Global Drone Software Market Size, Share, and COVID-19 Impact Analysis, By Architecture (Open Source and Closed Source), By Platform (Application-Based Software and Desktop-Based Software), By Application (Analytics, Image Processing, and Control & Data Capture), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Drone Software Market Insights Forecasts to 2033

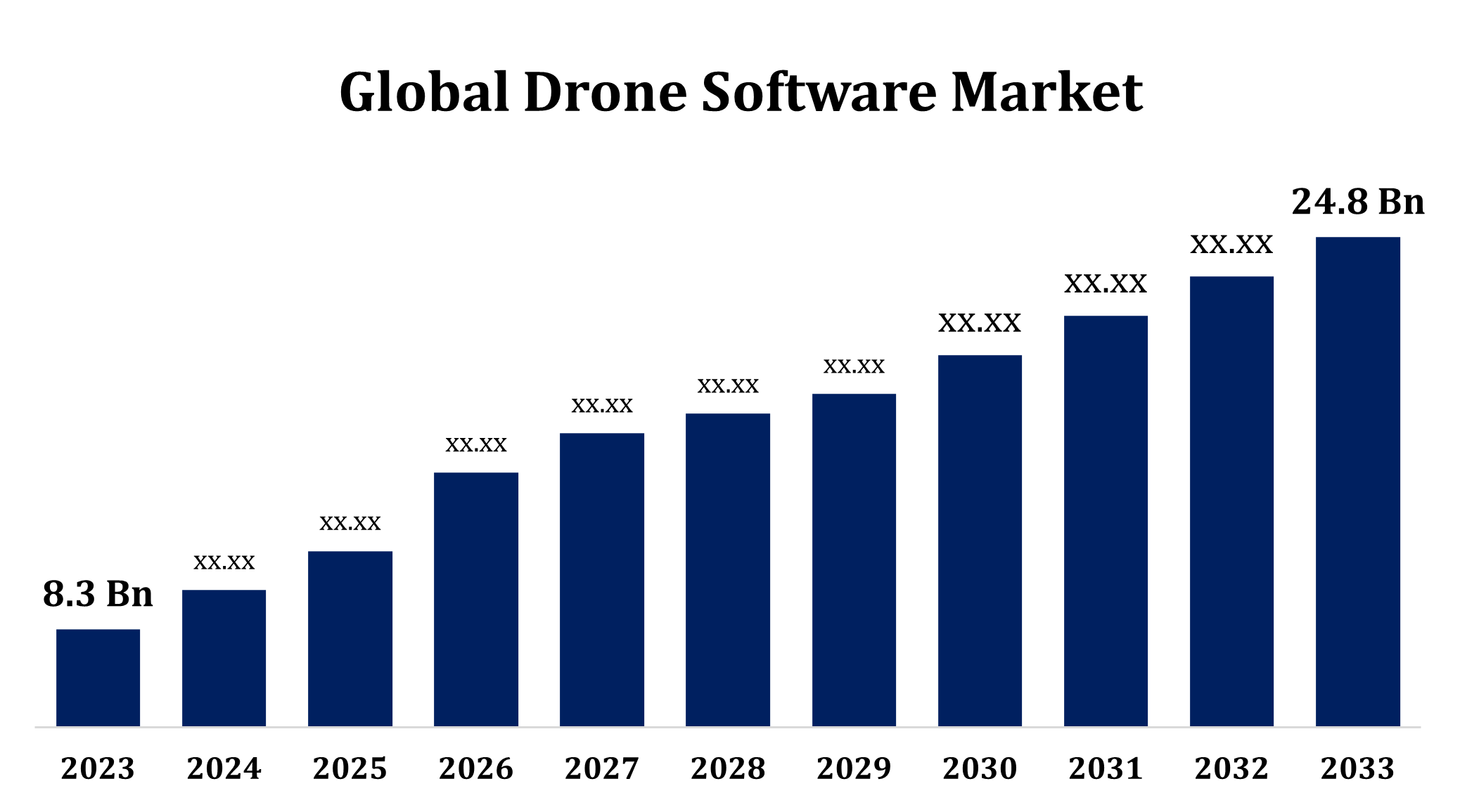

- The Global Drone Software Market Size was valued at USD 8.3 Billion in 2023.

- The Market Size is Growing at a CAGR of 11.57% from 2023 to 2033.

- The Worldwide Drone Software Market Size is expected to reach USD 24.8 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Drone Software Market is expected to reach USD 24.8 Billion by 2033, at a CAGR of 11.57% during the forecast period 2023 to 2033.

The drone software market is expanding rapidly, driven by advancements in AI, automation, and real-time data analytics. Drone software market size is increasing as industries like agriculture, construction, defense, and logistics adopt advanced solutions for flight control, mission planning, and data processing. Drone software market growth is fueled by rising demand for cloud-based and AI-driven technologies, improving operational efficiency. Key drone software market trends include the rise of drone-as-a-service (DaaS) and enhanced cybersecurity measures. Drone software market analysis highlights North America’s dominance due to high adoption rates, while Asia-Pacific is experiencing significant expansion. Drone software market forecast suggests continued growth, with leading players innovating and forming strategic partnerships. Drone software market share is expected to shift as competition intensifies across various sectors.

Drone Software Market Value Chain Analysis

The drone software market value chain consists of several key stages, from development to end-user applications. It begins with software developers creating flight control, mission planning, and data analytics solutions. Hardware manufacturers integrate these software solutions into drones, ensuring compatibility and efficiency. Cloud service providers play a crucial role by offering storage, real-time processing, and AI-driven analytics. Regulatory bodies impact the market by setting compliance standards and safety regulations. System integrators customize software solutions for industries like agriculture, defense, and logistics. End users, including commercial enterprises and government agencies, utilize drone software for mapping, surveillance, and automation. Continuous innovation, partnerships, and cybersecurity enhancements drive market growth, making the value chain dynamic and essential for the expanding drone ecosystem.

Drone Software Market Opportunity Analysis

The drone software market presents significant opportunities as industries increasingly adopt drones for automation and data-driven operations. With the rising drone software market size, sectors such as agriculture, construction, defense, and logistics are driving demand for advanced flight control, mapping, and analytics solutions. Drone software market growth is fueled by AI integration, real-time data processing, and cloud-based platforms, enhancing operational efficiency and decision-making. Key drone software market trends include the expansion of drone-as-a-service (DaaS), growing regulatory support, and advancements in cybersecurity to protect sensitive data. Emerging markets, especially in Asia-Pacific, offer lucrative opportunities as drone adoption expands. Companies investing in innovation, partnerships, and scalable software solutions will benefit from the evolving demand, making the drone software industry a high-growth market.

Global Drone Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 8.3 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 11.57% |

| 023 – 2033 Value Projection: | USD 24.8 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 246 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Architecture, By Platform, By Application and By Regional Analysis |

| Companies covered:: | AirMap Inc. (DroneUp, LLC), DELAIR SAS, SZ DJI Technology Co., Ltd., DroneDeploy, Inc., Esri, Pix4D SA, PrecisionHawk, Inc., AgEagle Aerial Systems Inc., Skycatch, Inc., Skydio, Inc., Skyward IO, Inc., Yuneec International Co., Ltd, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Drone Software Market Dynamics

The integration of artificial intelligence in drone technology is expected to fuel market growth

The integration of artificial intelligence in drone technology is expected to fuel drone software market growth by enhancing automation, real-time data processing, and decision-making capabilities. AI-powered drones improve efficiency in industries such as agriculture, construction, logistics, and defense by enabling autonomous navigation, obstacle detection, and predictive maintenance. Machine learning algorithms enhance image recognition, allowing drones to analyze vast amounts of data for mapping, surveillance, and inspection tasks. AI-driven advancements in cloud computing and edge processing further optimize drone operations, reducing human intervention and operational costs. As regulatory frameworks evolve to support AI-powered drones, market adoption is expected to rise. Companies investing in AI-driven drone software solutions will gain a competitive edge, driving innovation and expanding the overall drone software market size.

Restraints & Challenges

The drone software market faces several challenges that impact its growth and adoption. One major issue is regulatory compliance, as governments impose strict rules on drone operations, data security, and airspace management. Cybersecurity threats pose another challenge, with concerns over data breaches and unauthorized access to drone systems. High development and integration costs make it difficult for small businesses to adopt advanced drone software solutions. Technical limitations, such as limited battery life and connectivity issues, affect real-time data processing and autonomous flight capabilities. Additionally, interoperability challenges arise due to the lack of standardization across different drone platforms. Market competition is intensifying, requiring continuous innovation. Overcoming these obstacles through advanced security measures, regulatory clarity, and improved software solutions will be essential for sustaining drone software market growth.

Regional Forecasts

North America Market Statistics

Get more details on this report -

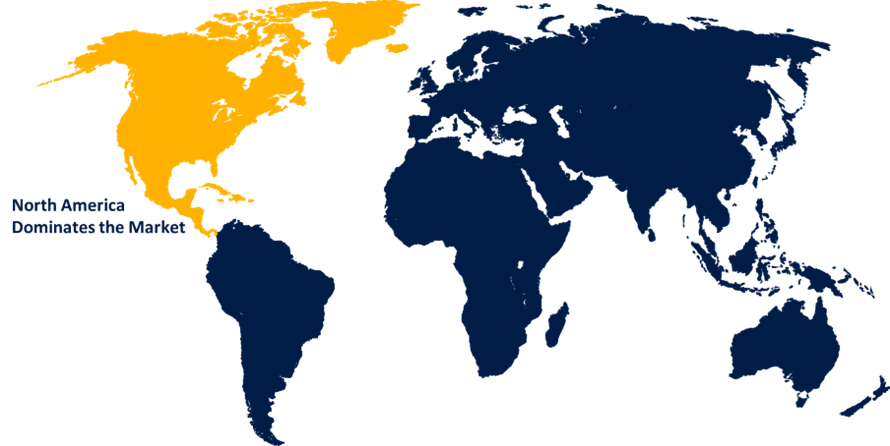

North America is anticipated to dominate the Drone Software Market from 2023 to 2033. The region benefits from advanced technological infrastructure, significant investments in AI and automation, and supportive government regulations for commercial drone use. The U.S. leads in military drone applications, while commercial sectors increasingly rely on drone software for real-time data analytics, mapping, and surveillance. The presence of major drone software companies and startups further accelerates market growth. Challenges include stringent FAA regulations and cybersecurity concerns, but continuous advancements in cloud computing and AI-driven analytics are driving innovation. As drone-as-a-service (DaaS) gains popularity, North America is expected to maintain its leadership in the drone software market, offering lucrative opportunities for software providers and investors.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The region is investing heavily in drone technology, supported by government initiatives and favorable regulations. The region's expanding e-commerce and smart city projects are boosting demand for AI-powered drone software solutions, including real-time data analytics, automated navigation, and surveillance. China dominates the market due to its strong manufacturing capabilities and advancements in AI-driven drone applications. However, challenges such as regulatory uncertainties and cybersecurity risks persist. As technological innovations continue and drone-as-a-service (DaaS) gains traction, Asia-Pacific is expected to witness significant drone software market growth, attracting investments from global and regional players.

Segmentation Analysis

Insights by Architecture

The open-source architecture segment accounted for the largest market share over the forecast period 2023 to 2033. Open-source platforms enable developers to modify and enhance drone software for various applications, including mapping, surveillance, and autonomous navigation. This segment is particularly gaining traction among startups, research institutions, and defense organizations seeking flexibility and innovation. The rise of AI and cloud-based analytics is further fueling adoption, as open-source frameworks integrate seamlessly with advanced technologies. However, challenges such as security vulnerabilities and lack of standardization persist. Despite this, ongoing community-driven enhancements and increasing corporate interest in open-source drone software solutions are expected to propel market expansion, making it a key driver of future drone software market growth.

Insights by Platform

The desktop-based software segment accounted for the largest market share over the forecast period 2023 to 2033. Industries such as defense, agriculture, and construction rely on desktop-based solutions for advanced flight planning, 3D mapping, and geospatial analysis. Unlike cloud-based software, desktop applications offer greater control over data security, making them ideal for sensitive operations. The increasing adoption of high-performance computing and AI-driven analytics further enhances their functionality. However, challenges such as limited remote accessibility and high system requirements may hinder widespread adoption. Despite this, continuous software advancements and demand for high-precision data processing are fueling market expansion. As businesses seek reliable, powerful solutions, the desktop-based software segment remains a crucial component of the growing drone software market.

Insights by Application

The control & data capture segment accounted for the largest market share over the forecast period 2023 to 2033. The control & data capture segment is experiencing significant growth in the drone software market, driven by increasing demand for real-time data collection, automation, and precision analytics. Industries such as agriculture, construction, defense, and logistics rely on advanced software to manage drone flight control, navigation, and high-resolution data acquisition. AI-powered algorithms enhance object detection, terrain mapping, and surveillance, improving operational efficiency. The rise of cloud-based and edge computing solutions further boosts data processing speed and accessibility. However, challenges such as cybersecurity risks and data storage limitations remain. Despite this, the growing adoption of drones for smart city projects, infrastructure monitoring, and environmental assessments is fueling expansion. As technology advances, the control & data capture segment will continue to drive drone software market growth.

Recent Market Developments

- In August 2020, DJI, a leading Chinese company, released an update for its DJI Terra drone mapping software, making it 400 times faster than the previous version.

Competitive Landscape

Major players in the market

- AirMap Inc. (DroneUp, LLC)

- DELAIR SAS

- SZ DJI Technology Co., Ltd.

- DroneDeploy, Inc.

- Esri

- Pix4D SA

- PrecisionHawk, Inc.

- AgEagle Aerial Systems Inc.

- Skycatch, Inc.

- Skydio, Inc.

- Skyward IO, Inc.

- Yuneec International Co., Ltd

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Drone Software Market, Architecture Analysis

- Open Source

- Closed Source

Drone Software Market, Platform Analysis

- Application-Based Software

- Desktop-Based Software

Drone Software Market, Application Analysis

- Analytics

- Image Processing

- Control & Data Capture

Drone Software Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Drone Software Market?The global Drone Software Market is expected to grow from USD 8.3 billion in 2023 to USD 24.8 billion by 2033, at a CAGR of 11.57% during the forecast period 2023-2033.

-

2. Who are the key market players of the Drone Software Market?Some of the key market players of the market are AirMap Inc. (DroneUp, LLC); DELAIR SAS; SZ DJI Technology Co., Ltd.; DroneDeploy, Inc.; Esri; Pix4D SA; PrecisionHawk, Inc.; AgEagle Aerial Systems Inc.; Skycatch, Inc.; Skydio, Inc.; Skyward IO, Inc.; Yuneec International Co., Ltd.

-

3. Which segment holds the largest market share?The desktop-based software segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?