Global Electrical Steel Non-grain Oriented (NOES) Market Size, Share, & COVID-19 Impact Analysis, By Thickness ((0.35 mm, 0.5 mm, 0.65 mm, and Others); By Type (Semi-processed and Fully Processed), By Application (Household Appliances, AC Motor, Power Generation, and Others), and Regional Forecast, 2021-2030

Industry: Advanced MaterialsGlobal Electrical Steel Non-grain Oriented (NOES) Market Insights Forecasts to 2030

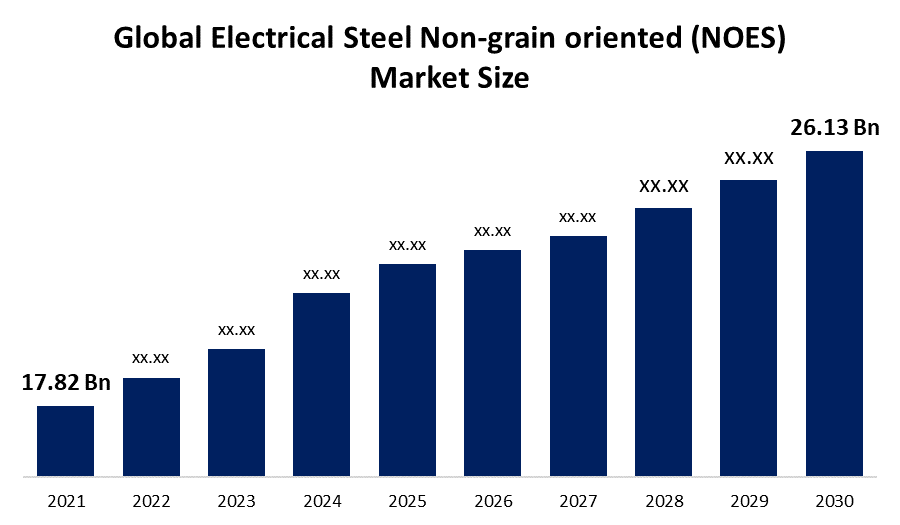

- The Global Electrical Steel Non-grain Oriented (NOES) Market Size was valued at USD 17.82 Billion in 2021

- The Market is Growing at a CAGR of 6.1% from 2022 to 2030

- The Worldwide Electrical Steel Non-grain oriented (NOES) Market Size is expected to reach USD 26.13 Billion By 2030

- North America is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Electrical Steel Non-Grain Oriented (NOES) Market Size is expected to reach USD 26.13 Billion by 2030, at a CAGR of 6.1% during the forecast period 2022 to 2030.

Electrical steel is a type of steel that is used in the cores of electromagnetic equipment including motors, generators, and transformers to prevent power loss. Since Si is the primary added element, electrical steel is also known as silicon steel. Among all soft magnetic materials, electrical steels are the most widely utilized (almost 90% by volume). Silicon-iron electrical steel in the shape of fine laminations is the most common soft magnetic material used by electrical machinery.

Non-oriented (NO) electrical steel and grain-oriented (GO) electrical steel are the two forms of electrical steel. NO steel is commonly used in rotating electrical equipment, such as motors and generators, where the magnetization orientation is changed in the sheet plane. GO steel is primarily utilized as a core material for unidirectional magnetized static equipment such as transformers. Because of the varied flux directions, oriented steels have the least core loss and are utilized in transformers, whereas non-oriented steel is employed in electrical equipment. NOES is a direct material input utilized in the production of electric motors for both hybrid and electric automobiles.

COVID-19 Impact Electrical Steel Non-grain oriented (NOES) Market

The government limitations associated with the COVID-19 outbreak that led the steel industry to cease had a substantial influence on the market. Governments have also issued new restrictions for COVID-19 affected manufacturing facilities. As a result, mining operations decreased, leading to additional disruptions in steel production, affecting end-use industries. Also, supply chain interruptions in the steel industry hampered the production of electrical steel for non-grain-oriented applications. Also, to prevent the virus from spreading, electrical steel companies chose to reduce productivity or discontinued manufacturing operations. As a result, all of these variables disrupted the supply and demand for such electrical steel.

Global Electrical Steel Non-grain Oriented (NOES) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 17.82 Billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 6.1% |

| 2030 Value Projection: | USD 26.13 Billion |

| Historical Data for: | 2018-2020 |

| No. of Pages: | 165 |

| Tables, Charts & Figures: | 93 |

| Segments covered: | Global Electrical Steel (Non-grain oriented (NOES) Market Size, By Thickness ((0.35 mm, 0.5 mm, 0.65 mm, and Others); By Type (Semi-processed and Fully Processed), By Application (Household Appliances, AC Motor, Power Generation, and Others), and Regional Forecast, 2023-2030 |

| Companies covered:: | ArcelorMittal S.A., Baosteel Group Corporation, Pohang Iron and Steel Company (POSCO), Nippon Steel & Sumimoto Metal Corporation (NSSMC), JFE Holdings Inc., Jiangsu Shagang Group, Tata Steel, ThyssenKrupp Steel Europe, Voestalpine AG (Australia), SAIL (India), FE Steel Corporation (Japan), The United States Steel Corporation (US Steel), Angang Steel Co. Ltd., Gerdau. And among others we will covered in final report |

| Growth Drivers: | Increased Demand from Various Industries is Expected Drive the Consumption of Non-Grain Oriented Electrical Steel |

| Pitfalls & Challenges: | Covid-19 affected supply chain and Fluctuation in Steel Prices to Hinder the Market Growth |

Get more details on this report -

Driving Factors

Increasing demand for drive systems, high-frequency converters, and high-speed electric drivetrains from hybrid electric vehicles, in addition to an increasing demand for Non-Oriented Electrical Steel, is likely to boost market expansion. Given its homogenous structural and magnetic properties in all directions, non-oriented electric steel is extensively used as ferrous alloying elements in rotating machinery that includes miniature precision electric motors to large power generators. Non-grain oriented steel is an important magnetic and structural material that is used worldwide because it has a higher magnetic flux, is more efficient, and has superior punching strength and durability. As a result, it is well-suited to the production of electrical devices such as power production motors, propellers, and electrical equipment.

Furthermore, non-oriented grain electrical steel has several features over grain-oriented steel, including improved punch capability and acting as a lubricant during stamping, making it suitable for massive rotating equipment such as AC alternators and independent power producers. They're also present in power generation iron cores, tiny power transformers, ac motors, and other home devices. The market value of non-oriented electrical steel has profited from all of its properties, including such light core weight and excellent permeability of the material, and its use in other industries and products. As a result, these sectors strong demand for non-grain oriented electrical is propelling market expansion.

Restraining Factors

The availability of alternatives, which include grain-oriented electrical steel, is limiting the growth of the non-oriented electrical steel market. Moreover, price fluctuations in steel raw commodities like coal, scrap, and iron steel are projected to hamper the growth of the market. This is because raw material prices are extremely unstable and fluctuate as per demand and supply factors. Steel prices are also influenced by production costs, the cost of crude oil, and storage capabilities. As a result, these issues are projected to impede the growth of the non-grain oriented electrical steel market.

Market Segmentation

Thickness Type Insights

The 0.5 mm segment accounted the largest market share over the forecast period.

On the basis of thickness, the global electrical steel non-grain oriented market is segmented into 0.35 mm, 0.5 mm, 0.65 mm, and others. Among these, the 0.5 mm is dominating the market and is going to continue its dominance over the forecast period. This thickness type offers the best performance in terms of magnetic characteristics and weight of electrical devices made with this sheet size. Heavy-duty electrical equipment, such as large power generators and transformers, often utilizes thicker non-grain oriented electrical sheets with thicknesses ranging from 0.5 mm and higher. The efficiency of the material is the most important concern in such devices, with weight and space taken up by electrical equipment being a less significant impediment.

Type Insights

The semi-processed segment is dominating the market with the largest revenue share over the forecast period.

On the basis of type, the global electrical steel non-grain oriented market is segmented into semi-processed and fully processed. Among these, the semi-processed segment is dominating the market with the largest revenue share of 56% over the forecast period. Non-oriented semi-processed grades are advantageous for tiny rotors, Stators, and power generation equipment. Semi-processed non-oriented electrical steel is extensively utilized and accounts for a sizable market share. The semi-processed version must be heat treated at the optimal temperature to create the correct microstructure. The temperature of steel might vary depending on its final application. The semi-processed type's strong customizable capability contributes to its widespread alternative among electrical device producers, who employ it to build stators and rotors for electric motors. The semi-processed category leads the market due to all of these factors.

Application Type Insights

The power generation accounted the largest revenue share of more than 57% over the forecast period.

On the basis of application, the global electrical steel non-grain oriented market is segmented into household appliances, AC motors, power generation, and others. Among these, the power generation is dominating the market with the largest revenue share of 57% over the forecast period. The non-grain oriented electrical steel material is primarily used in power transformers, small transformers, and distribution transformers and is available in coiled, punched sheets, and laminated forms. Because of its low friction losses, high permeability, and high resistance, it is employed in electrical transformer cores and other electrical equipment. The segment's expansion is being driven by increased demand for transformers as a result of high energy usage.

Regional Insights

Asia Pacific dominates the market with the largest market share over the forecast period.

Get more details on this report -

Asia Pacific is dominating the market with more than 52% market share over the forecast period. The region's expansion of the electrical steel sector is attributable to the region's largest market for transmission systems. Power transformers are still in the growing market in several Asian countries, including China, India, and Japan. India is expected to develop rapidly as a result of a variety of factors, notably increasing demand for reliable energy, rapid urbanization energy demand, and industrial growth. These countries vast latent economic growth potential is expected to be achieved over the forecast period. This is expected to increase the development such as infrastructure for power generation, transmission, and distribution in the region. As a result, increased electrical power industry demand is likely to boost market expansion in the Asia Pacific.

On the contrary, North America is predicted to grow the fastest during the forecast period. Given the highly industrialized region of North America has a strong demand for energy. The area has a well-developed infrastructure for power generation and transmission, which needs regular maintenance and upgrading. In recent years, the region has seen a remarkable increase in electric vehicle production, and this is anticipated to continue throughout the projected timeframe.

List of Key Market Players

- Baowu

- Arcelor Mittal

- POSCO

- Shougang Group

- Nippon Steel Corporation

- Thyssenkrupp

- Voestalpine AG

- Jindal Steel and Power Limited

- Benxi Steel Group Co., Ltd

- United States Steel Corporation

- Nucor Corporation

- NLMK

- SAIL

- HBIS Group

- Aperam S.A.

- JFE Steel Corporation

- Arnold Magnetic Technologies

- Baosteel Group Corporation

- TATA Steel Limited

- FE Steel Corporation

Key Market Developments

- On February 2023, JFE Steel Corporation announced that it will be expanding the electrical steel sheet capacity of its West Japan Works (Kurashiki Area) for a startup in the first half of the fiscal year beginning April 2024 and that it is now planning an additional expansion for a startup in the fiscal year beginning April 2026. The further extension, which will cost around 50.0 billion yen, will increase the works' present capacity for top-grade non-oriented electrical steel sheets used in electric car main engine motors.

- On March 2023, United States Steel Corporation announced that manufacturing of its new electrical steel product, InduX, will begin in the summer of 2023 at its Big River Steel facility with the inauguration of its new non-grain oriented (NGO) electrical steel line. InduX electrical steel is a broad, ultra-thin, light-weight steel with all of the magnetic qualities required for electric vehicles (EV), generators, and transformers.

- On April 2022, POSCO has begun construction on a new electrical steel facility. South Korea's largest steelmaker will invest 1 trillion won (US$805 million) in the construction of the factory in the southwestern port of Gwangyang, which will have a capacity of 300,000 tons of non-oriented electrical steel per year. POSCO presently manufactures about 1 million tons of both types of electrical steel each year. POSCO's current integrated steel mill in Gwangyang is the world's largest.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2030. Spherical Insights has segmented the Global Electrical Steel Non-grain oriented (NOES) Market based on the below-mentioned segments:

Electrical Steel Non-grain oriented (NOES) Market, Thickness Type Analysis

- 0.35 mm

- 0.5 mm

- 0.65 mm

- Others

Electrical Steel Non-grain oriented (NOES) Market, Type Analysis

- Semi-processed

- Fully Processed

Electrical Steel Non-grain oriented (NOES) Market, Application Type Analysis

- Household Appliances

- AC Motor

- Power Generation

- Others

Electrical Steel Non-grain oriented (NOES) Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

Which region is dominating the Electrical Steel Non-grain oriented (NOES) market ?Asia Pacific is dominating the Electrical Steel Non-grain oriented (NOES) market with more than 52% market share.

-

Which are the key companies in the market ?Baowu, Arcelor Mittal, POSCO, Shougang Group, Nippon Steel Corporation, Thyssenkrupp, Voestalpine AG, Jindal Steel and Power Limited, Benxi Steel Group Co., Ltd, United States Steel Corporation, Nucor Corporation, NLMK, SAIL, HBIS Group, Aperam S.A., JFE Steel Corporation, Arnold Magnetic Technologies, Baosteel Group Corporation, TATA Steel Limited, FE Steel Corporation

-

What is the market size of the Electrical Steel Non-grain oriented (NOES) market?The Global Electrical Steel Non-grain oriented (NOES) Market is expected to grow from USD 17.82 billion in 2021 to USD 26.13 billion by 2030, at a CAGR of 6.1% during the forecast period 2021-2030.

-

Which segment holds the largest market share of the Electrical Steel Non-grain oriented (NOES) market?The semi-processed segment based on type holds the maximum market share of the Electrical Steel Non-grain oriented (NOES) market.

-

Which segment dominated the Electrical Steel Non-grain oriented (NOES) market share?The power generation segment in application dominated the Electrical Steel Non-grain oriented (NOES) market in 2021 and accounted for a revenue share of over 57%.

-

What are the elements driving the growth of the Electrical Steel Non-grain oriented (NOES) market?The global market is expanding due to increased demands from the energy-producing and transmission industries, as well as rising global electricity output.

Need help to buy this report?