Global EAA Ionomer Market Size, Share, and COVID-19 Impact Analysis, By Product (Zinc Ionomer, Sodium Ionomer, and Others), By Application (Food Packaging, Construction, Healthcare & Cosmetics Packaging, Golf Ball Covers, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal EAA Ionomer Market Insights Forecasts to 2033

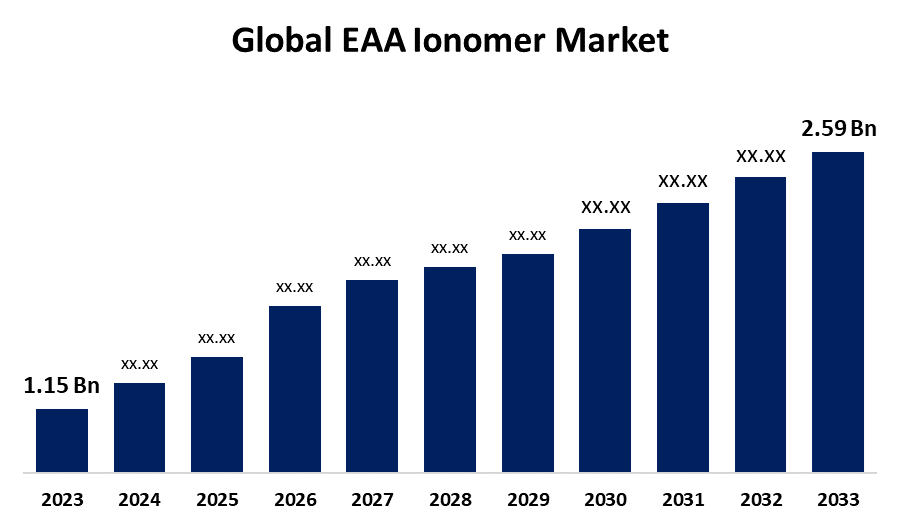

- The Global EAA Ionomer Market Size was estimated at USD 1.15 Billion in 2023

- The Global EAA Ionomer Market Size is Expected to Grow at a CAGR of around 8.46% from 2023 to 2033

- The Worldwide EAA Ionomer Market Size is Expected to Reach USD 2.59 Billion By 2033

- Asia Pacific is Expected to Grow the fastest during the Forecast Period.

Get more details on this report -

The Global EAA Ionomer Market Size is Expected to Cross USD 2.59 Billion By 2033, Growing at a CAGR of 8.46% from 2023 to 2033. The Market for EAA ionomer offers opportunities in innovative packaging, automotive components, coatings, adhesives, and electronics because of its barrier qualities, durability, and rising sustainability need.

Market Overview

The manufacturing, distribution, and usage of ethylene acrylic acid-based ionomers—specialized polymers created by partially neutralizing acrylic acid copolymers with metal ions like sodium, zinc, or magnesium are the focus of the global industry known as the EAA ionomer market. EAA ionomer are commonly used in protective films for renewable energy systems including solar panels, adhesives for EV batteries, and corrosion-resistant coatings for infrastructure. The distinctive qualities of these EAA ionomers, such as their exceptional chemical resistance, high durability, and barrier resistance, make them appropriate for a variety of consumer and industrial applications. Rising demand for environmentally friendly packaging options, technical developments, and expanding use in new sectors like renewable energy and electric cars are driving the EAA ionomer market. The primary factors driving EAA ionomer market expansion are growing utilization in construction and rising demand for flexible food packaging. Several reasons in the packaging, automotive, and industrial sectors are driving the EAA ionomer market.

Report Coverage

This research report categorizes the EAA ionomer market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the EAA ionomer market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the EAA ionomer market.

Global EAA Ionomer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.15 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.46% |

| 2033 Value Projection: | USD 2.59 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Application, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Dow, Honeywell International Inc, Mitsui Chemicals, Inc., LyondellBasell, Solvay S.A., INEOS, SK Geo Centric, ExxonMobil Chemical Company and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Global economic concerns, changes in consumer demand, and new developments in environmentally friendly packaging and automotive components are all factors driving the EAA ionomer market. EAA ionomer numerous uses in a variety of sectors, especially packaging and the automotive sector, are the main factors driving the EAA ionomer market. Rising demand for high-performance packaging, expansion in the electronics and automotive sectors, improvements in manufacturing methods, and a growing focus on sustainability and environmentally friendly materials are the main factors of the EAA ionomer market.

Restraining Factors

The high cost of manufacture in comparison to other traditional polymers is one of the main challenges. The high cost of producing EAA ionomer due to its intricate synthesis and reliance on particular raw ingredients can restrict its use in situations where cost is a concern.

Market Segmentation

The EAA ionomer market share is classified into product and application.

- The zinc ionomer segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the product, the EAA ionomer market is divided into zinc ionomer, sodium ionomer, and others. Among these, the zinc ionomer segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Zinc ionomers are widely used due to their superior chemical resistance, longevity, and improved performance in a variety of applications, including coatings, automotive, and food packaging.

- The food packaging segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the EAA ionomer market is divided into food packaging, construction, healthcare & cosmetics packaging, golf ball covers, and others. Among these, the food packaging segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. EAA ionomers are especially prized in the food packaging sector due to their superior barrier qualities, which assist prolong food products' shelf lives by shielding them from impurities, moisture, and oxygen.

Regional Segment Analysis of the EAA Ionomer Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the EAA ionomer market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the EAA ionomer market over the predicted timeframe. The packaging, automotive, and coatings sectors in North America, and particularly the United States, are significant consumers of EAA ionomer market. The demand for high-end products such as EAA ionomers is fueled by the robust North America economy, which encourages the use of better materials. The production and distribution of EAA ionomer are facilitated by the region's developed manufacturing base. The demand for both current and new applications is met by this infrastructure.

Asia Pacific is expected to grow at the fastest CAGR growth of the EAA ionomer market during the forecast period. Asia Pacific is rapidly becoming more industrialized and urbanized, especially in nations like China, India, Japan, and South Korea. Asia Pacific's packaging industry is among the biggest and fastest-growing in the world, especially given the burgeoning middle class and changing purchasing habits in nations like China and India. Due to their superior barrier qualities, which preserve food products' quality and shelf life, EAA ionomer are widely utilized in food packaging.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the EAA ionomer market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dow

- Honeywell International Inc

- Mitsui Chemicals, Inc.

- LyondellBasell

- Solvay S.A.

- INEOS

- SK Geo Centric

- ExxonMobil Chemical Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the EAA ionomer market based on the below-mentioned segments:

Global EAA Ionomer Market, By Product

- Zinc Ionomer

- Sodium Ionomer

- Others

Global EAA Ionomer Market, By Application

- Food Packaging

- Construction

- Healthcare & Cosmetics Packaging

- Golf Ball Covers

- Others

Global EAA Ionomer Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the EAA ionomer market over the forecast period?The EAA ionomer market is projected to expand at a CAGR of 8.46% during the forecast period.

-

2. What is the market size of the EAA ionomer market?The Global EAA Ionomer Market Size is Expected to Grow from USD 1.15 Billion in 2023 to USD 2.59 Billion by 2033, at a CAGR of 8.46% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the EAA ionomer market?North America is anticipated to hold the largest share of the EAA ionomer market over the predicted timeframe.

Need help to buy this report?