Global Drill Pipe Market Size, Share, and COVID-19 Impact Analysis, By Type (Standard Drill Pipes, Heavy Weight Drill Pipes, Drill Collars), By Material (Alloys, Composites, Others), By Grade (American Petroleum Institute (API) Grade, Premium Grade), By Application (Agriculture, Mining, Oil & Gas Industry, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Construction & ManufacturingGlobal Drill Pipe Market Insights Forecasts to 2033

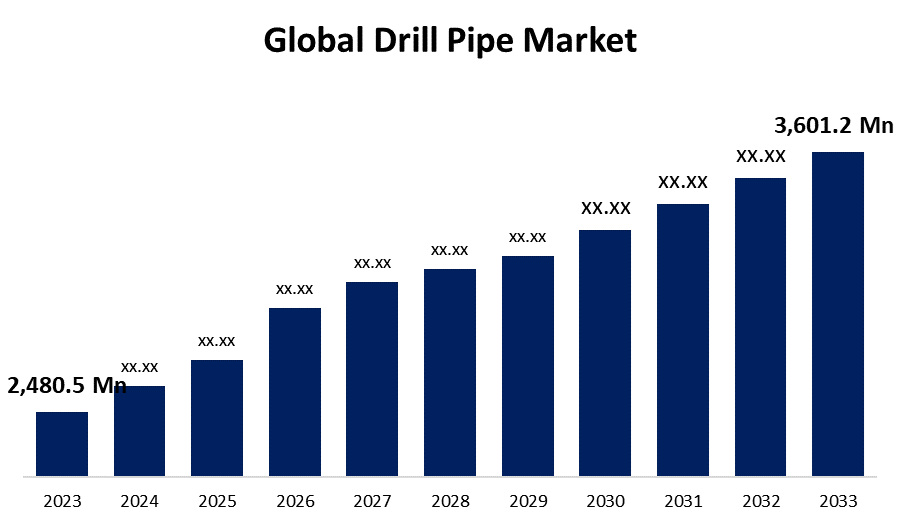

- The Global Drill Pipe Market Size was Valued at USD 2,480.5 Million in 2023

- The Market Size is Growing at a CAGR of 3.8% from 2023 to 2033

- The Worldwide Drill Pipe Market Size is Expected to Reach USD 3,601.2 Million by 2033

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Drill Pipe Market Size is Anticipated to Exceed USD 3,601.2 Million by 2033, Growing at a CAGR of 3.8% from 2023 to 2033.

Market Overview

In general, drill pipes are thin-walled steel and aluminum alloy piping that is primarily used for horizontal drilling or to facilitate borehole drilling. Its hollow shape allows the drilling fluid to be pumped down the hole via the bit and the backup of the annuals. However, the drill pipe is only a part of the drill string, which includes the bottom hole assembly and the drill pipe. Every section of the drill pipe that has two ends is connected by tool joints. Furthermore, drill pipes are classified into standard drill pipes, heavy-weight drill pipes, and drill collars. Drill pipes are used in a variety of applications, including mining, agriculture, the oil and gas industry, and more. An increase in mining activities, combined with the development of new oil and gas fields, serves as a major market driver. Moreover, the growth of the drill pipe market is primarily driven by increased oil and gas exploration activities onshore and offshore in response to rising demand for petroleum products and energy. Recent advancements in drilling technology, combined with a drop in crude oil prices, have created a significant market demand for optimizing E&P in current oil fields that are operating at economical rates.

Report Coverage

This research report categorizes the market for the global drill pipe market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global drill pipe market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global drill pipe market.

Global Drill Pipe Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2,480.5 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 3.8% |

| 2033 Value Projection: | USD 3,601.2 Million |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Material, By Grade, By Application, By Region |

| Companies covered:: | DP Master Manufacturing Pvt. Ltd, Hilong Group, Jiangyin Long Bright Drill Pipe Manufacture Co. Ltd, Interdril Asia Ltd, National Oilwell Varco, R K Pipe LLC, Oil Country Tubular Limited, Superior Drill Pipe Manufacturing Inc, Tenaris SA, Tejas Tubular Products Inc, Texas Steel Conversion Inc, TPS-Technitube Röhrenwerke, TMK Group, Vallourec SA, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The main driver of market growth is the ever-increasing demand for oil and gas supply from the industrial, transportation, and residential sectors. Furthermore, drill pipes play an important role in oil and gas exploration because they can withstand extreme stress, heat, and load during drilling and completion fluid operations. They also prevent operational failures, which can result in delays and resource losses. Furthermore, drill pipes are used to cut through rocky layers both on land and underwater during well drilling. As global oil exploration shifts toward more difficult geographical areas, there is a growing demand for advanced drill pipes. Furthermore, the market is being driven by increased investment in offshore exploration and production activities in both developed and emerging economies. Numerous product innovations, such as the introduction of drill pipes capable of operating in environments with high pressure, temperatures, permafrost, or high concentrations of toxic substances such as hydrogen sulfide (H2S), are fueling market growth.

Restraining Factors

The lack of interoperability is a major factor that is expected to limit market growth. These interoperability issues in several countries might limit ongoing market growth, reducing drill pipe sales and usage in the coming years. This is because drill pipes do not meet interoperability standards. The drill pipe industry must develop RFID interoperability standards, which are not as widely used in the oil and gas industry as they are in other fields.

Market Segmentation

The global drill pipe market share is classified into type, material, grade, and application.

- The standard drill pipes segment is expected to hold a significant share of the drill pipe market during the forecast period.

Based on the type, the global drill pipe market is categorized into standard drill pipes, heavy-weight drill pipes, and drill collars. Among these, the standard drill pipes segment is expected to hold a significant share of the drill pipe market during the forecast period. The main reason for this is that standard drill pipes are lighter, making them easier to move and operate. In addition, standard drill pipes require less manual labor and are less expensive than heavy-weight drill pipes.

- The composites segment is expected to hold a significant share of the drill pipe market during the forecast period.

Based on the material, the global drill pipe market is categorized into alloys, composites, and others. Among these, the composites segment is expected to hold a significant share of the drill pipe market during the forecast period. The main reason for this is that composite drill pipes have greater corrosion resistance, flexibility, durability, strength, and stability than drill pipes made of metallic alloys (such as aluminum alloy). Composite drill pipes are expected to become more popular in the coming years due to their lightweight, low cost, and low maintenance requirements.

- The American Petroleum Institute (API) grade segment is expected to hold a significant share of the drill pipe market during the forecast period.

Based on the grade, the global drill pipe market is categorized into American Petroleum Institute (API) grade and premium grade. Among these, the American Petroleum Institute (API) grade segment is expected to hold a significant share of the drill pipe market during the forecast period. The primary reason for this is that higher API-graded drill pipe indicates a lighter or lower-density crude, which is generally more valuable because it produces high-value products. The use of these products results in lower operating costs for E&P and operator companies. API grade products are widely preferred in normal environments and conventional basins due to their ease of availability and low OpEx for both E&P and contractors. Exploration in unconventional and harsh environments, particularly in shale, CBM, and tight reserves, is expected to drive demand for API-grade drill pipes during the forecast period.

- The oil & gas industry segment is expected to hold a significant share of the drill pipe market during the forecast period.

Based on the application, the global drill pipe market is categorized into agriculture, mining, oil & gas industry, and others. Among these, the oil & gas industry segment is expected to hold a significant share of the drill pipe market during the forecast period. The primary reason for this is the growing demand for oil and gas production in many countries around the world. For Instance, in 2019, the NGOC announced that it had set aside INR 6,000 crore (US$ 8.2 billion) for the drilling of 200 wells in Assam over the next seven years to boost state output. The wells are expected to be drilled over the next seven years. Similarly, the Ministry of Petroleum and Natural Gas (MoPNG) announced the continuation of five major ongoing projects totaling INR 1.67 lakh crore ($22.85 billion) since April 2020.

Regional Segment Analysis of the Global Drill Pipe Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global drill pipe market over the predicted timeframe.

Get more details on this report -

North America is projected to hold the largest share of the global drill pipe market over the forecast period owing to increased drilling activities combined with an extensive share of gas extraction. The United States is playing an important role in meeting the growing global demand for drill pipe. The demand for drill pipe in European countries is expected to grow steadily. Russia, the United Kingdom, Italy, and other countries are expected to account for a significant portion of the drill pipe market.

The Asia Pacific market is expected to grow at the fastest CAGR growth during the forecast period. China's independent energy players and government energy companies are investing heavily in drilling activities to meet the rising demand for oil and gas. China is expected to dominate the drill pipe market in Asia Pacific. Oil exporting countries in the MEA, such as Saudi Arabia, the United Arab Emirates, Iran, and Kuwait, are expected to increase hydrocarbon production. The UAE is expected to be the largest market for drill pipe growth in the Middle East and Africa.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global drill pipe market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- DP Master Manufacturing Pvt. Ltd

- Hilong Group

- Jiangyin Long Bright Drill Pipe Manufacture Co. Ltd

- Interdril Asia Ltd

- National Oilwell Varco

- R K Pipe LLC

- Oil Country Tubular Limited

- Superior Drill Pipe Manufacturing Inc

- Tenaris SA

- Tejas Tubular Products Inc

- Texas Steel Conversion Inc

- TPS-Technitube Röhrenwerke

- TMK Group

- Vallourec SA

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2022, Vedanta-Cairn, the Directorate General of Hydrocarbons (DGH), and the Ministry of Petroleum and Natural Gas of India announced the discovery of a new exploratory oil block in the Barmer district, in which Vedanta has a 100% participating interest. After determining the discovery's commercial viability, the company intends to proceed with production.

- In September 2021, PetroChina intends to invest billions of dollars in developing rare shale oil and gas formations in northeastern China to meet demand as the world's largest consumer of refined petroleum.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Drill Pipe Market based on the below-mentioned segments:

Global Drill Pipe Market, By Type

- Standard Drill Pipes

- Heavy Weight Drill Pipes

- Drill Collars

Global Drill Pipe Market, By Material

- Alloys

- Composites

- Others

Global Drill Pipe Market, By Grade

- American Petroleum Institute (API) Grade

- Premium Grade

Global Drill Pipe Market, By Application

- Agriculture

- Mining

- Oil & Gas Industry

- Others

Global Drill Pipe Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global drill pipe market over the forecast period?The global drill pipe market is projected to expand at a CAGR of 3.8% during the forecast period.

-

2. What is the projected market size & growth rate of the global drill pipe market?The global drill pipe market was valued at USD 2,480.5 Million in 2023 and is projected to reach USD 3,601.2 Million by 2033, growing at a CAGR of 3.8% from 2023 to 2033.

-

3. Which region is expected to hold the highest share in the global drill pipe market?The North America region is expected to hold the highest share of the global drill pipe market.

Need help to buy this report?