Global Electric Construction Equipment Market Size, Share, and COVID-19 Impact Analysis, By Type (Excavators, Loaders, Cranes, Dozers, and Others), By Battery Type (Lithium Ion, Lead Acid, and Others), By Application (Construction, Mining, Material Handling, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Electric Construction Equipment Market Insights Forecasts to 2033

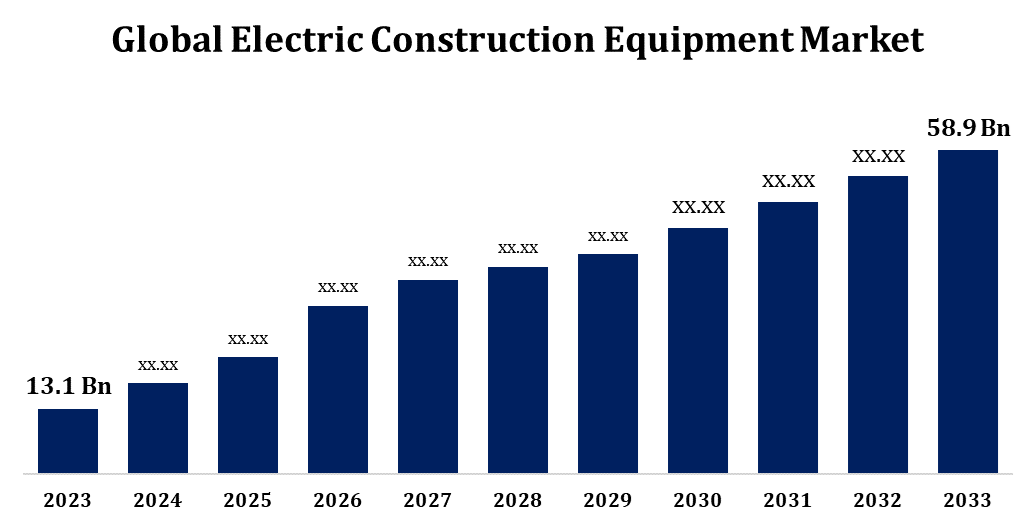

- The Global Electric Construction Equipment Market Size was valued at USD 13.1 Billion in 2023.

- The Market is Growing at a CAGR of 16.22% from 2023 to 2033.

- The Worldwide Electric Construction Equipment Market Size is Expected to reach USD 58.9 Billion By 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Electric Construction Equipment Market Size is Expected to Reach USD 58.9 Billion By 2033, at a CAGR of 16.22% during the forecast period 2023 to 2033

The electric construction equipment market is rapidly evolving, driven by the growing demand for sustainable and energy-efficient solutions. Electric machinery, including excavators, loaders, and cranes, is gaining traction due to stricter emission regulations and increasing fuel costs. Advancements in battery technology, such as higher energy density and faster charging, are enhancing equipment performance and adoption rates. Governments worldwide are incentivizing the transition to electric vehicles in construction through subsidies and grants, further boosting the market. Key players are heavily investing in R&D to introduce innovative and versatile models catering to various construction needs. However, challenges like high upfront costs and limited charging infrastructure persist. Despite this, the market is poised for significant growth, reshaping the future of the construction industry.

Electric Construction Equipment Market Value Chain Analysis

The value chain of the electric construction equipment market encompasses several key stages, from raw material sourcing to end-user applications. It begins with the procurement of essential components like batteries, electric motors, and advanced control systems, often supplied by specialized manufacturers. Equipment manufacturers integrate these components into construction machinery, focusing on design, assembly, and performance optimization. Distributors and dealers play a vital role in bridging manufacturers and end-users, ensuring availability and technical support. Charging infrastructure providers and energy suppliers are integral, offering solutions for operational efficiency. End-users, including construction companies and contractors, drive demand, influenced by regulations and environmental goals. Aftermarket services, such as maintenance and battery recycling, complete the chain. Collaboration across these stages is crucial for seamless adoption and market growth.

Electric Construction Equipment Market Opportunity Analysis

The electric construction equipment market presents significant opportunities driven by environmental concerns, regulatory mandates, and technological advancements. Growing awareness about reducing carbon footprints and strict emission standards are pushing the adoption of electric machinery over traditional diesel-powered equipment. Urbanization and infrastructure development in emerging markets provide a fertile ground for deploying electric construction tools, especially in noise-sensitive areas like residential zones. Advancements in battery technology, such as longer lifespans and faster charging, enhance the feasibility of electric equipment for heavy-duty applications. Government subsidies and incentives for electric vehicle adoption further stimulate market growth. Additionally, the rise of smart construction solutions and integration with IoT and AI technologies create opportunities for enhanced efficiency and automation. These trends position the market for robust growth and innovation.

Global Electric Construction Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 13.1 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 16.22% |

| 2033 Value Projection: | USD 58.9 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 235 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Battery Type, By Application, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Komatsu Ltd. (Japan), Doosan Group (South Korea), Sany Heavy Industries Co., Ltd. (China), Hitachi Construction Machinery Co., Ltd. (Japan), Xuzhou Construction Machinery Group Co., Ltd. (XCMG) Group (China), and other key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Electric Construction Equipment Market Dynamics

Market growth is being propelled by stringent environmental regulations and a strong focus on sustainability goals

The electric construction equipment market is experiencing growth fueled by stringent environmental regulations and an increasing emphasis on sustainability goals. Governments and regulatory bodies worldwide are implementing policies to curb greenhouse gas emissions, making electric equipment a preferred choice over traditional diesel-powered machines. These regulations aim to mitigate air and noise pollution, particularly in urban and environmentally sensitive areas, driving demand for cleaner technologies. Additionally, construction companies are adopting sustainable practices to align with corporate social responsibility and achieve carbon-neutral targets. Innovations in battery technology, combined with renewable energy integration, further support these goals by enhancing operational efficiency and reducing energy consumption. As sustainability becomes a priority across industries, the electric construction equipment market is poised to play a critical role in driving eco-friendly infrastructure development.

Restraints & Challenges

High initial costs of electric machinery, driven by advanced batteries and components, often deter small and medium-sized construction firms. Limited charging infrastructure, particularly in remote or large-scale project sites, poses operational hurdles, affecting adoption rates. Battery performance, including limited runtime and slower charging times compared to refueling diesel equipment, impacts productivity in demanding environments. The need for specialized training to operate and maintain electric equipment adds complexity for companies transitioning to this technology. Additionally, concerns about battery disposal and recycling raise sustainability questions, potentially negating environmental benefits. Manufacturers must address these issues through cost-effective innovations, expanded infrastructure, and robust support systems to overcome barriers and achieve widespread acceptance in the industry.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Electric Construction Equipment Market from 2023 to 2033. The North American electric construction equipment market is gaining momentum, driven by stringent environmental regulations and government incentives promoting clean energy solutions. The United States and Canada are at the forefront, emphasizing the reduction of greenhouse gas emissions from construction activities. Urbanization, coupled with the rising demand for eco-friendly infrastructure, has accelerated the adoption of electric machinery such as excavators, loaders, and cranes. Advancements in battery technology and the expansion of charging infrastructure are further supporting market growth. Additionally, the presence of key manufacturers and increased investments in research and development contribute to innovation and product diversification. However, challenges like high upfront costs and limited availability of charging stations in remote areas persist. Despite this, the region is poised for significant growth as sustainability remains a priority.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The Asia-Pacific electric construction equipment market is experiencing rapid growth, fueled by urbanization, infrastructure development, and stringent environmental policies in key economies like China, India, and Japan. Governments are implementing stricter emission norms and offering subsidies to promote sustainable construction practices. The region’s expanding construction sector, driven by mega infrastructure projects, creates a robust demand for electric machinery such as excavators, loaders, and compact equipment. Advancements in battery technology and the integration of renewable energy sources enhance the feasibility of electric equipment for diverse applications.

Segmentation Analysis

Insights by Type

The excavators segment accounted for the largest market share over the forecast period 2023 to 2033. The excavators segment is emerging as a key growth driver in the electric construction equipment market, supported by rising demand for sustainable and efficient machinery. Electric excavators are gaining traction due to their ability to operate in noise-sensitive and emission-regulated environments, such as urban areas and indoor construction sites. Advancements in battery technology, including higher energy density and faster charging, have improved their operational performance and runtime, making them viable for heavy-duty applications. The segment benefits from growing investments in smart construction and automated technologies, enabling better precision and reduced energy consumption. Governments’ incentives and policies to adopt eco-friendly machinery further bolster the segment's growth. Despite challenges like high upfront costs and limited charging infrastructure, the excavators segment is poised for significant expansion in the shift towards sustainable construction practices.

Insights by Battery Type

The lithium ion segment accounted for the largest market share over the forecast period 2023 to 2033. The lithium-ion battery segment is driving growth in the electric construction equipment market, due to its superior performance, durability, and efficiency. These batteries offer higher energy density, enabling longer runtimes and reduced charging intervals, essential for demanding construction applications. Their lightweight design enhances equipment mobility and operational efficiency compared to traditional lead-acid batteries. Growing advancements in lithium-ion technology, such as improved thermal management and faster charging capabilities, are further boosting their adoption. The segment is also supported by declining battery production costs due to economies of scale and increased demand across various industries. However, challenges such as supply chain dependency for raw materials like lithium and cobalt persist. Despite this, the lithium-ion segment is set to grow, driven by the global shift toward sustainable and energy-efficient construction solutions.

Insights by Application

The construction segment accounted for the largest market share over the forecast period 2023 to 2033. The construction segment is witnessing significant growth within the electric construction equipment market as it shifts towards sustainability and efficiency. Increasingly stringent environmental regulations, along with a focus on reducing carbon emissions, are driving the adoption of electric machinery in construction applications such as excavators, loaders, and cranes. These machines offer benefits like lower operational costs, reduced noise pollution, and zero emissions, which align with the industry’s sustainability goals. Technological advancements, such as improved battery life and integration with smart construction technologies, further enhance their performance and appeal. The expanding urbanization and infrastructure projects across regions like North America, Asia-Pacific, and Europe are providing ample opportunities for electric construction equipment. Despite challenges like high initial costs and limited charging infrastructure, the segment is poised for substantial growth as the industry prioritizes eco-friendly and efficient construction solutions.

Recent Market Developments

- In April 2024, Volvo Construction Equipment (Volvo CE) announced intentions to launch the biggest electric excavator in Japan, highlighting the company's dedication to environmentally friendly and cutting-edge construction equipment. The goal of this launch is to satisfy the rising demand in the Japanese construction sector for environmentally friendly equipment.

Competitive Landscape

Major players in the market

- Komatsu Ltd. (Japan)

- Doosan Group (South Korea)

- Sany Heavy Industries Co., Ltd. (China)

- Hitachi Construction Machinery Co., Ltd. (Japan)

- Xuzhou Construction Machinery Group Co., Ltd. (XCMG) Group (China)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Electric Construction Equipment Market, Type Analysis

- Excavators

- Loaders

- Cranes

- Dozers

- Others

Electric Construction Equipment Market, Battery Type Analysis

- Lithium Ion

- Lead Acid

- Others

Electric Construction Equipment Market, Application Analysis

- Construction

- Mining

- Material Handling

- Others

Electric Construction Equipment Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Electric Construction Equipment Market?The global Electric Construction Equipment Market is expected to grow from USD 13.1 billion in 2023 to USD 58.9 billion by 2033, at a CAGR of 16.22% during the forecast period 2023-2033.

-

2. Who are the key market players of the Electric Construction Equipment Market?Some of the key market players of the market are Ficosa International, S.A.(Spain), Continental AG (Germany), Hirschmann Car Communication GmbH (Germany), West Corporation (US), Ace Technologies Corp. (Korea), Antenova M2M (UK), WORLD PRODUCTS INC.(US), KATHREIN SE (Germany), and Laird (US) and others.

-

3. Which segment holds the largest market share?The construction segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Electric Construction Equipment Market?North America dominates the Electric Construction Equipment Market and has the highest market share.

Need help to buy this report?