Global E-Axle Market Size, Share, and COVID-19 Impact Analysis, By Application (Front, Rear) By Component (Combining Motors, Power Electronics, Transmission) By Vehicle Type (ICE Vehicle, Electric Vehicles) By Region (North America, Europe, Asia Pacific, Middle East & Africa, South America) Industry Analysis Report, Regional Outlook, Growth Potential, Price Trends, Competitive Market Share & Forecast, 2021 - 2030

Industry: Automotive & TransportationGlobal E-Axle Market Insights Forecasts to 2030

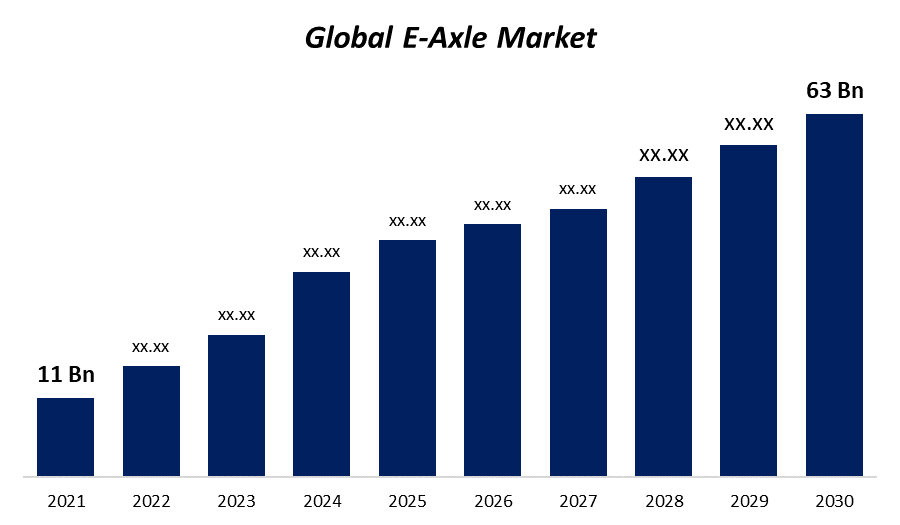

The global e-axle market size was valued at $11 billion in 2021 and is expected to reach $63 billion in 2030 at a CAGR of 27% from 2021 to 2030. The market is primarily driven by the rising sales of battery electric cars and the expanding use of automotive e-axles in the market for light commercial vehicles. Additionally, advancements in e-axle design have been made as a result of the introduction of automotive e-axles for heavy commercial vehicles and rising spending in the R&D of electric cars. Automobile makers may now increase the battery capacity of the cars, extending their driving range on a single charge. This is made possible by the modular e-axle architecture.

Get more details on this report -

The market is primarily being driven by an increase in battery electric vehicle sales along with an expansion of automotive e-axles in the light commercial vehicle segment. The design of electric axles has improved as a result of research and development into electric cars.

The emergence of autonomous vehicles and an increase in the number of electric cars is rapidly changing the automotive industry and propelling the E-Axle Market. A chance will be presented by the rising use of electric vehicles in developing economies and the arrival of driverless vehicles. Due to factors like rising oil prices and environmental pollution, electrified personal transportation in the form of hybrid, plug-in hybrid, fuel-cell, and electric cars (EVs) is currently expanding.

Driving Factors

Manufacturers have been forced to concentrate on the development of technologically innovative products due to the increasing need for lightweight, structurally safe, and cost-effective chassis & automotive systems. AxleTech, for instance, has created an integrated e-axle that offers greater performance in a smaller package. The medium- and heavy-duty commercial trucks are the main applications for the e-axle.

Automobile axle manufacturers have a lot of room to develop thanks to rising demand for AWD and FWD vehicles as well as the popularity of hybrid and driverless vehicles. Additionally, the market for technologically advanced automotive axles has grown in demand as consumers desire safer and more pleasant car features.

These factors fuel this market's expansion. Additionally, in some nations, the lack of rules will encourage the use of e-axles because there is an increasing need for electrified transportation. As a result, more power and the associated efficiencies will be delivered.

E-Axle Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 11 Billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 27% |

| 2030 Value Projection: | USD 63 Billion |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 209 |

| Tables, Charts & Figures: | 118 |

| Segments covered: | By Application, By Component, By Vehicle Type, By Region, COVID-19 Impact Analysis |

| Companies covered:: | American Axle & Manufacturing, Inc., GNA Group, Talbros Engineering Limited., Dana Incorporated, Meritor, Inc., Melrose Industries PLC, ZF Friedrichshafen AG, Daimler AG, Robert Bosch, Nidec Corporation, AxleTech, Magna International Inc., Schaeffler AG, Continental AG, GKN Automotive Limited |

| Pitfalls & Challenges: | Due to the increasing number of COVID-19 cases |

Get more details on this report -

Restraining Factors

One of the most significant issues faced by producers of automotive axles is the fluctuating price of raw materials. Volatile prices for raw materials like aluminium, steel, and copper can have a negative effect on the revenue and profit margins of automotive axle producers.

Covid 19 Impact

Significant Tier I and II suppliers like ZF, GKN Automotive, Dana Incorporated, Meritor, Automotive axle & manufacture, and others serve the automotive axle and propeller shaft sector. The manufacturers who supply the worldwide automotive axle market are dispersed over a number of nations in Asia Pacific, Europe, North America, South America, and the Middle East & Africa. All of these players' businesses have been impacted by the COVID-19 pandemic, which has caused supply chain disruptions and lowered demand in the US, France, Germany, Italy, and Spain. These players have announced a temporary shutdown of production due to lockdown and to protect the safety of their employees.

Segmentation

The global E-Axle market is segmented into Application, Component, Vehicle Type, and Region.

Global E-Axle Market, By Application

In 2021, the market for automotive e-axles was dominated by the front passenger car e-axle segment. The market is anticipated to grow at a CAGR of 27% from 2021 to 2030. This is a result of cost-sensitive economies producing more entry- and mid-level electric passenger automobiles. As commercial vehicles become more technologically advanced during the projected period, the rear e-axle category is anticipated to exhibit strong growth potential.

Commercial vehicle adoption of e-axles is a significant driver affecting market expansion and application diversity. Their expanding use in commercial vehicles would strengthen the manufacturing industry and attract significant investments to improve R&D capabilities. With commercial vehicle e-axles that are highly advanced and technologically refined, this would eventually help the industry and its end customers.

Global E-Axle Market, By Component

The market is divided into four categories based on component: combining motors, power electronics, transmission, and others. The segment for transmission and power electronics has the largest market share. One small unit that directly drives the car's axle is formed by the power electronics and transmission. Because of this, the powertrain is not only much more economical but also significantly more efficient, which benefits the market segment with the highest growth potential.

Global E-Axle Market, By Vehicle Type

The market is divided into three categories: ICE vehicles, electric vehicles, and passenger cars. In the upcoming years, it is anticipated that the passenger car category will hold the largest market share. This is mostly because people are buying more automobiles, and cars are becoming more and more popular in both developed and developing nations. The sectors for light commercial vehicles and large commercial vehicles are the ones that come after this one. With the increased use of transport trailers, significant development is anticipated.

Global E-Axle Market, By Region

Get more details on this report -

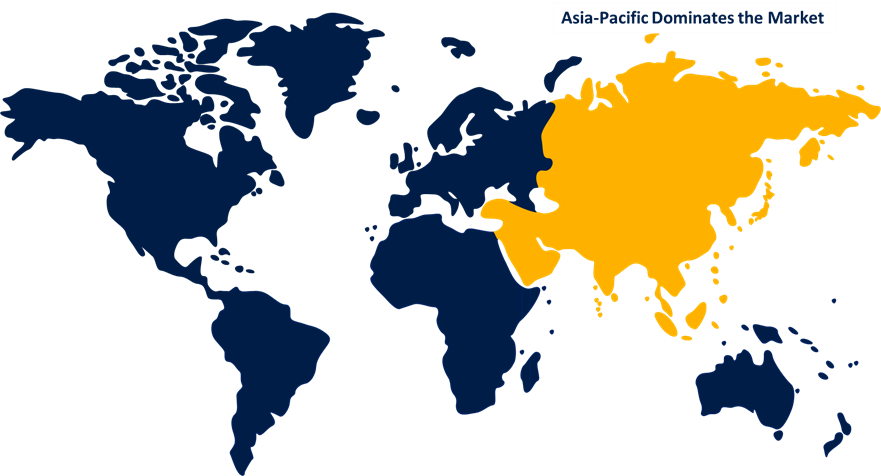

The Global E-Axle Market is divided into four regions based on geography: North America, Europe, Asia Pacific, and the Rest of the World. The majority of the market share belongs to the Asia-Pacific E-Axle Market, which was highly regarded. Over the course of the projected period, the area is likely to be supported in maintaining its dominance by developing nations like India and China as well as developed nations like Japan and South Korea. One of the first continents to use electric automobiles is Europe. Additionally, the region has recently experienced a steady increase in the manufacture of conventional fuel automobiles. According to projections, changes in automobile motivation legislation would cause significant changes in the dynamics of the vehicle industry in the North American region.

Recent Developments in Global E-Axle Market

- May 2019: Dana Incorporated provided driveline innovations to General Motors Vehicle in South and North America, including Spicer prop shafts and rear and front Spicer AdvanTEK axles.

List of Key Market Players

- American Axle & Manufacturing, Inc.

- GNA Group

- Talbros Engineering Limited.

- Dana Incorporated

- Meritor, Inc.

- Melrose Industries PLC

- ZF Friedrichshafen AG

- Daimler AG

- Robert Bosch

- Nidec Corporation

- AxleTech

- Magna International Inc.

- Schaeffler AG

- Continental AG

- GKN Automotive Limited

Segmentation

By Application

- Front

- Rear

By Component

- Combining Motors

- Power Electronics

- Transmission

By Vehicle Type

- ICE Vehicle

- Electric Vehicles

By Region

North America

- North America, by Country

- U.S.

- Canada

- Mexico

- North America, by Application

- North America, by Component

- North America, by Vehicle Type

Europe

- Europe, by Country

- Germany

- Russia

- U.K.

- France

- Italy

- Spain

- The Netherlands

- Rest of Europe

- Europe, by Application

- Europe, by Component

- Europe, by Vehicle Type

Asia Pacific

- Asia Pacific, by Country

- China

- India

- Japan

- South Korea

- Australia

- Indonesia

- Rest of Asia Pacific

- Asia Pacific, by Application

- Asia Pacific, by Component

- Asia Pacific, by Vehicle Type

Middle East & Africa

- Middle East & Africa, by Country

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

- Middle East & Africa, by Component

- Middle East & Africa, by Application

- Middle East & Africa, by Vehicle Type

South America

- South America, by Country

- Brazil

- Argentina

- Colombia

- Rest of South America

- South America, by Application

- South America, by Component

- South America, by Vehicle Type

Need help to buy this report?