Global Electrochemical Sensors Market Size, Share, and COVID-19 Impact Analysis, By Type (Conductometric Sensors, Potentiometric Sensors, Amperometric Sensors), By Product (Humidity Sensor, Nitrogen Oxide Sensor, Hydrogen Sulfide Gas Sensor, Sulfur Dioxide Sensor, and Others), By Application (Healthcare, Agriculture, Food & Beverage, Veterinary), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Electrochemical Sensors Market Insights Forecasts to 2033

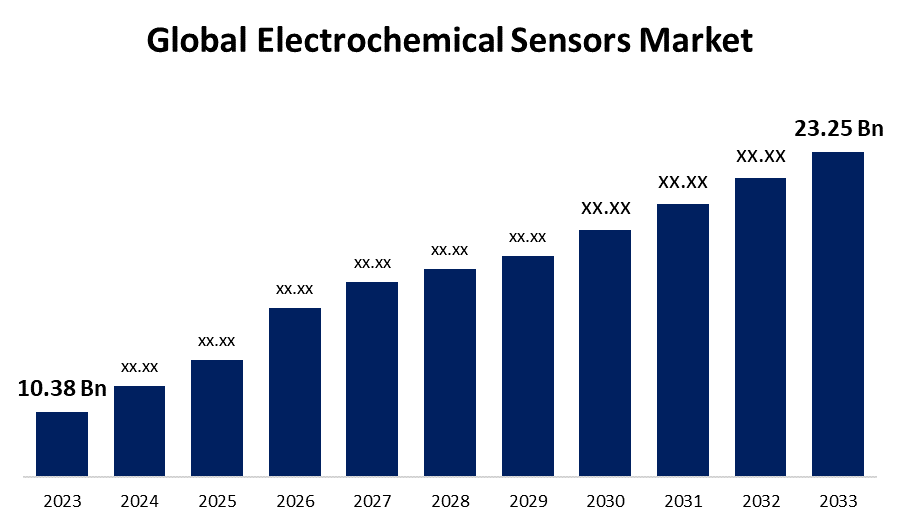

- The Global Electrochemical Sensors Market Size was Valued at USD 10.38 Billion in 2023

- The Market Size is Growing at a CAGR of 8.40% from 2023 to 2033

- The Worldwide Electrochemical Sensors Market Size is Expected to Reach USD 23.25 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Electrochemical Sensors Market Size is Anticipated to Exceed USD 23.25 Billion by 2033, Growing at a CAGR of 8.40% from 2023 to 2033.

Market Overview

Chemical compounds are detected and measured using electrochemical sensors, which translate the concentration of the substances into an electrical signal. Based on electrochemical principles, these sensors usually include redox reactions at the electrode surface. They are extensively used in many different fields, including food safety, industrial process control, medical diagnostics, and environmental monitoring. These sensors are widely used because of their many benefits, which include great sensitivity, cost-effectiveness, and the ability to monitor in real-time. The most popular and well-promoted type of sensors are electrochemical ones, which are utilized in glucose testing. Both enzymatic and nonenzymatic sensors are included in this classification. Due to their exceptional electrical conductivity and electrochemical inertness, carbon materials like diamond, fullerenes, graphene, carbon nanofibers, and carbon nanotubes have been widely used as electrode materials for nonenzymatic glucose sensors. Graphene is the most often utilized substance among them. In addition, glucose electrochemical sensors that are implanted and flexible are the latest developments in blood glucose monitoring technologies for diabetics. Additionally driving market demand are the requirements for effective and precise detection techniques as well as the increased attention being paid to environmental requirements. One of the factors supporting the growth of the electrochemical sensors market is the increasing prevalence of diabetes driven by poor nutritional choices, obesity, and aging.

Report Coverage

This research report categorizes the market for the global electrochemical sensors market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global electrochemical sensors market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global electrochemical sensors market.

Global Electrochemical Sensors Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 10.38 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 8.40% |

| 023 – 2033 Value Projection: | USD 23.25 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 235 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Product, By Application, By Region |

| Companies covered:: | Thermo Fisher Scientific, Inc., Conductive Technologies Inc., Abbott, Dexcom, Inc, F. Hoffmann-La Roche AG, Ascensia Diabetes Care., Siemens Healthineers, Zimmer & Peacock AS, Metrohm AG, SGX Sensortech Ltd, Ametek Inc., Figaro USA Inc., Dragerwerk AG, Alphasense, Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

The need for real-time monitoring and growing awareness of environmental contamination is driving the adoption of electrochemical sensors to evaluate the quality of air and water. As a result of greater government regulations mandating the use of electrochemical sensors in industrial settings for worker safety and emission control, the market is expanding. The growing application of electrochemical sensors in healthcare, particularly in glucose monitoring for the treatment of diabetes, is driving the market demand for these sensors. More efficient and versatile electrochemical sensors are being developed as a result of ongoing advancements in sensor technology, which have produced smaller, more sensitive, and more selective sensors with a wider range of applications.

Restraining Factors

The sensors are sensitive to temperature, so it is usually necessary to maintain a constant sample temperature. That is the reason the sensors are frequently internally temperature changed. Generally speaking, an electrochemical sensor's shelf life ranges from six months to a year, contingent upon the gas it detects and its environment.

Market Segmentation

The global electrochemical sensors market share is classified into type, product, and application.

- The potentiometric segment dominates the market with the largest market share through the forecast period.

Based on the type, the global electrochemical sensors market is categorized into conductometric sensors, potentiometric sensors, and amperometric sensors. Among these, the potentiometric segment dominates the market with the largest market share through the forecast period. Modern diagnostic methods are required, and advances in microfabrication methods have led to the development of sensitive, targeted, and effective electrochemical sensors for clinical examination. Billions of dollars are spent on research and development to advance medical technologies. The development of bio-sensors using electrochemical sensing technology has been accelerating due to the growing need for point-of-care applications such as self-monitoring blood glucose meters.

- The humidity sensor segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the product, the global electrochemical sensors market is categorized into humidity sensors, nitrogen oxide sensors, hydrogen sulfide gas sensors, sulfur dioxide sensors, and others. Among these, the humidity sensor segment is anticipated to grow at the fastest CAGR growth through the forecast period. The increasing industrialization of the world has resulted in poor air quality in many countries, especially in urban areas. Air pollution is mostly caused by nitrogen oxides, sulfur oxides, hydrogen sulfide, and other volatile organic compounds, all of which pose a threat to human health.

- The healthcare segment accounted for the largest revenue share through the forecast period.

Based on the application, the global electrochemical sensors market is categorized into healthcare, agriculture, food & beverage, and veterinary. Among these, the healthcare segment accounted for the largest revenue share through the forecast period. The excellent performance, portability, simplicity, and affordability of electrochemical sensors contributed to their use in a variety of analytical, medical diagnostic, and screening applications. Blood gas analyzers, glucose meters, cholesterol testers, and other healthcare instruments are some of several uses for electrochemical sensors.

Regional Segment Analysis of the Global Electrochemical Sensors Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global electrochemical sensors market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global electrochemical sensors market over the predicted timeframe. Growing R&D activities in the biomedical, automotive, building automation and other sectors are mostly to responsibility for the region's high demand. The market is anticipated to increase due to rapid technical breakthroughs including the advent of miniaturized diagnostic equipment that provides quick and precise findings and the increasing adoption of electronic medical records (EMR). In addition it is anticipated that the existence of the United States Clean Air Act, Clean Water Act, and National Environmental Policy Act all of which mandate the ongoing monitoring of environmental pollution will generate profitable growth prospects.

Asia Pacific is expected to grow at the fastest CAGR growth of the global electrochemical sensors market during the forecast period. According to the International Diabetes Federation and the lancet, 101 million persons worldwide will have diabetes in 2023, representing a prevalence of 11.4%. In addition, in India, cardiovascular illnesses are the main cause of death. Therefore, it is anticipated that India's need for electrochemical biosensors will be driven by the rising incidence of diabetes and cardiovascular disorders. According to the International Diabetes Federation, 13% of Chinese adults have diabetes, or around 140 million cases. Electrochemical sensors are useful for the everyday monitoring of conditions like diabetes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global electrochemical sensors market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Thermo Fisher Scientific, Inc.

- Conductive Technologies Inc.

- Abbott

- Dexcom, Inc

- F. Hoffmann-La Roche AG

- Ascensia Diabetes Care.

- Siemens Healthineers

- Zimmer & Peacock AS

- Metrohm AG

- SGX Sensortech Ltd

- Ametek Inc.

- Figaro USA Inc.

- Dragerwerk AG

- Alphasense

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2023, Dexcom, Inc. announced the integration of Dexcom G7 CGM with the slim X2 insulin pump by Tandem Diabetes Care.

- In March 2023, Abbott received U.S. FDA approval for the integration of its FreeStyle Libre 3 and FreeStyle Libre 2 Integrated Continuous Glucose Monitoring (iCGM) system sensors with Automated Insulin Delivery (AID) systems. Both the FreeStyle Libre 3 and FreeStyle Libre 2 sensors are currently accessible in the U.S., with approval for use in individuals aged 4 years and above.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global electrochemical sensors market based on the below-mentioned segments:

Global Electrochemical Sensors Market, By Type

- Conductometric Sensors

- Potentiometric Sensors

- Amperometric Sensors

Global Electrochemical Sensors Market, By Product

- Humidity Sensor

- Nitrogen Oxide Sensor

- Hydrogen Sulfide Gas Sensor

- Sulfur Dioxide Sensor

- Others

Global Electrochemical Sensors Market, By Application

- Healthcare

- Agriculture

- Food & Beverage

- Veterinary

Global Electrochemical Sensors Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?