Global Electric Commercial Vehicles Market Size, Share & Trends, Covid-19 Impact Analysis Report, By Product ( Light Commercial Vehicles (LCVs), Buses & Coaches, and Heavy Trucks) By End-user (Mining & Construction, Industrial, Passenger Transportation, Logistics, and Others) By Propulsion Type ( IC Engine, Electric Vehicle) By Power Source (Gasoline, Diesel, HEV / PHEV, Battery Electric Vehicle (BEV), Fuel Cell Vehicle) By Region (North America, Europe, Asia Pacific, Middle East & Africa, and South America), Analysis And Forecast 2021 - 2030

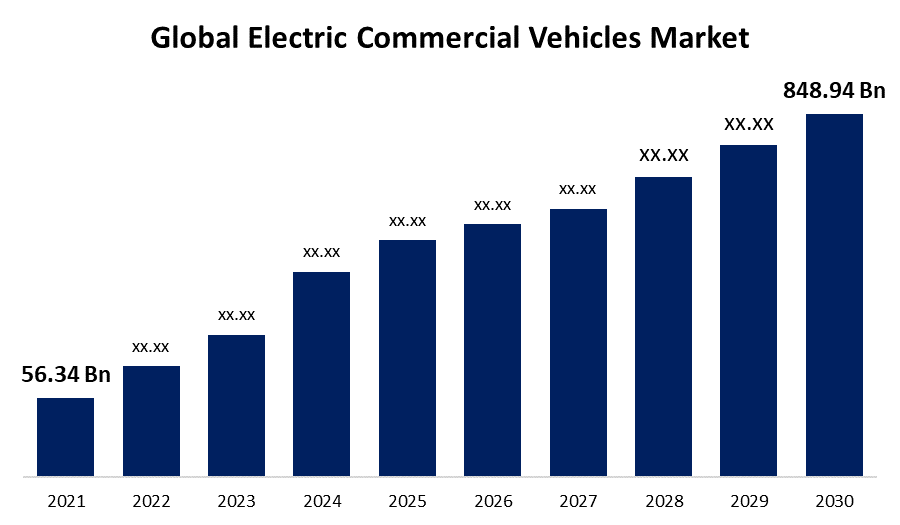

Industry: Automotive & TransportationThe Global Electric Commercial Vehicles Market Size was valued at USD 56.34 Billion in 2021, the Market Size is projected to Grow USD 848.94 Billion in 2030, at a CAGR of 34.4%. Growth is also anticipated to be fueled by the restart of mining operations in several regions of the world, which has increased the demand for tippers. Additionally, the continuous infrastructural development and rising disposable income levels in both developed and emerging nations are expected to support market expansion.

Get more details on this report -

An electric commercial vehicle can run on electricity either totally or partially in place of diesel or gasoline. Since they have fewer moving parts to maintain and consume little to no fossil fuels, electric commercial vehicles are also incredibly cost-effective to operate (petrol or diesel). Fleets of vehicles powered by renewable resources are the new trend for governmental authorities, non-profit organisations, and many private firms encouraging sustainable development. Over the past few years, initiatives for technological advances and innovation in transportation have increased.

Driving Factors

Despite the market's recent sluggish growth, it is anticipated that commercial vehicle sales will go up overall, particularly in developing nations. In the upcoming years, it is projected that digitization and growing infrastructure spending would spur market growth for commercial vehicles. Initially, there was a strong correlation between market development and the expansion of the world economy; however, this connection is breaking down quickly now. Consumer demand for certain transportation options, the incorporation of telematics services, and the expanding acceptance of shared mobility are some of the key themes influencing the growth of the commercial vehicle industry.

Additionally, governments from a number of countries have put in place a range of laws and rules to manage the quantity of the cargo that can be transported in a commercial truck. For instance, the Federal Motor Carrier Safety Administration (FMCSA) in the US was set up to avoid accidents involving commercial trucks that result in fatalities and injuries. In response, the body has set a limit on the size of the cargo that can be transported in these vehicles. The sale of commercial automobiles is then anticipated to boom in the near future.

Global Electric Commercial Vehicles Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 56.34 Billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 34.4% |

| 2030 Value Projection: | USD 848.94 Billion |

| Historical Data for: | 2017 - 2020 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Product, By End-user, By Propulsion Type, By Power Source, By Region |

| Companies covered:: | AB Volvo (Sweden), Tesla (US), Daimler AG (Germany), PACCAR Inc. (US), BYD Company Limited (China), Proterra (US), Scania (Sweden), VDL (Netherlands), CAF (Spain), KING LONG (China), Renault Trucks (France) and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Restraining Factors

The adoption of electric commercial vehicles by medium and large fleet owners is what drives the growth of the global market for electric commercial vehicles. The biggest source of worry for fleet owners is the expensive cost of an electric commercial vehicle and its accessories. Since the heavy-duty commercial vehicle's current battery capacity is insufficient for long-haul trucking applications, which prevents the use of electric commercial vehicles outside of predetermined regional routes, the three main concerns of buyers of electric commercial vehicles are their battery prices, range, and life.

Although the cost of batteries has decreased recently, producers of electric commercial vehicles are still having trouble creating a reliable and inexpensive substitute for ICE commercial cars in the majority of applications. The adoption of electric commercial vehicles is also constrained by the requirement to replace the battery every one to two years. The market adoption of electric commercial vehicles has also been constrained by their lengthy charging times and safety and security concerns around battery explosion in extreme weather and operating circumstances.

COVID 19 Impact

Automakers are taking drastic steps, such as closing plants, to stop the spread of COVID-19 due to the novel coronavirus's ongoing spread throughout the world. As more European businesses halt operations and US and APAC automakers prolong shutdown periods, the scenario is still murky. The governments of the nations are imposing what seem to be progressively stricter restrictions on travel, social engagement, and attendance at work in diverse places. The automotive industry is at the centre of this unrest, which is impeding the development of the global electric commercial vehicle. These regions are going through comparable problems, which is having a noticeable impact on the economy as well as society and producing huge economic disruption.

Segmentation

The global electric commercial vehicles market is segmented into Product, Propulsion Type, Power Source, End User, and Region.

Global Electric Commercial Vehicles Market, By Product

Light Commercial Vehicles (LCVs) held a commanding 78% revenue share in 2021 and are expected to continue holding that position throughout the projected period. The dynamic character of the vehicle, which permits the integration of cutting-edge technologies, makes a significant contribution to the segment's growth. Additionally, the introduction of battery-powered engines and vehicle electrification is anticipated to increase demand for light commercial vehicles in the upcoming years. A significant increase in the industrial sector's growth also drives up LCV demand. The fleet management systems are currently in disarray due to the emergence of smart industries. The necessity for a smart and efficient vehicle has been driven by the requirement for real-time monitoring, tracking, and successfully controlling the product delivery systems. The sale of LCVs is expected to increase dramatically as a result in the near future.

Global Electric Commercial Vehicles Market, By Propulsion Type

The IC engine dominates the global commercial vehicles market in terms of revenue share, but electric vehicles are expected to increase at the quickest rate throughout the forecasted period. Government attempts to promote the use of electric vehicles across all sectors are largely to blame for the market for commercial vehicles' fast rise in this area. Additionally, the environmentally favourable features of electric vehicles aid in reducing pollution levels nationwide.

Global Electric Commercial Vehicles Market, By End Use

In 2021, passenger transportation accounted for a considerable market value share and was anticipated to increase at a profitable 8% annual pace. One of the key elements driving the segment's growth is an increase in transportation spending to increase accessibility and affordability. Other significant factors driving the expansion of passenger transportation in the upcoming years include the rising shared mobility trend and regulations governing fleet traffic on roads.

Global Electric Commercial Vehicles Market, By Region

Get more details on this report -

In the global commercial vehicles market, North America held the largest market value share and was projected to expand significantly over the forecast period. Due to the U.S.'s high rate of commercial vehicle adoption, North America has risen to the top of the worldwide commercial vehicle industry. Some of the key drivers of the market growth in North America are industrial development, infrastructural expansion, and governmental rules governing the maximum carrying capacity for commercial vehicles. The main driver of the region's growth is the significant expansion of the industrial sector together with strict government regulations governing the load carrying capacity of commercial trucks. Additionally, it is anticipated that in the upcoming years, demand for commercial vehicles would increase due to increased acceptance of electric and battery-powered vehicles as well as government programmes to encourage their use in order to reduce carbon emissions.

Recent Developments in Global Electric Commercial Vehicles Market

- May 2021: In order to increase the fleet of vehicles operating in the Barcelona Metropolitan Area, Solaris, a subsidiary of the CAF Group, inked an agreement with the Transports Metropolitans de Barcelona (TMB) to provide 30 Urbino 12 hybrid buses.

- May 2021: With 41 eCanter currently in use on a daily basis, FUSO, a Daimler Trucks brand, became the largest electric fleet customer through a partnership with international logistics service provider DB Schenker.

List of Key Market Players

- AB Volvo (Sweden)

- Tesla (US)

- Daimler AG (Germany)

- PACCAR Inc. (US)

- BYD Company Limited (China)

- Proterra (US)

- Scania (Sweden)

- VDL (Netherlands)

- CAF (Spain)

- KING LONG (China)

- Renault Trucks (France)

Segmentation

By Product

- Light Commercial Vehicles (LCVs)

- Buses & Coaches

- Heavy Trucks

By End-use

- Mining & Construction

- Industrial

- Passenger Transportation

- Logistics

- Others

By Propulsion Type

- IC Engine

- Electric Vehicle

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Middle East & Africa

- South America

Need help to buy this report?