Global Docking System Market Size, Share, and COVID-19 Impact Analysis, By Type (Nose Docks, Engine Docks, Fuselage Docks, Wing Docks, Tail Docks, and Others), By Aircraft Type (Narrow Body, Wide Body, Regional Jet, and Others), By End User (OEM and MRO), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Docking System Market Insights Forecasts to 2033

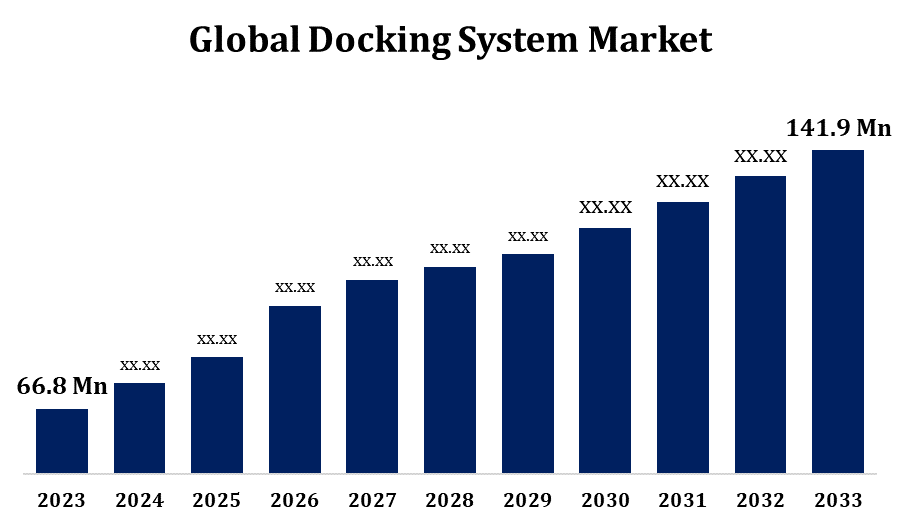

- The Docking System Market Size was valued at USD 66.8 Million in 2023.

- The Market Size is Growing at a CAGR of 7.83% from 2023 to 2033

- The Worldwide Docking System Market Size is Expected to reach USD 141.9 Million by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Docking System Market is Expected to reach USD 141.9 Million by 2033, at a CAGR of 7.83% during the forecast period 2023 to 2033.

The docking system market is expanding rapidly, driven by rising demand for simplified, effective logistics and transportation solutions. This market includes a variety of docking systems, including as automobile, marine, and aircraft docking options. Automation and safety innovations are major trends driving market growth, as companies strive to improve operational efficiency and reduce turnaround times. The expansion of e-commerce and worldwide trade, combined with the improvement of transportation infrastructure, are key contributors to the market's rising trend. Key players are concentrating on combining sophisticated technologies like IoT and AI to provide smart docking solutions.

Docking System Market Value Chain Analysis

The docking system market value chain encompasses several critical stages, beginning with raw material suppliers who provide essential components like steel, electronics, and hydraulic systems. Manufacturers then design and produce various docking solutions, incorporating advanced technologies such as IoT and AI to enhance functionality and safety. These products are distributed through a network of wholesalers and retailers, who cater to end-users across industries like logistics, transportation, and aerospace. Installation and maintenance services play a crucial role, ensuring the longevity and efficiency of docking systems. Additionally, continuous feedback from end-users drives innovation and customization, fostering a cycle of improvement and adaptation.

Docking System Market Opportunity Analysis

The docking system market presents significant opportunities driven by technological advancements and expanding applications. The integration of IoT and AI offers avenues for developing smart docking solutions that enhance efficiency and safety, appealing to industries focused on automation. The rapid growth of e-commerce and global trade fuels demand for advanced docking systems in logistics and warehousing, while the modernization of transportation infrastructure creates new prospects in marine and aerospace sectors. Emerging markets in Asia-Pacific, with their rapid industrialization and urbanization, represent a substantial growth potential. Additionally, the push for sustainable and energy-efficient solutions opens up opportunities for innovative docking systems designed to reduce environmental impact, making sustainability a competitive differentiator in the market.

Global Docking System Marke Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 66.8 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.83% |

| 2033 Value Projection: | USD 141.9 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 214 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Aircraft Type, By End User, By Region |

| Companies covered:: | Targus Corporation, Dell Technologies Inc., StarTech.com, ACCO Brands Corporation, HP Development Company L.P, Lenovo Group Limited, Plugable Technologies, TOSHIBA CORPORATION, Acer Inc., Samsung Electronics Co., Ltd., and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Market Dynamics

Docking System Market Dynamics

Increase in Air Travel and Number of Flights Per Aircraft to Drive Market Growth

As global air passenger traffic surges, airlines are expanding their fleets and increasing flight frequencies to meet demand. This necessitates efficient and reliable aircraft docking systems to ensure quick turnaround times and maintain operational efficiency. Enhanced docking solutions, equipped with advanced technologies for precision and safety, are becoming essential to handle the higher volume of aircraft movements at airports. Additionally, the push for improved ground handling and maintenance operations further propels the adoption of sophisticated docking systems. Consequently, the aviation sector's expansion directly contributes to the robust growth of the docking system market.

Restraints & Challenges

High initial costs associated with advanced docking systems deter some potential buyers, particularly smaller enterprises. Additionally, the integration of sophisticated technologies like IoT and AI requires significant investment in infrastructure and training, which can be a barrier for adoption. Maintenance and operational reliability are also concerns, as downtime or malfunctions can disrupt logistics and transportation operations. Moreover, the market is highly competitive, with numerous players striving to innovate and capture market share, leading to price pressures. Regulatory compliance and safety standards vary across regions, adding complexity to market operations. These challenges necessitate continuous innovation and strategic planning to ensure sustainable growth and competitiveness in the docking system market.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Docking System Market from 2023 to 2033. The growth is driven by the region's advanced infrastructure and high demand for efficient logistics and transportation solutions. The presence of major airports and seaports necessitates sophisticated docking systems to manage increased traffic and cargo volumes. The strong e-commerce sector in the United States and Canada further fuels the need for advanced warehouse docking solutions. Additionally, the emphasis on automation and smart technologies in North American industries supports the adoption of IoT and AI-enabled docking systems. Regulatory frameworks promoting safety and efficiency also bolster market growth. Key players in the region are focusing on innovation and strategic partnerships to cater to the diverse needs of the logistics, aviation, and marine sectors, maintaining North America's market leadership.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The booming e-commerce sector and expanding trade activities necessitate advanced docking solutions to handle increased logistics demands. Countries like China, India, and Japan are investing heavily in upgrading their transportation infrastructure, including airports and seaports, to support economic growth. This drives the demand for efficient and reliable docking systems. Additionally, the region's focus on automation and smart technologies aligns with the global trend towards IoT and AI-enabled docking solutions. Competitive manufacturing costs and a large skilled workforce further bolster market development.

Segmentation Analysis

Insights by Type

The engine docks segment accounted for the largest market share over the forecast period 2023 to 2033. As airlines expand their fleets and intensify flight schedules, the demand for efficient and reliable engine docks rises to ensure timely and effective maintenance and repairs. Advanced engine docking solutions equipped with precision technologies and safety features are essential to minimize aircraft downtime and enhance operational efficiency. The integration of automation and smart systems in engine docks further boosts their appeal, providing real-time diagnostics and streamlined workflows.

Insights by Aircraft Type

The narrow body segment dominates the market and has the largest market share over the forecast period 2023 to 2033. The growth is driven by the increasing deployment of narrow-body aircraft in both domestic and international routes. Airlines favor these aircraft for their fuel efficiency and operational flexibility, leading to a higher demand for specialized docking systems that cater to their unique dimensions and maintenance needs. As air travel recovers and expands, particularly in emerging markets, the frequency of narrow-body aircraft operations is rising, necessitating efficient docking solutions to optimize turnaround times and maintenance processes. Additionally, advancements in docking technologies, such as automated alignment and enhanced safety features, further support the growth of this segment.

Insights by End User

The MRO segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is propelled by the increasing need for efficient and reliable aircraft maintenance solutions. As global air traffic continues to rise, airlines are prioritizing the upkeep and longevity of their fleets, leading to a surge in demand for advanced MRO docking systems. These systems facilitate streamlined maintenance processes, reducing aircraft downtime and ensuring operational efficiency. Innovations in MRO technologies, such as automated docking and real-time diagnostic tools, enhance precision and safety, making them highly sought after. The robust growth in the aviation sector across North America, Europe, and Asia-Pacific further boosts this segment, as regional airlines and MRO service providers invest in modernizing their maintenance infrastructure to meet escalating demands.

Recent Market Developments

- In July 2023, Sagar Asia, one of India's leading manufacturers of aluminium extrusion and access systems, has signed two memorandums of understanding (MOUs), the first with NIJL Aircraft Docking in the Netherlands and the second with Reroy Group Ltd (RGL) in Ghana.

Competitive Landscape

Major players in the market

- Targus Corporation

- Dell Technologies Inc.

- StarTech.com

- ACCO Brands Corporation

- HP Development Company L.P

- Lenovo Group Limited

- Plugable Technologies

- TOSHIBA CORPORATION

- Acer Inc.

- Samsung Electronics Co., Ltd.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Docking System Market, Type Analysis

- Nose Docks

- Engine Docks

- Fuselage Docks

- Wing Docks

- Tail Docks

- Others

Docking System Market, Aircraft Type Analysis

- Narrow Body

- Wide Body

- Regional Jet

- Others

Docking System Market, End User Analysis

- OEM

- MRO

Docking System Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Docking System?The global Docking System Market is expected to grow from USD 66.8 million in 2023 to USD 141.9 million by 2033, at a CAGR of 7.83% during the forecast period 2023-2033.

-

2. Who are the key market players of the Docking System Market?Some of the key market players of the market are Targus Corporation; Dell Technologies Inc.; StarTech.com; ACCO Brands Corporation; HP Development Company L.P; Lenovo Group Limited; Plugable Technologies; TOSHIBA CORPORATION; Acer Inc.; Samsung Electronics Co., Ltd.

-

3. Which segment holds the largest market share?The MRO segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Docking System market?North America dominates the Docking System market and has the highest market share.

Need help to buy this report?