Global Electric Coolant Pump Market Size, Share, and COVID-19 Impact Analysis, By Type (Cantilever Pumps, Submersible Pumps, Horizontal Pumps, Vertical Pumps), By End Use (Automotive, Aerospace, Marine, Industrial), By Cooling Method (Air-Cooled, Liquid-Cooled, Chiller-Based), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Electric Coolant Pump Market Insights Forecasts to 2033

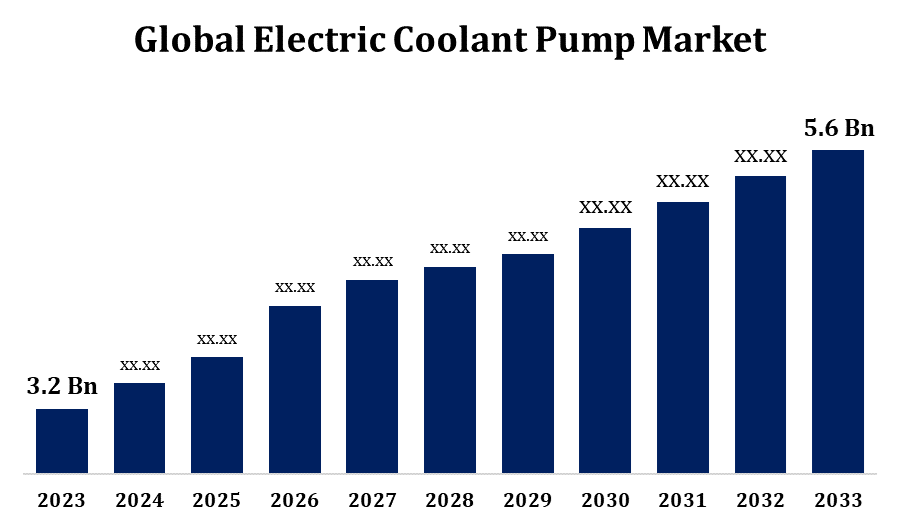

- The Global Electric Coolant Pump Market Size was valued at USD 3.2 Billion in 2023.

- The Market is Growing at a CAGR of 5.76% from 2023 to 2033.

- The Worldwide Electric Coolant Pump Market Size is Expected to reach USD 5.6 Billion By 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Electric Coolant Pump Market Size is Expected to reach USD 5.6 Billion by 2033, at a CAGR of 5.76% during the forecast period 2023 to 2033.

The electric coolant pump market is experiencing rapid growth, driven by the increasing adoption of electric and hybrid vehicles, which require efficient thermal management systems. These pumps replace traditional mechanical pumps, offering advantages such as improved energy efficiency, reduced emissions, and enhanced performance. The rising focus on environmental sustainability and stringent emission regulations worldwide further propels market demand. Additionally, the integration of electric coolant pumps in advanced industrial and agricultural machinery boosts their adoption across sectors. Emerging trends include smart, digitally controlled pumps and lightweight designs, which align with the growing push for energy efficiency. Asia-Pacific dominates the market due to high vehicle production and technological advancements, while Europe and North America also contribute significantly with their focus on electrification and green technologies.

Electric Coolant Pump Market Value Chain Analysis

The value chain of the electric coolant pump market encompasses several stages, from raw material procurement to end-user applications. It begins with sourcing raw materials like metals, polymers, and electronic components required for manufacturing pump housings, impellers, and control units. Component suppliers play a crucial role in providing sensors, motors, and electronics. Manufacturers then design and assemble electric coolant pumps, incorporating advanced technologies for energy efficiency and durability. Distributors and OEMs act as intermediaries, delivering products to automotive, industrial, and agricultural machinery sectors. The aftermarket services, including maintenance and repair, add further value. The chain is influenced by innovation, with R&D investments enabling lightweight designs, IoT integration, and smart thermal management solutions. Regulatory frameworks and customer demands drive efficiency and sustainability throughout the value chain.

Electric Coolant Pump Market Opportunity Analysis

The electric coolant pump market offers significant growth opportunities, driven by the transition to electric and hybrid vehicles and the global focus on sustainable mobility. Rising adoption of advanced thermal management solutions in electric drivetrains creates a demand for efficient and digitally controlled pumps. Developing economies, particularly in Asia-Pacific, present opportunities due to increasing automotive production and urbanization. Technological advancements, such as smart pumps with IoT capabilities, enable real-time monitoring, enhancing operational efficiency and predictive maintenance. Additionally, industrial and agricultural applications are expanding, leveraging electric pumps for energy efficiency and reduced emissions. As governments enforce stricter emission regulations and promote green initiatives, manufacturers can capitalize on these trends by developing eco-friendly, high-performance solutions. Collaboration with OEMs and aftermarket service providers further amplifies market potential.

Global Electric Coolant Pump Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.2 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.76% |

| 2033 Value Projection: | USD 5.6 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 227 |

| Tables, Charts & Figures: | 108 |

| Segments covered: | By Type, By End Use, By Cooling Method, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Calsonic Kansei, Dana Incorporated, Kohler, Magna International, Aisin Seiki, Robert Bosch, SHW AG, Denso, Aptiv, Continental, Aperam, Gates Corporation, Xiangtan Electric Manufacturing Group, Johnson Electric, Valeo, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Electric Coolant Pump Market Dynamics

Benefit of electric coolant pumps over mechanical ones in terms of technology

Electric coolant pumps bring a technological edge over mechanical pumps, especially in the evolving electric coolant pump market. Their ability to operate independently of engine speed allows precise, demand-based coolant flow control, enhancing thermal management efficiency. This leads to reduced energy consumption and improved system reliability. Unlike mechanical pumps, electric variants support integration with advanced electronic control systems, enabling smart monitoring and real-time performance adjustments. This adaptability is crucial for electric and hybrid vehicles, which require efficient thermal regulation for batteries and power electronics. Additionally, electric pumps are quieter, more compact, and lighter, simplifying vehicle design and assembly. Their compatibility with emerging technologies like IoT and predictive maintenance further strengthens their market position, offering a modern, sustainable solution for advanced cooling needs.

Restraints & Challenges

High initial costs of electric pumps compared to mechanical ones can deter adoption, particularly in cost-sensitive markets. Limited awareness and technical expertise regarding advanced cooling systems in developing regions further hinder market penetration. The integration of electric pumps into complex vehicle systems requires sophisticated engineering and compatibility with existing components, adding to development time and costs. Additionally, reliance on raw materials like rare earth metals for motors can lead to supply chain disruptions and price volatility. The evolving regulatory landscape and the need for compliance with stringent environmental standards add complexity to manufacturing. Moreover, intense competition among players demands continuous innovation, making it challenging for smaller companies to sustain and compete effectively.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Electric Coolant Pump Market from 2023 to 2033. The North American electric coolant pump market is poised for significant growth, driven by the region's strong automotive industry and increasing adoption of electric and hybrid vehicles. Stringent emission regulations, such as those enforced by the Environmental Protection Agency (EPA) and Corporate Average Fuel Economy (CAFE) standards, encourage the adoption of efficient thermal management systems like electric coolant pumps. Technological advancements and the integration of smart pumps in electric vehicle (EV) designs further propel market demand. The growing focus on sustainability and energy efficiency among consumers and manufacturers supports market expansion. The presence of leading automakers and a well-established aftermarket service network provides additional growth opportunities.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The Asia-Pacific electric coolant pump market is witnessing robust growth, fueled by the region's dominance in automotive production and rapid adoption of electric and hybrid vehicles. China, Japan, and South Korea lead in EV manufacturing, supported by government initiatives promoting clean energy and reducing carbon emissions. The region's expanding industrial and agricultural sectors also drive demand for electric coolant pumps in machinery requiring efficient thermal management. Technological advancements and investments in R&D by key players further enhance market potential. Moreover, the growing urbanization and increasing disposable income boost vehicle ownership, propelling market growth. However, challenges such as high initial costs and limited awareness in developing countries may hinder adoption. Nonetheless, Asia-Pacific remains a critical hub for innovation and market expansion in the electric coolant pump industry.

Segmentation Analysis

Insights by Type

The Cantilever Pumps segment accounted for the largest market share over the forecast period 2023 to 2033. The cantilever pumps segment in the electric coolant pump market is experiencing notable growth due to their unique design and operational advantages. Unlike traditional pumps, cantilever pumps operate without bearings or seals in the liquid zone, reducing maintenance requirements and enhancing durability. This makes them ideal for applications requiring reliability in handling corrosive or abrasive fluids, such as in industrial machinery and advanced cooling systems. The segment benefits from the increasing demand for energy-efficient and low-maintenance solutions across automotive and non-automotive sectors. Cantilever pumps are particularly suited for heavy-duty environments and applications requiring robust thermal management. Rising adoption of electric and hybrid vehicles further accelerates growth, as these pumps align with advanced cooling needs. Innovations in materials and smart technologies continue to expand their applicability and market appeal.

Insights by Cooling Method

The Air-Cooled segment accounted for the largest market share over the forecast period 2023 to 2033. Air-cooled electric pumps are often favored in applications where liquid cooling systems are impractical or cost-prohibitive. They are typically used in automotive, industrial, and HVAC systems where space constraints and cooling efficiency are key concerns. In the automotive sector, particularly in electric and hybrid vehicles, air-cooled pumps offer a lightweight and energy-efficient alternative for managing the thermal needs of electric drivetrains and batteries. As the market shifts toward sustainable and low-maintenance solutions, air-cooled pumps are gaining traction due to their simplicity, reduced environmental impact, and ability to function without requiring additional fluids. This segment is poised for growth, especially in regions with high adoption of electric vehicles and eco-friendly technologies.

Insights by End Use

The automotive segment accounted for the largest market share over the forecast period 2023 to 2033. The automotive segment is driving significant growth in the electric coolant pump market, fueled by the global shift toward electric and hybrid vehicles. These pumps play a critical role in managing the thermal demands of electric drivetrains, batteries, and internal components, ensuring optimal performance and longevity. Stringent emission regulations and a growing focus on fuel efficiency are prompting automakers to adopt electric coolant pumps over traditional mechanical ones. Their precise, demand-based operation reduces energy consumption and enhances vehicle efficiency. The increasing production of passenger and commercial electric vehicles, particularly in regions like Asia-Pacific, Europe, and North America, further accelerates demand. Innovations such as smart pumps with IoT integration enhance reliability and performance, solidifying their importance in modern automotive thermal management systems.

Recent Market Developments

- In February 2024, Schaeffler AG's Automotive Aftermarket division has expanded its INA brand product portfolio to include high-quality auxiliary electric water pumps that meet the stringent standards of leading OEMs.

Competitive Landscape

Major players in the market

- Calsonic Kansei

- Dana Incorporated

- Kohler

- Magna International

- Aisin Seiki

- Robert Bosch

- SHW AG

- Denso

- Aptiv

- Continental

- Aperam

- Gates Corporation

- Xiangtan Electric Manufacturing Group

- Johnson Electric

- Valeo

- Others

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Electric Coolant Pump Market, Type Analysis

- Cantilever Pumps

- Submersible Pumps

- Horizontal Pumps

- Vertical Pump

Electric Coolant Pump Market, Cooling Method Analysis

- Air-Cooled

- Liquid-Cooled

- Chiller-Based

Electric Coolant Pump Market, End Use Analysis

- Automotive

- Aerospace

- Marine

- Industrial

Electric Coolant Pump Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Electric Coolant Pump Market?The Global Electric Coolant Pump Market Size is Expected to Grow from USD 3.2 Billion in 2023 to USD 5.6 Billion by 2033, at a CAGR of 5.76% during the forecast period 2023-2033.

-

2. Who are the key market players of the Electric Coolant Pump Market?Some of the key market players of the market are Calsonic Kansei, Dana Incorporated, Kohler, Magna International, Aisin Seiki, Robert Bosch, SHW AG, Denso, Aptiv, Continental, Aperam, Gates Corporation, Xiangtan Electric Manufacturing Group, Johnson Electric, Valeo.

-

3. Which segment holds the largest market share?The automotive segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Electric Coolant Pump Market?North America dominates the Electric Coolant Pump Market and has the highest market share.

Need help to buy this report?