others.

-

2. What is the size of the global distribution automation market?The Global Distribution Automation Market Size is Expected to Grow from USD 14.5 Billion in 2023 to USD 31.7 Billion by 2033, at a CAGR of 8.14% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?Asia Pacific is anticipated to hold the largest share of the global distribution automation market over the predicted timeframe.

Need help to buy this report?