Global Drone Services Market Size By Service Type (Drone Platform Services, Drone MRO Services, and Drone Training & Simulation Services), By Application (Aerial Photography, Product Delivery, Surveillance & Inspection, Data Acquisition & Analytics, and Others), By End-use Industry (Agriculture, Infrastructure, Oil & Gas, Logistics, and Others), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Drone Services Market Insights Forecasts to 2033

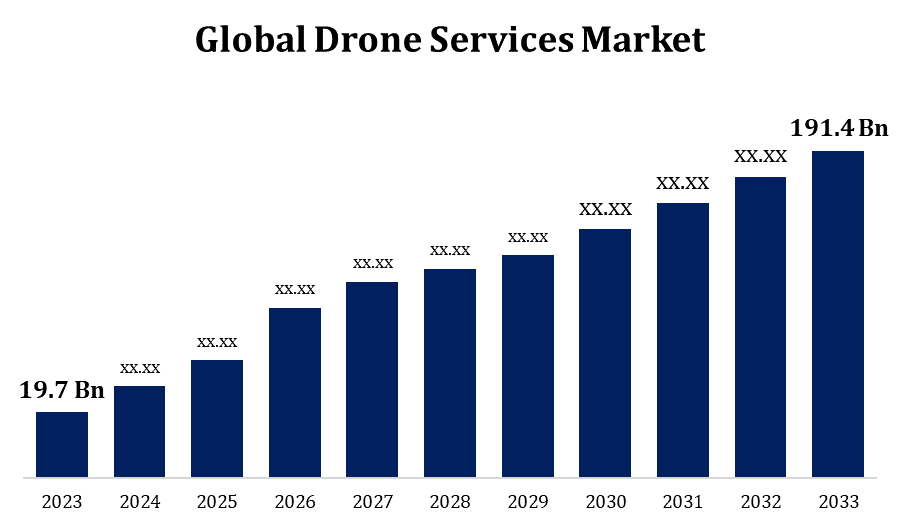

- The Global Drone Services Market Size was valued at USD 19.7 Billion in 2023.

- The Market Size is Growing at a CAGR of 25.53% from 2023 to 2033

- The Worldwide Drone Services Market Size is expected to reach USD 191.4 Billion by 2033

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Drone Services Market Size is expected to reach USD 191.4 Billion by 2033, at a CAGR of 25.53% during the forecast period 2023 to 2033.

The drone industry was expanding due to advancements in technology, including extended flight durations, increased payload capacity, better sensors, and improved autonomous capabilities. Businesses were spending money on R&D to improve the effectiveness, dependability, and affordability of drones. The drone industry was characterised by fierce competition between technology companies, service providers, and drone manufacturers. In order to gain market share, both established companies and startups developed unique technologies, provided specialised services, and formed strategic alliances. Drone services were becoming more and more popular due to a number of issues, such as the need for affordable aerial photography and data collecting, the expansion of applications in sectors including construction, infrastructure inspection, and agricultural, and the increased emphasis on operational efficiency and safety.

Drone Services Market Value Chain Analysis

Purchasing the raw materials, including as airframes, motors, batteries, sensors, and communication systems, is the first step in the manufacturing of drones. After obtaining the raw ingredients, producers put them together to create completed drone products. Drone design, prototype, and mass production are all part of this process. In order to market drones, inform consumers about their capabilities and uses, and close sales, sales teams and channels are essential. Customers in a variety of industries can choose from a broad range of drone services provided by service providers, such as aerial photography and videography, mapping and surveying, monitoring and inspection, delivery services, and more. Drones are used to gather data, which service providers then process and analyse to give their clients with actionable insights. After processing and analysis, service providers provide their clients with reports, visualisations, and suggestions. To guarantee their continuous operation and performance, drones need to get routine maintenance, repairs, and technical assistance.

Drone Services Market Opportunity Analysis

The market for drone services is expected to grow significantly in a number of sectors, including public safety, energy, construction, agriculture, and transportation. Drones can be used to improve operational efficiency and save costs by performing jobs including infrastructure inspection, delivery services, surveillance, and crop monitoring. Data analytics and insights services are in more demand as drones are used for data collection. Companies have the chance to create specialised software that processes, analyses, and visualises data from drones, giving customers useful information for improved decision-making. There is a global need for drone services, which presents potential for businesses to grow internationally. Businesses can profit from its rising demand by entering foreign markets and establishing strategic alliances.

Global Drone Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 19.7 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 25.53% |

| 2033 Value Projection: | USD 191.4 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Service Type, By Application, By End-use Industry, By Region. |

| Companies covered:: | Aerial Drone Services Inc., Aerodyne Group, Arch Aerial LLC, AUAV, CYBERHAWK, Drone Services Canada Inc., Dronegenuity, FLIGHTS Inc., FlyGuys, NADAR Drone Company, Phoenix Drone Services LLC, TERRA DRONE CORPORATION, Wing Aviation LLC, and Others |

| Growth Drivers: | Increasing Demand for Drone Services from Various End-user Industries |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Drone Services Market Dynamics

Increasing Demand for Drone Services from Various End-user Industries

One of the main industries influencing the need for drone services is agriculture. Precision farming, yield optimisation, pest control, and crop monitoring are among the growing applications of drone technology. For site surveys, progress reports, and structural inspections, the building and infrastructure industries use drone services. In place of more expensive and time-consuming traditional surveying techniques, drones help construction companies cut costs, increase safety, and expedite project completion. For last-mile delivery, inventory management, and warehouse operations, the transportation and logistics sector is increasingly utilising drone services. For airborne photography, filmmaking, and cinematography, the media and entertainment industry uses drone services. Filmmakers, broadcasters, and content producers can improve the calibre and inventiveness of their productions by using drones to get distinctive angles and dynamic pictures.

Restraints & Challenges

There are logistical and technological difficulties with integrating drones into the current airspace systems, especially in cities with high air traffic. Coordination between regulators, airspace management, and industry stakeholders is necessary to ensure the safe and effective integration of drones into airspace while minimising conflicts with manned aircraft. In the drone services industry, safety is of utmost importance due to the possibility of mishaps, crashes, and unapproved aerial operations. Drone operators must complete extensive training programmes, safety regulations must be put in place, and best practices for risk reduction must be followed in order to ensure the safe use of drones. The market for drone services is getting more and more competitive, with several companies providing comparable products and services. It can be difficult for businesses to stand out in a competitive market and differentiate their goods based on value, quality, and innovation.

Regional Forecasts

North America Market Statistics

Get more details on this report -

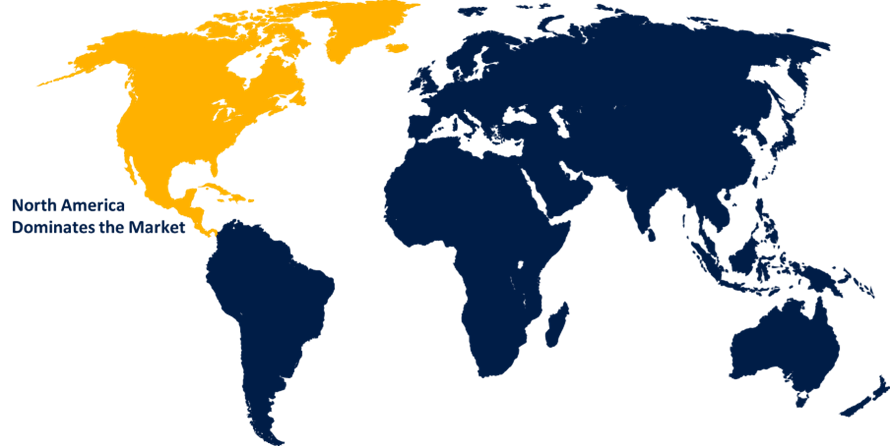

North America is anticipated to dominate the Drone Services Market from 2023 to 2033. The region's robust economy, innovative technology, and advantageous legal framework encourage the use of drone services in a variety of sectors. In North America, a wide range of businesses, including journalism, public safety, infrastructure, energy, construction, and agriculture, have embraced drone services. Drones are used by businesses and organisations to carry out a variety of functions, including delivery, filming, mapping, aerial surveying, inspection, and monitoring. Drone hardware, software, sensors, and autonomous capabilities are all being developed in large part by businesses and academic institutions in North America, which is a major centre for technological innovation in the drone sector. The North American drone services market is faced with obstacles like competitiveness, safety concerns, privacy difficulties, and regulatory complexity, despite the potential opportunities.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Drone services are being adopted for a variety of purposes by many sectors in Asia-Pacific. Drones are used in a variety of industries, including construction, mining, energy, transportation, logistics, and surveying, mapping, inspection, and aerial photography and videography. In the drone sector, Asia-Pacific is a hotbed of technological innovation. Drone hardware, software, sensor, and autonomous capabilities are being advanced by businesses and research institutes in China, Japan, South Korea, and India. Advancements in fields like robotics, artificial intelligence, and 5G connectivity are expanding the potential uses and capacities of drones in the area.

Segmentation Analysis

Insights by Service Type

The drone platform services segment accounted for the largest market share over the forecast period 2023 to 2033. Drone platforms that are specifically designed to meet the needs and applications of many sectors are necessary. Drones with LiDAR sensors are needed for site mapping and 3D modelling in construction, while multispectral cameras are needed for crop monitoring in agriculture. Demand for industry-specific drone platforms and solutions is rising for service providers catering to public safety, energy, construction, and agriculture. The Internet of Things (IoT), edge computing, machine learning, artificial intelligence, and drone platforms are becoming more and more intertwined. In order to enable smooth integration with hardware, software, and Internet of Things devices from third parties, service providers who offer drone platform services may create middleware solutions, application programming interfaces (APIs), and software development kits (SDKs).

Insights by Application

The surveillance and inspection segment accounted for the largest market share over the forecast period 2023 to 2033. This market is expanding due to the rising need for surveillance and inspection services brought on by worries about asset integrity, safety, and security. Drone services are becoming more widely used and funded as a result of businesses and organisations realising the benefit of drones in improving their monitoring and inspection capacities. Numerous industries, including as oil and gas, utilities, infrastructure, agriculture, public safety, and security are served by the surveillance and inspection segment. Drones are used to inspect pipelines, electricity lines, buildings, farms, bridges, and more in order to find structural flaws, leaks, and other problems.

Insights by End Use

The infrastructure segment accounted for the largest market share over the forecast period 2023 to 2033. Drones are being used more and more to examine and monitor many kinds of infrastructure, such as buildings, electrical lines, pipes, roads, trains, bridges, and pipelines. Drones using LiDAR, thermal imaging, and high-resolution cameras can identify anomalies, damages, and flaws in infrastructure assets more quickly and affordably than with conventional inspection techniques. The use of drones in the creation and construction of infrastructure projects, including roads, trains, airports, dams, and buildings, is growing. Drones can help with site planning, design optimisation, construction management, and progress monitoring by offering services including aerial surveys, topographic mapping, and 3D modelling.

Recent Market Developments

- In January 2023, Pyka Inc. and Skyports Drone, a U.K.-based provider and operator of eVTOL drone solutions for cargo drone deliveries, survey, and monitoring, worked together on heavy payload drone logistics.

Competitive Landscape

Major players in the market

- Aerial Drone Services Inc.

- Aerodyne Group

- Arch Aerial LLC

- AUAV

- CYBERHAWK

- Drone Services Canada Inc.

- Dronegenuity

- FLIGHTS Inc.

- FlyGuys

- NADAR Drone Company

- Phoenix Drone Services LLC

- TERRA DRONE CORPORATION

- Wing Aviation LLC

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Drone Services Market, Service Type Analysis

- Drone Platform Services

- Drone MRO Services

- Drone Training & Simulation Services

Drone Services Market, Application Analysis

- Aerial Photography

- Product Delivery

- Surveillance & Inspection

- Data Acquisition & Analytics

- Others

Drone Services Market, End Use Analysis

- Agriculture

- Infrastructure

- Oil & Gas

- Logistics

- Others

Drone Services Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Drone Services Market?The global Drone Services Market is expected to grow from USD 19.7 billion in 2023 to USD 191.4 billion by 2033, at a CAGR of 25.53% during the forecast period 2023-2033.

-

2. Who are the key market players of the Drone Services Market?Some of the key market players of the market are Aerial Drone Services Inc., Aerodyne Group, Arch Aerial LLC, AUAV, CYBERHAWK, Drone Services Canada Inc., Dronegenuity, FLIGHTS Inc., FlyGuys, NADAR Drone Company, Phoenix Drone Services LLC, TERRA DRONE CORPORATION, Wing Aviation LLC.

-

3. Which segment holds the largest market share?The infrastructure segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Drone Services Market?North America is dominating the Drone Services Market with the highest market share.

Need help to buy this report?