Global Electrical Steel Market Size, Share, and COVID-19 Impact, By Type (Grain Oriented, Non Grain Oriented); By Application (Transformers, Motors, Inductors, Others); By End Use (Energy, Automotive, Household Appliances, Manufacturing, Others); by Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032.

Industry: Chemicals & MaterialsGlobal Electrical Steel Market Insights Forecasts to 2032

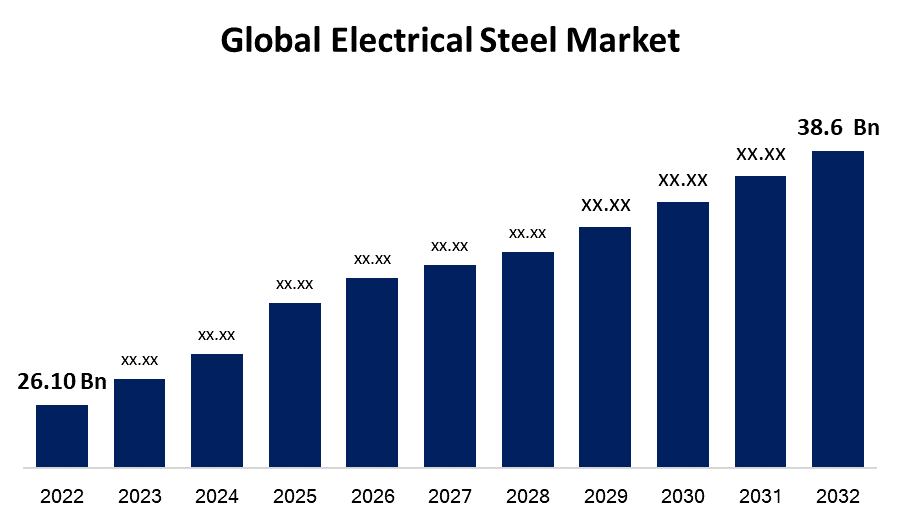

- The Electrical Steel Market Size was valued at USD 26.10 Billion in 2022.

- The Market Size is Growing at a CAGR of 5.1% from 2022 to 2032

- The Worldwide Electrical Steel Market Size is expected to reach USD 38.6 Billion by 2032

- Europe is expected To Grow the fastest during the forecast period

Get more details on this report -

The Global Electrical Steel Market Size is expected to reach USD 38.6 Billion by 2032, at a CAGR of 5.1% during the forecast period 2022 to 2032.

A particular kind of steel alloy created to have certain magnetic characteristics suited for use in electrical equipment is known as electrical steel, sometimes known as silicon steel or transformer steel. It is largely utilised in the motor, generator, and transformer cores of electrical devices. Electrical steel is primarily used in the cores of electrical transformers, where it helps to direct and regulate the magnetic flux that the primary winding generates. The energy losses from eddy currents and hysteresis (magnetic energy loss) are reduced by employing electrical steel in the transformer core, leading to a more effective transformer. Electrical steel is primarily used in the cores of electrical transformers, where it helps to direct and regulate the magnetic flux that the primary winding generates. The energy losses from eddy currents and hysteresis (magnetic energy loss) are reduced by employing electrical steel in the transformer core, leading to a more effective transformer.

Impact of COVID-19 on Global Electrical Steel Market

With the outbreak of the COVID-19 pandemic, the demand, as well as the supply of electrical steel-based products, were significantly affected. The market was severely disrupted in the infrastructural projects which have reduced the manufacturing of automobiles and halted operations of production plants over the pandemic. Thus, electricity consumption across various countries was reduced during the period of lockdown. In addition, the limitations in governments that were implemented over the pandemic during the pandemic have immensely affected production. Apart from this, the stoppage of mining activities, closure of machinery, and restriction in movement have impacted the market proliferation in a negative way. All these factors have resulted in a decline in the demand of electric steel for various applications like transformers, high efficiency power generation motors, inductors, and motors. But the governments of various countries are implementing regulations in order to get their economies recovered.

Electrical Steel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 26.10 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 5.1% |

| 2032 Value Projection: | USD 38.6 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By End Use, by Region. |

| Companies covered:: | Shandong Iron and Steel Group Co Ltd, ArcelorMittal, SAIL, Nippon Steel & Sumitomo Metal Corporation (NSSMC) Group, Tata Steel Limited, Baosteel Group, United States Steel Corporation, JFE Steel Corporation, Shagang Group Inc., Jindal Steel and Power Limited, Ansteel Group Corporation, Voestalpine Group, HBIS Group. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Key Market Drivers

The growth of the automotive segment along with the increasing use of hybrid vehicles is propelling the adoption of electrical steel for making improvements in the aesthetic performance and reducing the weight of the vehicle. In addition, various government regulations in the developing nations such as Brazil, the U.S., India, and China for protecting the environment through vehicles are driving the demand of the product. In addition, various government bodies are conducting research and development activities and have started emphasizing the reduction of carbon dioxide which would make huge contribution to the adoption of sustainable steel. Moreover, the rise in the adoption of hybrid vehicles as well as increasing consumer expenses will boost the adoption of the vehicle. All these factors are creating lucrative opportunities for the market to grow in a positive way over the forecast period.

Key Market Challenges

The price of steel mainly depends on the raw materials which are required during electrical steel production. The key materials such as coal, ferroalloys, iron ore, and other industrial gases. But the cost of the all these raw materials are very volatile which has made severe fluctuations in the steel prices and caused variations in the overall price. Moreover, the storage, capacity of crude oil, price of crude oil, and manufacturing cost have influenced the steel prices. Electrical steel can be substituted with a variety of other materials, including stainless steel and carbon steel. These materials frequently cost less and perform better than electrical steel, which puts pressure on manufacturers of electrical steel to cut costs or provide higher-quality goods. All these factors are impeding the growth of the global electrical steel market.

Market Segmentation

Types Insights

Non Grain Oriented Electrical Steel segment accounted the highest market share

On the basis of types, the global electrical steel market is segmented into gain oriented and non gain oriented. Among these, non grain oriented electrical steel segment accounted the highest market share and is dominating the market over the forecast period. The growth is attributed to the increasing demand for non grain oriented electrical steel from the power generation as well as transmission industry. NGOES is generally employed in situations where rotating gear, such as motors and generators, have magnetic fields whose cores are continually changing in direction. Because the magnetic flux in these applications is not restricted to one direction, NGOES' isotropic nature is useful. The expansion of the power generation segment in the developing economies is the key driving factor of the segment. Government rules requiring the use of energy-efficient equipment are also helping this market sector to expand. For instance, the European Union has put in place a number of directives and laws demanding that member states encourage energy efficiency and cut back on industrial emissions.

Application Insights

Motor segment is dominating the market over the forecast period

Based on the application, the global electrical steel market is segmented into transformers, motos, inductors, and others. Among these, motor segment holds the largest market share and is dominating the market over the forecast period. The popularity of electrical vehicles are increasing owing to their environmental benefits as well as lower running costs. In addition, the increasing awareness about the harmful impacts of carbon emissions has resulted into the increase in the demand of electric vehicles. Rising demand for electric cars is a result of growing knowledge of the negative impacts of carbon emissions. These electric cars need to be driven by effective and potent motors. In addition, the advancement in the field of technology has resulted into the development of efficient and powerful motors. All these factors are driving the growth of segment over the forecast period.

End Use Insights

The manufacturing segment holds the largest market share over the forecast period.

On the basis of end use, the global electrical steel market is segmented into energy, automotive, manufacturing, household appliances, and others. Among these, the manufacturing segment holds the largest market share over the forecast period. The growth of the segment is mainly attributed to the rising production of electric vehicles and industrialization. This is because the rise in the use of electrical steel in different end use industries.

Regional Insights

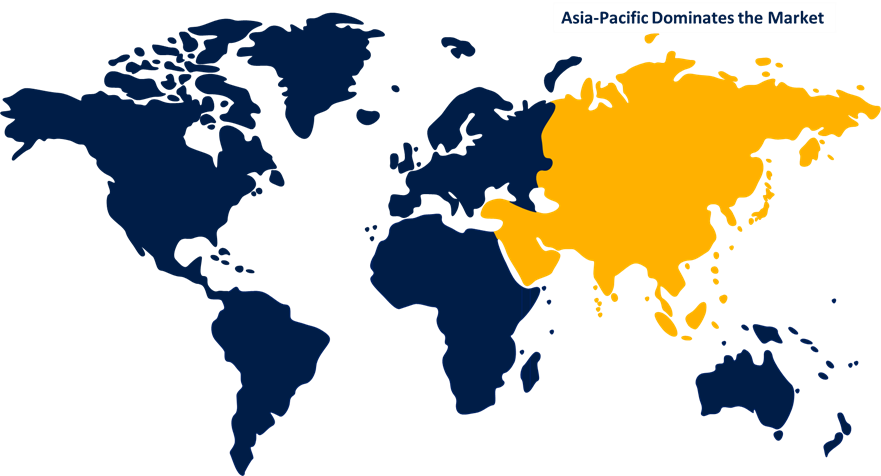

Asia Pacific is dominating the market over the forecast period

Get more details on this report -

Among all other regions, Asia Pacific is dominating the market over the forecast period. The greatest market for power Transformers is one of the factors driving the expansion of the electrical steel industry in this region. In several countries in the Asia Pacific area, including China, India, and Indonesia, there is a high need for power transformers. One of the biggest producers of power transformers worldwide is China. Due to a number of variables, including a rise in the need for the renewable energy industry, an increase in the demand for energy, and an increase in population and urbanisation, India is also predicted to expand at a significant rate.

Europe, on the other hand is estimated to witness the fastest market growth over the forecast period. Power generation, distribution, and the production of electric motors are just a few of the businesses that are driving the need for electrical steel in Europe. The need for high-quality electrical steel in Europe is anticipated to remain constant due to the increased focus on renewable energy sources and the requirement for more energy-efficient electrical equipment.

Recent Market Developments

- In April 2022, POSCO have started the construction of an electrical steel production unit. The company has invested USD 805 million in the construction of the manufacturing unit.

- In May 2021, JSW Steel and JFE Steel Corporation have signed a MoU in order to carry out a feasibility study for the establishment of manufacturing and sales joint venture company.

List of Key Companies

- Shandong Iron and Steel Group Co Ltd

- ArcelorMittal

- SAIL

- Nippon Steel & Sumitomo Metal Corporation (NSSMC) Group

- Tata Steel Limited

- Baosteel Group

- United States Steel Corporation

- JFE Steel Corporation

- Shagang Group Inc.

- Jindal Steel and Power Limited

- Ansteel Group Corporation

- Voestalpine Group

- HBIS Group.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global Electrical Steel Market based on the below-mentioned segments:

Electrical Steel Market, Type Analysis

- Gain Oriented

- Non Grain Oriented

Electrical Steel Market, Application Analysis

- Transformers

- Motors

- Inductors

- Others

Electrical Steel Market, End Use Analysis

- Energy

- Automotive

- Household Appliances

- Manufacturing

- Others

Electrical Steel Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of Electrical Steel Market?The global Electrical Steel Market is expected to grow from USD 26.10 Billion in 2022 to USD 38.6 Billion by 2032, at a CAGR of 5.1% during the forecast period 2022-2032.

-

2. Who are the key market players of Electrical Steel Market?Some of the key market players of Shandong Iron and Steel Group Co Ltd, ArcelorMittal, SAIL, Nippon Steel & Sumitomo Metal Corporation (NSSMC) Group, Tata Steel Limited, Baosteel Group, United States Steel Corporation, JFE Steel Corporation, Shagang Group Inc., Jindal Steel and Power Limited, Ansteel Group Corporation, Voestalpine Group, and HBIS Group.

-

3. Which segment hold the largest market share?Manufacturing segment holds the largest market share is going to continue its dominance

-

4. Which region is dominating the Electrical Steel Market?Asia Pacific is dominating the Electrical Steel Market with the highest market share.

Need help to buy this report?