Global Drug Discovery Services Market Size, Share, and COVID-19 Impact Analysis, By Process (Target Selection, Lead Optimization, Hit-to-lead), By Type (Chemistry, Biology), By Drug Type (Small Molecule, Biologics), By End User (Pharma, Biotech, Academic), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032.

Industry: HealthcareGlobal Drug Discovery Services Market Insights Forecasts to 2032.

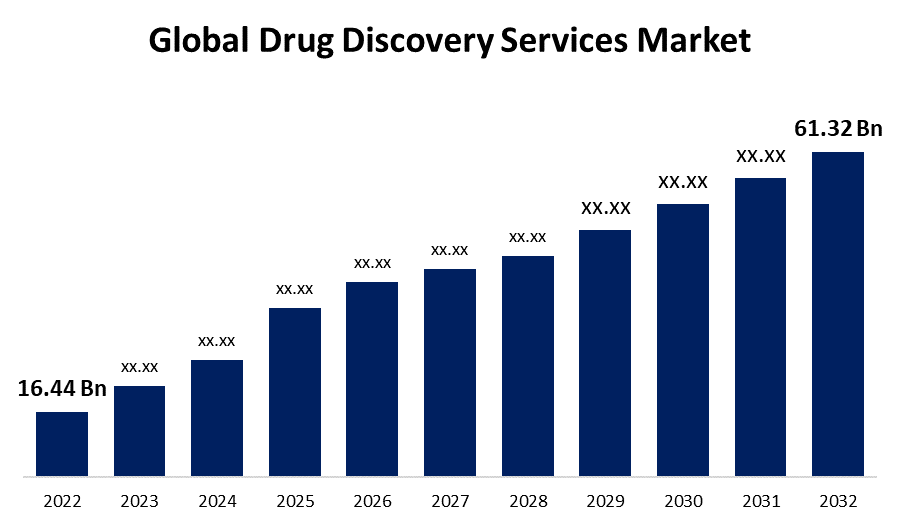

- The Global Drug Discovery Services Market Size was valued at USD 16.44 Billion in 2022.

- The Market is Growing at a CAGR of 14.1% from 2022 to 2032.

- The Worldwide Drug Discovery Services Market Size is expected to reach USD 61.32 Billion by 2032.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Drug Discovery Services Market size is anticipated to exceed USD 61.32 Billion by 2032, growing at a CAGR of 14.1% from 2022 to 2032. Technological developments, the emergence of new drug discovery methods, the expiration of patents, and rising end-user demand for specialized testing services are projected to provide growth opportunities for market participants. However, stringent regulations governing the use of animals in drug discovery, as well as a scarcity of skilled professionals, prove to be a constraint and a challenge for drug discovery service providers.

Market Overview

The procedure of discovering a compound that can be utilized for curing and treating diseases is known as drug discovery. A drug identifying effort generally starts with a molecule with intriguing biological activities or tackles a biological target that has been shown to play a role in disease development. As a result of novel innovations, drug discovery has recently evolved significantly, enabling the procedure to become more refined, precise, and time-consuming. Identifying the active ingredient in traditional remedies or by chance, as in the case of penicillin, led to the discovery of drugs. The procedure of drug discovery is a critical process within R&D departments in pharmacology, biotechnology, and medicine domains, and thus drug discovery services find major applications to enable the design and discovery of new therapeutics and medications. Furthermore, the core of drug discovery services are drug target recognition, drug discovery selection, and drug design based on processes such as lead compound recognition, lead optimization, and others.

Report Coverage

This research report categorizes the market for the global drug discovery services market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the drug discovery services market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the drug discovery services market.

Global Drug Discovery Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 16.44 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 14.1% |

| 2032 Value Projection: | USD 61.32 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Process, By Type, By Drug Type, By End User, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Laboratory Corporation of America Holdings, Charles River Laboratories International Inc., WuXi AppTec, Thermo Fisher Scientific Inc, General Electric, Eurofins Scientific, PPD Inc., Syngene International Limited, Frontage Labs, Galapagos NV, Aurigene Discovery Technologies, Genscript, Domainex, Evotec and other key venders. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Pharmaceutical and biopharmaceutical companies' increasing R&D spending is encouraging them to seek fully integrated or functional outsourcing services for drug discovery and development, from the early development stage to the late-stage development phase. Outsourcing has evolved as a strategic alternative to overcome the lack of in-house resources required for new product development because pharmaceutical companies have budget constraints and must contain fixed costs. Major pharmaceutical companies are shifting to a leaner business model that relies heavily on outsourcing. Many pharmaceutical and biopharmaceutical companies prefer to outsource their testing functions during R&D in order to improve profitability, meet drug development timelines, and save money. This is supported by recent agreements between major pharmaceutical companies and CROs providing drug discovery and development services. As a result, increasing pharmaceutical R&D spending aids market growth.

Restraining Factors

The strict laws governing drug discovery services could seriously hinder market gains in this sector. To ensure the quality, safety, and effectiveness of new drugs, regulatory authorities impose stringent regulations and guidelines on the drug discovery process. Complying with complex regulatory requirements lengthens and increases the cost of drug discovery and development. Furthermore, strict regulations can result in longer authorization timelines, higher development expenditures, and an increased risk of regulatory stumbling blocks. These factors can stifle innovation and investment in drug discovery, especially for small businesses with limited resources.

Market Segmentation

The Global Drug Discovery Services Market share is classified into process, type, and drug type.

- The lead optimization segment is expected to hold the significant share of the global drug discovery services market over the forecast period.

The global drug discovery services market is categorized by process into target selection, lead optimization, and hit-to-lead. Among these, the lead optimization segment is expected to hold the significant share of the global drug discovery services market over the forecast period. One of the most important procedures in drug discovery services is lead optimization, which involves refining and optimizing potential drug candidates in order to enhance their efficacy, safety, and pharmacological properties. Furthermore, lead optimization aims to improve the pharmacokinetic properties of the drug candidate, such as absorption, distribution, metabolism, and excretion, in order to improve drug bioavailability and therapeutic outcomes. It also helps to reduce potential toxicity and adverse effects, making the drug candidate more secure for human use.

- The chemistry segment is expected to lead the global drug discovery services market over the forecast period.

Based on the type, the global drug discovery services market is divided into chemistry and biology. Among these, the chemistry segment is expected to lead the global drug discovery services market over the forecast period. In 2022, the chemistry services segment held a major percentage of this market. The widespread use of chemistry services in various early drug development phases to deliver robust drug candidates is driving growth in this market segment. The widespread use of chemistry in academia, biotechnology, and large pharmaceutical companies also contributes to market growth.

- The small molecule segment is expected to hold the largest share of the global drug discovery services market during the forecast period.

Based on the drug type, the global drug discovery services market is divided into small molecule, biologics. Among these, the small molecule segment is expected to hold the largest share of the global drug discovery services market during the forecast period. In 2022, small-molecule drugs held a major portion of the market. The simple process of working with small molecules, their affordable prices, and the growing number of start-ups and new entrants focusing on developing small-molecule drugs all contribute to this segmental growth.

Regional Segment Analysis of the Global Drug Discovery Services Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America holds the largest share of the global drug discovery services market in 2022.

Get more details on this report -

North America holds the largest share of the global drug discovery services market in 2022. North America is the main geographic region for drug discovery services, whereas Europe is the second-largest market. The market is being driven by a well-established pharmaceutical sector, ongoing research and development studies, high R&D expenditure, expansion in the biosimilars and generics markets, and increasing outsourcing of R&D services by pharmaceutical as well as biopharmaceutical companies in the region.

Asia Pacific is expected to grow at the fastest pace in the global drug discovery services market during the forecast period. The growth can be attributed to a variety of factors, including the rising prevalence of chronic lifestyle disorders in the region, which drives companies to develop therapeutics in these areas. Furthermore, the region's growing number of biopharmaceutical businesses increases the market as more opportunities for drug discovery services emerge. Furthermore, business strategies and regional collaboration are projected to have a major beneficial effect on the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global drug discovery services along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Laboratory Corporation of America Holdings

- Charles River Laboratories International Inc.

- WuXi AppTec

- Thermo Fisher Scientific Inc

- General Electric

- Eurofins Scientific

- PPD Inc.

- Syngene International Limited

- Frontage Labs

- Galapagos NV

- Aurigene Discovery Technologies

- Genscript

- Domainex

- Evotec

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2023, Charles River Laboratories (US) disclosed a multi-program agreement with Pioneering Medicines, a Flagship Pioneering (US) initiative, granting access to its Logica AI platform for small-molecule drug discovery.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Drug Discovery Services Market based on the below-mentioned segments:

Global Drug Discovery Services Market, By Process

- Target Selection

- Lead Optimization

- Hit-to-lead

Global Drug Discovery Services Market, By Type

- Chemistry

- Biology

Global Drug Discovery Services Market, By Drug Type

- Small Molecule

- Biologics

Global Drug Discovery Services Market, By End User

- Pharma

- Biotech

- Academic

Global Drug Discovery Services Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?