Global Dry Gin Market Size, Share, and COVID-19 Impact Analysis, By Product Type (London Dry Gin, Old Tom Gin, Sloe Gin, Genever, New Weste Dry Gin), By Alcohol By Volume (Low ABV [up to 25%], Standard ABV [25% - 40%], High ABV [above 40%]), By Distribution Channel (On-trade [bars, restaurants, and hotels], Off-trade [retail stores, supermarkets, and online], Specialty Spirits Stores, Duty-Free Outlets), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Food & BeveragesGlobal Dry Gin Market Insights Forecasts to 2033

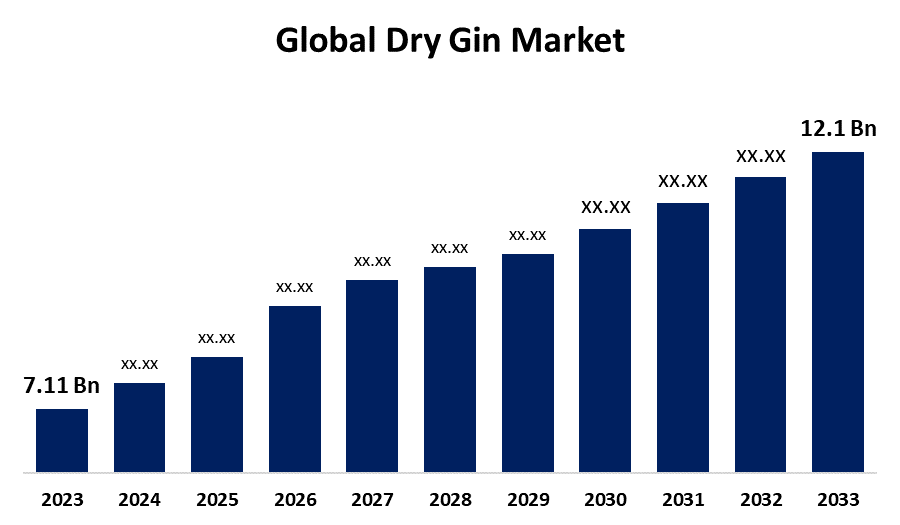

- The Global Dry Gin Market Size was estimated at USD 7.11 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 5.46% from 2023 to 2033

- The Worldwide Dry Gin Market Size is Expected to Reach USD 12.1 Billion by 2033

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Dry Gin Market Size was worth around USD 7.11 Billion in 2023 and is predicted to Grow to around USD 12.1 Billion by 2033 with a Compound Annual Growth Rate (CAGR) of 5.46% between 2023 and 2033. The dry gin market is propelled by rising cocktail culture popularity, premium, and craft spirits growth, growing demand for low-calorie and health-conscious options, and innovation in the production and flavor of gin.

Market Overview

The dry gin market is the worldwide industry involved in the production, distribution, and consumption of dry gin, a category of gin known for its dry taste with minimal or no added sugar. Dry gin is generally produced from grain or malt distillate and flavored mainly with juniper berries and other ingredients like coriander, citrus peel, angelica root, herbs, and spices. Additionally, the growth in popularity of cocktails and mixology has driven the dry gin market as well. Traditional cocktails such as the gin and tonic and the martini have gained a strong revival, and creative variations are being developed, which further increases gin's popularity. Moreover, the emergence of social media sites has enabled brands to communicate directly with consumers, demonstrating the versatility of dry gin across different cocktail recipes. Consequently, manufacturers are heavily investing in marketing approaches that highlight the product's quality and craftsmanship, appealing to a discerning consumer looking for true experiences. Furthermore, dry gin is setting its stamp in culinary use, as chefs infuse it into foods to provide unique flavors, reflecting its versatility beyond the glass.

Report Coverage

This research report categorizes the dry gin market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the dry gin market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the dry gin market.

Global Dry Gin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 7.11 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.46% |

| 2033 Value Projection: | USD 12.1 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product Type, By Alcohol By Volume, By Distribution Channel and By Region |

| Companies covered:: | CHUGOKU JOZO, Bombay Spirits, Four Pillars, BRITISH GIN, Scapegrace, Gin Sul, Bottega, KOVAL, The Botanist, FILLIERS DISTILLERY, Whitley Neill, and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factor

As customers demand better-quality, more handcrafted alcoholic drinks, the demand for craft and premium gins has increased. Craft distilleries provide distinctive, small-batch gins that are usually infused with unusual botanicals and made in new ways, appealing to customers seeking new and different flavors propelling its demand. Additionally, as compared to sweeter spirits, dry gin contains less sugar, hence attracting health-aware consumers seeking to minimize calorie consumption without compromising taste. This has contributed to increasing its popularity, especially in low-sugar cocktails or neat servings.

Restraining Factors

The production of high-quality dry gin may involve the use of different botanicals, some of which may be costly or hard to find. Availability and price instability of these ingredients, such as juniper berries or expensive herbs and spices, may impact production costs and consequently the price of dry gin, which will impede the demand of the dry gin market.

Market Segmentation

The dry gin market share is classified into product type, alcohol by volume, and distribution channel.

- The london dry gin segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the dry gin market is divided into london dry gin, old tom gin, sloe gin, genever, and new weste dry gin. Among these, the london dry gin segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period. The growth is attributed to london dry gin is famous for having a strong and crisp taste with juniper berries being the dominating flavor and traces of citrus and botanicals. This character attracts a wide spectrum of consumers because it's versatile to use in cocktails and simple to mix. Its clean and refreshing taste is regarded as the traditional type of gin.

- The standard ABV segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the alcohol by volume, the dry gin market is divided into low ABV, standard ABV, and high ABV. Among these, the standard ABV segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The growth is driven by gins in the 25%-40% ABV category providing a balanced taste that deliver the message of the botanicals, especially the juniper, across while being smooth and palatable. That balance makes it suitable for a broad category of consumers, whether drinking gin on its own or as an ingredient in cocktails.

- The on-trade segment accounted for the biggest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the dry gin market is divided into on-trade, off-trade, specialty spirits stores, and duty-free outlets. Among these, the on-trade segment accounted for the biggest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth is due to the on-trade segment typically includes premium and craft gins that are less accessible through retail outlets. Consumers of bars and restaurants are more likely to experiment with new and innovative gin expressions, such as cocktails and specialty gin blends created by professional mixologists. It provides an element of exclusivity and enables bars and restaurants to sell high-margin, specialty gin products.

Regional Segment Analysis of the Dry Gin Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

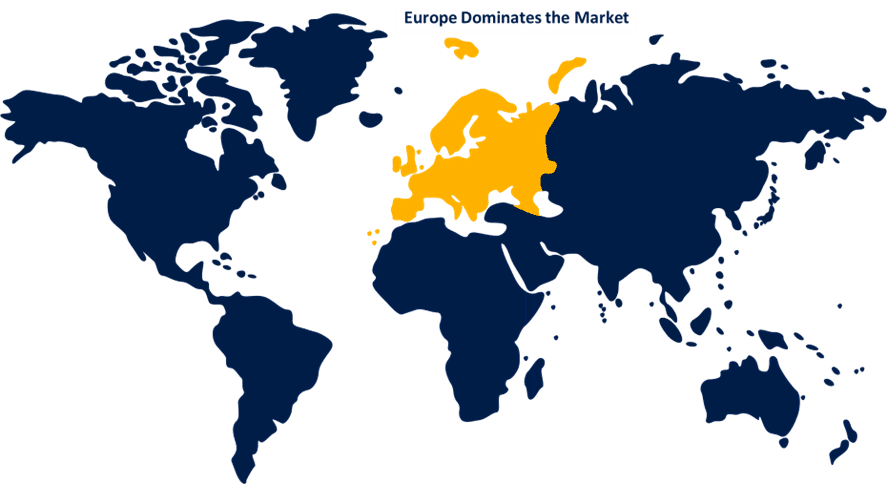

Europe is anticipated to hold the largest share of the dry gin market over the predicted timeframe.

Get more details on this report -

Europe is anticipated to hold the largest share of the dry gin market over the predicted timeframe. Europe, particularly the United Kingdom, has a rich history with gin. Gin itself was created in the Netherlands and became popular in the UK in the 17th century. The UK, Spain, and the Netherlands are among the European nations that have had a long history of producing and consuming gin. This heritage has contributed to the richness of the market and made Europe the dominant region for gin sales.

Asia Pacific is expected to grow at a rapid CAGR in the dry gin market during the forecast period. The Asia-Pacific market, especially nations such as China, India, and Japan, is rapidly urbanizing, with a greater prospect for Western-type bars, restaurants, and shopping centers. Urbanized, young consumers are taking to global trends in drinking more and more, such as gin cocktails. Furthermore, the ability of gin to be mixed and matched in so many ways makes it attractive to a new set of consumers looking to try new varieties of liquor.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the dry gin market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CHUGOKU JOZO

- Bombay Spirits

- Four Pillars

- BRITISH GIN

- Scapegrace

- Gin Sul

- Bottega

- KOVAL

- The Botanist

- FILLIERS DISTILLERY

- Whitley Neill

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2024, Portofino Dry Gin unveiled 'La Penisola,' a limited-edition gin dedicated to the beautiful landscape of Portofino's peninsula. The latest offering is characterized by a vibrant and aromatic profile, reflecting the green surroundings and lively coastal setting. Its elegantly crafted bottle with Castello Brown, La Penisola represents refinement and Portofino's natural beauty. It has already achieved accolades in The Gin Guide Awards 'Negroni' and 'Design & Branding' categories.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the dry gin market based on the below-mentioned segments:

Global Dry Gin Market, By Product Type

- London Dry Gin

- Old Tom Gin

- Sloe Gin

- Genever

- New Weste Dry Gin

Global Dry Gin Market, By Alcohol By Volume

- Low ABV [up to 25%]

- Standard ABV [25% - 40%]

- High ABV [above 40%]

Global Dry Gin Market, By Distribution Channel

- On-trade

- Bars

- Restaurants

- Hotels

- Off-trade

- retail stores

- supermarkets

- online

- Specialty Spirits Stores

- Duty-Free Outlets

Global Dry Gin Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the dry gin market over the forecast period?The global dry gin market is projected to expand at a CAGR of 5.46% during the forecast period.

-

2. What is the market size of the dry gin market?The global dry gin market size is expected to grow from USD 7.11 Billion in 2023 to USD 12.1 Billion by 2033, at a CAGR of 5.46% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the dry gins market?Europe is anticipated to hold the largest share of the dry gin market over the predicted timeframe.

Need help to buy this report?