Global Electric Insulator Market Size, Share, and COVID-19 Impact Analysis, By Material (Glass, Ceramic/Porcelain, Composites, and Others), By Category (Bushings and Other Insulators), By Installation (Transmission Lines, Substations Railways, Distribution Networks, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Energy & PowerGlobal Electric Insulator Market Insights Forecasts to 2033

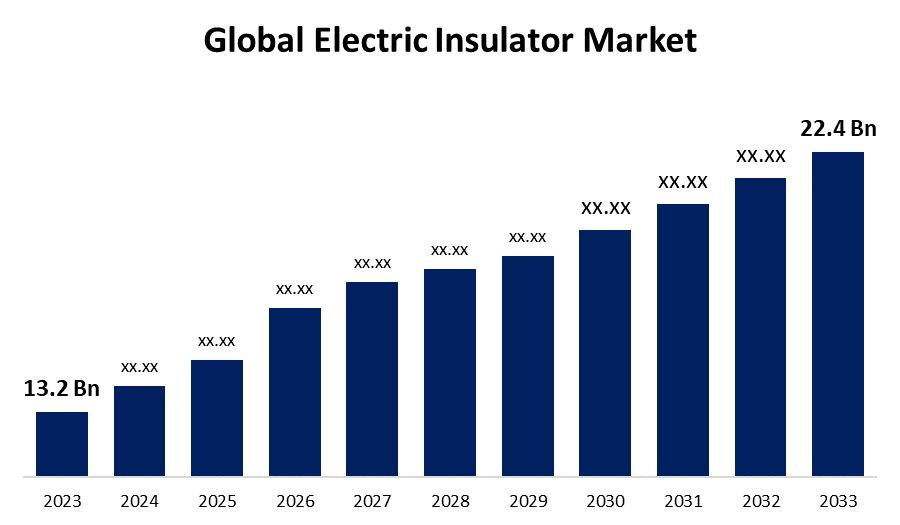

- The Global Electric Insulator Market Size was Valued at USD 13.2 Billion in 2023

- The Market Size is Growing at a CAGR of 5.4% from 2023 to 2033

- The Worldwide Electric Insulator Market Size is Expected to Reach USD 22.4 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Electric Insulator Market Size is Anticipated to Exceed USD 22.4 Billion by 2033, Growing at a CAGR of 5.4% from 2023 to 2033.

Market Overview

An electrical insulator is a material in which electrical current cannot readily flow. The atoms of the insulator have tightly bound, immobile electrons. In other words, an insulator's valence shell contains no free electrons. Conductors and semiconductors allow for a greater degree of electrical current flow than other materials. When an insulator's resistivity is greater than that of a semiconductor or a conductor, it can be recognized. The majority of non-metals are regarded as insulators. Electrical insulators include but are not limited to, plastic, rubber, wax, glass, bakelite, ceramics, mica, porcelain, quartz, and so on.

For instance, in September 2023, the newly designed volt tough line of electrical insulation tape solutions was launched from Avery Dennison Performance Tapes. This cutting-edge product is a single-sided film tape that is electrically insulative and designed to solve the problems associated with inadequate electrical insulation in electric vehicle battery packs.

The market for high-voltage electric insulators is expected to rise as a result of the steady development of high-voltage transmission networks and continuous improvements in grid infrastructure. The deployment of significant wind and solar energy projects, along with a paradigm shift toward renewable energy generation, is expected to further propel the growth of the electric insulator market.

Report Coverage

This research report categorizes the market for the global electric insulator market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global electric insulator market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global electric insulator market.

Global Electric Insulator Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 13.2 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.4% |

| 2033 Value Projection: | USD 22.4 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 187 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Material, By Category, By Installation, By Region. |

| Companies covered:: | Hubbell Power Systems, Modern Insulators, NGK Insulators, Ltd., INCAP, TE Connectivity, Seves Group, Hitachi Energy, Aditya Birla Insulators, BHEL, Zhengzhou Orient Power, Olectra Greentech, Almatis GmbH, Elsewedy Electric, GE Grid Solutions, MacLean-Fogg Company, Siemens AG, ABB Ltd and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market is expanding mostly due to the quickening pace of power infrastructure development and the rising electricity demand. The requirement for electrical infrastructure is also being accelerated by the rising rates of industrialization and urbanization, which is favorable for the electric insulator industry. The United States government has undertaken the task of updating, renovating, and modernizing its outdated electrical infrastructure. For illustration, in May 2024, The U.S. Energy Information Administration (EIA) predicted in its Short-Term Energy Outlook (STEO) that power consumption in the country will reach all-time highs in 2024 and 2025. According to EIA projections, power demand is expected to increase to 4,159 billion kWh in 2025 and 4,103 billion kWh in 2024. In contrast, 2023 will see 4,000 billion kWh and 2022 will see a record 4,067 billion kWh. According to the EIA, power sales in 2024 are expected to reach 1,510 billion kWh for residential consumers, 1,396 billion kWh for commercial customers, and 1,048 billion kWh for industrial customers. This increase can be attributed to the growing demand from data centers as well as the increased use of electricity by homes and businesses in place of fossil fuels for transportation and heat.

Restraining Factors

There are both organized and unorganized players/sectors in the electric insulator industry. While players in the unorganized sector offer less expensive alternatives to boost their market presence and break into local markets, the organized sector primarily targets industrial buyers and maintains excellent product quality. Leading market companies must contend with fierce competition from unorganized players that offer low-cost, low-quality products. These unorganized market competitors outperform the major firms in terms of price competitiveness and the local supply networks they maintain, which are challenging for multinational players to attain. Since low-quality products are being offered under the names of market leaders, the growth in sales of electric insulators on the grey market damages their brands. The chances for the global players to grow their revenues (market shares) are diminished by the rising sales of both local and gray market participants.

Market Segmentation

The global electric insulator market share is segmented into material, category, and installation.

- The ceramic/porcelain segment dominates the market with the largest market share through the forecast period.

Based on the material, the global electric insulator market is segmented into glass, ceramic/porcelain, composites, and others. Among these, the ceramic/porcelain segment dominates the market with the largest market share through the forecast period. Due to their superior electrical and mechanical qualities, which make them appropriate for high-voltage applications. Without ceramics, the global electronics industry, valued at over $4.5 trillion, would not be possible. In items like smartphones, computers, televisions, automobile electronics, and medical equipment, ceramic-based components are essential. Ceramic and porcelain insulators are commonly utilized. In contrast to glass, which conducts more electricity at higher temperatures and whose dielectric constant increases with temperature, these insulators often have greater dielectric constants that do not change significantly with temperature.

- The bushings segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the category, the global electric insulator market is segmented into bushings and other insulators. Among these, the bushings segment is anticipated to grow at the fastest CAGR growth through the forecast period. Due to they offer support and insulation where power lines or conductors go through obstacles like walls, enclosures, or transformers, bushings are essential components of electrical systems. There are several reasons for the bushings segment's growth. The growing need for dependable and effective electricity distribution and transmission networks is one major motivator.

- The distribution networks segment accounted for the largest revenue share through the forecast period.

Based on the installation, the global electric insulator market is segmented into transmission lines, substations railways, distribution networks, and others. Among these, the distribution networks segment accounted for the largest revenue share through the forecast period. The effective and dependable transportation of power, which fuels the need for insulators, is greatly dependent on these systems. One of the main drivers of market expansion is the distribution networks segment. At the local level, there is a growing need for power due to ongoing urbanization and population growth. Substations provide electricity to households, businesses, and industries through distribution networks.

Regional Segment Analysis of the Global Electric Insulator Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the global electric insulator market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global electric insulator market over the predicted timeframe. The most populous region in the globe, Asia-Pacific, is home to several developing and economically disadvantaged nations. It is also home to a growing population and a significant number of large cities. China and India are the region's two principal revenue-generating countries. The expanding population increases the need for electricity and consequently for passive electrical components such as insulators. In the future years, market expansion is anticipated to be driven by the rising demand for smart cities and smart grids.

With a budget of Rs. 3,03,758 crore spread over five years, from FY 2021–2022 to FY 2025–2026, the Central Government of India has approved the Revamped Distribution Sector Scheme, a Reforms and Results linked scheme, to enhance the quality, dependability, and affordability of power supply to consumers through an operationally and financially sustainable distribution sector. Except for Private Sector DISCOMs, the Scheme seeks to improve the operational efficiencies and financial sustainability of all DISCOMs/Power Departments to reduce AT&C losses to pan-India levels of 12–15% and the ACS-ARR gap to zero by 2024–25. Funds for pre-paid smart metering, system metering, and distribution infrastructure improvements for loss reduction and modernization would be available to DISCOMs and Power Departments under the scheme.

North America is expected to grow at the fastest CAGR growth of the global electric insulator market during the forecast period. The growing demand for energy in the US is expected to propel the market for electric insulators in this nation. It is anticipated that this will increase demand for efficient energy transmission and distribution. It is anticipated that electric insulators will be the best option for ensuring secure electrical flow and averting transformer leakage currents. Growth is anticipated to be supported by an increase in the need for transformers to step down or raise voltage levels. Growth is expected to accelerate as electricity providers in the US place a greater emphasis on safety and dependability. They are working tirelessly to equip electric insulators with transformers to improve their performance. They are developing novel insulators that can withstand high temperatures, humidity, and pollution.

In 2023, the United States recorded one of the highest levels of electricity consumption throughout the time under review, with 4,000 terawatt-hours consumed. The figures show energy end usage, which is the total of the producing entity's direct electrical use and retail sales. It is anticipated that American electricity usage will rise during the coming decades.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global electric insulator market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hubbell Power Systems

- Modern Insulators

- NGK Insulators, Ltd.

- INCAP

- TE Connectivity

- Seves Group

- Hitachi Energy

- Aditya Birla Insulators

- BHEL

- Zhengzhou Orient Power

- Olectra Greentech

- Almatis GmbH

- Elsewedy Electric

- GE Grid Solutions

- MacLean-Fogg Company

- Siemens AG

- ABB Ltd

- Otheres.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

• In April 2024, The glass-reinforced Windform thermoplastic composites from CRP Technologies have been shown to offer favorable electrical insulating qualities for 3D printing using Selective Laser Sintering (SLS).

• In March 2024, To create an electronic switch that is more efficient than a transistor, researchers at the Indian Institute of Science (IISc) worked with scientists from Japan, Denmark, and the United States to develop a synthetic material design that allows them to control the temperature at which a material can overcome electronic "traffic jams," or the transition from an electricity insulator to a conductor.

• In March 2024, Two portable, lightweight (1.3 kg) insulation resistance testers from Fluke are now available for testing up to 2500 V (DC) quickly, accurately, and dependably. For industrial electricians, maintenance technicians, electrical engineers, and field service engineers aiming to streamline front-line troubleshooting and boost efficiency, the high-voltage 1535 and 1537 Insulation Resistance Testers are perfect.

• In December 2022, An upgrade to its previous V PLUS PerformTM polyurethane technology for insulated metal panels, V PLUS Perform next was unveiled by Dow. The product combines V PLUS PerformTM's high-performance energy efficiency and fire safety features with low-carbon and circular ingredients that are made to order.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global electric insulator market based on the below-mentioned segments:

Global Electric Insulator Market, By Material

- Glass

- Ceramic/Porcelain

- Composites

- Others

Global Electric Insulator Market, By Category

- Bushings

- Other Insulators

Global Electric Insulator Market, By Installation

- Transmission Lines

- Substations Railways

- Distribution Networks

- Others

Global Electric Insulator Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?Hubbell Power Systems, Modern Insulators, NGK Insulators, Ltd., INCAP, TE Connectivity, Seves Group, Hitachi Energy, Aditya Birla Insulators, BHEL, Zhengzhou Orient Power, Olectra Greentech, Almatis GmbH, Elsewedy Electric, GE Grid Solutions, MacLean-Fogg Company, Siemens AG, ABB Ltd, and Others.

-

2. What is the size of the global electric insulator market?The Global Electric Insulator Market Size is Expected to Grow from USD 13.2 Billion in 2023 to USD 22.4 Billion by 2033, at a CAGR of 5.4% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?Asia Pacific is anticipated to hold the largest share of the global electric insulator market over the predicted timeframe.

Need help to buy this report?