Global Electric Bus Market Size, Share, and COVID-19 Impact Analysis By Type (All-electric, PHEV, FCEV), By Battery Capacity (Below 100 kWh, 100 - 300 kWh, Above 300 kWh), By Seating Capacity (Below 40 Seats, 40 - 70 Seats, Above 70 Seats), By Application (Intracity, Intercity), Regional Outlook, Growth Potential, Price Trends, Competitive Market Share & Forecast, 2021 - 2030

Industry: Automotive & TransportationGLOBAL ELECTRIC BUS MARKET: INFORMATION BY PROPULSION TYPE, POWER OUTPUT, REGIONAL ANALYSIS, AND FORECAST TILL 2030.

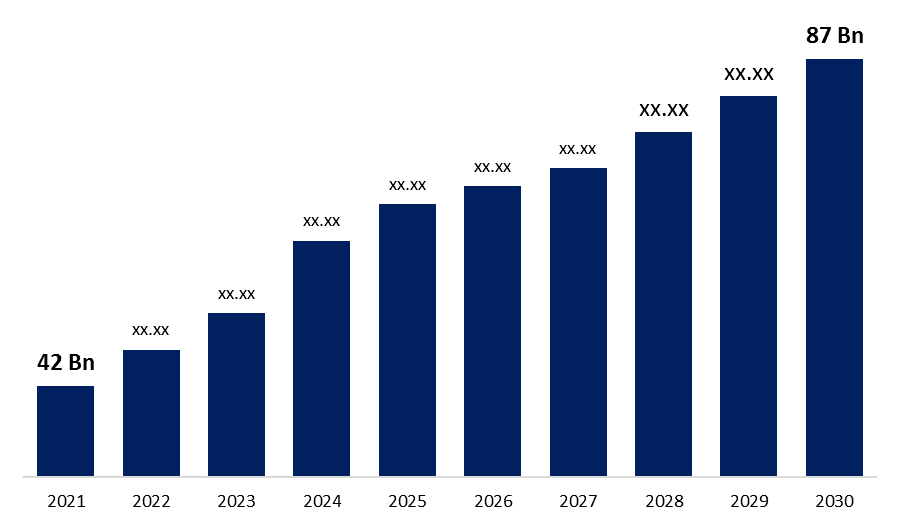

In 2021, the Global Market For Electric Buses was estimated to be worth USD 42 Billion, and by 2030, the market will be worth USD 87 Billion, registering a CAGR of 17.6%.

Get more details on this report -

MARKET OVERVIEW

In response to growing worries about greenhouse gas emissions and their negative impacts on the environment, the growth of electric vehicles is proving to be humanity's greatest gift to nature, reducing carbon and other hazardous emissions into the atmosphere. In the past few years, the global market for electric buses has expanded significantly, as governments across the globe have adopted electric vehicles for their public transportation systems. Alongside this, the rising desire for fuel-efficient vehicles with excellent performance and low emissions propels the market for electric vehicles forward.

Global Electric Buses Market Size is estimated to be 112,041 units in 2022 and expected to reach 871,285 units by 2030, registering a CAGR of 17.6%.(2022-2030)

GLOBAL MARKET DRIVERS FOR ELECTRIC BUS

Increased Demand For Fuel-Efficient, High-Performance, Low-Emission Buses is The Primary Factor Driving The Worldwide Electric Bus Market.

Petrol and diesel, the principal fuels for the vast majority of vehicles, are not renewable energy sources and will soon run out. Both of these gasoline-based fuels have good performance, but they emit dangerous pollutants into the sky. To encourage sustainable development, it was necessary to identify alternate fuel sources, leading to the evolution of electric vehicles. Electric buses do not use gasoline or gasoline-based fuels, making them more cost-effective than conventionally-fueled buses. Unlike gasoline-powered vehicles, an electric bus converts over fifty percent of the grid-supplied electricity into wheel power. The rising demand for electric vehicles is due to the outstanding performance offered by fuel-efficient vehicles. An electric bus may drive up to 150 kilometres on a single charge, which is significantly more than the public and transportation administration anticipate. People are captivated by the low emissions of these electric buses because it answers the requirement for pollution-free transportation at this time.

The Decrease In Battery Prices is Proving To Be An Additional Driver Boosting The Worldwide Electric Bus Market.

When operating on electricity, electric buses cannot run continuously on an AC power supply; all such vehicles utilise a DC power supply. For this purpose, electric buses use batteries to power the entire vehicle as well as the interior accessories. The electric buses are totally battery-powered. The cost of batteries was a major worry for the transportation authorities, as the cost of an electric vehicle's battery was far greater than that of a conventional vehicle's battery, and it plays a vital role in the overall cost of an electric bus. Consequently, battery packs are regarded as an essential cost factor that ultimately affects market expansion.

With the recent technological improvements in the electric car market, however, the prices of batteries for electric vehicles have decreased dramatically. This is proving to be another driver driving the global electric bus market, as the primary cost component for an electric bus is readily available at a low price, hence raising the purchase volume.

Global Electric Bus Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 42 Billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 17.6% |

| 2030 Value Projection: | USD 87 Billion |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | COVID-19 Impact Analysis By Type, By Battery Capacity, By Seating Capacity, By Application |

| Companies covered:: | AB Volvo, Anhui Ankai Automobile Co., Ltd., Beiqi Foton Motor Co., Ltd., BMW AG, BYD Company Ltd., Daimler AG, Ford Motor Company, General Motors, Honda Motor Co., Ltd., Hyundai Motor Company, Irizar S.C., Iveco SpA, MAN SE, Mitsubishi Motors Corporation, NFI Group Inc., Nissan Motor Corporation, SCANIA AB, Tata Motors, Tesla, Inc., Toyota Motor Corporation, Volkswagen AG, VDL Bus & Coach B.V., and Zhengzhou Yutong Bus Co., Ltd. |

| Growth Drivers: | Increased Demand For Fuel-Efficient, High-Performance, Low-Emission Buses is The Primary Factor Driving The Worldwide Electric Bus Market. |

| Pitfalls & Challenges: | High Production Volume Cost and Serviceability Are Impediments To The Expansion of The Electric Bus Market |

Get more details on this report -

GLOBAL ELECTRIC BUS MARKET RESTRAINS

High Production Volume Cost and Serviceability Are Impediments To The Expansion of The Electric Bus Market

Electric buses are not yet built in vast quantities because their necessity and desire are limited to specific places worldwide. The largest number of electric buses operate in the European region, particularly in Turkey, where the famous Turkish Buses operate. Nonetheless, Europe lacks a facility for mass production of electric buses on the go. This is why a significant cost factor affects the entire electric bus market, making electric vehicles more expensive than traditional fuel-powered buses. In addition, the lack of suitable infrastructure for producing electric buses and the high investment required is inhibiting the growth of the electric bus industry.

OPPORTUNITIES IN THE GLOBAL ELECTRIC BUS MARKET

The Global Market For Electric Buses Is Ripe For Expansion Due To Technological Advances and Strong Government Initiatives.

The modern-day is controlled by technology, and the technology of electric vehicles is always improving.

Since the introduction of the electric bus to the market in 2010, there have been numerous technological advancements in electric automobiles. In recent years, the electric vehicle market has witnessed technological breakthroughs in battery capacity, increased performance and efficiency, designs and aesthetics, IoT-connected buses, fleet management systems, etc.

As far as technology is concerned, the coming years may bring more beneficial improvements in electric buses, which has created several opportunities in Research & Development, Manufacturing, Electric technology, Artificial Intelligence in electric buses, fleet management services, etc.

In addition to technological advancements, favourable government policies play a significant influence in the expansion of the electric bus business. The government provides subsidies to maintain the final vehicle price as low as feasible, tax breaks, and measures that promote the electric vehicle market sector. Even manufacturing plants for electric vehicles receive numerous government perks, ranging from site acquisition to tax exemptions. The electric vehicle market offers a once-in-a-lifetime opportunity to profit and cause a revolution in the automotive industry, which is why it is such a hot topic at the moment.

SEGMENTATION OF THE GLOBAL ELECTRIC BUS MARKET

The primary segments of the global electric bus market are propulsion type and power output. The propulsion type segmentation is further divided into BEV (Battery Electric Vehicle), FCEV (Fuel Electric Vehicle), and plug-in hybrid electric vehicle categories (PHEV). The battery electric vehicle segment is predicted to expand at a CAGR of 12.8% between 2021 and 2030, from USD 12567 million in 2021 to USD 37155 million.

The battery electric vehicle operates with the assistance of a battery-charged electric motor; in the majority of electric buses in use, the batteries can recharge themselves through regenerative braking, which assists the vehicle in decelerating and recovers the energy converted to heat by the brakes. BEVs are in high demand in the electric bus market due to the benefits associated with their use. The following category is Fuel Electric Vehicle (FCEV), which is anticipated to expand at a remarkable CAGR of 18% by 2030 and hold an estimated market share of USD 1,438 million.

The hybrid architecture of these vehicles incorporates both batteries and a hydrogen cell for efficiently running the bus. Plug-in hybrid electric vehicles employ an electric motor and battery that are connected and hooked into a power grid system to recharge the battery. Additionally, it is powered by an IC engine that may be utilised to replenish the batteries. This segment's market value is expected to reach USD 6,244 million by 2030, expanding at a CAGR of 14.1%.

The second segmentation of the global electric bus market is based on power output, which is subdivided into up to 250 kW and over 250 kW. The market share of cars with a power output of up to 250 kW will reach USD 27851 million by 2030, growing at a CAGR of 12.6%. This category includes all-electric buses with a power output of less than or equal to 250 kW. The aforementioned segment leads the market with its inexpensive performance. The second segment of power output is "over 250kW," which is expected to reach a market value of USD 17258 million by 2030 at a CAGR of 14.2%. All electric buses with a power output over 250 kW fall into this category. As demand for high-performance electric buses rises, the aforementioned market category is anticipated to expand rapidly.

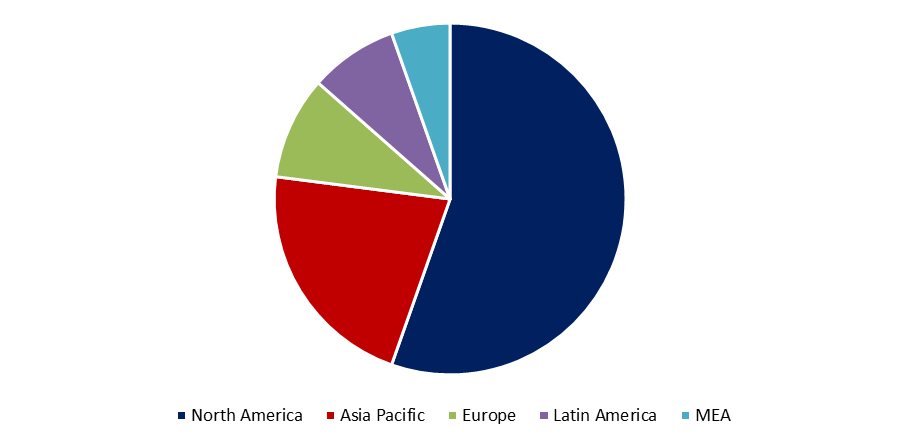

REGIONAL SEGMENTATION OF THE GLOBAL MARKET FOR ELECTRIC BUSES

The global market for electric buses is largely divided into four regions: North America, Europe, Asia-Pacific, and the Middle East and Africa. With a market value of USD 141,96 million in 2021 and expected to reach USD 40,325 million by 2030 at a CAGR of 12.3%, the Asia-Pacific region is the most dominating geographical region. As the world's largest economy, the Asia-Pacific area has good conditions for producing and marketing electric vehicles.

Numerous nations in the region have begun using electric buses for public transportation, and governments are also providing specific incentives, tax exemptions, and subsidies for producing electric vehicles. Due to the existence of key nations such as India, China, Japan, South Korea, etc., the Asia-Pacific region dominates the worldwide electric bus market. With a market value which registered the figures of USD 999 million in 2021 and projected growth to USD 3,880 million by 2030 at a CAGR of 16.60%, Europe is the second-most dominant region after Asia-Pacific.

Get more details on this report -

As the world's automotive centre, Europe boasts the most electric vehicle manufacturing facilities. Numerous European nations employ electric buses for public transit, which is why the region drives the global market for electric buses. North America ranks third on the list of dominating regions in the worldwide electric bus market, with a market share of USD 588 million in 2021 and an expected CAGR of 17.9% to reach USD 2588 million by 2030. Various programmes undertaken by the governments of North American nations, including those of the United States, Canada, and Mexico, promote the use of electric transit buses in the public transportation systems of various nations, such as the United States, Canada, and Mexico. The Middle East and Africa region has the lowest revenue generation, with a market value of USD 125 million in 2021 and projected to grow to USD 1152 million by 2030 at a CAGR of 28%.

COMPETITORS ON THE GLOBAL MARKET FOR ELECTRIC BUSES

The prominent electric bus manufacturers across the globe include AB Volvo, Anhui Ankai Automobile Co., Ltd., Beiqi Foton Motor Co., Ltd., BMW AG, BYD Company Ltd., Daimler AG, Ford Motor Company, General Motors, Honda Motor Co., Ltd., Hyundai Motor Company, Irizar S.C., Iveco SpA, MAN SE, Mitsubishi Motors Corporation, NFI Group Inc., Nissan Motor Corporation, SCANIA AB, Tata Motors, Tesla, Inc., Toyota Motor Corporation, Volkswagen AG, VDL Bus & Coach B.V., and Zhengzhou Yutong Bus Co., Ltd. and others are the leading key participants in the worldwide electric bus industry.

RECENT DEVELOPMENTS BY KEY PLAYERS -

- In July 2020, AB Volvo teamed with the Public Transport Authority of Western Australia (PTA) to introduce the country's first electric buses.

- In July of 2019, Ankai bus joined with the global fintech firm Ideanomics Inc. to collaboratively develop new energy alternatives, including hydrogen-powered buses.

- In October 2020, BYD Company inked a contract with Nobina to deliver 106 BYD electric buses in Finland.

- In September 2020, Daimler AG released eCitaro G, an electric bus with a solid-state battery pack.

SEGMENTATION OF THE GLOBAL ELECTRIC BUS MARKET -

- Based on Propulsion Type:

- BEV

- FCEV

- PHEV

- Based on Output Power –

- Up to 2,550 kW

- Above 250 kW

- Based on Region –

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

Need help to buy this report?