Global Electric Utility Vehicle Market Size, Share, and COVID-19 Impact Analysis, By Propulsion (Hybrid Electric, Pure Electric), By Application (Industrial, Agricultural, Sports, Passenger Commute, Commercial Transport, Recreation, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 – 2030

Industry: Automotive & TransportationGlobal Electric Utility Vehicle Market Insights Forecasts to 2030

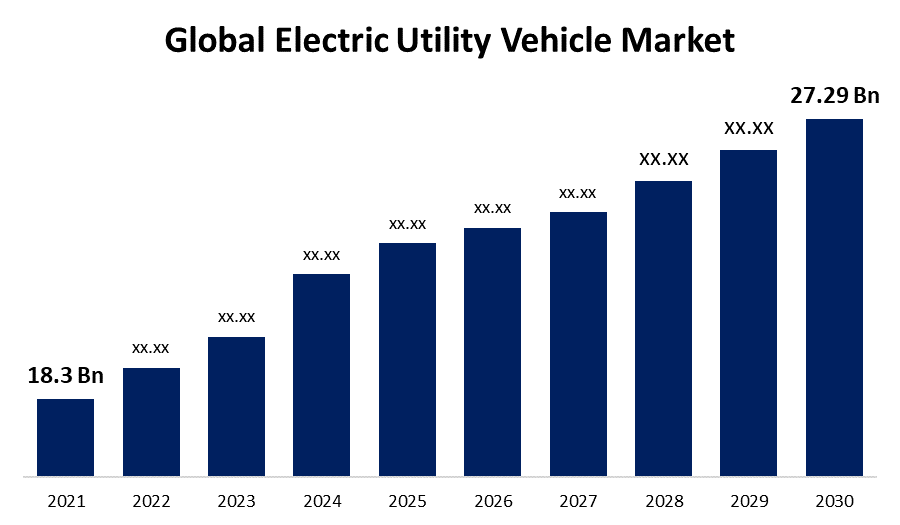

- The Global Electric Utility Vehicle Market Size was valued at USD 18.3 Billion in 2021.

- The Market is Growing at a CAGR of 4.9% from 2021 to 2030

- The Worldwide Electric Utility Vehicle Market is expected to reach USD 27.29 Billion by 2030

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Electric Utility Vehicle Market Size is expected to reach USD 27.29 Billion by 2030, at a CAGR of 4.9% during the forecast period 2021 to 2030. Electric vehicles (EVs) have become progressively predominant as primary vehicles since they have low pollutants, cheaper energy options, and lower maintenance requirements. In recent years, the global market for low-emission utility vehicles has developed dramatically. The market for electric utility and shuttle carts is also anticipated to increase more quickly than that of other utility power vehicles due to the rapid installation of charging stations across the world.

A utility vehicle (UTV) is a commercial vehicle designed primarily for businesses and individuals who want high levels of quality, dependability, and performance. They are primarily intended to be a replacement for standard utility terrain vehicles driven by engines with internal combustion.

The introduction of contemporary and enhanced electric utility vehicles that can operate in unique settings where security is essential, such as chemical plants, oil refineries, and other types of hazardous areas, is driving the global electric utility vehicle market forward. A normal combustion engine cannot work in these settings due to safety concerns concerning explosion risk.

Depending on the type of user, this vehicle typically performs the following tasks: Electric UTVs are typically purchased by government agencies for street cleaning, waste management, and park maintenance. Additionally, because this vehicle emits no micro pollutants, neither environmental nor noise, it can be driven in enclosed places and on streets with emission limitations, especially in urban areas.

COVID-19 Impact Electric Utility Vehicle Market

The COVID-19 pandemic's effects have disrupted the supply chain, resulting in low markdowns of commercial vehicles and a temporary halt to vehicle production globally. This has decreased utility vehicle demand globally. Even though, while sales of electric vehicles were adversely affected in the brief term due to the pandemic, the industry is expected to rebound with faster productivity than the preceding year, attributed to the continuous rise in fuel prices and rise in understanding of the environmental greenhouse gasses, as well as the availability of funding by successive governments.

Global Electric Utility Vehicle Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 18.3 Billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 4.9% |

| 2030 Value Projection: | USD 27.29 Billion |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Propulsion, By Application, By Region, COVID-19 Impact Analysis |

| Companies covered:: | Polaris, Bollinger Motors Inc., Club Car, Star EV Corporation, Ford Motor Company, Hyundai Motor Company, Toyota Industries Corporation, NAVYA, Alke, E-Z-GO, John Deere, Marshell Green Power, Tesla, Inc., Textron, Addax Motors, Garia Utility, Guangdong Lvtong, EsagonoGastone, Mahindra Electric Mobility Limited |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Key Driving Factors

The increased demand for warehouses in the e-commerce, automotive component manufacturing, consumer products, and electronics sectors is driving up the number of storage facilities for each region. As a result of the growing number of onsite storage facilities, the market for commercial electric utility vehicles is expected to increase. Furthermore, as the number of storage facilities increases and material handling becomes more common, there will be a higher demand for efficient electric forklifts.

By facilitating battery swapping at EV charging stations, an emergence, and development minimizes the amount of time required for rechargeable batteries for users of electric utility vehicles. The swapping stations will help lower the initial cost of electric utility cars by replacing battery purchasing with battery leasing. Furthermore, the development of electric utility vehicles contributes to the goal of lowering carbon emissions and mitigating the effects of climate change. The electrification of transportation is expected to initiate more opportunities for utility vehicles to augment consumer interaction. As a result, the increasing emphasis of automobile manufacturers on reducing escalating greenhouse gas emissions is expected to increase demand for electric utility vehicles throughout the forecast period.

Restraining Factors

Increasing limitations such as the requirement for greater capacity battery packs for long-haul trucks and a lack of efficient EV battery charging infrastructure in emerging and undeveloped nations are expected to significantly hamper market expansion over the projection period.

Market Segmentation

Propulsion Type Insights

The pure electric segment is dominating the market with the largest revenue share over the forecast period.

On the basis of propulsion type, the global electric utility vehicle market is segmented into hybrid electric, pure electric. Among these, the pure electric segment is dominating the market with the largest revenue share of 67.5% over the projection period, owing to leading electric utility vehicle manufacturers offering pure-electric utility vehicles as an additional product category. Pure-electric utility vehicles are provided by prominent manufacturers such as BYD, Club Car, WAEV, Dana, Polaris, Toyota Industries, Ari Motors, John Deere, and Alke. For example, Dana Incorporated stated in July 2022 that its Birmingham, United Kingdom, division had been allocated a USD 2.7 million investment to manufacture an e-Powertrain for OX Delivers, the world's first flat-pack utility vehicle targeted for African emerging markets. Hybrid-electric utility vehicles, on the other hand, have substantially lower market than pure-electric utility vehicles since they require twin drivetrains in the restricted space that utility vehicles have. When compared to pure-electric or ICE alternatives, this limits utility vehicle effectiveness and increase vertical load. Dodge, for example, introduces the 2023 Hornet compact utility vehicle with a plug-in hybrid option.

Application Insights

The commercial transport segment accounted the largest revenue share of more than 76.2% over the forecast period.

On the basis of application, the global electric utility vehicle market is segmented into industrial, agricultural, sports, passenger commute, commercial transport, recreation, and others. Among these, the commercial transport segment accounted for the largest revenue share of over 76.2% over the forecast period. Commercial transportation constitutes one of the most primary applications for electric utility vehicles, with an increasing requirement for electric shuttle carts for passenger carriage in metropolitan areas and utility carts providing slightly longer last-mile transportation in rural and urban locations. Electric utility carts for commercial transportation are manufactured by major corporations such as Garia, Taylor Dunn, Smart Cart, Goupil, Columbia Vehicle, Electric Last Mile Solutions, and Ari Motors. These corporations have a diverse product portfolio for the market. For example, once the ELMS Board approved manufacturing, Electric Last Mile Solutions, Inc. (ELMS) announced its decision to proceed with preparations to introduce the Urban Utility vehicle. The Urban Utility is a Class 3 commercial electric vehicle with a maximum payload of 5,700 lbs, a GVWR of more than 11,000 lbs, and a range of around 125 miles. With the introduction of the Urban Utility, ELMS will have a product portfolio spanning the USD 130 billion North America Class 1-3 commercial vehicle market.

Regional Insights

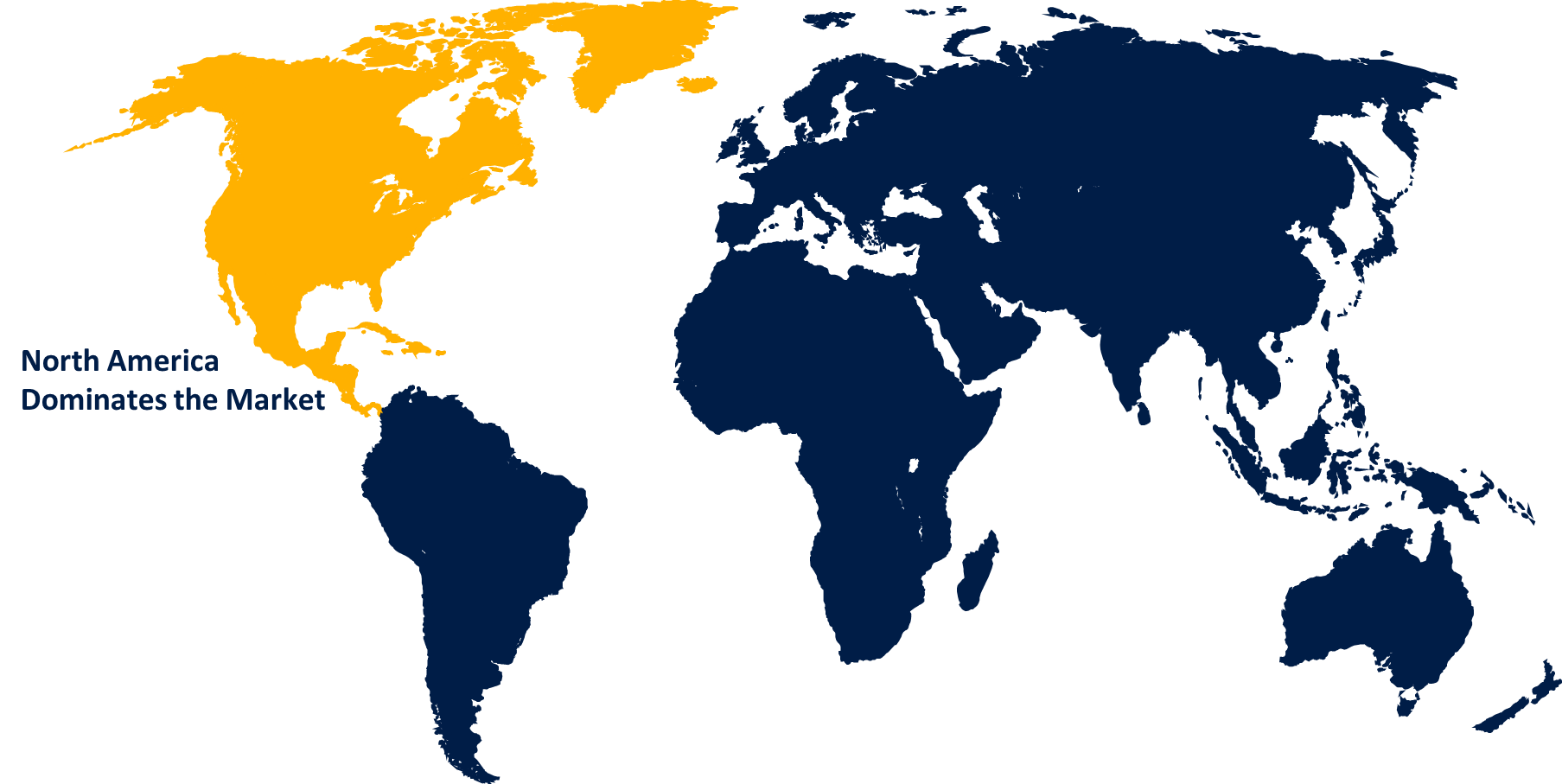

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America will dominate the market with a market share of more than 47% during the forecast period because of the rapid implementation of technological developments such as the transformation of transportation with rapid progress and continuous improvement aimed at a fuel-efficient economic system and the incorporation of electric vehicles over traditional cars for green and sustainable transportation. The ATV/UTV market in North America ranks among the most technologically sophisticated worldwide, accounting for more than half of the global supply. With the US government urging farm owners to switch to electric utility vehicles, these vehicles have seen significant development in popularity in agriculture, hunting, and forest rides. North America additionally features a substantial shuttle cart market, with the United States accounting for 90% of regional demand. The United States accounts for over two-thirds of utility-derived and shuttle cart demands, trailed by Canada and Mexico.

Asia Pacific is predicted to grow significantly as a result of technology improvement and the adoption of development initiatives or activities to terminate ICE vehicle sales in the electric utility vehicle market by nations such as China, Japan, and India. For example, China is anticipated to phase out ICE car manufacturing and sales by 2040, while the Indian government stated in the same year its ambitious goal of ensuring that all new vehicles sold after 2030 are electric, virtually a prohibition on the sale of ICE vehicles after 2030.

Europe, on the other hand, is expected to show significant revenue growth throughout the forecast period owing to the presence of existing manufacturers and suppliers and their rising investments in r&d and electric mobility to achieve an objective of green and fuel-efficient transportation.

Key Market Developments

- On September 2022, Fisker Inc. plans to begin selling its Ocean electric sport-utility vehicle (SUV) in India in July 2023, and it hopes to begin manufacturing locally within a few years. The company is currently looking for real estate property in New Delhi to open a showroom and meeting with automotive local suppliers to acquire parts for worldwide production.

- In June 2022, Navya announced the signing of a contract with Muses Europe for the assembly of 300 electric utility vehicles to participate in the development of a future autonomous version. The first pre-series of 300 Muses will be assembled by Navya at its Vénissieux plant near Lyon. The Muses urban vehicle is a polyvalent electric utility model capable of transporting large volumes.

- In August 2021, Dual will provide seat covers for the Hyundai Genesis GV60. The Genesis GV60 is an electric coupe-style premium crossover utility vehicle (CUV) manufactured by Hyundai Motor Group's luxury vehicle brand, Genesis. The Hyundai Electric Global Modular Platform was used to create the GV60 (E-GMP). Dual will generate more than KRW 90 billion in total revenue from the GV60 supply by 2027.

List of Key Market Players

- Polaris

- Bollinger Motors Inc.

- Club Car

- Star EV Corporation

- Ford Motor Company

- Hyundai Motor Company

- Toyota Industries Corporation

- NAVYA

- Alke

- E-Z-GO

- John Deere

- Marshell Green Power

- Tesla, Inc.

- Textron

- Addax Motors

- Garia Utility

- Guangdong Lvtong

- EsagonoGastone

- Mahindra Electric Mobility Limited

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2030. Spherical Insights has segmented the global electric utility vehicle market based on the below-mentioned segments:

Electric Utility Vehicle Market, Vehicle Type Analysis

- Electric Utility Carts

- Electric ATVs

- Electric Shuttle Carts

- Electric UTVs

- Industrial Electric Utility Vehicles

- Hybrid Electric

- Others

Electric Utility Vehicle Market, Propulsion Type Analysis

- Hybrid Electric

- Pure Electric

Electric Utility Vehicle Market, Application Analysis

- Industrial

- Agricultural

- Sports

- Passenger Commute

- Commercial Transport

- Recreation

- Others

Electric Utility Vehicle Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which region is dominating the electric utility vehicle market?North America is dominating the electric utility vehicle market with more than 47% market share

-

2. Which segment holds the largest market share of the electric utility vehicle market?The pure electric segment based on propulsion holds the maximum market share of the electric utility vehicle market.

-

3. Which are the major key players in the global electric utility vehicle market?Polaris, Bollinger Motors, Club Car, Star EV Corporation, Ford Motor Company, Hyundai Motor Company, Toyota Industries, NAVYA, Alke, E-Z-GO, John Deere, Marshell Green Power, Textron, Mahindra Electric Mobility Limited, and many others.

-

4. What is the market size of the electric utility vehicle market?The global electric utility vehicle market is expected to grow from USD 18.3 Billion in 2021 to USD 27.29 Billion by 2030, at a CAGR of 4.9% during the forecast period 2021-2030.

-

5. Which segment dominated the electric utility vehicle market share?The commercial transport segment in industry application dominated the electric utility vehicle market in 2021 and accounted for a revenue share of over 76.2%.

Need help to buy this report?