Global E-Commerce Automotive Aftermarket Size, Share, and COVID-19 Impact Analysis, By Replacement Part (Engine Parts, Transmission and Steering, Breaking System, Lighting, Electrical Parts, Suspension Systems, Wipers, and Others), By End Use (Business to Business and Business to Customer), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Automotive & TransportationGlobal E-Commerce Automotive Aftermarket Insights Forecasts to 2033

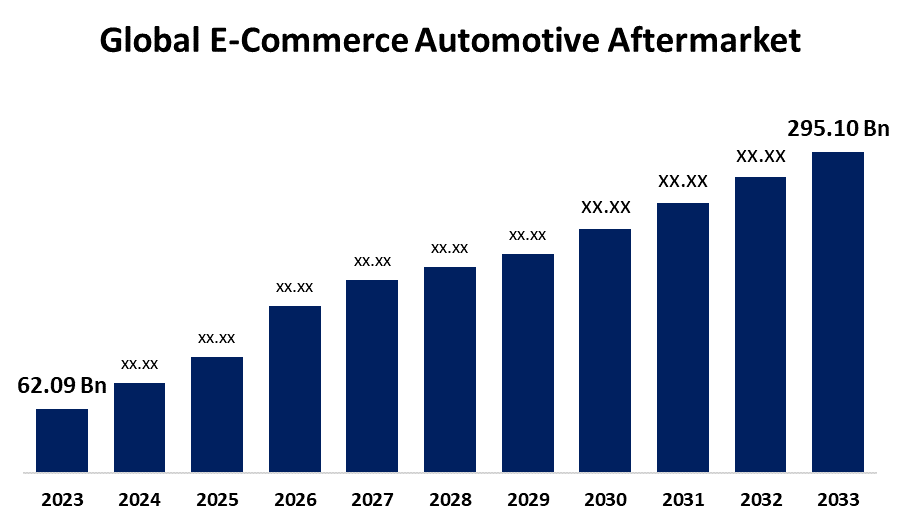

- The Global E-Commerce Automotive Aftermarket Size was Valued at USD 62.09 Billion in 2023

- The Market Size is Growing at a CAGR of 16.87% from 2023 to 2033

- The Worldwide E-Commerce Automotive Aftermarket Size is Expected to Reach USD 295.10 Billion by 2033

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global E-Commerce Automotive Aftermarket Size is anticipated to exceed USD 295.10 billion by 2033, growing at a CAGR of 16.87% from 2023 to 2033. The trend is anticipated to continue as digital literacy and internet access increase globally, making e-commerce platforms the go-to way to buy automotive aftermarket products.

Market Overview

A platform that sells auto components online to do-it-yourselfers and auto repair specialists is known as an e-commerce automotive aftermarket. The phrase "aftermarket" refers to any automotive equipment, accessories, spare parts, and services that are purchased through online marketplaces following sporadic vehicle use. The entire online shopping experience is improved by technological advancements like better logistics and real-time inventory management. Customers looking for convenience, variety, and affordable prices are driving a major trend in the increasing use of online platforms for the purchase of auto parts and accessories. Market expansion is driven by consumers' increasing inclination for online shopping in several industries, including auto parts and accessories. The need for e-commerce automotive aftermarket services has also grown as a result of the expanding value of digitization in emerging nations and the increasing penetration of the Internet.

Report Coverage

This research report categorizes the e-commerce automotive aftermarket based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the e-commerce automotive aftermarket. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the e-commerce automotive aftermarket.

Global E-Commerce Automotive Aftermarket Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 62.09 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 16.87% |

| 2033 Value Projection: | USD 295.10 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 266 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Replacement Part, By End Use, By Regional Analysis |

| Companies covered:: | Texas Instruments, Garrett Motion., AutoNation, Inc., AutoZone Inc., CARiD.com, National Automotive Parts Association, Advance Auto Parts, Alibaba Group Holding Limited, eBay Inc., O’Reilly Auto Parts, Amazon.com, Inc., Flipkart.com, RockAuto, LLC, Others, and |

| Pitfalls & Challenges: | COVID-19 Impact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

E-commerce websites are easier to access due to the widespread use of cell phones and internet connectivity. The increasing demand for online automotive aftermarket services and the trend towards digital retail channels have been further driven by the widespread usage of mobile devices, which enable customers to make purchases from any location at any time. Increased availability of a wide range of car products, faster shipping options, and easier return policies all contribute to supplying the demand boom. The increasing demand for online shopping is driving the growth of the automotive e-commerce aftermarket.

Restraining Factors

The growth of the e-commerce automotive aftermarket is anticipated to be restricted by delivery-related concerns as well as issues related to fraudulent activities.

Market Segmentation

The E-commerce automotive aftermarket share is classified into replacement part and end use.

- The transmission and steering segment is estimated to hold the largest market revenue share through the projected period.

Based on the replacement part, the e-commerce automotive aftermarket is classified into engine parts, transmission and steering, breaking system, lighting, electrical parts, suspension systems, wipers, and others. Among these, the transmission and steering segment is estimated to hold the largest market revenue share through the projected period. The age of the car causes wear and tear on equipment like the transmission and steering, increasing the need for replacements.

- The business to customer segment is anticipated to hold the largest market share through the forecast period.

Based on the end use, the e-commerce automotive aftermarket is divided into business to business and business to customer. Among these, the business to customer segment is anticipated to hold the largest market share through the forecast period. Convenience, affordable prices, and the wide selection of products offered by e-commerce platforms are the main factors driving the business-to-customer segment's rising consumer preference for online shopping.

Regional Segment Analysis of the E-Commerce Automotive Aftermarket

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the e-commerce automotive aftermarket over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the e-commerce automotive aftermarket over the predicted timeframe. The need for maintenance services and replacement parts is increased by the ageing automotive fleet in the United States and Canada, where many vehicles are over ten years old. Online purchases in this industry are being further accelerated by companies like Amazon and RockAuto, as well as existing shops growing their online presence and improving their e-commerce infrastructure with quick shipping and simple return policies in this region.

Asia Pacific is expected to grow at the fastest CAGR growth of the e-commerce automotive aftermarket during the forecast period. Due to the ease of price comparison, access to a wider selection of products, and competitive pricing, consumers in the region are increasingly using online platforms. Additionally, e-commerce is more widely available due to advancements in digital infrastructure, the growing popularity of smartphones, and the expansion of internet usage. Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the e-commerce automotive aftermarket along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Texas Instruments

- Garrett Motion.

- AutoNation, Inc.

- AutoZone Inc.

- CARiD.com

- National Automotive Parts Association

- Advance Auto Parts

- Alibaba Group Holding Limited

- eBay Inc.

- O’Reilly Auto Parts

- Amazon.com, Inc.

- Flipkart.com

- RockAuto, LLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2024, Texas Instruments announced the "AWR2544," a new automotive chip. This single-chip radar sensor, which is satellite-based, enhances sensor fusion and decision-making in ADAS while allowing for a high degree of autonomy. Texas's website and a few other e-commerce platforms offer online ordering for this component.

- In December 2023, A cutting-edge e-commerce platform was launched by Garrett Motion. The "Garrett Marketplace" e-commerce site specializes in offering racing enthusiasts aftermarket vehicle parts.

Market Segment

- This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the e-commerce automotive aftermarket based on the below-mentioned segments:

Global E-Commerce Automotive Aftermarket, By Replacement Part

- Engine Parts

- Transmission and Steering

- Breaking System

- Lighting

- Electrical Parts

- Suspension Systems

- Wipers

- Others

Global E-Commerce Automotive Aftermarket, By End Use

- Business to Business

- Business to Customer

Global E-Commerce Automotive Aftermarket, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the E-commerce automotive aftermarket over the forecast period?The e-commerce automotive aftermarket is projected to expand at a CAGR of 16.87% during the forecast period.

-

2. What is the market size of the E-commerce automotive aftermarket?The Global E-Commerce Automotive Aftermarket Size is Expected to Grow from USD 62.09 Billion in 2023 to USD 295.10 Billion by 2033, at a CAGR of 16.87% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the e-commerce automotive aftermarket?North America is anticipated to hold the largest share of the e-commerce automotive aftermarket over the predicted timeframe.

Need help to buy this report?