Global Docking Station Market Size By Product (Laptop, Smartphones And Tablets), By Connectivity (Wired, Wireless), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Semiconductors & ElectronicsGlobal Docking Station Market Insights Forecasts to 2033

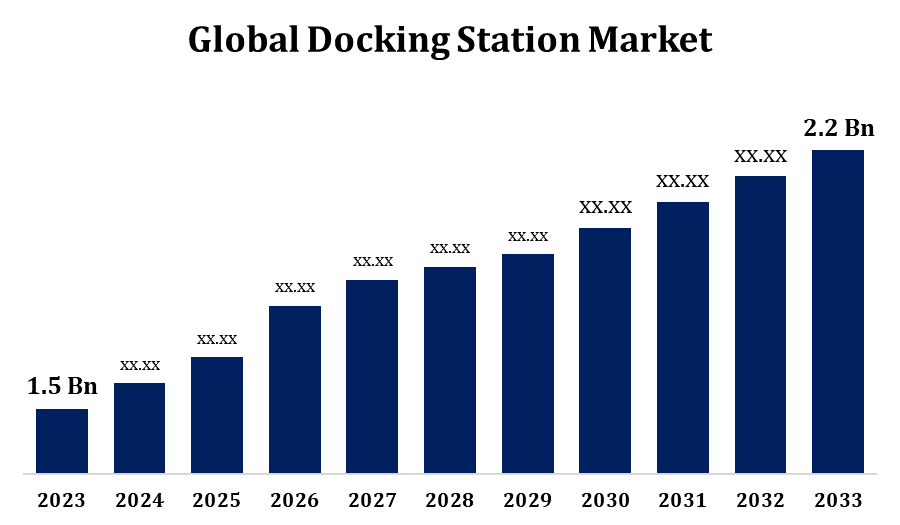

- The Global Docking Station Market Size was valued at USD 1.5 Billion in 2023.

- The Market Size is growing at a CAGR of 3.90% from 2023 to 2033

- The Worldwide Docking Station Market Size is expected to reach USD 2.2 Billion by 2033

- Asia Pacific Market is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Docking Station Market Size is expected to reach USD 2.2 Billion by 2033, at a CAGR of 3.90% during the forecast period 2023 to 2033.

Docking stations come in a variety of sorts and models, each designed to work with a specific laptop brand or model. Some are global, while others are targeted to certain companies such as Dell, HP, and Lenovo. Docking stations can give a variety of connectivity choices, including USB-C, Thunderbolt, HDMI, and DisplayPort. Docking station prices vary according on brand, compatibility, and features. Basic docking stations with fewer ports may be less expensive, whereas complex versions with extensive connectivity and power delivery capabilities are typically more expensive. While docking stations are most usually associated with laptop computers, they are also utilised with other docking-capable devices such as tablets. This adaptability aids in the widespread acceptance of docking stations.

Docking Station Market Value Chain Analysis

Docking stations are built with a variety of components, including USB ports, HDMI ports, power delivery circuits, and other electronic components. Companies that manufacture docking stations purchase components from a variety of sources to ensure compatibility, quality, and cost effectiveness. Manufacturers assemble docking stations by incorporating acquired components into the finished product. Rigorous quality control measures are required to ensure that docking stations fulfil industry standards and specifications. Companies add branding and design aspects to docking stations to differentiate their products on the market. Docking stations come with user manuals and other equipment. Packaging also helps to sell and protect the product during shipment. Docking stations are distributed via a variety of methods, including direct sales, retailers, e-commerce platforms, and corporate suppliers. Companies use marketing methods to increase awareness and promote their docking stations. This encompasses advertising, social media, and other promotional activities. Docking stations are widely utilised in professional contexts, with corporate clients buying them for their personnel to boost productivity.

Docking Station Market Opportunity Analysis

There is a chance to create docking stations that work with a wider range of devices, such as different laptop models, tablets, and smartphones. Developing universal docking solutions that support numerous operating systems and networking protocols may appeal to a broader user base. The continual evolution of technology allows for the enhancement of docking station capabilities. With the growing popularity of remote work, there is a greater demand for accessories that support an efficient home office setup. Increased environmental awareness creates opportunity for eco-friendly docking station designs. Recycling materials, using energy-efficient components, and creating products with sustainability in mind can all help to attract environmentally aware customers.

Global Docking Station Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.5 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.90% |

| 2033 Value Projection: | USD 2.2 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Connectivity, By Distribution Channel, By Region, By Geographic Scope |

| Companies covered:: | Toshiba Corp, The Targus Corp, Apple, Inc, StarTech.com, Dell Technologies, Inc., HP Development Company, Samsung Group, ACCO Brands Corp, Lenovo Group Ltd, Plugable Technologies, and Other Key Vendors. |

| Growth Drivers: | Increasing digitization across industrial verticals |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Docking Station Market Dynamics

Increasing digitization across industrial verticals

The digitalization trend, fueled by the demand for remote work solutions, has compelled firms to undergo digital changes. As organisations adopt more digital workflows, the demand for docking systems to allow remote work arrangements with numerous monitors, peripherals, and power delivery grows. Industrial settings are progressively adopting IoT devices for monitoring and control, resulting in the development of smart factories and connected ecosystems. Docking systems can act as a hub for linking many IoT devices, allowing users to easily integrate and manage data from multiple sources. Docking systems that enable high-speed data transfer and numerous display configurations are critical for data-intensive professionals such as data analysts, engineers, and researchers.

Restraints & Challenges

The wide variety of laptops, tablets, and other devices on the market may cause compatibility issues between docking stations and individual models. Users may experience irritation and inconvenience if their gadgets are not entirely compatible with the docking system, resulting in potential returns and consumer unhappiness. The rapid evolution of connecting standards (such as USB-C and Thunderbolt) and other technologies might make it difficult for docking system makers to stay current with the latest trends. The rising use of docking systems in professional contexts raises security concerns about data flow and potential vulnerabilities. Natural catastrophes, geopolitical tensions, and health crises can all cause global supply chain interruptions in the docking system industry, as they do in many other industries.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Docking Station Market from 2023 to 2033. North America, which includes the United States and Canada, is a key market for docking stations due to the extensive use of laptop computers and the growing popularity of remote work. The increase in remote work, fueled by the COVID-19 epidemic, had a significant impact on the docking station market. Professionals working from home sought docking solutions to increase productivity and establish efficient home office environments. North America is home to several significant technology businesses and manufacturers, resulting in a competitive docking station industry. Large organisations and enterprises in North America have been investing in docking systems to provide their employees with efficient workstations, whether in typical office settings or remote work locations.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The Asia-Pacific area, comprising nations like China, Japan, India, South Korea, and others, constituted a substantial and increasing market for docking stations. The region's docking station market grew as laptop adoption increased and remote work became more popular. The Asia-Pacific area has led the way in technology adoption, with a rapidly rising tech-savvy populace. The rising use of laptops, tablets, and other mobile devices in a variety of businesses and consumer segments has driven demand for docking stations. The rise of the middle class in countries such as China and India has increased consumer spending power, boosting demand for technology accessories such as docking stations.

Segmentation Analysis

Insights by Product

The laptop segment accounted for the largest market share over the forecast period 2023 to 2033. The COVID-19 has exacerbated the increase in remote work, resulting in a boom in the usage of laptops as major work equipment. Professionals working from home seek docking stations to construct ergonomic workstations with additional accessories and multiple monitors. The growth of hybrid work patterns, which combine remote and in-office work, has raised the need for portable computing devices such as laptops. Docking stations were essential in shifting between home and office work locations, ensuring a consistent user experience. The drive towards more portable computer solutions has fueled the popularity of ultrabooks, thin-and-light laptops, and 2-in-1 devices. Laptop computers have become increasingly popular in the education sector as tools for remote learning and digital education projects.

Insights by Connectivity

The wired segment accounted for the largest market share over the forecast period 2023 to 2033. Wired docking solutions provide dependable and stable connections, resulting in consistent data transmission speeds and low latency. Professionals and enterprises frequently prioritise wired connections for key tasks and applications, which contributes to the ongoing demand for wired docking solutions. Wired docking stations provide high-speed data transfer rates, allowing users to transfer big files, access network resources, and operate data-intensive apps with ease. Many wired docking stations enable power delivery, allowing customers to charge their laptops and devices with a single cable connection. Professionals who require extended desktops or efficient multitasking can benefit from wired docking stations, which frequently allow several external screens. The ability to connect several screens via wired connections is a strong selling point for these docking solutions.

Insights by Distribution Channel

The offline segment accounted for the largest market share over the forecast period 2023 to 2033. Docking systems can be utilised to construct efficient workstations for operations like data gathering, analysis, and equipment control in industrial and outdoor situations where internet connectivity is not readily available. Docking stations make it easier to connect peripherals and additional displays to laptops for effective data processing in situations where sensitive data is processed offline owing to security or privacy concerns. Docking systems can help military and defence personnel create compact and versatile workstations for laptops or ruggedized devices in areas where safe offline activities are critical. In distant or underdeveloped areas with inadequate internet connectivity, educational institutions may use docking systems to build up offline computer laboratories or training facilities.

Recent Market Developments

- In April 2022, Targus, a leading maker of laptop coverings and mobile computing accessories, announced the debut of two new Thunderbolt 3 Docks, with Thunderbolt speed for high-resolution graphics and are designed to meet the demanding needs of creative professionals and studios.

Competitive Landscape

Major players in the market

- Toshiba Corp

- The Targus Corp

- Apple, Inc

- StarTech.com

- Dell Technologies, Inc.

- HP Development Company

- Samsung Group

- ACCO Brands Corp

- Lenovo Group Ltd

- Plugable Technologies

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Docking Station Market, Product Analysis

- Laptop

- Smartphones

- Tablets

Docking Station Market, Connectivity Analysis

- Wired

- Wireless

Docking Station Market, Distribution Channel Analysis

- Offline

- Online

Docking Station Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Docking Station Market?The Global Docking Station Market Size is expected to grow from USD 1.5 Billion in 2023 to USD 2.2 Billion by 2033, at a CAGR of 3.90% during the forecast period 2023-2033.

-

2. Who are the key market players of the Docking Station Market?Some of the key market players of the market are Toshiba Corp, The Targus Corp, Apple, Inc, StarTech.com, Dell Technologies, Inc., HP Development Company, Samsung Group, ACCO Brands Corp, Lenovo Group Ltd, and Plugable Technologies.

-

3. Which segment holds the largest market share?The wired segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Docking Station Market?North America is dominating the Docking Station Market with the highest market share.

Need help to buy this report?