Global Drone Warfare Market Size, Share, and COVID-19 Impact Analysis, By Mode of Operation (Semi-Autonomous and Autonomous), By Capability (Platform, Application Software, Services, Ground Control Station, and Drone Launch And Recovery System), By Application (Unmanned Combat Aerial Vehicles (UCAVs), Intelligence, Surveillance, Reconnaissance (ISR), and Delivery), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Drone Warfare Market Insights Forecasts to 2033

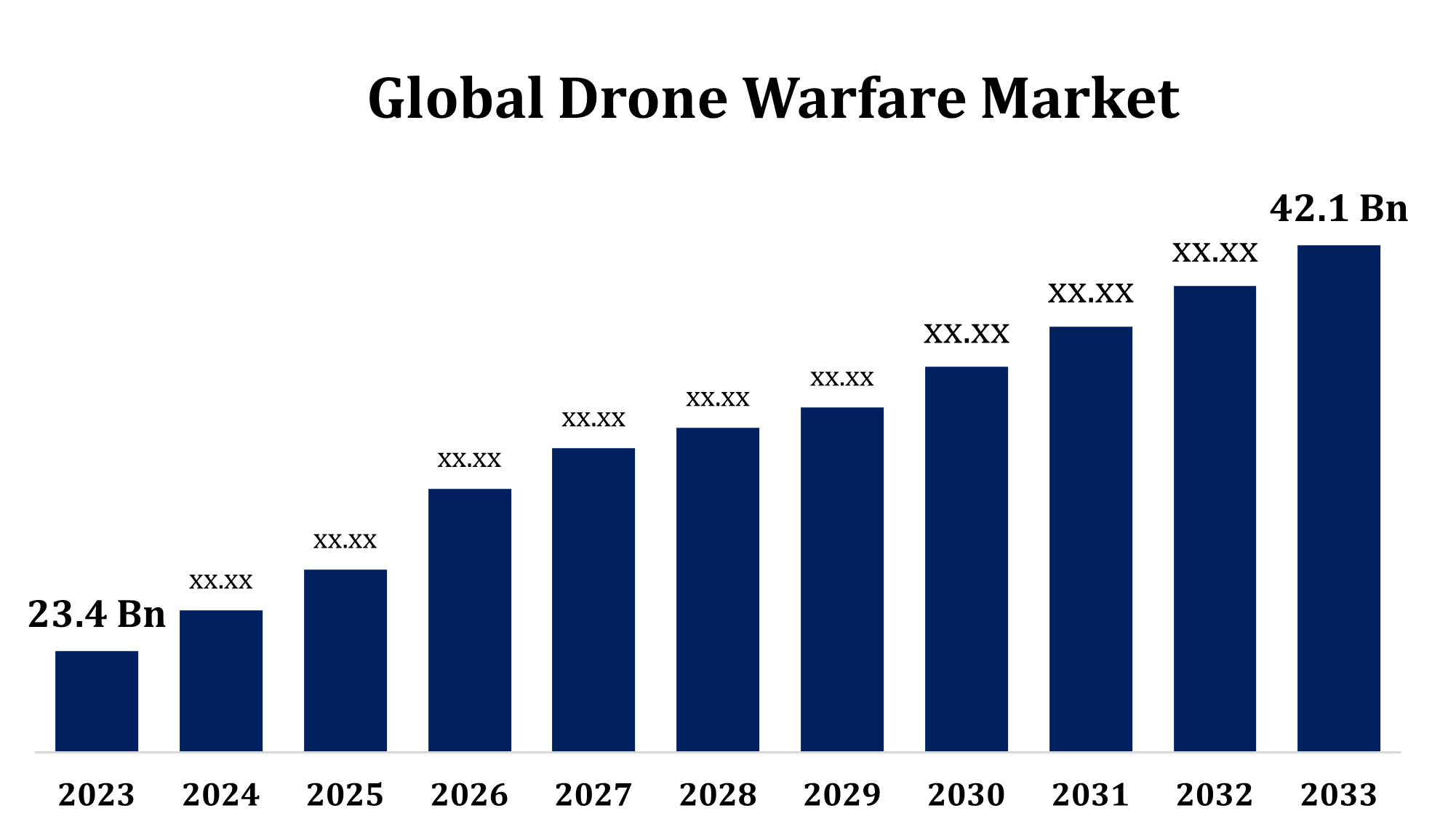

- The Global Drone Warfare Market Size was valued at USD 23.4 Billion in 2023.

- The Market is Growing at a CAGR of 6.05% from 2023 to 2033.

- The Worldwide Drone Warfare Market Size is expected to reach USD 42.1 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Drone Warfare Market Size is expected to reach USD 42.1 Billion by 2033, at a CAGR of 6.05% during the forecast period 2023 to 2033.

The drone warfare market has witnessed significant growth in recent years, driven by advancements in drone technology, increasing military budgets, and rising demand for unmanned aerial systems (UAS) for surveillance, intelligence, and combat missions. Drones are increasingly being used in defense operations due to their ability to perform precise strikes, reduce human risk, and gather real-time intelligence. Nations are investing heavily in developing and acquiring drones, ranging from small tactical units to large combat drones. This market expansion is also fueled by the growing adoption of autonomous systems and AI integration. The rise of geopolitical tensions and military modernization programs further accelerates market growth. However, regulatory challenges, ethical concerns, and counter-drone technologies remain key factors influencing the market's future trajectory.

Drone Warfare Market Value Chain Analysis

The drone warfare market value chain encompasses various stages, from research and development (R&D) to post-deployment services. It begins with the design and manufacturing of unmanned aerial systems (UAS), which involves key players in aerospace, electronics, and software engineering. The next stage includes the integration of advanced technologies such as AI, machine learning, and GPS for enhanced operational capabilities. After production, UAS are tested and sold to defense organizations or military contractors. Post-sale, maintenance, upgrades, and training are provided by service companies. Additionally, a growing segment focuses on counter-drone technologies and anti-drone systems, ensuring defense against adversary UAVs. The value chain also involves partnerships between governments, defense agencies, and private sector firms, contributing to both development and deployment in a highly competitive and innovation-driven market.

Drone Warfare Market Opportunity Analysis

The drone warfare market presents numerous opportunities, driven by evolving defense needs and technological advancements. As military forces seek more cost-effective and precise solutions, drones offer a strategic advantage in surveillance, reconnaissance, and targeted strikes. Growing geopolitical tensions and the demand for non-combatant casualty reduction further drive the adoption of unmanned systems. Emerging economies are increasingly investing in drone technologies, expanding the market beyond traditional military powers. Additionally, the integration of artificial intelligence (AI) and autonomous systems in drones presents new growth avenues, enhancing operational efficiency and decision-making. The increasing focus on counter-drone systems offers potential for defense contractors to develop advanced anti-drone technologies. Moreover, partnerships between governments, private entities, and defense firms create opportunities for innovation, enhancing market growth in both military and commercial sectors.

Global Drone Warfare Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 23.4 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 6.05 |

| 023 – 2033 Value Projection: | USD 42.1 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 257 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By Mode of Operation, By Capability, By Application, By Regional Analysis |

| Companies covered:: | Airbus SE, General Atomics Aeronautical Systems, Inc, Israel Aerospace Industries (IAI), BAE Systems plc, Boeing Company, Elbit Systems Ltd, General Dynamics Corporation, FLIR Systems, Inc, Kratos Defense & Security Solutions, Inc, Lockheed Martin Corporation, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Drone Warfare Market Dynamics

Rising military expenditures are fueling the growth of the market

As defense budgets increase worldwide, nations are investing heavily in advanced technologies to enhance military capabilities, with drones playing a crucial role in modernizing defense strategies. Drones provide numerous advantages, such as cost-efficiency, precision in strikes, reduced risk to human personnel, and the ability to conduct surveillance over vast areas. This trend is particularly evident in countries with growing security concerns or geopolitical tensions, where drones offer a tactical edge in intelligence gathering and combat missions. The shift toward unmanned aerial systems aligns with military modernization programs, further accelerating market expansion. As defense spending continues to rise, the demand for advanced drone systems and supporting technologies is expected to grow, driving market opportunities in both developed and emerging economies.

Restraints & Challenges

One major issue is the ethical and legal implications of using unmanned systems for targeted strikes, particularly concerns over civilian casualties and accountability in conflict zones. Additionally, the high cost of advanced drone technology and maintenance can be a barrier, especially for smaller defense budgets. Regulatory hurdles also pose a challenge, with varying laws on drone usage and airspace control, complicating deployment strategies. Another concern is the development of counter-drone technologies, as adversaries are rapidly advancing anti-drone systems to neutralize UAVs. Furthermore, cybersecurity risks related to the potential hacking or jamming of drones create vulnerabilities in military operations. These challenges necessitate careful navigation by governments, defense contractors, and international organizations to ensure effective and responsible use of drone warfare technologies.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Drone Warfare Market from 2023 to 2033. The U.S. Department of Defense has been a major player, continually enhancing its unmanned aerial systems (UAS) capabilities for surveillance, intelligence gathering, and targeted strikes. The region’s strong military infrastructure, technological expertise, and rapid adoption of AI and autonomous systems further boost the market. Additionally, North America is home to numerous defense contractors that specialize in drone development and counter-drone technologies. Rising geopolitical tensions and military modernization efforts, along with a growing focus on non-combatant safety, contribute to the region’s expanding drone warfare market. With a large defense budget and a high demand for advanced unmanned systems, North America remains a dominant force in the global drone warfare market.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China, in particular, has made significant advancements in drone technology, with a focus on both military and commercial applications. As geopolitical tensions rise, especially in regions such as the South China Sea and the Korean Peninsula, demand for drones as a strategic defense tool has surged. Additionally, smaller nations in the region are increasingly acquiring UAS to enhance their military capabilities. The integration of AI and autonomous technologies further accelerates the adoption of drones in defense, positioning the Asia Pacific region as a key player in the global drone warfare market.

Segmentation Analysis

Insights by Mode of Operation

The semi-autonomous segment accounted for the largest market share over the forecast period 2023 to 2033. These drones are equipped with advanced navigation systems and AI capabilities, enabling them to perform complex missions with minimal human intervention while still allowing for operator oversight. This hybrid approach enhances operational flexibility and reduces the cognitive load on operators, making semi-autonomous drones ideal for surveillance, reconnaissance, and precision strikes. Military forces prefer semi-autonomous systems as they provide more control over mission execution while minimizing human errors and risks. Additionally, advancements in AI and machine learning are improving the performance and reliability of these drones. As defense budgets increase globally and demand for smarter, cost-efficient systems rises, the semi-autonomous drone segment is expected to grow rapidly, contributing significantly to market expansion.

Insights by Capability

The application software segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is driven by the increasing integration of advanced technologies like artificial intelligence (AI), machine learning, and data analytics in unmanned aerial systems (UAS). These software solutions enhance the operational capabilities of drones, enabling real-time data processing, improved decision-making, and mission optimization. They play a crucial role in areas such as navigation, surveillance, target identification, and autonomous flight control. As military forces demand more advanced drone operations, software applications are becoming essential for tasks such as battlefield management, real-time communication, and mission planning. Furthermore, the development of cybersecurity solutions to protect drone systems from hacking and jamming is also propelling the growth of this segment. With continuous advancements in software capabilities, the application software segment is poised for significant growth, driving overall market expansion.

Insights by Application

The intelligence, surveillance, and reconnaissance (ISR) segment accounted for the largest market share over the forecast period 2023 to 2033. Drones equipped with high-resolution cameras, sensors, and advanced imaging technology are becoming vital tools for gathering real-time intelligence and conducting surveillance over vast areas without risking personnel. Military forces across the globe are increasingly relying on unmanned aerial systems (UAS) for ISR missions, as drones provide an edge in monitoring enemy movements, tracking targets, and assessing battlefield conditions. The integration of AI and machine learning in drones further enhances their ISR capabilities, enabling automated data analysis and faster decision-making. As geopolitical tensions rise and security concerns escalate, the demand for efficient and precise ISR solutions continues to grow, positioning this segment as a key driver of the drone warfare market's expansion.

Recent Market Developments

- In February 2024, the U.S. State Department has authorized the sale of thirty-one MQ-9B Sea Guardian drones to India.

Competitive Landscape

Major players in the market

- Airbus SE

- General Atomics Aeronautical Systems, Inc

- Israel Aerospace Industries (IAI)

- BAE Systems plc

- Boeing Company

- Elbit Systems Ltd

- General Dynamics Corporation

- FLIR Systems, Inc

- Kratos Defense & Security Solutions, Inc

- Lockheed Martin Corporation

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Drone Warfare Market, Mode of Operation Analysis

- Semi-Autonomous

- Autonomous

Drone Warfare Market, Capability Analysis

- Platform

- Application Software

- Services

- Ground Control Station

- Drone Launch And Recovery System

Drone Warfare Market, Application Analysis

- Unmanned Combat Aerial Vehicles (UCAVs)

- Intelligence, Surveillance, Reconnaissance (ISR)

- Delivery

Drone Warfare Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Drone Warfare Market?The global Drone Warfare Market is expected to grow from USD 23.4 billion in 2023 to USD 42.1 billion by 2033, at a CAGR of 6.05% during the forecast period 2023-2033.

-

2. Who are the key market players of the Drone Warfare Market?Some of the key market players of the market are Airbus SE, General Atomics Aeronautical Systems, Inc, Israel Aerospace Industries (IAI), BAE Systems plc, Boeing Company, Elbit Systems Ltd, General Dynamics Corporation, FLIR Systems, Inc, Kratos Defense & Security Solutions, Inc, and Lockheed Martin Corporation.

-

3. Which segment holds the largest market share?The application software segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Drone Warfare Market?North America dominates the Drone Warfare Market and has the highest market share.

Need help to buy this report?