Global Drone Battery Market Size, Share, and COVID-19 Impact Analysis, by Technology (Lithium-based, Nickel-based, Fuel Cell), by Component (Cell, BMS, Enclosure, Connector), by Drone Type (Fixed-wing, Fixed-wing VTOL, Rotary-wing), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Drone Battery Market Insights Forecasts to 2033

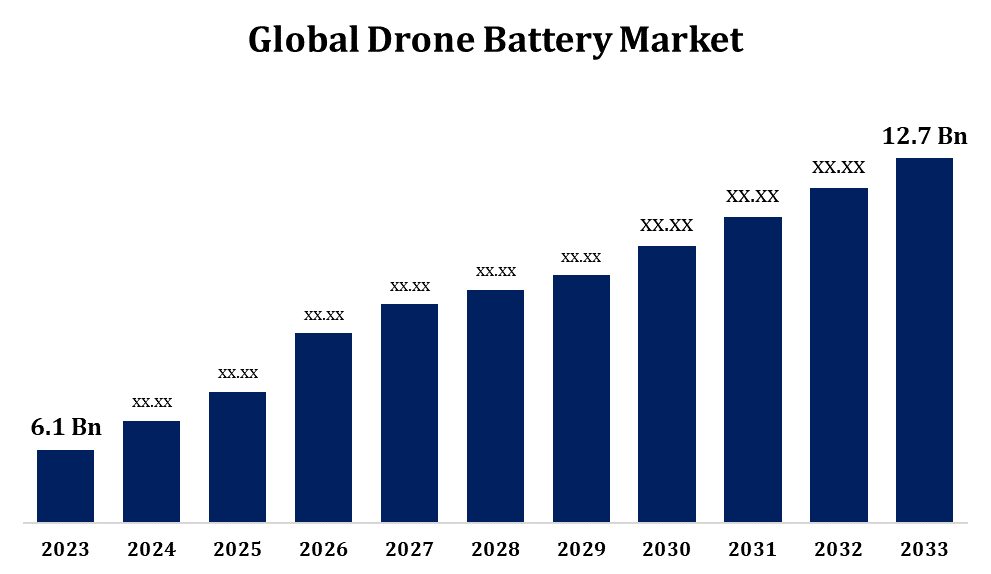

- The Drone Battery Market was valued at USD 6.1 Billion in 2023.

- The Market Size is Growing at a CAGR of 7.61% from 2023 to 2033.

- The Worldwide Drone Battery Market Size is Expected to reach USD 12.7 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Drone Battery Market is Expected to reach USD 12.7 Billion by 2033, at a CAGR of 7.61% during the forecast period 2023 to 2033.

The drone battery market is experiencing rapid growth, driven by increasing demand for drones across industries such as defense, agriculture, logistics, and aerial photography. Advancements in lithium-ion and lithium-polymer battery technologies are improving flight time, efficiency, and safety. With the rise of commercial and recreational drone usage, manufacturers are focusing on high-capacity, lightweight, and fast-charging battery solutions. The market is also witnessing developments in solid-state and hydrogen fuel cell batteries for extended endurance. However, challenges such as limited energy density, battery lifespan, and environmental concerns over disposal remain. Key players include DJI, Panasonic, and LG Chem, with emerging startups innovating in battery efficiency. North America and Asia-Pacific dominate the market, with increasing investments in drone technology driving further growth.

Drone Battery Market Value Chain Analysis

The drone battery market value chain consists of several key stages, from raw material sourcing to end-user application. It begins with the procurement of raw materials such as lithium, cobalt, and nickel, which are essential for battery manufacturing. Battery cell manufacturers then produce lithium-ion or lithium-polymer cells, which are assembled into battery packs by integrators. These packs undergo testing and quality control before being supplied to drone manufacturers. Distributors and retailers further facilitate the market by making batteries available to commercial, industrial, and consumer drone users. Recycling and disposal play a crucial role in sustainability, with companies focusing on battery reuse and eco-friendly disposal methods. Innovations in battery technology, such as solid-state batteries, are influencing the entire value chain by enhancing efficiency and longevity.

Drone Battery Market Opportunity Analysis

The drone battery market presents significant opportunities due to the rising adoption of drones in defense, agriculture, logistics, and commercial applications. The demand for longer flight times and improved energy efficiency is driving innovation in high-capacity, fast-charging, and lightweight batteries. Advancements in solid-state and hydrogen fuel cell batteries offer potential breakthroughs for endurance and safety. The increasing use of drone swarms and autonomous UAVs in military and industrial sectors further accelerates battery demand. Additionally, regulatory support for drone technology and the expansion of drone delivery services create new growth avenues. Emerging markets in Asia-Pacific and Latin America offer untapped potential, while sustainable battery recycling solutions present an opportunity for eco-conscious businesses. Investments in R&D for energy-dense and cost-effective batteries will be key to market expansion.

Drone Battery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 6.1 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.61% |

| 2033 Value Projection: | USD 6.1 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 213 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By Component, By Drone Type |

| Companies covered:: | Amperex Technology Limited, Autel Robotics, DJI, LG Chem, MaxAmps, Panasonic, Parrot, Samsung SDI, Tadiran Batteries, Tattu (Shenzhen Grepow Battery Co., Ltd), and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Market Dynamics

Drone Battery Market Dynamics

Growing demand for drones across diverse industries and applications

The drone battery market is expanding rapidly, driven by the growing demand for drones across diverse industries and applications such as defense, agriculture, logistics, surveillance, and aerial photography. As drones become integral to commercial and industrial operations, the need for high-performance, lightweight, and long-lasting batteries is increasing. Innovations in lithium-ion, lithium-polymer, and solid-state battery technologies are enhancing energy density, charging speed, and overall efficiency. Additionally, the rise of drone delivery services and autonomous UAVs is fueling the demand for advanced battery solutions. Governments and private sector investments in drone technology are further accelerating market growth.

Restraints & Challenges

Battery lifespan is another concern, as frequent charging and discharging reduce performance over time. High costs of advanced battery technologies, such as solid-state and hydrogen fuel cells, limit widespread adoption. Safety risks, including overheating and fire hazards, pose significant challenges, particularly in high-power applications. Additionally, environmental concerns related to battery disposal and recycling require sustainable solutions. Regulatory restrictions on battery transportation and drone usage further impact market growth. The need for fast-charging and lightweight battery solutions adds to the complexity of innovation. Overcoming these challenges requires continuous research and development, investment in next-generation battery materials, and advancements in energy management systems to enhance efficiency and safety.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Drone Battery Market from 2023 to 2033. The U.S. leads the market with strong government investments in UAV technology for military and commercial applications. The region’s focus on research and development has led to advancements in high-capacity lithium-ion and emerging solid-state batteries, improving drone endurance and efficiency. The growing demand for drone delivery services from companies like Amazon and UPS further boosts battery innovation. Key market players, including Tesla, Panasonic, and emerging startups, are investing in next-generation battery technologies, positioning North America as a hub for drone battery advancements.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The expansion of e-commerce and drone delivery services is driving demand for high-performance batteries. Advancements in battery manufacturing, supported by strong supply chains and raw material availability, are lowering production costs and boosting innovation. The rise of smart cities and 5G integration is further enhancing drone applications, increasing the need for efficient power solutions. Growing adoption of electric aviation and drone taxis is accelerating research in solid-state and hydrogen fuel cell batteries. Additionally, supportive regulatory frameworks and public-private collaborations are fostering technological advancements, making the region a key contributor to the global drone battery market's expansion.

Segmentation Analysis

Insights by Technology

The lithium-based segment accounted for the largest market share over the forecast period 2023 to 2033. Lithium-ion and lithium-polymer batteries remain the preferred choice for commercial, industrial, and military drones, offering longer flight durations and improved efficiency. Continuous advancements in battery chemistry are enhancing power output, safety, and lifecycle performance. The increasing demand for high-endurance drones in logistics, surveillance, and mapping applications is further fueling adoption. Additionally, declining production costs and advancements in battery management systems are making lithium-based batteries more accessible. Innovations in solid-state lithium technology promise even greater energy efficiency and safety.

Insights by Component

The battery management system segment accounted for the largest market share over the forecast period 2023 to 2033. As drones become more advanced, the demand for intelligent BMS solutions is increasing to enhance energy efficiency, prevent overheating, and ensure stable performance. Innovations in real-time monitoring, AI-driven analytics, and wireless communication are improving battery reliability and operational safety. The expansion of high-endurance drones for defense, logistics, and industrial applications is further driving the need for sophisticated BMS technologies. Additionally, advancements in fast-charging and thermal management systems are boosting adoption. With the rise of lithium-ion and solid-state batteries, BMS solutions are evolving to support longer flight times and improved energy storage, making them a crucial component of drone technology development.

Insights by Drone Type

The fixed-wing segment accounted for the largest market share over the forecast period 2023 to 2033. Fixed-wing drones offer extended flight endurance and higher payload capacity compared to multi-rotor drones, driving demand for high-energy-density batteries. Advancements in lithium-ion and lithium-sulfur batteries are enabling longer operational hours and improved efficiency. The rise of autonomous fixed-wing UAVs for military reconnaissance and large-scale mapping is further accelerating battery innovation. Additionally, the expansion of drone-based infrastructure monitoring and environmental research is fueling the need for lightweight, long-lasting power solutions. Ongoing research in solid-state and hybrid battery technologies aims to enhance energy storage and reduce charging times, ensuring continued growth for the fixed-wing drone battery market.

Recent Market Developments

- In February 2021, Shenzhen Grepow Battery Co. Ltd. has introduced an upgraded version of the Tattu Plus 1.0 16000mAh 12S compact smart battery, featuring a lighter design than its predecessor.

Competitive Landscape

Major players in the market

- Amperex Technology Limited

- Autel Robotics

- DJI

- LG Chem

- MaxAmps

- Panasonic

- Parrot

- Samsung SDI

- Tadiran Batteries

- Tattu (Shenzhen Grepow Battery Co., Ltd)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Drone Battery Market, Technology Analysis

- Lithium-based

- Nickel-based

- Fuel Cell

Drone Battery Market, Component Analysis

- Cell

- BMS

- Enclosure

- Connector

Drone Battery Market, Drone Type Analysis

- Fixed-wing

- Fixed-wing VTOL

- Rotary-wing

Drone Battery Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of the Drone Battery Market?The global Drone Battery Market is expected to grow from USD 6.1 billion in 2023 to USD 12.7 billion by 2033, at a CAGR of 7.61% during the forecast period 2023-2033.

-

2.Who are the key market players of the Drone Battery Market?Some of the key market players of the market are the Amperex Technology Limited, Autel Robotics, DJI, LG Chem, MaxAmps, Panasonic, Parrot, Samsung SDI, Tadiran Batteries, Tattu (Shenzhen Grepow Battery Co., Ltd).

-

3.Which segment holds the largest market share?The fixed-wing segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?