Global Electronic Article Surveillance Market Size, Share, and COVID-19 Impact Analysis By Component (Tags, Antennas, and Deactivators/Detachers), By End-User (Clothing & Fashion Accessories, Cosmetics/Pharmacy, Supermarkets, and Mass Merchandise Stores), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 – 2030.

Industry: Semiconductors & ElectronicsGlobal Electronic Article Surveillance Market Insights Forecasts to 2030

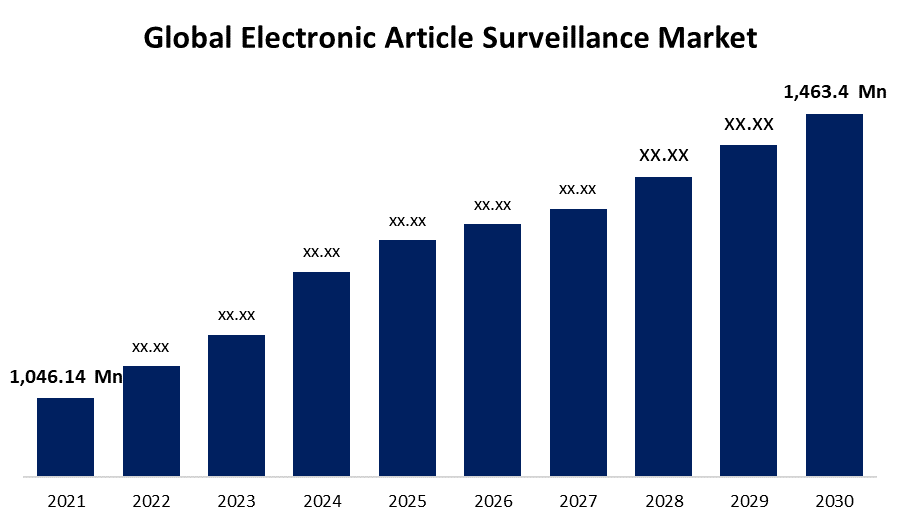

- The global electronic article surveillance market was valued at USD 1,046.14 million in 2021.

- The market is growing at a CAGR of 3.8% from 2021 to 2030

- The global electronic article surveillance market is expected to reach USD 1,463.4 million by 2030

- The Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The global electronic article surveillance market is expected to reach USD 1,463.4 million by 2030, at a CAGR of 3.8% during the forecast period 2021 to 2030. Electronic item surveillance (EAS) is an industry with many different parts, like tags and antennas, that can be used. It stops people from stealing from stores like supermarkets, clothing and accessory boutiques, and other similar places by using technology. The fact that these products are sold in stores all over the world may have something to do with the growth of this industry.

Market Overview:

Because of the COVID-19 pandemic, stores worldwide, including clothing and fashion stores, as well as other department stores, have had to close for the time being. Because of this, the market has grown much more slowly than expected. Also, because there won't be any big growth during this time, demand for EAS systems is expected to stay about the same. Currently, the main thing driving the market is using EAS products to protect against inventory loss, shoplifting, and theft. For example, the National Retail Federation (NRF) says organized retail crime (ORC) is to blame for about $30 billin in annual retail business losses. Also, the National Retail Security Survey (NRRS) found that theft is one of the main reasons why stores lose money. Because of all of these things, businesses have been forced to devise a way to stop theft, making EAS more popular. The Office of National Statistics says that between 2019 and 2020, there were 359.24 thousand shoplifting crimes in England and Wales. This number is for both counties (UK). When EAS is used, it's unnecessary to have a lot of surveillance in every area. This saves money and gives the products the highest safety and security possible. This is a direct result of the fact that there have been more and more reports of shoplifting all over the world. Businesses are also putting a lot of money into developing this smart label technology. ThinFilm, a company based in Oslo, did something similar by putting a "smart label" on electronic products to make them more secure. This was done so that the regular Electronic Article Surveillance (EAS) technology could be made better. Because of this, a new label to stop shoplifting has been made. These labels are easy to put on products, and they work with the 8.2 MHz RF EAS infrastructure already in place worldwide. EAS providers also have much to look forward to with the growing preference for digital operations and the better growth potential in emerging markets. A big part of the EAS market share is expected to belong to stores that sell clothes and fashion accessories.

Global Electronic Article Surveillance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 1,046.14 Million |

| Forecast Period: | 2021 - 2030 |

| Forecast Period CAGR 2021 - 2030 : | 3.8% |

| 2030 Value Projection: | USD 1,463.4 Million |

| Historical Data for: | 2017 - 2020 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 106 |

| Segments covered: | By Component, By End-User, By Region |

| Companies covered:: | TAG Company (UK), Cross Point (The Netherland), Johnson Controls (Ireland), ALL-TAG Corporation (US), Amersec (Czech Republic), WG Security Products (US), Softdel (US), Agon Systems (UK), Shenzhen Emeno Technology (China), Takachiho Koheki (Japan), Checkpoint Systems (Canada), Stanley Security (US), Dexilon Automation (Spain), Feltron Security Systems (UAE), Sentry Custom Security (Canada) |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Report Coverage

This research report categorizes the market for global based electronic article surveillance market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global electronic article surveillance market. Recent market developments and competitive strategies such as expansion, product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each global electronic article surveillance market sub-segments.

Segmentation Analysis

- In 2021, the tags segment dominated the market with the largest market share of 37% and market revenue of 387.0 million.

Based on the component, the electronic article surveillance market is categorized into Tags, Antennas, and Deactivators/Detachers. In 2021, the tags segment dominated the market with the largest market share of 37% and market revenue of 387.0 million. The tag that is attached to the item being watched is an important part of an electronic article surveillance (EAS) system. The tag is a small signal transmitter that is attached to the thing that is for sale. When an EAS tag gets close to one or more EAS antennas, it sends a signal to the antennas, making them sound an alarm. Putting tags on products, either in the form of a hard tag or a sticker, could happen when the product is being made, when it is being packed, or in a store. When a customer is checking out, a store staff member will use a deactivation pad or a detacher to turn off the tags. This will make it possible to remove the hard tag pin. Depending on the tags used, they can come in many different shapes and sizes. Merchants are always making new products and putting them on the market.

- In 2021, the Clothing & Fashion Accessories segment accounted for the largest share of the market, with 30% and market revenue of 313.8 million.

Based on the end user, the electronic article surveillance market is categorized into Clothing & Fashion Accessories, Cosmetics/Pharmacies, Supermarkets, and Mass Merchandise Stores. In 2021, Clothing & Fashion Accessories dominated the market with the largest market share of 30% and market revenue of 313.8 million. EAS is used in the clothing and fashion accessory industries because it is easy to set up, requires less labor, allows for open merchandising and brand development, speeds up delivery on the shop floor, and improves the customer experience. Radio Frequency Identification (RFID)-based solutions show exactly where and how many clothes and shoes are on their way from the factory to the store. This means that inventory costs can be cut, the number of items that are out of stock can be reduced, and sales and profits can go up.

Regional Segment Analysis of the Electronic Article Surveillance Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, the U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Get more details on this report -

Among all regions, North America emerged as the largest market for the global electronic article surveillance market, with a market share of around 36% and 1,046.14 million of the market revenue in 2021.

- In 2021, North America emerged as the largest market for the global electronic article surveillance market, with a market share of around 36% and 1,046.14 million of the market revenue. Analysts think that the United States will have the biggest share of the North American market during the forecast period. In recent months, there have been more retail store openings all over the country. Ulta Beauty, for example, has said that they want to open forty more stores by 2021 and would spend a total of seventy million dollars on this. The company also planned to rebuild 11 stores in the U.S. and move 10 stores to new locations within the country. These kinds of investments have created many opportunities in the area's EAS market.

- The Asia Pacific market is expected to grow at the fastest CAGR between 2022 and 2030. There is a huge amount of untapped potential in the electronic article surveillance (EAS) market, especially in places like India, China, Japan, and Australia. The EAS market in the Asia-Pacific region is expected to grow at a significant rate. As the number of grocery stores, mass merchandise stores, and clothing stores continue to grow, there is expected to be a high demand for POS systems. Pomelo's clothing company said it would open stores in Southeast Asia in August 2020. These shops will be in places like Singapore and Malaysia, and they will be made to help customers get the most out of their omnichannel shopping. The company will open twenty new locations in the area as part of its plan to grow its presence there. In this part of the world, the demand for EAS solutions is driven up by fashion retailers who take action like this.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global electronic article surveillance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Market Players:

- TAG Company (UK)

- Cross Point (The Netherland)

- Johnson Controls (Ireland)

- ALL-TAG Corporation (US)

- Amersec (Czech Republic)

- WG Security Products (US)

- Softdel (US)

- Agon Systems (UK)

- Shenzhen Emeno Technology (China)

- Takachiho Koheki (Japan)

- Checkpoint Systems (Canada)

- Stanley Security (US)

- Dexilon Automation (Spain)

- Feltron Security Systems (UAE)

- Sentry Custom Security (Canada)

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Third-party knowledge providers

- Value-Added Resellers (VARs)

Recent Development

- In July 2021, ADT Commercial said it would move into the EAS market. This would be done through a strategic partnership with WG Security Products Inc. and a team of players from vertical markets. The company that will install and service WG Security Products' EAS solutions will do so in the United States. WG Security Products' EAS solutions include detection systems, specialty tags, hard tags, disposable labels, deactivation devices, and detachers.

- In September 2020, Avery Dennison said the AD-362r6-P inlay would be available. This inlay mostly combines the item-level tracking and digital ID features of a high-performance RAIN RFID (UHF) tag that can be used for a wide range of retail apparel products and applications, as well as the secondary loss prevention features of an EAS tag. These skills are good for a wide range of retail clothing products and use.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2030. Spherical Insights has segmented the global electronic article surveillance market based on the below-mentioned segments:

Global Electronic Article Surveillance Market, By Component

- Tags

- Antennas

- Deactivators/Detachers

Global Electronic Article Surveillance Market, By End User

- Clothing & Fashion Accessories

- Cosmetics/Pharmacy

- Supermarkets

- Mass Merchandise Stores

Global Electronic Article Surveillance Market, Regional Analysis

- North America

- The US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- The Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the market size of the Electronic Article Surveillance market?As per Spherical Insights, the size of the Electronic Article Surveillance market was valued at USD 1,046.14 billion in 2021 to USD 1,463.4 billion by 2030.

-

What is the market growth rate of the Electronic Article Surveillance market?The Electronic Article Surveillance market is growing at a CAGR of 3.8% from 2021 to 2030.

-

Which country dominates the Electronic Article Surveillance market?North America emerged as the largest market for Electronic Article Surveillance.

-

Who are the key players in the Electronic Article Surveillance market?Key players in the Electronic Article Surveillance market are TAG Company (UK), Cross Point (The Netherland), Johnson Controls (Ireland), ALL-TAG Corporation (US), Amersec (Czech Republic), WG Security Products (US), Softdel (US), Agon Systems (UK), Shenzhen Emeno Technology (China), Takachiho Koheki (Japan), Checkpoint Systems (Canada), Stanley Security (US), Dexilon Automation (Spain), Feltron Security Systems (UAE), and Sentry Custom Security (Canada).

-

Which factor drives the growth of the Electronic Article Surveillance market?Protection against inventory losses is expected to drive the market's growth over the forecast period.

Need help to buy this report?