Global Edible Oils Market Size, Share, and COVID-19 Impact Analysis, By Type (Sunflower Oil, Palm Oil, Soybean Oil, Rapeseed Oil, Olive Oil), By Packaging Type (Cans, Pouches, Jars, and Bottles), By End Use (Food Service, Domestic, and Industrial), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Food & BeveragesGlobal Edible Oils Market Insights Forecasts to 2032

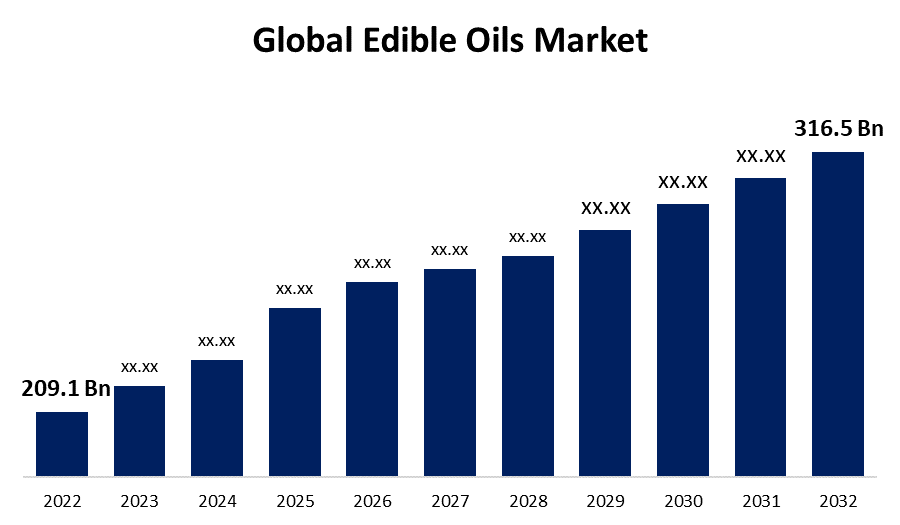

- The Global Edible Oils Market Size was valued at USD 209.1 Billion in 2022.

- The Market is Growing at a CAGR of 4.2% from 2022 to 2032

- The Worldwide Edible Oils Market Size is expected to reach USD 316.5 Billion by 2032

- North America is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Edible Oils Market is projected to exceed USD 316.5 billion by 2032, growing at a CAGR of 4.2% from 2022 to 2032. In accordance with rising rates of non-communicable diseases, worldwide consumers are changing their purchasing habits towards edible oils that have been scientifically proven to promote heart health, such as olive oil, rapeseed oil, soybean oil, and sunflower oil. As a consequence, rising demand for and usage of edible oils in households and food services is driving growth in the global edible oils market.

Market Overview

The global edible oils market is a large and growing industry that involves the production, processing, and distribution of various types of edible oils, such as palm oil, soybean oil, canola oil, and sunflower oil. Edible oils are widely used in cooking, baking, and frying, as well as in the production of margarine, mayonnaise, and other food products. The global edible oils market is being driven by several key factors, including the increasing demand for healthy and nutritious food products, rising awareness about the benefits of a balanced diet, and the growing popularity of plant-based diets. The market is also being driven by the increasing use of edible oils in food processing and the rising demand for biofuels. Technological advancements in edible oil processing and the development of sustainable production methods are also expected to drive the growth of the market in the coming years. The global edible oils market is expected to continue to grow in the coming years, as companies work to meet the increasing demand for healthy and sustainable food products. The industry is likely to continue to innovate and develop new and improved products that meet the changing needs and preferences of consumers around the world.

Report Coverage

This research report categorizes the market for the global edible oils market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the edible oils market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the edible oils market.

Global Edible Oils Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 209.1 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 4.2% |

| 2032 Value Projection: | USD 316.5 Billion |

| Historical Data for: | 2020-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Type, By Packaging Type, By End Use, By Region, and COVID-19 Impact Analysis |

| Companies covered:: | Associated British Foods PLC , Archer Daniels Midland Company, Louis Dreyfus Company, Bunge Limited, The Adams Group Inc., American Vegetable Oils, Inc., COFCO, Emami Agrotech Ltd., Richardson International Limited, Adani Wilmar Limited, Sime Darby Plantation Berhad, Cargill, Incorporated, Wilmar International Limited, Borges International Group, S.L.U. |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Driving Factors

With growing concerns over health and wellness, consumers are seeking out food products that are perceived as healthier, including cooking oils. This trend is driving the demand for edible oils that are rich in beneficial nutrients and free from harmful chemicals. Consumers are increasingly turning to edible oils like olive oil, coconut oil, and avocado oil, which are perceived as healthier alternatives to traditional cooking oils. These oils are high in monounsaturated and polyunsaturated fats, which have been shown to have a positive impact on heart health, as well as other important nutrients like antioxidants and vitamins. In addition, the rise of plant-based diets and the demand for vegan and vegetarian food products has also driven the demand for healthier cooking oils. Many of these diets prioritize the use of plant-based oils over animal-based fats, further boosting the demand for edible oils. The increasing demand for healthier food options has also led to the development of new varieties of edible oils. For example, manufacturers have started to produce oils made from seeds such as chia, flax, and hemp, which are high in omega-3 fatty acids and other beneficial nutrients. These oils are marketed as healthy and sustainable alternatives to traditional cooking oils.

The demand for healthier cooking oils is expected to continue to drive the growth of the global edible oils market in the coming years. As consumers become more health-conscious, they are likely to seek out cooking oils that offer a range of health benefits and are free from harmful chemicals, driving the demand for high-quality edible oils.

Restraining Factors

The prices of edible oils are subject to volatility due to a variety of factors, including weather patterns, crop yields, and geopolitical tensions. This volatility can make it difficult for manufacturers and retailers to manage costs, and it can also impact the affordability of these products for consumers. Weather patterns and crop yields are two of the primary drivers of price volatility in the edible oils market. Droughts, floods, and other extreme weather events can impact crop yields, leading to a reduction in the supply of edible oils and an increase in prices. Similarly, geopolitical tensions and trade disputes can impact the global supply of edible oils and lead to price spikes. Price volatility can also impact the profitability of edible oil producers and manufacturers. Sudden price increases can make it difficult to manage costs and can impact profit margins. This can also impact the affordability of these products for consumers, particularly in developing countries where food budgets are already stretched.

Market Segmentation

The Global Edible Oils Market share is classified into type, packaging type, and end use.

- The palm oil segment is estimated to hold the largest share of the global edible oils market over the period of study.

Based on the type, the global edible oils market is segmented into sunflower oil, palm oil, soybean oil, rapeseed oil, and olive oil. Among these, the palm oil segment is estimated to hold the largest share of the global edible oils market over the period of study. The reason behind the growth is its widespread use in the food industry and its relatively low cost. Palm oil is an edible oil that is widely used in the food industry due to its high melting point and stability at high temperatures. It is used in a wide range of products, including baked goods, snacks, and margarine.

- The bottle segment is expected to hold the largest share of the global edible oils market during the forecast period.

Based on the packaging type, the global edible oils market is segmented into cans, pouches, jars, and bottles. Among these, the bottle segment is expected to hold the largest share of the global edible oils market during the forecast period. The growth can be attributed to its versatility and consumer popularity for daily use in cooking, baking, and finishing oils. Bottles are a popular option for consumers who want a versatile and easy-to-use packaging option. They are often made of plastic or glass and come in a range of sizes and shapes to suit different needs. Bottles are typically used for oils that are used in smaller quantities or as finishing oil. They have a shorter shelf life than cans or jars but are more durable than pouches. Examples of oils that are commonly packaged in bottles include extra-virgin olive oil, grapeseed oil, and infused oils.

- The domestic segment is anticipated to hold the largest share of the global edible oils market over the projected period.

Based on the end use, the global edible oils market is segmented into food service, domestic, and industrial. Among these, the domestic segment is anticipated to hold the largest share of the global edible oils market over the projected period. The reason for the increase is the high demand for edible oils in households for cooking and baking. The domestic segment is driven by consumer preferences for healthier and natural oils, as well as convenience and affordability. Oils commonly used in households include olive oil, coconut oil, and sunflower oil. The domestic segment includes edible oils sold directly to households for home use. These oils are often packaged in smaller sizes, such as bottles and pouches, and are sold through supermarkets, grocery stores, and online retailers. Domestic oils are used for a variety of cooking and baking applications, such as frying, roasting, and salad dressings.

Regional Segment Analysis of the Edible Oils Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is estimated to hold the largest share of the global edible oil market during the predicted timeframe.

Get more details on this report -

Asia Pacific is the largest regional segment in the global edible oils market, accounting for a significant share of the overall market. The region's dominance is attributed to the large population and increasing disposable income, which has led to a surge in demand for edible oils. Countries like India and China are major consumers of edible oils, and their growing populations and changing lifestyles have resulted in a higher demand for edible oils. Another factor driving the Asia Pacific edible oils market is the increasing disposable income in the region. As people's incomes rise, they tend to consume more and better-quality food products, including edible oils. Additionally, with urbanization and changing lifestyles, people are shifting towards convenience foods and ready-to-eat meals, which also drive demand for edible oils.

North America is expected to grow at the highest CAGR in the global edible oil market during the forecast timeframe. The major regional segments in the global edible oils market comprise countries like the United States, Canada, and Mexico. The region has a well-established market for edible oils, with high levels of consumer awareness regarding the health benefits and culinary applications of different types of oils. The North American edible oils market is highly competitive, with several large players and small-scale manufacturers offering a wide range of edible oil products. The region's well-developed distribution network and advanced food processing technologies facilitate the availability of different types of edible oils in various packaging sizes and formats. In addition, government regulations and labeling requirements play a crucial role in the North American edible oils market. For instance, the Food and Drug Administration (FDA) in the United States has set standards for the labeling of edible oils, including mandatory nutritional labeling, which helps consumers make informed choices about the products they purchase.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global edible oils along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Associated British Foods PLC

- Archer Daniels Midland Company

- Louis Dreyfus Company

- Bunge Limited

- The Adams Group Inc.

- American Vegetable Oils, Inc.

- COFCO

- Emami Agrotech Ltd.

- Richardson International Limited

- Adani Wilmar Limited

- Sime Darby Plantation Berhad

- Cargill, Incorporated

- Wilmar International Limited

- Borges International Group, S.L.U.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2021, Cargill and Frontline International collaborated to develop the Kitchen Controller end-to-end automated oil management solution. Frontline International's Smart Oil Management equipment expertise and client relationships were combined with Cargill's foodservice experience and knowledge of oil quality to provide foodservice operators with an integrated, intelligent approach to oil management.

- In September 2022, Longriver Farms and Louis Dreyfus Company Asia Pte. Ltd. (LDC) have reached an agreement for LDC to acquire Emerald Grain Pty. Ltd. (Emerald Grain). This agreement aided LDC's expansion in the Australian market.

- In February 2023, Cargill has introduced an edible oil brand in South India, backed by the Nellore plant.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Edible Oils Market based on the below-mentioned segments:

Global Edible Oils Market, By Type

- Sunflower Oil

- Palm Oil

- Soybean Oil

- Rapeseed Oil

- Olive Oil

Global Edible Oils Market, By Packaging Type

- Cans

- Pouches

- Jars

- Bottles

Global Edible Oils Market, By End Use

- Food Service

- Domestic

- Industrial

Global Edible Oils Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?