Global Electric Vehicle Plastics Market Size, Share, and COVID-19 Impact Analysis, By Type (PP, PA, PC, PE, PU, PVC, PVB, PBT, ABS, PET, Others), By Components (Battery, Lighting, Steering & Dashboards, Car Upholstery, Bumper, Door Assembly, Connector & Cables, Electric Wiring, Exterior Trim, Interior Trim, Others), By Vehicle Type (EV, HEV, PHEV, BEV), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 - 2030

Industry: Advanced MaterialsGlobal Electric Vehicle Plastics Market Insights Forecasts to 2030

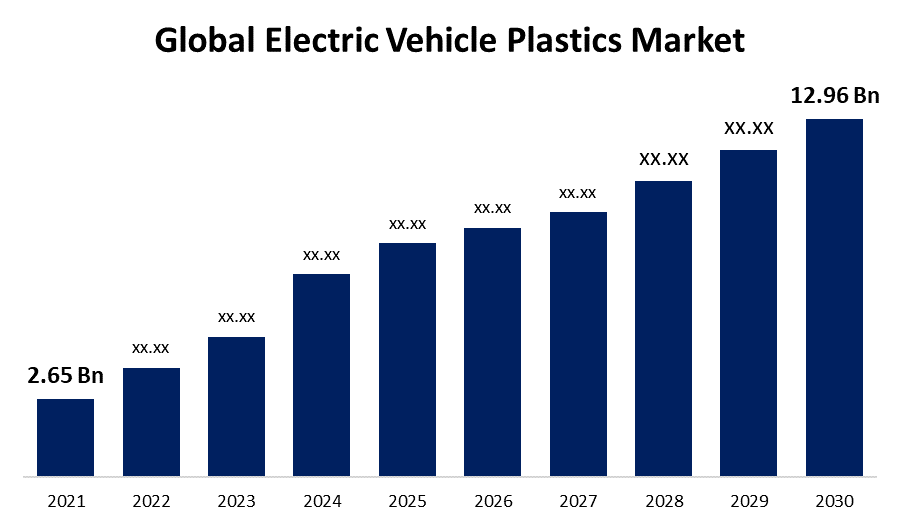

- The Electric Vehicle Plastics Market Size was valued at USD 2.65 Billion in 2021.

- The Market is growing at a CAGR of 27.7% from 2022 to 2030

- The Worldwide Electric Vehicle Plastics Market is expected to reach USD 12.96 Billion by 2030

- Europe is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Electric Vehicle Plastics Market is expected to reach USD 12.96 Billion by 2030, at a CAGR of 27.7% during the forecast period 2022 to 2030. The growing popularity of electric vehicles, as well as increased demand for lightweight EVs, is anticipated to fuel market demand over the forecasted timeframe. The potential market is expected to emerge from technological advancements in electric vehicles. Due to the region's rising demand for electric vehicles, the Asia Pacific region now holds a majority of the global market.

Plastic can function as both an insulator and an electric conductor. As a result, it has distinct roles in power production, various drivetrain components, and battery packs. The global demand for electric vehicle plastics is increasing to reduce greenhouse gas (GHG) emissions. Plastics can enable electric cars to achieve longer operating ranges by reducing weight. Several electric vehicles use solid batteries, however, the weight of the metal hinders the automobiles from working effectively. As such plastic is used to ensure that the vehicle is running efficiently.

Hybridization will boost the demand for improved safety, extended battery life, lightweight and space savings, and efficiency. In hybrid vehicles, plastic sensors, connectors, harnesses, seals, capacitors, and fuses condense parts, minimize noise, and withstand corrosion. Plastics are widely accepted as insulators, but they may be made conductive, which allows hybrid engines to condense parts and reduce weight even further.

Global Electric Vehicle Plastics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 2.65 Billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 27.7% |

| 2030 Value Projection: | USD 12.96 Billion |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Type, By Components, By Vehicle Type, By Region, and COVID-19 Impact Analysis |

| Companies covered:: | Dow, BASF SE, SABIC, LyondellBasell Industries Holdings B.V., Evonik Industries, Covestro AG, Dupont, INEOS Capital Ltd., Plastic Omnium, Sumitomo Chemicals Co. Ltd., Avient Corporation, Toray Industries Inc., Evonik Industries AG, Kureha Corporation, Covestro AG, Arkema, LG Chem, Asahi Kasei, LANXESS, INEOS Group, Celanese Corp., AGC Chemicals, EMS Chemie Holding, Eastman Chemical Company, Mitsubishi Engineering Plastics Corp. |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Key Market Drivers

Since the introduction of the first electric car, consumer demand for electrically powered vehicles has grown significantly. The rise of the market for electric vehicles continues to inspire polymer innovation, with government legislation, norms, and incentive programs being implemented in a number of nations. Because of changes in consumer modern lifestyle and environmental legislation, there is an instantaneous rise in consumer demand for reasonably priced electric vehicles.

The global demand for electric vehicles increased by 75% from 2020 to 2021, resulting in massive sales growth from 2019. After years of poor sales, electric vehicles are on a steady rise in growth, with forecasts indicating that up to 50% of the industry will be hybrids or electric vehicles by 2030.

Plastics are naturally lighter-weight materials that are employed in modern vehicles to minimize the weight of conventional materials such as metal and steel. As a result, hybrid, electric and sometimes even combustion engine cars and trucks may travel farther while using less energy to accelerate and maintain motion with the help of plastics. Furthermore, in combustible vehicles, the Manufacturer can increase fuel economy by reducing vehicle weight. Additionally, with plastics in both the outside and interior sections, EV interiors are more comfortable and quieter.

The growing development of EVs has resulted in a huge increase in demand for the electric vehicle plastics market. Given inflation in gasoline prices, strict regulations pertaining to the environment, and rapid urbanization, the demand for electric vehicles have driven the adoption of plastic in the manufacturing industry. Plastics exhibit structural stability, conductivity insulation, and flame retardancy qualities that are identical to conventional automotive components. Rapid expansion in the EV industry for such plastics is expected to further grow during the forecast period. As a result, such factors are likely to boost plastics market demand in the electric vehicle sector.

Key Market Challenges

Recycling of plastic products using for electric automotive components, on the other hand, can be a major constraint to the expansion of the electric vehicle plastics market. Automotive vehicle equipment is made from a variety of plastic materials, which necessitates component separation prior to the recycling process.

Market Segmentation

Type Insights

The Polypropylene (PP) segment accounted the largest market share over the forecast period.

On the basis of type, the global electric vehicle plastics market is segmented into Polypropylene (PP), Polyamide (PA), Polycarbonate (PC), Polyethylene (PE), Polyurethane (PU), Polyvinyl Chloride (PVC), Polyvinyl Butyral (PVB), Polybutylene Terephthalate (PBT), Acrylonitrile Butadiene Styrene (ABS), Polyethylene Terephthalate (PET), and others. Among these, the polypropylene (PP) segment is dominating the market and is going to continue its dominance over the forecast period. An aggregation of propylene monomers results in the thermoplastic known as polypropylene. Polypropylene is frequently utilized as a binder for thermoplastic components in natural fiber composites. It is also one of the lightweight available commercial plastic materials, rendering it excellent for producing lighter weight parts. It's also incredibly moisture resistant and has excellent resistance to chemicals, which makes it an excellent material for external car components like bumpers. Vehicle weight reduction optimizes better fuel economy and driving range, lowering cumulative automotive Greenhouse emissions.

Component Type Insights

The interior trim segment is dominating the market with the largest revenue share over the forecast period.

On the basis of component type, the global electric vehicle plastics market is segmented into battery, lighting, steering & dashboards, car upholstery, bumper, door assembly, connector & cables, electric wiring, exterior trim, interior trim, and others. Among these, the interior trim segment is dominating the market with the largest revenue share of 26.5% over the forecast period. Interior trim component segments comprise door lining, roof lining, seat trim, steering cover, along with others. The purpose of interior trim is to create comfort and an appropriate environment within the car. Plastics reduce battery production costs and will replace traditional parts and components. Plastics with high shock absorption capabilities, such as propylene, protect batteries from inadvertent shocks.

Vehicle Type Insights

The battery electric vehicle (BEV) segment accounted the largest revenue share of more than 65% over the forecast period.

On the basis of vehicle type, the global electric vehicle plastics market is segmented into electric vehicles (EVs), hybrid electric vehicles (HEVs), plug-in hybrid vehicles (PHEVs), and battery electric vehicles (BEVs). Among these, the battery electric vehicle (BEV) segment accounted for the largest revenue share of over 65% over the forecast period. The rapid growth of the population, along with increasing environmental standards, is driving up the market for plastics in electric vehicles. Plastics aid in vehicle weight reduction; BEV is focused on vehicle weight reduction, which aids in EV range expansion. Automotive manufacturers are focusing on car safety and durability, as well as adopting cost-effective plastics for batteries compartments sections. As a result, the rising popularity of BEV vehicles, along with other EV vehicle types, is expected to fuel demand for plastic components employed by these vehicles.

Regional Insights

Asia Pacific dominates the market with the largest market share over the forecast period.

Get more details on this report -

Asia Pacific is dominating the market with more than 62% market share over the forecast period. The leading nations with high manufacturing capabilities in the region are China, Japan, South Korea, and India. This is facilitated by skilled and economically cost labor, as well as the accessibility with which raw materials can be acquired. China is the primary market for EVs, encouraging an increasing number of automakers to venture further into the Chinese market. The country's market for plastic by the BEV type is expected to maintain the most compelling during the projected period due to their prevalence and zero-emission qualities when especially in comparison to PHEVs. Furthermore, the Indian government is encouraging the installation of electric vehicle (EV) charging stations by giving investment subsidies through the Faster Adoption and Manufacture of Hybrid & Electric Vehicles in India Programme Phase II and state-level programs.

In Japan, there is a stronger market demand for PHEVs than BEVs since PHEVs and HEVs are exempt from the 'automobile acquisition tax,' which includes licensing tax and tonnage tax, which has pushed consumer preference for PHEVs over BEVs. As a result, the market for plastics in PHEVs is expected to generate significant growth possibilities for Japanese EV plastic component manufacturers.

Europe, on the contrary hand, is expected to grow the fastest in terms of revenue share throughout the forecast period. Chemical industries within Europe are mass-producing polymers for EVs. The region's market for EVs is being boosted by tax breaks, subsidies, and supporting regulations, which will drive market growth throughout the projected timeframe.

List of Key Market Players

- Dow

- BASF SE

- SABIC

- LyondellBasell Industries Holdings B.V.

- Evonik Industries

- Covestro AG

- Dupont

- INEOS Capital Ltd.

- Plastic Omnium

- Sumitomo Chemicals Co. Ltd.

- Avient Corporation

- Toray Industries Inc.

- Evonik Industries AG

- Kureha Corporation

- Covestro AG

- Arkema

- LG Chem

- Asahi Kasei

- LANXESS

- INEOS Group

- Celanese Corp.

- AGC Chemicals

- EMS Chemie Holding

- Eastman Chemical Company

- Mitsubishi Engineering Plastics Corp.

Key Market Developments

- On February 2023, SABIC, a global leader in the chemical industry, will debut two new LNPTM CRX polycarbonate (PC) copolymer resins at MD&M West 2023, delivering a unique combination of chemical and impact resistance, thin-wall transparency, dimensional stability, and processability. The new materials can overcome significant disadvantages of incumbent PC resins and co-polyester resins when exposed to disinfectants or aggressive chemicals in device applications such as clear covers, screens, and display lenses. LNP ELCRES CRX1314TW and LNP ELCRIN CRX1314BTW grades can provide various advantages, including laser welding capability, to help streamline the manufacturing process.

- On June 2022, 3D Systems and EMS-GRILTECH have formed a collaborative agreement to advance additive manufacturing materials development. Combining 3D Systems' knowledge and reputation as an additive manufacturing solutions partner with EMS-expertise GRILTECH's in polyamide specialty manufacturing has enabled the firms to introduce DuraForm® PAx Natural, a revolutionary nylon copolymer. DuraForm PAx Natural is intended for use with any commercially available selective laser sintering (SLS) printer, regardless of manufacturer, allowing for simple integration into existing production workflows.

- On October 2022, Due in part to PA6 high-performance plastics, LANXESS can reduce its carbon impact. LANXESS' Durethan-brand polyamide 6 compounds are not only more cost-effective than polyamide-66-based compounds, but also significantly more environmentally benign. The cover for an on-board battery charger placed in an all-electric small vehicle manufactured by a German automaker demonstrates the extent to which the carbon footprint can be reduced.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2030. Spherical Insights has segmented the global electric vehicle plastics market based on the below-mentioned segments:

Electric Vehicle Plastics Market, Type Analysis

- Polypropylene (PP)

- Polyamide (PA)

- Polycarbonate (PC)

- Polyethylene (PE)

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Polyvinyl Butyral (PVB)

- Polybutylene Terephthalate (PBT)

- Acrylonitrile Butadiene Styrene (ABS)

- Polyethylene Terephthalate (PET)

- Others

Electric Vehicle Plastics Market, Components Type Analysis

- Battery

- Lighting

- Steering & Dashboards

- Car Upholstery

- Bumper

- Door Assembly

- Connector & Cables

- Electric Wiring

- Exterior Trim

- Interior Trim

- Others

Electric Vehicle Plastics Market, Vehicle Type Analysis

- Electric Vehicle (EV)

- Battery Electric Vehicle (BEV)

- Hybrid Electric Vehicle (HEV)

- Plug-in Hybrid Vehicle (PHEV)

Electric Vehicle Plastics Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the electric vehicle plastics market?The global electric vehicle plastics market is expected to grow from USD 2.65 Billion in 2021 to USD 12.96 Billion by 2030, at a CAGR of 27.7% during the forecast period 2021-2030.

-

2. Which region is dominating the electric vehicle plastics market?Asia Pacific is dominating the electric vehicle plastics market with more than 62% market share.

-

3. Which are the key companies in the market?BASF SE, SABIC, LyondellBasell Industries Holdings B.V., Evonik Industries, Covestro AG, Dupont, INEOS Capital Ltd., Plastic Omnium, Sumitomo Chemicals Co. Ltd., Avient Corporation, Toray Industries Inc., Evonik Industries AG, Kureha Corporation, Covestro AG, and Arkema.

-

4. Which segment holds the largest market share of the electric vehicle plastics market?Propylene based on type holds the maximum market share of the electric vehicle plastics market.

-

5. What are the major driving factors for the electric vehicle plastics market?Growing worldwide electric vehicle sales, escalating environmental concerns, and stringent pollution laws to encourage electrification, as well as need for lighter-weight metal component alternatives.

-

6. Which segment dominated the electric vehicle plastics market share?The Battery Electric Vehicle (BEV) segment in vehicle type dominated the electric vehicle plastics market in 2021 and accounted for a revenue share of over 65%.

Need help to buy this report?