Global Electric Traction Motor Market Size, Share, and COVID-19 Impact Analysis, By Type (AC and DC), By Power Rating (Below 200 kW, 200-400 kW, and Above 400 kW), By Application (Railways, Electric Vehicle, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Energy & PowerGlobal Electric Traction Motor Market Insights Forecasts to 2032

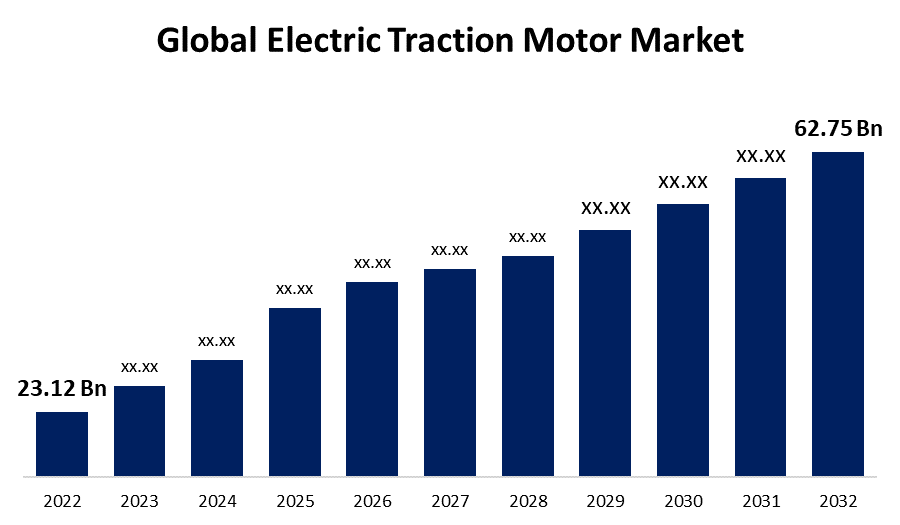

- The Global Electric Traction Motor Market Size was valued at USD 23.12 Billion in 2022.

- The Market Size is Growing at a CAGR of 10.5% from 2022 to 2032

- The Worldwide Electric Traction Motor Market Size is expected to reach USD 62.75 Billion by 2032

- Europe is expected to grow the significant during the forecast period

Get more details on this report -

The Global Electric Traction Motor Market Size is expected to reach USD 62.75 Billion by 2032, at a CAGR of 10.5% during the forecast period 2022 to 2032.

Market Overview

An electric traction motor is a crucial component in electric vehicles (EVs) and hybrid electric vehicles (HEVs) that converts electrical energy into mechanical energy to propel the vehicle. It plays a significant role in providing efficient and sustainable transportation solutions. Typically powered by batteries or fuel cells, the electric traction motor operates by utilizing the principles of electromagnetism. When electric current flows through the motor windings, a magnetic field is generated, which interacts with permanent magnets or electromagnets, resulting in rotational motion. These motors offer numerous advantages such as high torque, instant acceleration, regenerative braking, and low maintenance requirements. As the demand for environmentally friendly transportation increases, the development and optimization of electric traction motors continue to advance, driving the transition toward a greener future.

Report Coverage

This research report categorizes the market for electric traction motor market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the electric traction motor market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the electric traction motor market.

Global Electric Traction Motor Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022 : | USD 23.12 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 10.5% |

| 2032 Value Projection: | USD 62.75 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | Schneider Electric SE, The Curtiss-Wright Corporation, Prodrive Technologies, Toshiba Corporation, General Electric Co., CG Power & Industrial Solutions Ltd., Aisin, ABB, Ltd., Alstom S.A., Siemens AG, Delphi Automotive LLP, Voith GmbH, Mitsubishi Electric Corporation, Bombardier Inc., American Traction Systems, VEM Group, Caterpillar Inc., Kawasaki Heavy Industries Ltd., Traktionssysteme Austria GmbH, Hyundai Rotem Company, Hitachi, Ltd., Ansaldo Signalling, Magna Internationa |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The electric traction motor market is driven by several factors that contribute to its growth and adoption. The increasing concerns about environmental sustainability and the need to reduce greenhouse gas emissions have prompted a shift towards electric vehicles, thereby boosting the demand for electric traction motors. Government regulations and incentives promoting the use of electric vehicles also play a significant role in market growth. Additionally, advancements in battery technology, improving energy density and reducing costs, have made electric vehicles more viable and attractive to consumers. The growing infrastructure for electric vehicle charging stations further supports the market. Moreover, rising consumer awareness about the benefits of electric vehicles, such as lower operating costs and reduced dependence on fossil fuels, is driving the demand for electric traction motors. Overall, the continuous research and development efforts by manufacturers to enhance motor efficiency, power density, and reliability contribute to the market's expansion.

Restraining Factors

While the electric traction motor market shows promising growth prospects, it also faces certain restraints. One significant restraint is the high initial cost of electric vehicles, mainly due to expensive battery technology and the complex manufacturing processes associated with electric traction motors. Limited driving range and the need for frequent charging infrastructure pose challenges to consumer adoption. Additionally, the availability and accessibility of charging stations are still limited in many regions, hindering the widespread adoption of electric vehicles. Concerns regarding the disposal and recycling of batteries also pose environmental challenges. Furthermore, the lack of standardization in charging protocols and connector types adds complexity to the charging infrastructure, impacting the market's growth. Overcoming these restraints requires continuous technological advancements, supportive policies, and infrastructure development.

Market Segmentation

- In 2022, the AC segment accounted for around 74.8% market share

On the basis of the type, the global electric traction motor market is segmented into AC and DC. The alternating current (AC) segment currently holds the largest market share in the electric traction motor market. This can be attributed to numerous advantages such as high-power density, improved efficiency, and compact size, making them well-suited for electric vehicles. They are capable of delivering high torque at low speeds, which is crucial for smooth acceleration and driving performance. Additionally, AC motors are relatively simpler in design and have fewer components compared to DC (direct current) motors, leading to lower manufacturing costs. Furthermore, advancements in motor control technologies, such as vector control and sensorless control, have further enhanced the performance and efficiency of AC motors. The widespread availability of AC charging infrastructure and compatibility with grid power supply also favor the adoption of AC motors in electric vehicles. These factors combined have propelled the AC segment to hold the largest market share in the electric traction motor market.

- The 200-400 kW segment is expected to grow at a CAGR of around 8.6% during the forecast period

Based on the power rating, the global electric traction motor market is segmented into below 200 kW, 200-400 kW, and above 400 kW. The 200-400 kW segment is anticipated to witness substantial growth during the forecast period in the electric traction motor market. This growth can be attributed to several factors driving the demand for electric vehicles with higher power ratings. The rising popularity of electric SUVs, performance-oriented electric sports cars, and electric commercial vehicles necessitates higher power outputs in the 200-400 kW range. Additionally, advancements in motor technology have made it more feasible to achieve higher power ratings within this segment while maintaining efficiency and compactness. Furthermore, improvements in battery technology and charging infrastructure support the development of electric vehicles with longer driving ranges and higher power requirements. The growing consumer demand for electric vehicles with enhanced performance and driving experience is expected to propel the growth of the 200-400 kW segment in the electric traction motor market.

Regional Segment Analysis of the Electric Traction Motor Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific dominated the market with more than 46.2% revenue share in 2022.

Get more details on this report -

Based on region, Asia-Pacific currently holds the largest market share in the electric traction motor market, and this dominance is expected to continue during the forecast period. Several factors contribute to Asia-Pacific's leading position. The region is home to some of the world's largest automotive markets, such as China, Japan, and South Korea, which have witnessed a significant increase in the adoption of electric vehicles. The supportive government policies and incentives aimed at promoting electric vehicle sales in these countries have further fueled the market growth. Additionally, Asia-Pacific is a hub for electric vehicle component manufacturing, including electric traction motors, benefiting from cost-effective production and supply chains. Furthermore, the region's robust infrastructure development, including charging networks, supports the widespread adoption of electric vehicles. The continuous technological advancements, investments in research and development, and collaborations between automotive manufacturers and technology companies in the region also contribute to its substantial market share.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global electric traction motor market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Schneider Electric SE

- The Curtiss-Wright Corporation

- Prodrive Technologies

- Toshiba Corporation

- General Electric Co.

- CG Power & Industrial Solutions Ltd.

- Aisin

- ABB, Ltd.

- Alstom S.A.

- Siemens AG

- Delphi Automotive LLP

- Voith GmbH

- Mitsubishi Electric Corporation

- Bombardier Inc.

- American Traction Systems

- VEM Group

- Caterpillar Inc.

- Kawasaki Heavy Industries Ltd.

- Traktionssysteme Austria GmbH

- Hyundai Rotem Company

- Hitachi, Ltd.

- Ansaldo Signalling

- Magna International

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2022, ABB India has recently declared the opening of its newly expanded factory for digital substation products and systems in Vadodara, Gujarat. Situated in ABB India's largest manufacturing campus, the state-of-the-art facility aims to cater to the increasing demand for a diverse array of digital substation products and solutions not only in India but also in over 50 countries worldwide.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global electric traction motor market based on the below-mentioned segments:

Electric Traction Motor Market, By Type

- AC

- DC

Electric Traction Motor Market, By Power Rating

- Below 200 kW

- 200-400 kW

- Above 400 kW

Electric Traction Motor Market, By Application

- Railways

- Electric Vehicle

- Others

Electric Traction Motor Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?