Global Drug Discovery Outsourcing Services Market Size, Share, and COVID-19 Impact Analysis, By Drug Type (Small Molecules and Large Molecules), By Workflow (Target Identification & Screening, Target Validation & Functional Informatics, Lead Identification & Candidate Optimization, Preclinical Development, and Others), By Therapeutics Area (Respiratory System, Pain & Anesthesia, Oncology, Ophthalmology, Hematology, Cardiovascular, Endocrine, Gastrointestinal, Immunomodulation, Anti-Infective, Central Nervous System, Dermatology, and Genitourinary System), By Service Type (Chemistry Service and Biology Service), By End-User (Pharmaceutical & Biotechnology Companies, Academic Institutes, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Drug Discovery Outsourcing Services Market Insights Forecasts to 2033

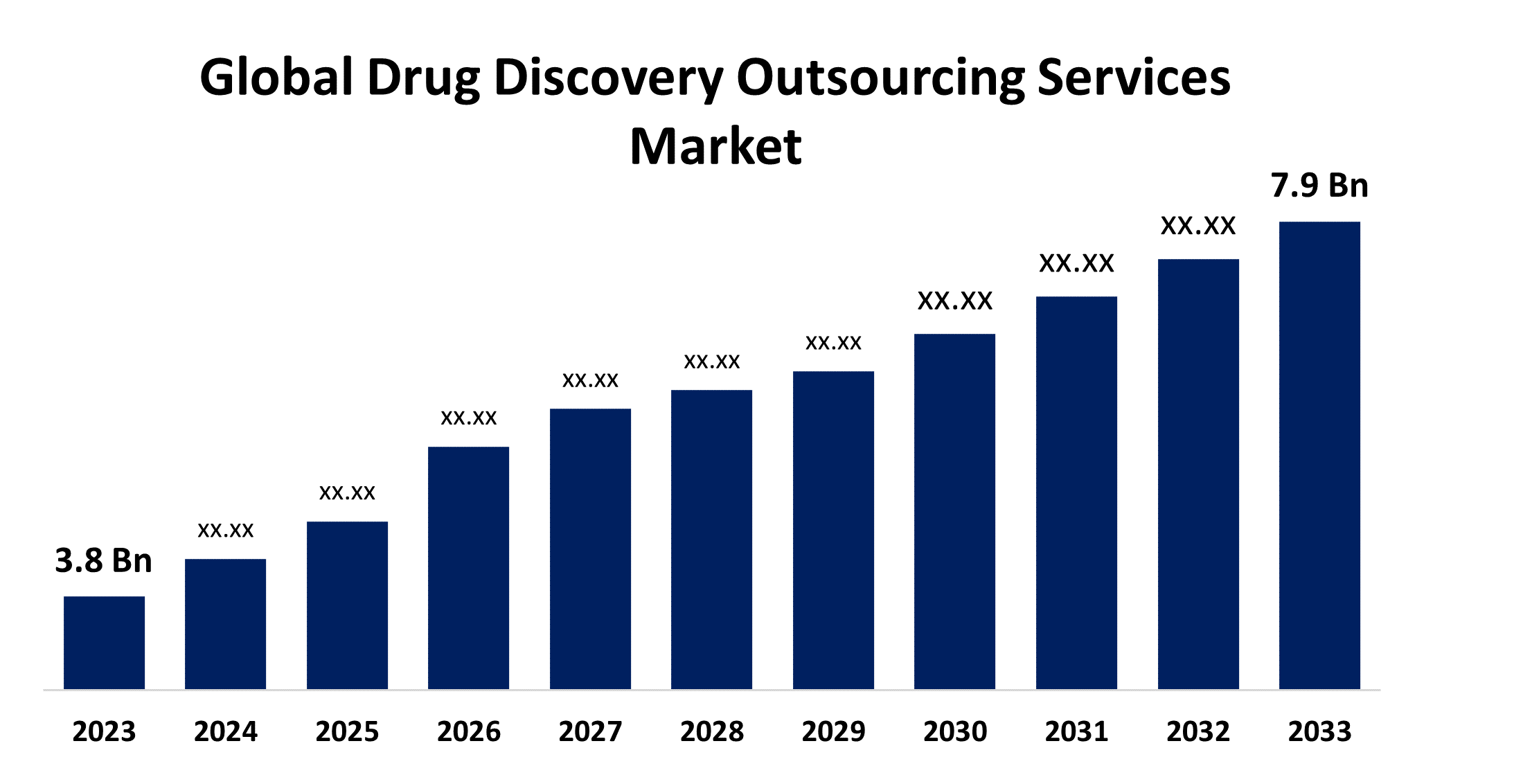

- The Global Drug Discovery Outsourcing Services Market Size was Valued at USD 3.8 Billion in 2023

- The Market Size is Growing at a CAGR of 7.59% from 2023 to 2033

- The Worldwide Drug Discovery Outsourcing Services Market Size is Expected to Reach USD 7.9 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Drug Discovery Outsourcing Services Market Size is Anticipated to Exceed USD 7.9 Billion by 2033, Growing at a CAGR of 7.59% from 2023 to 2033.

Market Overview

Drug discovery outsourcing services refer to the strategic practice of pharmaceutical companies enlisting external partners to handle various stages of the drug discovery development process. Drug discovery outsourcing services mediate advancing drugs from the laboratory to the clinic for biotechnology and pharmaceutical companies. It offers a variety of benefits, including access to a global network of cGMP facilities with high capacity and highly qualified experts across multiple disciplines facilitating the seamless transition of projects through all phases of development. The pharmaceutical and biotech companies opt for outsourcing drug discovery activities to reduce the cost of development. Further, academic and private Contract Research Organizations (CROs) adopt strategic initiatives with pharmaceutical companies to assist them in developing the desired drug. The rapid pace of technological advancement such as AI-driven drug discovery, innovation is reshaping the landscape of drug development. Advancements in high-potency active pharmaceutical ingredients (HPAPIs), antibody-drug conjugates (ADCs), and cell and gene therapies are opening new avenues for drug development. Due to the intense competitive landscape and and growing complexity of drug development, pharmaceutical, and biotech companies are experiencing a significant change in the planning and execution of drug discovery and development processes. This has created a market opportunity for drug discovery outsourcing services.

Report Coverage

This research report categorizes the market for the global drug discovery outsourcing services market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global Drug Discovery Outsourcing Services market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global drug discovery outsourcing services market.

Global Drug Discovery Outsourcing Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.8 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.59% |

| 2033 Value Projection: | USD 7.9 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 208 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Drug Type, By Workflow, By Therapeutics Area, By Service Type, By End-User |

| Companies covered:: | GenScript, Dalton Pharma Services, EVOTEC, Charles River, Thermo Fisher Scientific Inc., Eurofins SE, Syngene International Limited, QIAGEN, Jubilant Biosys, Albany Molecular Research Inc., Pharmaron Beijing Co., Ltd., Laboratory Corporation of America Holdings, WuXi AppTec, Curia Inc., and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

An estimated 75.0% to 80.0% of R&D spending in the biopharmaceutical industry can be outsourced, creating opportunities for Contract Research Organizations (CROs), which, in turn, is expected to boost the market growth. The growing demands for more specialized support and expertise for drug discovery from life science tools suppliers have accelerated the adoption of outsourcing activities resulting in driving the global drug discovery outsourcing market. Further, the growing investments in drug development by pharmaceutical and biopharmaceutical companies and increasing initiatives for research on rare diseases and orphan drugs influence the market growth. The introduction of new drug discovery techniques, patent expiration, and specialized testing services are further driving the market. Precision drug development is complex and requires specialized handling. Thus, to address these needs, companies especially small biotech companies surging the demand for outsourcing services for precision medicine drug development that drives the market demand.

Restraining Factors

Stringent rules and regulations concerning animal use in the drug discovery process and a lack of skilled professionals are restraining the market growth for the drug discovery outsourcing services market.

Market Segmentation

The global drug discovery outsourcing services market share is classified into drug type, workflow, therapeutics area, service type, and end-user.

- The small molecules segment held the largest share of the global drug discovery outsourcing services market in 2023.

Based on the drug type, the global drug discovery outsourcing services market is categorized into small molecules and large molecules. Among these, the small molecules segment held the largest share of the global drug discovery outsourcing services market in 2023. Small-molecule drugs are the preferred option for many therapeutic areas such as oncology, infectious diseases, and neurological disorders as they are effective molecules for targeting intracellular proteins and enzymes. The lower cost of small molecule drug discovery and an increase in approvals by the FDA and other regulatory agencies are significant factors contributing to the development of innovative treatments.

- The lead identification & candidate optimization segment dominated the market with the largest revenue share in 2023.

Based on the workflow, the global drug discovery outsourcing services market is categorized into target identification & screening, target validation & functional informatics, lead identification & candidate optimization, preclinical development, and others. Among these, the lead identification & candidate optimization segment dominated the market with the largest revenue share in 2023. The identification and optimization of lead compounds is an important step of drug discovery that focuses on optimizing different characteristics of lead compounds, such as target selectivity, biological activity, potency, and toxicity potential. The introduction of advanced in silico techniques such as computer-aided drug discovery (CADD) and structure-based drug designs to improve the lead identification process are promoting segment growth.

- The respiratory segment accounted for the largest revenue share of the global drug discovery outsourcing services market in 2023.

Based on the therapeutics area, the global drug discovery outsourcing services market is categorized into respiratory system, pain & anesthesia, oncology, ophthalmology, hematology, cardiovascular, endocrine, gastrointestinal, immunomodulation, anti-infective, central nervous system, dermatology, and genitourinary system. Among these, the respiratory segment accounted for the largest revenue share of the global drug discovery outsourcing services market in 2023. The prevalence and mortality of respiratory diseases are rising as a result of diverse factors such as common respiratory infections, greater exposure to indoor and outdoor air pollution and toxins from occupational dust, and a rising smoking population worldwide. The increase in drug-resistance cases surges the need for drug development for respiratory therapeutic areas.

- The chemistry service segment dominated the market with a significant market share through the forecast period.

Based on the service type, the global drug discovery outsourcing services market is categorized into chemistry service and biology service. Among these, the chemistry service segment dominated the market with a significant market share through the forecast period. The use of combinational chemistry, high-throughput screening, and molecularly defined targets allow structure-based drug design. The development of advanced laboratory techniques, computational tools, and artificial intelligence for drug discovery are driving the market in the chemistry segment.

- The pharmaceutical & biotechnology companies segment is anticipated to grow at the highest CAGR over the forecast period.

Based on the end-user, the global drug discovery outsourcing services market is categorized into pharmaceutical & biotechnology companies, academic institutes, and others. Among these, the pharmaceutical & biotechnology companies segment is anticipated to grow at the highest CAGR over the forecast period. Outsourcing drug discovery in pharmaceutical and biotechnology companies accelerates the drug discovery process and has a greater chance of success owing to the presence of a range of expertise and resources. The increasing burden of diseases is surging the need for new medication which is encouraging the development of new drugs by pharmaceutical and biotechnology companies.

Regional Segment Analysis of the Global Drug Discovery Outsourcing Services Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global drug discovery outsourcing services market over the predicted timeframe.

Get more details on this report -

North America is projected to hold the largest share of the global drug discovery outsourcing services market over the forecast period. The growing prevalence of cardiovascular and neurovascular diseases in the region is fueling the market demand. The availability of advanced technologies and platforms in the process of drug discovery and establishing multiple strategic initiatives are significantly driving the market growth. The presence of a well-established research infrastructure & key players, with higher investments in drug discovery R&D are responsible for driving the market. The growth in biosimilars and generic markets and increasing outsourcing of R&D services by pharmaceutical and biopharmaceutical companies are driving the market in the region.

Asia Pacific is expected to grow at the fastest CAGR growth in the global drug discovery outsourcing services market during the forecast period. The region is emerging as a hub for outsourcing drug discovery activities owing to the availability of skilled manpower, lower costs, favorable regulatory environment, and quality data. The high burden of chronic diseases like cardiovascular diseases, cancer, and respiratory diseases in the region is further expected to propel the market growth. Furthermore, collaborations with Contract Research Organizations (CROs) are accelerating the market growth in the region. The Japan Agency for Medical Research and Development (AMED), established in 2015, is an example of the initiatives taken to boost market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global drug discovery outsourcing services market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GenScript

- Dalton Pharma Services

- EVOTEC

- Charles River

- Thermo Fisher Scientific Inc.

- Eurofins SE

- Syngene International Limited

- QIAGEN

- Jubilant Biosys

- Albany Molecular Research Inc.

- Pharmaron Beijing Co., Ltd.

- Laboratory Corporation of America Holdings

- WuXi AppTec

- Curia Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2023, Charles River Laboratories International, Inc. announced a multi-program agreement with Pioneering Medicines, a strategic initiative of Flagship Pioneering, that gives Pioneering Medicines access to Logica. Through the agreement, Pioneering Medicines would deploy Logica across a portfolio of targets to create optimized small molecules that lead to novel therapies for unmet medical needs.

- In February 2023, Evotec SE announced that the company has extended and expanded its integrated multi-target drug discovery agreement with data-driven biotech creation firm, Related Sciences (“RS”), to continue to grow their joint portfolio of drug development candidates through 2030, leveraging Evotec’s industry-leading capabilities across the full R&D continuum.

- In January 2023, Charles River Laboratories International, Inc. announced that it had acquired Inc., a leading provider of high-quality, label-free high-throughput screening (HTS) solutions for drug discovery research.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global drug discovery outsourcing services market based on the below-mentioned segments:

Global Drug Discovery Outsourcing Services Market, By Drug Type

- Small Molecules

- Large Molecules

Global Drug Discovery Outsourcing Services Market, By Workflow

- Target Identification & Screening

- Target Validation & Functional Informatics

- Lead Identification & Candidate Optimization

- Preclinical Development

- Others

Global Drug Discovery Outsourcing Services Market, By Therapeutics Area

- Respiratory System

- Pain & Anesthesia

- Oncology, Ophthalmology

- Hematology

- Cardiovascular

- Endocrine

- Gastrointestinal

- Immunomodulation

- Anti-Infective

- Central Nervous System

- Dermatology

- Genitourinary System

Global Drug Discovery Outsourcing Services Market, By Service Type

- Chemistry Service

- Biology Service

Global Drug Discovery Outsourcing Services Market, By End-User

- Pharmaceutical & Biotechnology Companies

- Academic Institutes

- Others

Global Drug Discovery Outsourcing Services Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the global drug discovery outsourcing services market over the forecast period?The global drug discovery outsourcing services market is projected to expand at a CAGR of 7.59% during the forecast period.

-

2.What is the projected market size & growth rate of the global drug discovery outsourcing services market?The global drug discovery outsourcing services market was valued at USD 3.8 Billion in 2023 and is projected to reach USD 7.9 Billion by 2033, growing at a CAGR of 7.59% from 2023 to 2033.

-

3. Which region is expected to hold the highest share in the global drug discovery outsourcing services market?The North America region is expected to hold the highest share of the global drug discovery outsourcing services market.

Need help to buy this report?